Dogecoin's Recent Decline: Correlation With Tesla Stock And Elon Musk's Activities

Table of Contents

Tesla Stock Performance and its Impact on Dogecoin

Historically, Tesla stock price movements have shown a correlation with Dogecoin price. This connection is far from coincidental; it's largely driven by the actions and influence of Elon Musk, the CEO of Tesla and a vocal supporter of Dogecoin. The keywords here are Tesla stock price, Dogecoin price correlation, and Tesla influence.

-

Positive Tesla news often leads to a surge in both Tesla stock and Dogecoin. When Tesla announces strong earnings, launches new products, or receives positive media coverage, investor sentiment improves, often leading to a ripple effect boosting both Tesla stock and, surprisingly, Dogecoin. This isn't necessarily a direct causal relationship, but rather a reflection of shared investor enthusiasm and sentiment.

-

Conversely, negative news or decreased investor confidence in Tesla can negatively impact Dogecoin. Instances of production delays, supply chain issues, or negative news surrounding Tesla often translate into decreased investor confidence, leading to sell-offs in both Tesla stock and Dogecoin. This demonstrates the interconnectedness of these seemingly disparate assets.

-

This correlation is partly driven by Elon Musk's significant influence on both markets. Musk's pronouncements on Twitter and other platforms can significantly impact both Tesla's share price and Dogecoin's value, highlighting the immense power of social media in shaping market sentiment.

-

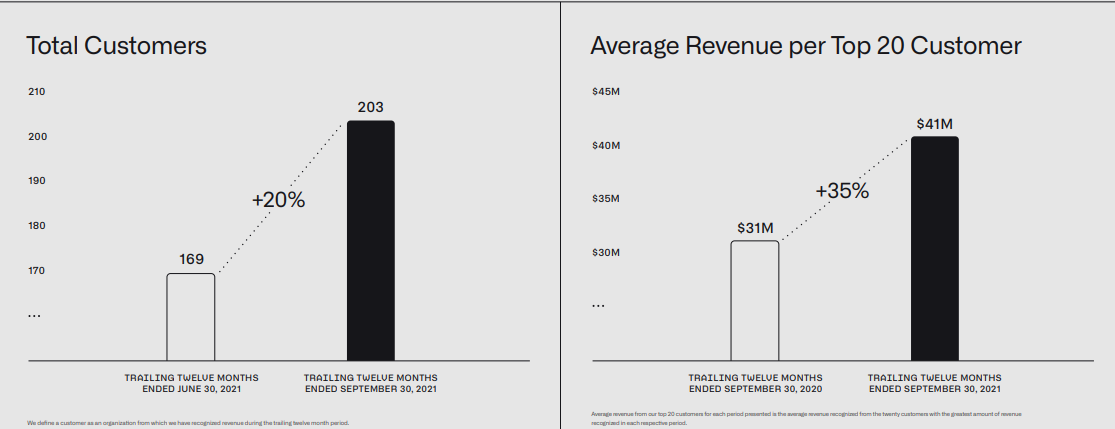

Analyzing recent Tesla performance data alongside Dogecoin price charts clearly visualizes this connection. A simple comparison of price charts for both assets often reveals a striking parallel, emphasizing the link between investor perception of Tesla and the value of Dogecoin. (Insert relevant chart here).

Elon Musk's Influence and its Effect on Dogecoin Price

Elon Musk's tweets and public statements frequently influence Dogecoin's price, making him a significant, albeit controversial, figure in the Dogecoin ecosystem. The keywords to note here are Elon Musk Dogecoin, Musk tweets, social media impact, and market manipulation.

-

Positive mentions often trigger price rallies; negative comments or silence can lead to significant drops. A single tweet from Musk can send Dogecoin's price soaring or plummeting, illustrating the considerable power of his influence and the volatility of the cryptocurrency market.

-

The impact highlights the role of social media in cryptocurrency markets. This dynamic underscores the growing importance of social media platforms in shaping market trends and investor behavior within the crypto space.

-

Discuss the ethical implications of such influence on a volatile asset like Dogecoin. The influence of a single individual on the price of a cryptocurrency raises ethical concerns regarding potential market manipulation and the fairness of the market. Regulations may be needed to mitigate this issue.

-

Analyzing specific instances where Musk's actions directly impacted the DOGE price provides concrete examples. For example, (insert specific example of a tweet from Musk and its impact on DOGE price). This analysis emphasizes the need for investors to critically evaluate news related to Musk's statements and actions, and understand their potential impact.

The Role of broader Market Sentiment

Dogecoin's price isn't solely determined by Tesla or Elon Musk; it's also influenced by broader cryptocurrency market trends and macroeconomic conditions. Key terms here are crypto market trends, overall market conditions, Bitcoin price, altcoin market, and risk appetite.

-

Dogecoin's price is also influenced by broader cryptocurrency market trends. When Bitcoin, the largest cryptocurrency, experiences a price drop, it often triggers a sell-off in other cryptocurrencies, including Dogecoin, highlighting the interconnectedness of the crypto market.

-

Negative sentiment in the overall crypto market (e.g., Bitcoin price drops) often affects Dogecoin. A downturn in the overall crypto market often spills over to Dogecoin, underscoring the risk inherent in investing in cryptocurrencies.

-

Macroeconomic factors also play a role, influencing investor risk appetite. Global economic conditions, inflation rates, and investor sentiment toward riskier assets all contribute to the price volatility of Dogecoin.

-

General market trends affect the price of both established and meme cryptocurrencies. A shift in investor risk appetite—for example, during periods of economic uncertainty—can heavily impact Dogecoin's price, highlighting the importance of considering broader economic factors.

Analyzing the Future of Dogecoin

Predicting the future of Dogecoin is inherently challenging given its volatility and dependence on external factors. However, considering its inherent volatility, potential for increased utility, and current adoption rate, we can speculate on its long-term prospects. Key terms include Dogecoin future, long-term outlook, investment risks, Dogecoin adoption, utility, and potential growth.

-

Assess the long-term prospects of Dogecoin considering its inherent volatility. Dogecoin's future price is highly speculative and depends on various factors, including continued adoption, technological advancements, and overall market sentiment.

-

Discuss the potential for increased utility and adoption of Dogecoin. Increased usage in real-world transactions or integration into decentralized applications could boost its value, but it remains a highly speculative investment.

-

Weigh the risks and rewards of investing in Dogecoin. Investing in Dogecoin carries significant risk, as its price can fluctuate dramatically. Investors must carefully consider their risk tolerance before investing.

-

Explore potential factors that could drive future price growth or decline. Factors like increased regulatory scrutiny, technological developments, or shifts in broader market sentiment could significantly impact Dogecoin's long-term prospects.

Conclusion

This analysis demonstrates a strong correlation between Dogecoin's recent decline, Tesla stock performance, and Elon Musk's activities. The influence of social media and market sentiment significantly impacts Dogecoin’s price volatility. While Dogecoin has shown periods of explosive growth, investors should understand the inherent risks associated with this highly speculative asset. Understanding these factors—the influence of Tesla, Elon Musk's pronouncements, and broader market trends—is key to making informed decisions about Dogecoin.

Call to Action: Stay informed about the latest developments in the Dogecoin market and continue to research before making any investment decisions related to Dogecoin or any other cryptocurrency. Understanding the complexities of Dogecoin and its susceptibility to external factors is crucial for responsible investment in this volatile asset.

Featured Posts

-

Is Palantir A Buy After A 30 Drop

May 10, 2025

Is Palantir A Buy After A 30 Drop

May 10, 2025 -

Jeanine Pirro To Speak In North Idaho Event Information

May 10, 2025

Jeanine Pirro To Speak In North Idaho Event Information

May 10, 2025 -

Trumps Tariffs 174 Billion Loss For Top 10 Billionaires

May 10, 2025

Trumps Tariffs 174 Billion Loss For Top 10 Billionaires

May 10, 2025 -

Punjab Government Announces Skill Development Program For Transgenders

May 10, 2025

Punjab Government Announces Skill Development Program For Transgenders

May 10, 2025 -

Behind The Scenes With Jeanine Pirro Uncovering The Fox News Star

May 10, 2025

Behind The Scenes With Jeanine Pirro Uncovering The Fox News Star

May 10, 2025