Investor Concerns About High Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's recent analysis delves into the factors driving these high stock market valuations, providing investors with a nuanced understanding of the current market landscape.

Identifying Factors Contributing to High Valuations

Several macroeconomic and company-specific factors contribute to the elevated market valuation we're seeing.

- Macroeconomic Factors: Persistently low interest rates, fueled by quantitative easing policies in the past, have encouraged increased borrowing and investment, pushing up asset prices. Inflation, while currently elevated, hasn't yet significantly dampened investor enthusiasm, contributing to higher stock market valuations.

- Company-Specific Factors: Strong earnings growth across many sectors, driven by technological advancements and robust consumer spending, has further bolstered market capitalization. Companies are reporting impressive profits, justifying – at least in the eyes of some investors – higher price-to-earnings ratios.

- Sector-Specific High Valuations: Certain sectors, such as technology and healthcare, are exhibiting particularly high stock market valuations, reflecting investor optimism about future growth prospects in these areas. This uneven distribution of overvalued stocks across sectors highlights the need for careful portfolio diversification. Understanding the individual market valuation of companies within each sector is crucial for strategic investing. The concentration of high valuations in specific sectors also raises concerns about potential bubbles.

Keywords: market valuation, stock market valuation, overvalued stocks, market capitalization

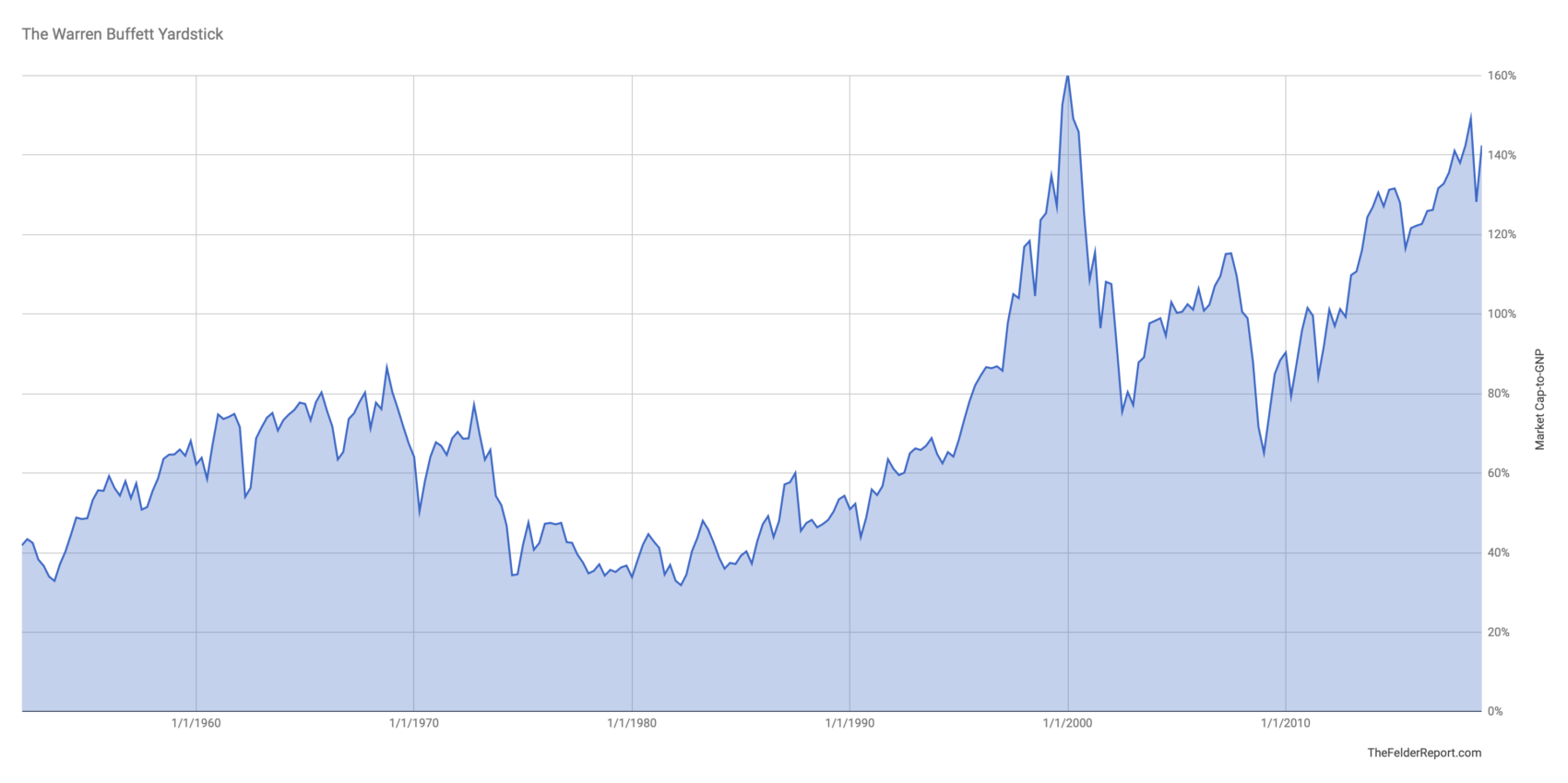

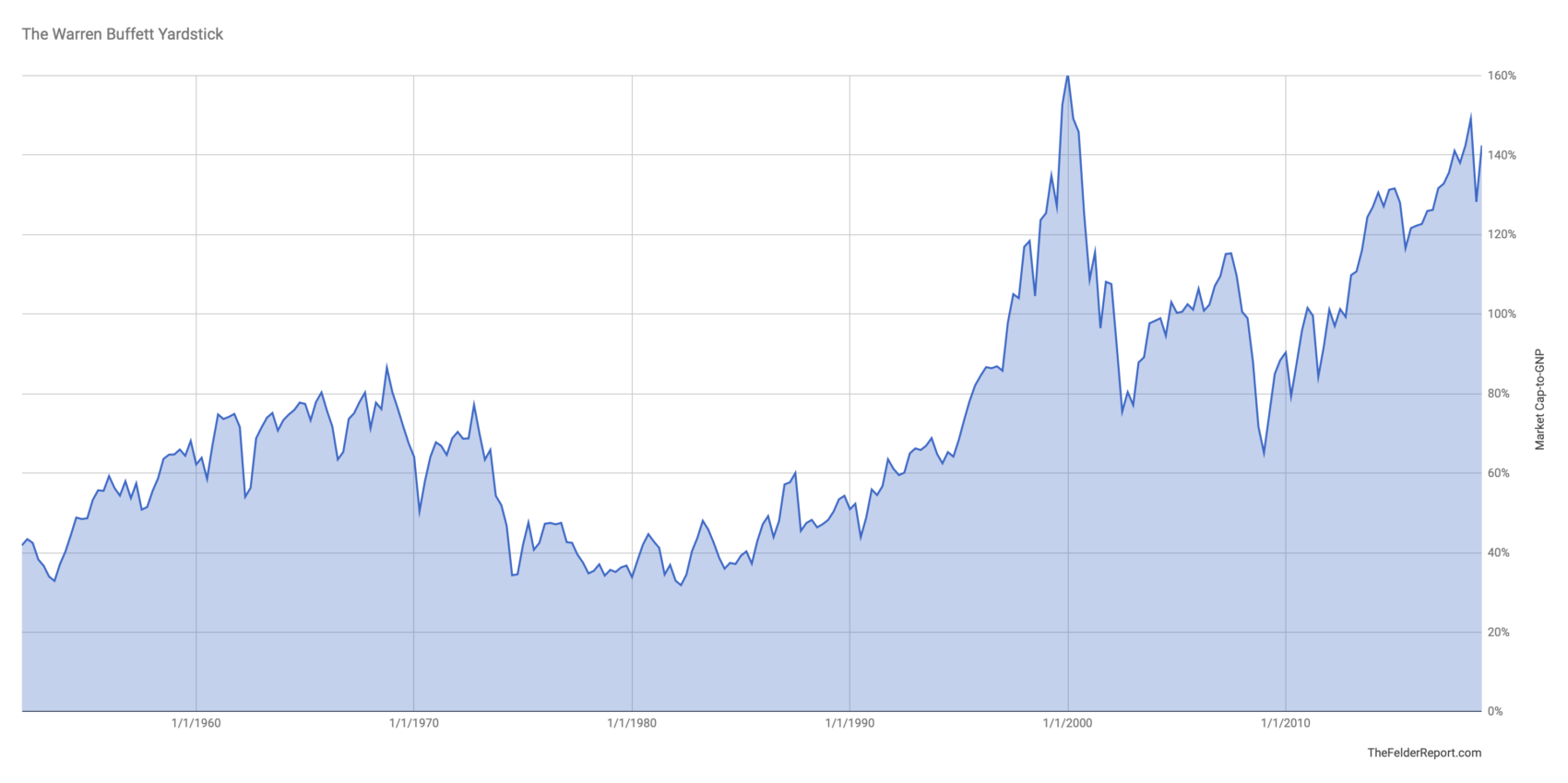

BofA's Valuation Metrics and Models

BofA employed various established financial metrics and sophisticated valuation models to assess the current market.

- Price-to-Earnings Ratios (P/E Ratios): BofA likely analyzed the P/E ratios of individual companies and the broader market to gauge whether current prices are justified by earnings potential. High P/E ratios often indicate high market valuation and potential overvaluation.

- Discounted Cash Flow (DCF) Analysis: This sophisticated financial modeling technique assesses the present value of a company's future cash flows to determine its intrinsic value. BofA likely used DCF analysis to compare a company's current market valuation to its intrinsic value. Discrepancies between the two suggest possible over or undervaluation.

- Other Metrics and Indices: BofA’s analysis likely incorporated other relevant metrics and indices, providing a comprehensive picture of the market's overall health and potential future performance. This helps contextualize individual market valuation against broader trends.

Keywords: P/E ratio, DCF analysis, valuation models, financial modeling

BofA's Predictions and Outlook for the Market

BofA's analysis offers both short-term and long-term perspectives on market performance and the implications of these high stock market valuations.

BofA's Short-Term Market Forecast

BofA's short-term market forecast (note: insert specific details from BofA's actual report here if available; otherwise, provide a generalized but realistic forecast) likely includes a range of possible scenarios, considering factors like inflation, interest rate changes, and geopolitical events. The report may suggest a period of consolidation or potential near-term volatility, highlighting risks and opportunities for investors.

Keywords: market forecast, market outlook, market prediction, stock market trends

BofA's Long-Term Market Perspective

BofA's long-term view on high stock market valuations is crucial for long-term investors. The firm may project sustained but potentially slower growth compared to recent years, emphasizing the importance of long-term investment strategies that account for increased market risk. Factors influencing their long-term predictions include technological innovation, demographic shifts, and evolving global economic landscapes.

Keywords: long-term investment, market growth, sustainable growth, future market trends

BofA's Recommendations for Investors

Navigating the complexities of high stock market valuations requires a well-defined investment strategy. BofA likely offers specific guidance to help investors mitigate risks and capitalize on opportunities.

Strategies for Navigating High Valuations

BofA's recommendations likely emphasize several key strategies:

- Diversification: Spread investments across different asset classes (stocks, bonds, real estate) and sectors to reduce the impact of potential market corrections in any single area. This is a core principle of effective portfolio diversification.

- Risk Management: Employ strategies like stop-loss orders to limit potential losses, and carefully assess risk tolerance before making investment decisions. Thorough risk management is vital when dealing with high stock market valuations.

- Sector-Specific Approaches: Identify undervalued sectors or companies within overvalued sectors, employing a balanced approach to asset allocation.

Keywords: investment strategy, risk management, portfolio diversification, asset allocation

BofA's Suggested Investment Approaches

Depending on their assessment, BofA might suggest either a more conservative or growth-oriented approach:

- Value Investing: Focus on undervalued companies with strong fundamentals, potentially finding opportunities in the current environment despite high stock market valuations.

- Growth Investing (with caution): While acknowledging the risks associated with high stock market valuations, BofA may still recommend exposure to growth stocks in select sectors, focusing on those with strong long-term potential. Careful selection and risk management are crucial in this strategy.

Keywords: value investing, growth investing, investment opportunities, investment advice

Conclusion: Investor Concerns About High Stock Market Valuations: BofA's Response

BofA's analysis offers valuable insights into the current state of the market and the implications of high stock market valuations. Their assessment combines macroeconomic factors, detailed valuation models, and insightful predictions for short-term and long-term market trends. The recommendations emphasize a balanced and cautious approach, highlighting the importance of diversification, risk management, and a thorough understanding of individual investment opportunities. Understanding high stock market valuations is crucial for informed investment decisions. We strongly encourage you to review BofA's complete report for detailed information and consider consulting a qualified financial advisor to develop a personalized investment strategy for effectively managing high stock market valuations and achieving your financial goals. Don't hesitate to take proactive steps towards understanding high stock market valuations – your financial future depends on it.

Featured Posts

-

The Economic Impact Of Shrinking College Enrollments In Boom Towns

May 21, 2025

The Economic Impact Of Shrinking College Enrollments In Boom Towns

May 21, 2025 -

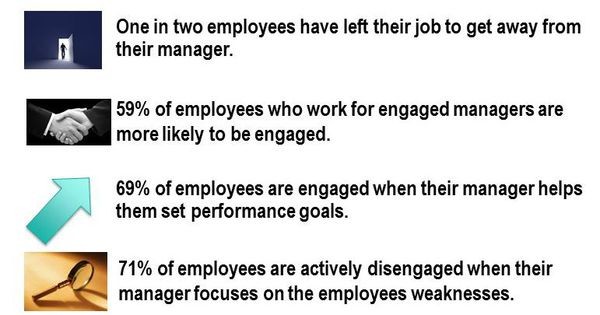

Understanding The Crucial Role Of Middle Management In Organizations

May 21, 2025

Understanding The Crucial Role Of Middle Management In Organizations

May 21, 2025 -

Low Fi Rock Vapors Of Morphine Live In Northcote

May 21, 2025

Low Fi Rock Vapors Of Morphine Live In Northcote

May 21, 2025 -

Republican Tax Cuts And The National Debt A Fact Based Assessment

May 21, 2025

Republican Tax Cuts And The National Debt A Fact Based Assessment

May 21, 2025 -

How Middle Management Drives Employee Engagement And Business Growth

May 21, 2025

How Middle Management Drives Employee Engagement And Business Growth

May 21, 2025

Latest Posts

-

Why Is D Wave Quantum Inc Qbts Stock Falling In 2025

May 21, 2025

Why Is D Wave Quantum Inc Qbts Stock Falling In 2025

May 21, 2025 -

D Wave Quantum Qbts Stock Plunge Understanding Mondays Decline

May 21, 2025

D Wave Quantum Qbts Stock Plunge Understanding Mondays Decline

May 21, 2025 -

D Wave Quantum Inc Qbts Stock Plunge In 2025 Reasons And Analysis

May 21, 2025

D Wave Quantum Inc Qbts Stock Plunge In 2025 Reasons And Analysis

May 21, 2025 -

D Wave Quantum Qbts Stock Crash Unpacking Mondays Sharp Decline

May 21, 2025

D Wave Quantum Qbts Stock Crash Unpacking Mondays Sharp Decline

May 21, 2025 -

D Wave Quantum Inc Qbts Stock Plunge Mondays Market Crash Explained

May 21, 2025

D Wave Quantum Inc Qbts Stock Plunge Mondays Market Crash Explained

May 21, 2025