Deutsche Bank Depositary Receipts Virtual Investor Conference: May 15, 2025

Table of Contents

Key Presentations & Announcements

The conference featured several key presentations, offering a comprehensive overview of Deutsche Bank's current standing and future aspirations.

Deutsche Bank's Strategic Outlook

Deutsche Bank presented a robust strategic outlook, emphasizing its commitment to sustainable growth and profitability. Key strategic initiatives included:

- Expansion in Key Sectors: The bank highlighted plans for significant growth in key sectors, including sustainable finance and technology-driven financial solutions. Specific targets included a projected 15% increase in revenue from sustainable finance initiatives within the next three years.

- Strategic Partnerships and Acquisitions: Several potential partnerships and acquisitions were discussed, aiming to enhance Deutsche Bank's technological capabilities and expand its global reach. One key acquisition, although still pending regulatory approval, could significantly boost the bank's presence in the Asian market.

- Improved Key Performance Indicators (KPIs): The presentation showcased improved KPIs across various areas, including a projected increase in return on equity (ROE) and a reduction in operating costs. Projected revenue for 2026 was indicated as exceeding €30 billion, a substantial increase compared to previous years.

Depositary Receipt Program Update

The conference included a dedicated segment to update investors on the Deutsche Bank Depositary Receipt program. Key updates included:

- Revised Dividend Policy: A revised dividend policy was announced, promising increased shareholder returns based on the bank's projected financial performance. This includes an anticipated increase in dividend payouts for the next fiscal year.

- No New DR Issuances (Currently): While no new DR issuances were announced at this time, the bank reiterated its commitment to maintaining a liquid and transparent DR market.

- Enhanced Trading and Settlement Procedures: Deutsche Bank outlined improvements to its DR trading and settlement procedures, aiming to enhance efficiency and reduce transaction costs for investors. This will include streamlined processes and the implementation of new technology to facilitate faster settlements.

Q&A Session Highlights

The live Q&A session proved invaluable in addressing key investor concerns. Key topics included:

- Regulatory Landscape: The impact of evolving regulatory frameworks on Deutsche Bank's operations was addressed, reassuring investors of the bank's proactive approach to compliance.

- Market Volatility: Management addressed concerns surrounding current market volatility and emphasized Deutsche Bank's resilience and preparedness to navigate economic uncertainties.

- Competitive Landscape: Questions regarding the competitive landscape in the banking sector were answered, highlighting Deutsche Bank's competitive advantages and strategies for maintaining market share.

Investor Relations & Communication

Deutsche Bank prioritized effective communication and accessibility during the virtual conference.

Accessibility & Technology

The virtual platform proved user-friendly and easily accessible. Features like:

- Live Q&A: Allowed real-time interaction between investors and management.

- Interactive Chat Function: Facilitated direct communication amongst participants.

- Presentation Downloads: Enabled attendees to access presentations post-conference.

received positive feedback.

Post-Conference Resources

For those unable to attend live or wishing to review the information, Deutsche Bank made all presentations and a recording of the conference available online. Access links were distributed via email following the event, and a dedicated webpage on the Deutsche Bank Investor Relations website was created for easy access to all related materials.

Market Implications & Analysis

The conference and its announcements had a noticeable impact on Deutsche Bank's DRs and the broader market.

Stock Price Performance

Following the conference, the price of Deutsche Bank DRs experienced a modest increase, reflecting positive investor sentiment towards the bank's strategic outlook and the updates on the DR program. (Charts and graphs would be inserted here if available). This positive movement is in line with broader market trends and improved investor confidence.

Expert Opinions

Several financial analysts commented positively on the conference. One leading analyst stated, "The strategic clarity and the commitment to shareholder value demonstrated at the conference are encouraging signs for Deutsche Bank's future prospects." (Source and credentials would be included here).

Conclusion

The Deutsche Bank Depositary Receipts Virtual Investor Conference of May 15, 2025, successfully showcased the bank's strategic direction, provided key updates on its DR program, and addressed investor concerns effectively. The virtual format enhanced accessibility and engagement. The positive market reaction following the event highlights the significance of the announcements and the overall investor confidence in Deutsche Bank's future. Stay updated on future Deutsche Bank investor events and learn more about investing in Deutsche Bank Depositary Receipts by visiting [link to relevant website].

Featured Posts

-

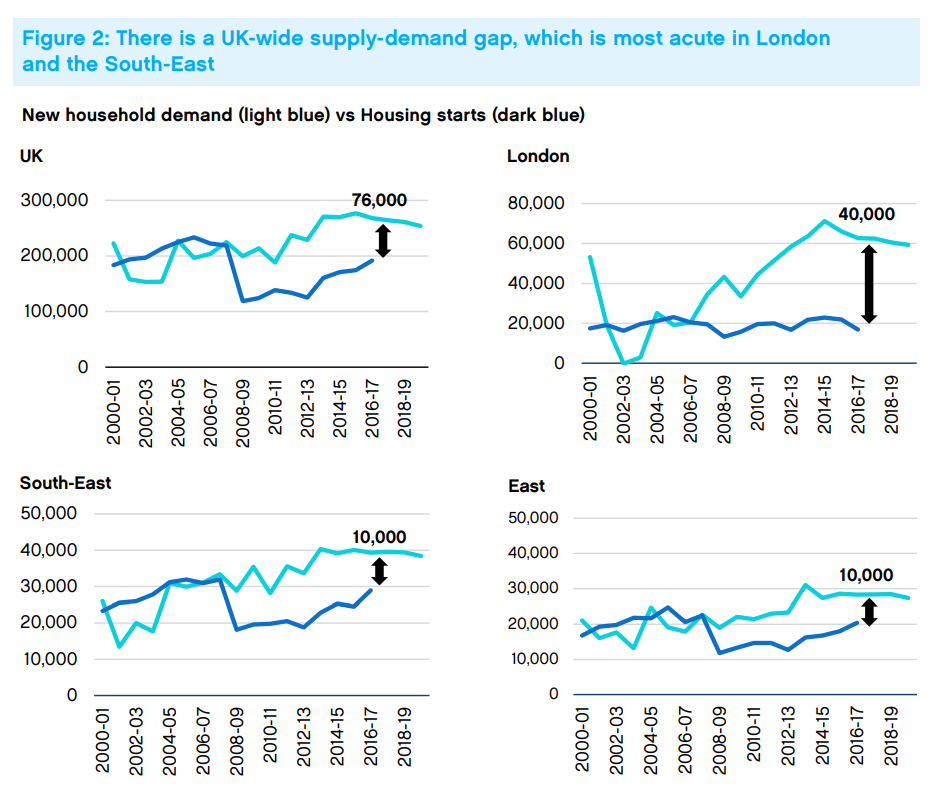

The Housing Market Crisis Understanding The Drop In Home Sales

May 30, 2025

The Housing Market Crisis Understanding The Drop In Home Sales

May 30, 2025 -

Extreme Heat Warning Texas Temperatures To Hit 111 Degrees Fahrenheit

May 30, 2025

Extreme Heat Warning Texas Temperatures To Hit 111 Degrees Fahrenheit

May 30, 2025 -

Augsburg Schnappt Sich Garteig Ingolstadt Torwart Wechselt Zum Fca

May 30, 2025

Augsburg Schnappt Sich Garteig Ingolstadt Torwart Wechselt Zum Fca

May 30, 2025 -

Live Now Pay Later Options Choosing The Best Plan For Your Needs

May 30, 2025

Live Now Pay Later Options Choosing The Best Plan For Your Needs

May 30, 2025 -

Appel Du Proces Rn Jacobelli Salue La Rapidite De La Justice

May 30, 2025

Appel Du Proces Rn Jacobelli Salue La Rapidite De La Justice

May 30, 2025