D-Wave Quantum (QBTS) Stock Plunge Explained: Thursday's Market Activity

Table of Contents

Analyzing the QBTS Stock Plunge: Key Contributing Factors

Several factors likely contributed to the significant drop in D-Wave Quantum (QBTS) stock price. Understanding these intertwined influences is crucial for interpreting the market's reaction and anticipating future trends in QBTS stock and the quantum computing sector.

Lack of Positive News & Guidance

The absence of positive news and forward guidance played a significant role in the QBTS stock plunge. Investors often react negatively when companies fail to deliver positive updates regarding their progress. Several factors may have contributed to this lack of positive sentiment:

- Absence of major contract announcements: No significant new contracts or partnerships were announced, leaving investors without tangible evidence of the company's growth trajectory. This lack of concrete progress can trigger sell-offs.

- Disappointing financial projections (if applicable): If D-Wave Quantum released any financial projections or warnings, these could have significantly impacted investor confidence, leading to a sell-off. Negative financial news is often a catalyst for stock price declines.

- Negative investor sentiment: A general lack of positive news, coupled with perhaps some perceived slow progress compared to competitors, might have fueled negative sentiment among investors.

- Comparison to competitors: The success of other players in the quantum computing space could have put pressure on QBTS, highlighting a perceived lack of competitiveness and influencing investors to divest.

Broader Market Downturn & Sector-Specific Sell-off

The QBTS stock plunge didn't occur in isolation. The broader market environment and sector-specific trends likely played a significant role.

- Overall market volatility: General market uncertainty and investor apprehension can impact even seemingly unrelated stocks. A wider downturn could have exacerbated the QBTS sell-off.

- Negative sentiment in the quantum computing sector: If other quantum computing stocks experienced similar declines, it suggests a potential sector-wide sell-off driven by investor concerns about the broader industry outlook. This could be linked to factors like regulatory changes or slower-than-expected technological advancements.

- Related stock performance: Analyzing the performance of other companies within the quantum computing sector can provide valuable context for the QBTS decline. Similar negative trends across the industry would indicate a broader market shift.

- Economic indicators: Macroeconomic factors such as rising interest rates, inflation, or geopolitical instability could contribute to a negative market sentiment, impacting investor confidence and causing a sell-off.

Technical Analysis of QBTS Stock Chart

A technical analysis of the QBTS stock chart provides further insights into the price movement.

- Trading volume: High trading volume during the decline indicates significant investor activity and potentially a forced sell-off. Increased volume confirms the strength of the downward movement.

- Price action: Examining the price action around the drop – particularly the speed and magnitude of the decline – helps in understanding the urgency of the sell-off. A rapid, steep drop suggests a panic sell-off.

- Support/resistance levels: Whether the price broke through key support levels indicates a potential breakdown in investor confidence and a shift in the short-term trend.

- Moving averages: Crossing of moving averages (e.g., 50-day and 200-day) could signal a bearish trend.

- Sell-off signals: Technical indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) might have signaled an oversold condition or bearish momentum before the drop.

Impact of Analyst Ratings & Reports

Analyst opinions and reports significantly influence investor sentiment and can trigger stock price fluctuations.

- Downgraded ratings: A change in analyst ratings, particularly downgrades from influential financial institutions, can signal a shift in sentiment and cause a drop in share price. Negative analyst reports often lead to investor sell-offs.

- Negative reports: Any negative reports detailing concerns about D-Wave Quantum's financial performance, technological progress, or competitive landscape could trigger a stock decline. These reports can significantly sway investor opinion.

- Investor confidence: Analyst opinions directly impact investor confidence. Negative reports erode trust, leading to selling pressure.

Potential Short-Selling Activity

The possibility of increased short-selling activity should also be considered.

- Short interest percentage: Analyzing the short interest percentage for QBTS can reveal the extent of bearish bets against the stock. High short interest indicates a significant number of investors betting against the stock.

- Short squeeze: While unlikely to be the sole cause, short-selling could amplify the downward pressure, particularly if a short squeeze occurs. A short squeeze involves short-sellers buying back shares to limit losses, which can temporarily inflate prices.

Conclusion

The D-Wave Quantum (QBTS) stock plunge on Thursday was likely a complex event resulting from a combination of factors, including a lack of positive news, broader market downturns, technical indicators, negative analyst opinions, and potentially increased short-selling. Understanding these intertwined influences is key to interpreting the market's reaction and preparing for future fluctuations.

Call to Action: Staying informed about D-Wave Quantum (QBTS) stock requires continuous monitoring of market activity, news reports, and analyst commentary. Conducting thorough due diligence and understanding the inherent risks within the volatile quantum computing sector is paramount for making informed investment decisions regarding QBTS and similar quantum computing stocks. By staying informed and acting strategically, you can better navigate the complexities of investing in D-Wave Quantum and other quantum computing companies.

Featured Posts

-

College Town Economies Navigating The Challenges Of Declining Enrollment

May 21, 2025

College Town Economies Navigating The Challenges Of Declining Enrollment

May 21, 2025 -

Is Canada Post Insolvent Report Advocates For The Phase Out Of Residential Mail Delivery

May 21, 2025

Is Canada Post Insolvent Report Advocates For The Phase Out Of Residential Mail Delivery

May 21, 2025 -

Sold Out Shows Vybz Kartels New York City Domination

May 21, 2025

Sold Out Shows Vybz Kartels New York City Domination

May 21, 2025 -

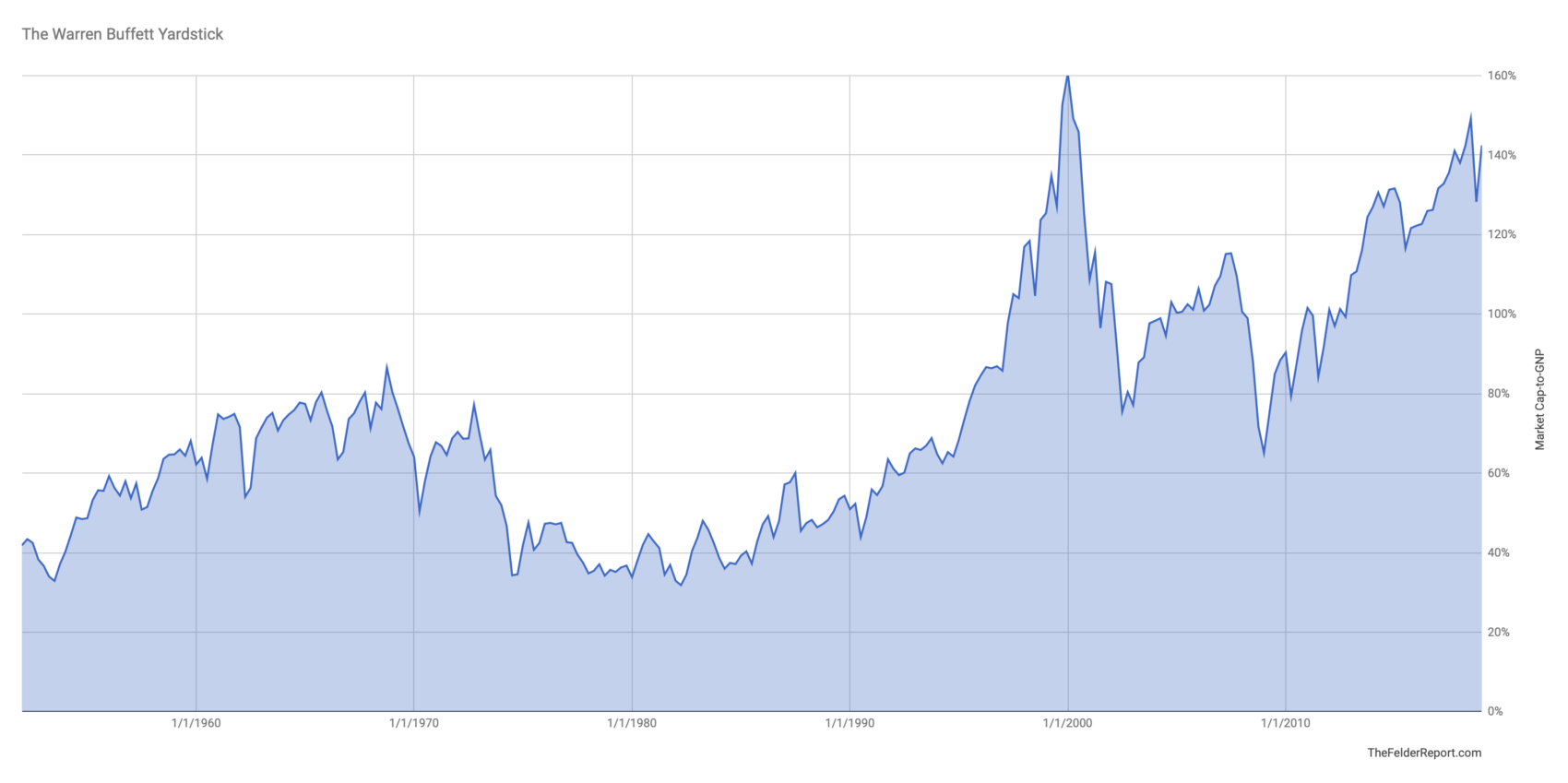

Investor Concerns About High Stock Market Valuations Bof As Response

May 21, 2025

Investor Concerns About High Stock Market Valuations Bof As Response

May 21, 2025 -

Fremantle Reports 5 6 Q1 Revenue Decline Budget Cuts Take Toll

May 21, 2025

Fremantle Reports 5 6 Q1 Revenue Decline Budget Cuts Take Toll

May 21, 2025

Latest Posts

-

William Goodge A New Benchmark For Fastest Cross Australia Foot Race

May 22, 2025

William Goodge A New Benchmark For Fastest Cross Australia Foot Race

May 22, 2025 -

Across Australia On Foot William Goodges Unprecedented Speed

May 22, 2025

Across Australia On Foot William Goodges Unprecedented Speed

May 22, 2025 -

Australian Trans Influencers Record Fact Or Fiction A Critical Analysis

May 22, 2025

Australian Trans Influencers Record Fact Or Fiction A Critical Analysis

May 22, 2025 -

Australian Ultramarathon Briton Battles Adversity

May 22, 2025

Australian Ultramarathon Briton Battles Adversity

May 22, 2025 -

Is This Australian Trans Influencers Record Legitimate Examining The Controversy

May 22, 2025

Is This Australian Trans Influencers Record Legitimate Examining The Controversy

May 22, 2025