Double-Digit Gains On BSE: Sensex Rally Highlights Top Performers

Table of Contents

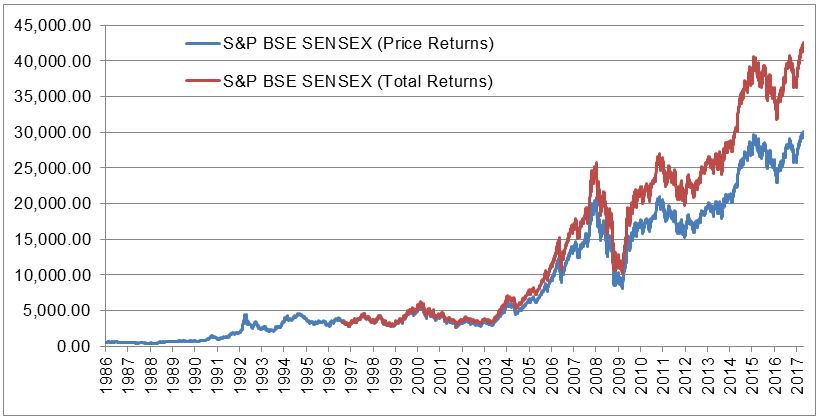

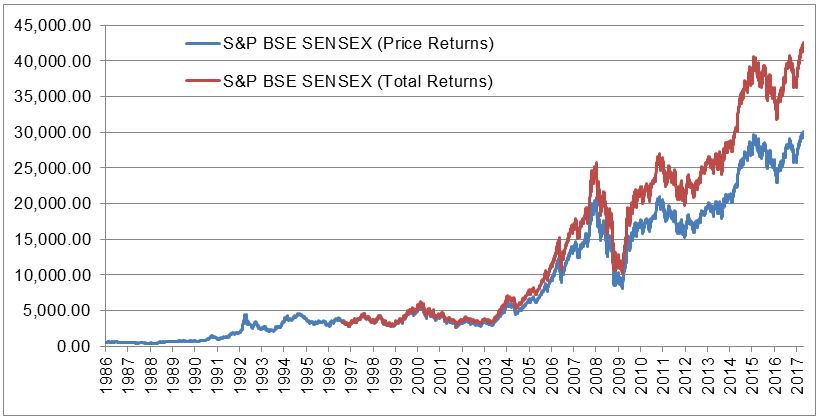

Key Sectors Driving the Sensex Rally

Several sectors played a pivotal role in propelling the Sensex to its double-digit gains. The strong performance of these sectors reflects positive economic indicators, robust earnings reports, and a surge in investor confidence. Let's delve into the key contributors:

-

Information Technology (IT): The IT sector experienced exceptional growth, driven by strong demand for software services and technological solutions globally. Companies like Infosys (INFY) and Tata Consultancy Services (TCS) showcased impressive gains, fueled by robust quarterly earnings and positive future outlook.

-

Financials: The financial sector also contributed significantly to the Sensex rally. Banks and Non-Banking Financial Companies (NBFCs) benefited from improved credit growth and positive regulatory announcements. HDFC Bank (HDFCBANK) and ICICI Bank (ICICIBANK) were among the top performers in this sector.

-

Fast-Moving Consumer Goods (FMCG): Despite inflationary pressures, the FMCG sector demonstrated resilience. Strong brand loyalty and consistent consumer demand for essential goods helped drive growth for leading companies like Hindustan Unilever (HINDUNILVR) and ITC (ITC).

Here's a breakdown of the top 5 performing sectors:

- IT: [Percentage Gain]%

- Financials: [Percentage Gain]%

- FMCG: [Percentage Gain]%

- Pharmaceuticals: [Percentage Gain]%

- Energy: [Percentage Gain]%

Keywords: Sectoral performance, BSE Sensex sectors, top performing sectors, IT stocks, financial stocks, FMCG stocks.

Top Performing Stocks: A Closer Look

Beyond the sectoral performance, several individual stocks demonstrated exceptional gains during the Sensex rally. These stocks benefited from a combination of strong fundamentals, positive news, and overall market sentiment.

Here are some of the top performers:

- Reliance Industries (RELIANCE): [Percentage Gain]%, driven by strong performance across its diverse business segments.

- HDFC Bank (HDFCBANK): [Percentage Gain]%, fueled by robust credit growth and positive investor sentiment.

- Infosys (INFY): [Percentage Gain]%, benefiting from strong demand for IT services.

- Tata Consultancy Services (TCS): [Percentage Gain]%, driven by robust quarterly earnings.

- Hindustan Unilever (HINDUNILVR): [Percentage Gain]%, reflecting consistent consumer demand.

Keywords: Top BSE stocks, best performing stocks, stock market winners, Sensex top gainers.

Analyzing the Factors Behind the Sensex Rally

The double-digit Sensex rally wasn't a singular event; it was the culmination of several interacting factors:

- Global Economic Trends: Positive global economic indicators and easing geopolitical tensions contributed to improved investor confidence.

- Government Policies: Supportive government policies and initiatives aimed at boosting economic growth played a significant role.

- Strong Corporate Earnings: Robust earnings reports from several listed companies reinforced positive market sentiment.

- Increased Foreign Institutional Investor (FII) Investments: Significant inflows of foreign investment further fueled the rally.

Keywords: Market analysis, economic factors, Sensex drivers, investor sentiment, market trends.

What Does This Mean for Investors?

The Sensex rally presents both opportunities and risks for investors. While the positive momentum is encouraging, it's crucial to approach investments with caution and conduct thorough research before making any decisions. The current rally indicates a positive market outlook, but future market trends are always subject to change. Diversification of your portfolio across various sectors and asset classes is crucial for effective risk management. Remember, this is not financial advice; consult with a qualified financial advisor before making any investment choices.

Keywords: Investment strategies, market outlook, Sensex prediction, risk management.

Conclusion: Navigating the Double-Digit Sensex Rally

The double-digit Sensex rally highlights the impressive performance of several key sectors and individual stocks on the BSE. The IT, Financials, and FMCG sectors were key drivers, with companies like Reliance Industries, HDFC Bank, and Infosys leading the charge. Understanding the macroeconomic factors contributing to this rally, including global economic trends and government policies, is essential for navigating the market effectively. While the current outlook is positive, investors should approach the market with caution and diversify their portfolios. Stay informed about future Sensex rallies and their impact on top BSE performers by subscribing to our newsletter! Learn more about maximizing your returns during a Sensex rally by exploring our investment resources.

Keywords: Sensex outlook, BSE investment, future market trends.

Featured Posts

-

What Makes A Crypto Exchange Compliant In India A Simple Guide For 2025

May 15, 2025

What Makes A Crypto Exchange Compliant In India A Simple Guide For 2025

May 15, 2025 -

Stocks Surged Sensex Rises Top Bse Stocks Up Over 10

May 15, 2025

Stocks Surged Sensex Rises Top Bse Stocks Up Over 10

May 15, 2025 -

Leeflang Affaire Npo Toezichthouder Vereist Gesprek Met Bruins

May 15, 2025

Leeflang Affaire Npo Toezichthouder Vereist Gesprek Met Bruins

May 15, 2025 -

Kuzey Kibris Yemek Kueltuerue Itb Berlin De Sergilendi

May 15, 2025

Kuzey Kibris Yemek Kueltuerue Itb Berlin De Sergilendi

May 15, 2025 -

Erbakan In Kibris Mesaji Sehitlerimizin Hatirasina Sadik Kalmak

May 15, 2025

Erbakan In Kibris Mesaji Sehitlerimizin Hatirasina Sadik Kalmak

May 15, 2025

Latest Posts

-

Onderzoek Naar Angstcultuur Bij De Npo Na Klachten Van Medewerkers Over Leeflang

May 15, 2025

Onderzoek Naar Angstcultuur Bij De Npo Na Klachten Van Medewerkers Over Leeflang

May 15, 2025 -

Npo Werknemers Melden Angstcultuur Onder Leiding Van Leeflang

May 15, 2025

Npo Werknemers Melden Angstcultuur Onder Leiding Van Leeflang

May 15, 2025 -

Leeflang En De Npo Klachten Over Angstcultuur Van Medewerkers

May 15, 2025

Leeflang En De Npo Klachten Over Angstcultuur Van Medewerkers

May 15, 2025 -

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025 -

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025