The Housing Market Crisis: Understanding The Drop In Home Sales

Table of Contents

The Impact of Rising Interest Rates on Home Sales

One of the most significant contributors to the drop in home sales is the sharp increase in interest rates. This directly impacts mortgage affordability. Higher interest rates translate to significantly higher monthly mortgage payments, effectively reducing the purchasing power of potential homebuyers. Even a small percentage point increase can drastically change the affordability equation, pushing homes out of reach for many.

- Higher interest rates = higher monthly payments: A 1% increase on a $300,000 mortgage can add hundreds of dollars to the monthly payment, a considerable burden for many households.

- Reduced purchasing power for potential homebuyers: With higher payments, buyers can afford less expensive homes, shrinking their pool of options and reducing overall sales.

- Increased cost of borrowing for investors: Higher rates also impact investors, who may reduce their activity due to increased borrowing costs, further impacting market demand.

- Impact on first-time homebuyers: First-time homebuyers, often relying on smaller down payments and tighter budgets, are particularly vulnerable to the effects of rising interest rates, exacerbating the drop in home sales.

Data from the Federal Reserve shows a significant increase in the benchmark interest rate over the past year, directly correlating with the observed decline in home sales figures reported by the National Association of Realtors.

Inflation and its Role in the Housing Market Downturn

Inflation is another major player in the current housing market crisis. The rising cost of living impacts housing affordability in multiple ways. Increased prices for building materials, such as lumber and concrete, and rising labor costs drive up the cost of new home construction. This, in turn, leads to higher prices for existing homes, creating a ripple effect throughout the market.

- Increased costs of construction: The cost of building a new home has increased significantly, making new builds less accessible and contributing to the overall shortage of housing inventory.

- Higher prices for existing homes: Existing home prices have increased sharply due to the surge in building costs and increased demand during the low-interest rate period.

- Reduced consumer confidence due to inflation: High inflation erodes consumer confidence, making people less likely to make large purchases, including homes, as their budgets are strained.

- Impact of inflation on household budgets: Inflation's impact on household budgets leaves less disposable income available for significant expenses like a down payment or monthly mortgage payments, impacting the drop in home sales directly.

For instance, lumber prices have more than doubled in recent years, significantly impacting the cost of new home construction and contributing to inflated prices across the board.

Economic Uncertainty and its Effect on Buyer Confidence

Economic uncertainty, driven by fears of a recession and potential job losses, is further dampening buyer confidence. Uncertainty about future income stability makes potential buyers hesitant to commit to the significant financial obligation of a mortgage. This hesitancy leads to decreased demand and contributes significantly to the drop in home sales.

- Fear of job losses affecting affordability: The threat of job losses significantly impacts a buyer's ability to afford a mortgage.

- Uncertainty regarding future income stability: Concerns about future income make it difficult for people to predict their ability to meet long-term mortgage commitments.

- Hesitation to commit to large financial obligations in uncertain times: In times of economic uncertainty, many prefer to delay large purchases, and buying a house ranks high on that list.

- Impact on investor confidence in the housing market: Economic uncertainty also negatively affects investor confidence, making them less inclined to participate in the market.

Recent unemployment figures, combined with forecasts predicting potential economic slowdowns, contribute to the prevailing sense of uncertainty and its influence on buying decisions.

Inventory Shortages and Their Unexpected Effect on Sales

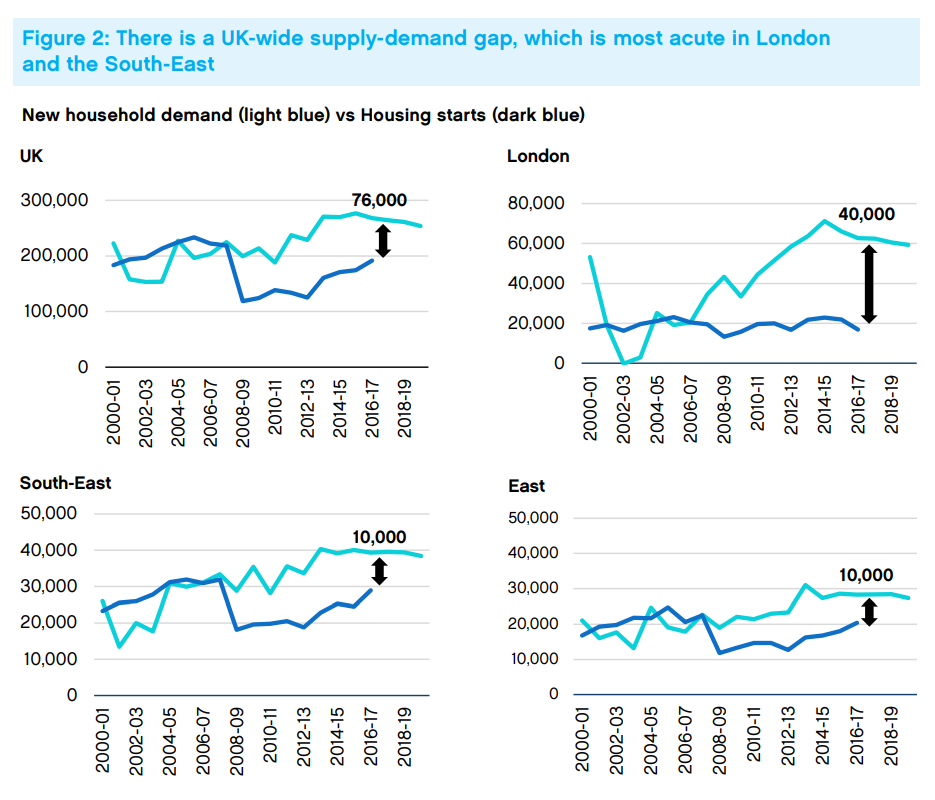

While it might seem counterintuitive, a shortage of available homes can also contribute to a drop in sales volume. A limited inventory creates less competition and fewer choices for buyers, causing some to delay their purchasing decisions. This is different from a classic buyer's market with plenty of homes to choose from, which generally leads to increased sales. This shortage is a result of reduced construction activity in previous years, coupled with current sellers' hesitancy to list their properties in a volatile market.

- Limited choices for buyers: A smaller pool of available homes restricts buyer choices, potentially leading to delays in purchasing decisions.

- Increased competition for available properties: The limited inventory intensifies competition for available properties, leading to potential bidding wars, higher prices, and ultimately impacting overall sales figures.

- Higher prices due to low inventory: Scarcity often inflates prices, further reducing affordability and contributing to the drop in home sales.

- Potential for bidding wars: Buyers are often forced into bidding wars, making securing a property more challenging and driving up the final purchase price.

Data from real estate market trackers indicate a significant undersupply of homes across many regions, adding another layer to the complexities of the current market.

Conclusion: Navigating the Drop in Home Sales

In summary, the current drop in home sales is a result of a perfect storm: rising interest rates, inflation, economic uncertainty, and inventory shortages. This situation significantly impacts the housing market and the broader economy. The future remains uncertain, with various potential scenarios ranging from a prolonged period of low sales to a potential market correction. Staying informed is crucial.

To navigate these challenging times, it's vital to stay informed about changes in the housing market by following reputable sources and continuing research and understanding the complexities surrounding the drop in home sales to make informed decisions. Understanding these factors empowers you to make smart choices whether you're buying, selling, or simply observing the market. Stay informed, stay proactive, and navigate the complexities of this changing market wisely.

Featured Posts

-

Raducanus Dominant Run Continues At Miami Open

May 30, 2025

Raducanus Dominant Run Continues At Miami Open

May 30, 2025 -

House Of Kong Gorillazs 25th Anniversary Exhibition And London Concert Series

May 30, 2025

House Of Kong Gorillazs 25th Anniversary Exhibition And London Concert Series

May 30, 2025 -

Tolyatti Otkrytiy Seminar Ot Russkoy Inzhenernoy Shkoly

May 30, 2025

Tolyatti Otkrytiy Seminar Ot Russkoy Inzhenernoy Shkoly

May 30, 2025 -

Experience Gorillaz House Of Kong Exhibition At Londons Copper Box Arena

May 30, 2025

Experience Gorillaz House Of Kong Exhibition At Londons Copper Box Arena

May 30, 2025 -

Nereden Izleyebilirim Augsburg Bayern Muenih Macinin Canli Yayini

May 30, 2025

Nereden Izleyebilirim Augsburg Bayern Muenih Macinin Canli Yayini

May 30, 2025

Latest Posts

-

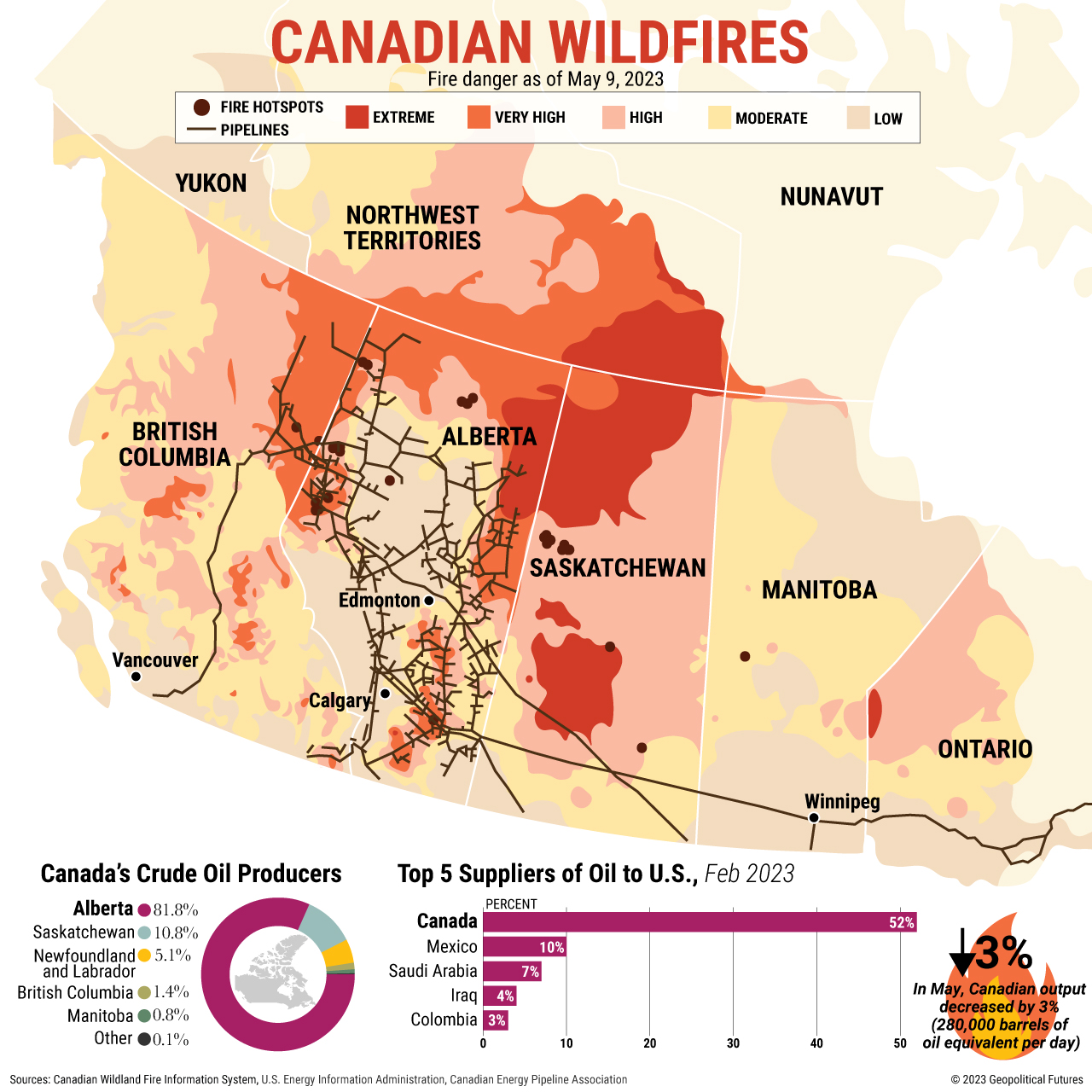

Hotter Temperatures Increase Saskatchewan Wildfire Threat

May 31, 2025

Hotter Temperatures Increase Saskatchewan Wildfire Threat

May 31, 2025 -

Newfoundland Wildfires Force Evacuations Cause Widespread Home Destruction

May 31, 2025

Newfoundland Wildfires Force Evacuations Cause Widespread Home Destruction

May 31, 2025 -

The Impact Of Canadian Wildfires On Minnesotas Air Quality

May 31, 2025

The Impact Of Canadian Wildfires On Minnesotas Air Quality

May 31, 2025 -

Canadian Wildfires And The Devastating Impact On Minnesotas Air

May 31, 2025

Canadian Wildfires And The Devastating Impact On Minnesotas Air

May 31, 2025 -

Officials Warn Of Intensified Wildfire Season In Saskatchewan Due To Heat

May 31, 2025

Officials Warn Of Intensified Wildfire Season In Saskatchewan Due To Heat

May 31, 2025