Dow Futures And Dollar Decline Following Moody's Rating Cut

Table of Contents

Moody's Rating Cut and its Justification

Moody's downgrade of the US government's credit rating from Aaa to Aa1 cited the country's fiscal challenges as the primary reason. This decision, announced on August 1, 2023, marked the first time the US rating had been lowered since 2011, underscoring the seriousness of the situation. The agency pointed to a sustained period of fiscal deterioration, characterized by:

-

Fiscal challenges facing the US government: The persistent widening of the budget deficit and the increasing national debt are key concerns. The inability to implement meaningful fiscal reforms contributes to this instability.

-

Increasing national debt and its projected trajectory: The national debt continues to climb at an unsustainable rate, raising concerns about the country's long-term debt sustainability. Moody's projects further increases without significant policy changes.

-

Political gridlock hindering fiscal reforms: Deep political divisions have hampered efforts to enact comprehensive fiscal reforms, further exacerbating the fiscal challenges. The lack of bipartisan cooperation is a significant obstacle.

-

Comparison to previous US credit rating downgrades: While this is not the first time the US has faced a credit rating downgrade, the current circumstances are unique, given the scale of the debt and the political polarization.

-

Moody's outlook for the US economy post-downgrade: Moody's outlook remains negative, suggesting a further potential decline in the credit rating if fiscal challenges are not addressed effectively.

Impact on Dow Futures

The announcement of the Moody's rating cut triggered an immediate negative reaction in Dow Futures. The Dow Jones Industrial Average experienced a significant drop, reflecting investor concerns about the economic implications of the downgrade. The percentage decrease, while varying depending on the specific timeframe, signaled a loss of confidence in the US economy.

-

Investor sentiment and its role in shaping Dow Futures: Negative investor sentiment, driven by uncertainty about the future economic outlook, played a crucial role in shaping the Dow Futures market's response.

-

Effect on various sectors within the Dow Jones Industrial Average: The impact varied across different sectors, with some more sensitive to the news than others. Financials, for example, were particularly hard hit.

-

Short-term and long-term predictions for Dow Futures based on expert opinions: Expert opinions are divided on the long-term implications for Dow Futures, with some predicting a sustained downturn, while others see potential for recovery.

-

Comparison to previous market reactions to credit rating changes: This reaction was comparable to, or even more pronounced than, previous market responses to similar credit rating downgrades.

-

Technical analysis of Dow Futures charts post-downgrade: Technical analysis of Dow Futures charts revealed significant volatility and downward pressure in the immediate aftermath of the announcement.

Dollar Decline in the Aftermath

The Moody's downgrade directly contributed to a decline in the value of the dollar. The decreased confidence in the US economy led investors to seek safer havens, resulting in a weakening dollar. This has implications across various aspects of the global economy:

-

Safe-haven assets and their relative performance compared to the dollar: Assets like gold and other precious metals experienced increased demand as investors sought safety.

-

Impact on foreign exchange markets and currency trading: The dollar's decline significantly impacted foreign exchange markets, influencing currency pairs and trading strategies.

-

Implications for US import and export businesses: A weaker dollar makes US exports cheaper but imports more expensive, impacting the competitiveness of American businesses.

-

Potential for inflation due to the weakening dollar: The weaker dollar could contribute to higher inflation as the cost of imported goods rises.

-

Predictions for the future value of the dollar based on current market trends: Predictions for the dollar's future value are uncertain, dependent on various economic and political factors.

Global Market Reactions

The impact of the Moody's rating cut extended beyond US borders, affecting global markets. European and Asian markets experienced varying degrees of negative impact, reflecting the interconnectedness of the global financial system.

-

Specific examples of market reactions in other countries: Stock markets in several countries saw declines following the news, highlighting the global reach of the impact.

-

Comparative analysis of the sensitivity of different markets to the news: Some markets were more sensitive to the news than others, reflecting their level of exposure to the US economy.

-

The role of global interconnectedness in amplifying the impact: Global interconnectedness played a significant role in amplifying the impact of the rating cut, spreading its effects across different markets.

-

Long-term global economic implications: The long-term global economic implications are uncertain, but could include increased volatility and uncertainty in global financial markets.

Conclusion

The Moody's rating cut had a profound and multifaceted impact on global markets. The decline in Dow Futures and the weakening of the dollar are clear manifestations of diminished investor confidence in the US economy. The interconnectedness of global markets amplified these effects, resulting in ripple effects across various financial instruments and geographical regions. Understanding the complex interplay between these factors is crucial. Stay informed about the evolving situation concerning Dow Futures and the dollar's value following the Moody's rating cut. Regularly monitor market updates and expert analyses to make informed decisions regarding your investments and financial planning. Understanding the implications of events like these is crucial for navigating the complexities of the global financial landscape. Continue to monitor Dow Futures, the dollar's value, and any further announcements related to the Moody's rating cut for a comprehensive understanding of the evolving market dynamics.

Featured Posts

-

Nyt Mini Crossword May 13 2025 Solutions And Tips

May 21, 2025

Nyt Mini Crossword May 13 2025 Solutions And Tips

May 21, 2025 -

Is It Time For Logitechs Forever Mouse A Realistic Assessment

May 21, 2025

Is It Time For Logitechs Forever Mouse A Realistic Assessment

May 21, 2025 -

Abn Amro Aex Stijgt Na Positieve Kwartaalresultaten

May 21, 2025

Abn Amro Aex Stijgt Na Positieve Kwartaalresultaten

May 21, 2025 -

Self Guided Walking Tour Of Provence A Mountain To Mediterranean Coast Journey

May 21, 2025

Self Guided Walking Tour Of Provence A Mountain To Mediterranean Coast Journey

May 21, 2025 -

Australian Man Achieves Fastest Ever Foot Crossing

May 21, 2025

Australian Man Achieves Fastest Ever Foot Crossing

May 21, 2025

Latest Posts

-

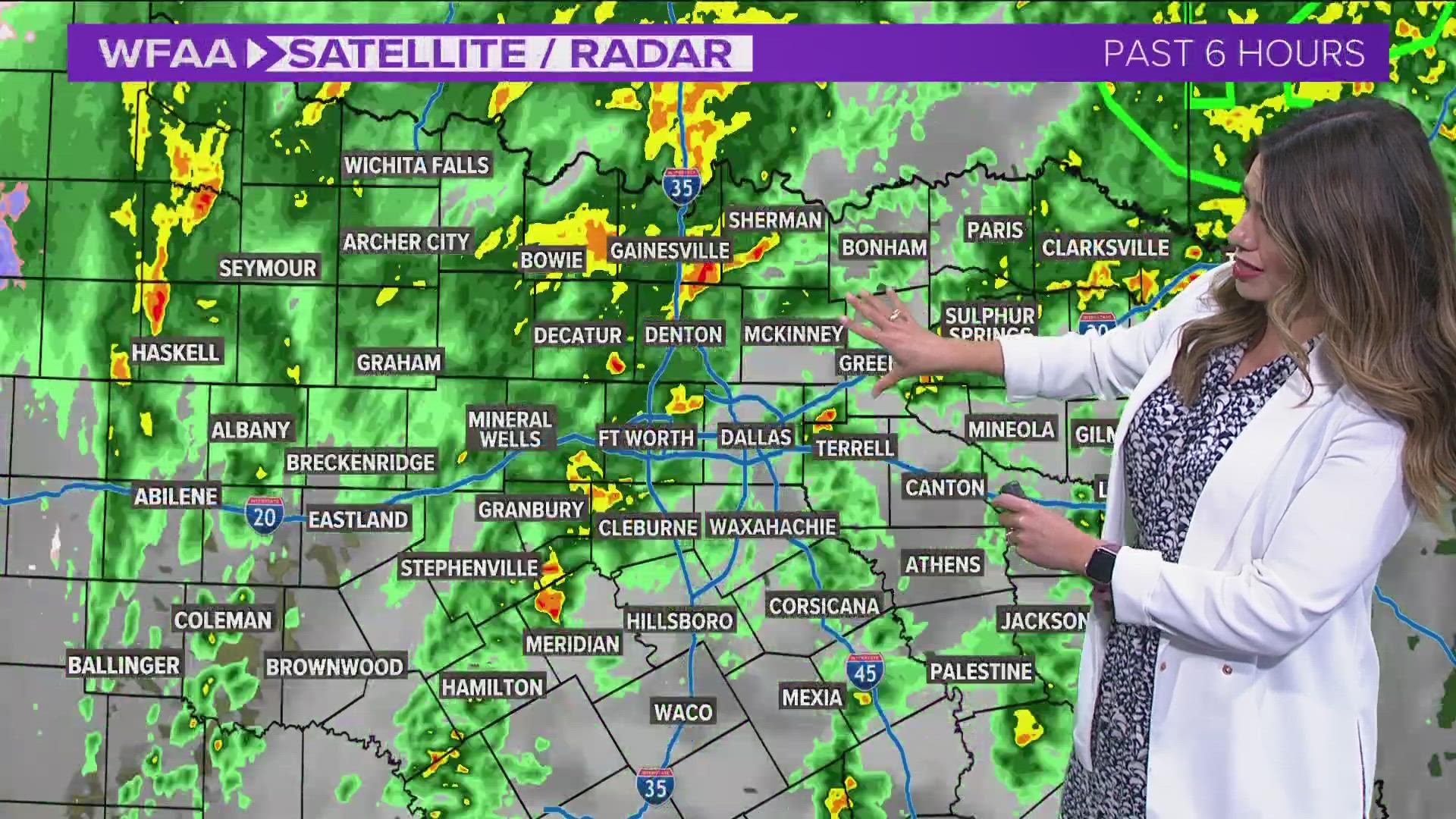

When Will It Rain Precise Timing And Chances Of Precipitation

May 21, 2025

When Will It Rain Precise Timing And Chances Of Precipitation

May 21, 2025 -

Checking For Rain Get The Latest Timing And Forecast Updates

May 21, 2025

Checking For Rain Get The Latest Timing And Forecast Updates

May 21, 2025 -

Current Rain Predictions Accurate Timing Of On And Off Showers

May 21, 2025

Current Rain Predictions Accurate Timing Of On And Off Showers

May 21, 2025 -

Reddits 12 Hottest Ai Stocks Should You Invest

May 21, 2025

Reddits 12 Hottest Ai Stocks Should You Invest

May 21, 2025 -

Big Bear Ai Stock Risks And Rewards For Investors

May 21, 2025

Big Bear Ai Stock Risks And Rewards For Investors

May 21, 2025