Dow Futures Fall: Moody's Downgrade Jolts Dollar And Markets

Table of Contents

Moody's Downgrade: The Catalyst for Market Uncertainty

Moody's decision to downgrade the US government's credit rating from Aaa to Aa1 was not unexpected but still sent a significant ripple effect through the markets. Their rationale centered around the US's increasing debt burden, projected fiscal deficits, and the erosion of governance strength. This downgrade signals a deterioration in the US government's fiscal strength and its ability to manage its debt obligations effectively.

- Details of the Downgrade: The downgrade moved the US from its top rating to the second-highest, indicating a heightened risk of default.

- Specific Fiscal Challenges: Moody's cited the persistent and rising US debt levels and the projected trajectory of deficits over the next few years as key factors in their decision. The lack of substantial progress in addressing long-term fiscal challenges also played a crucial role.

- Potential Impact on Long-Term Interest Rates: A credit downgrade typically increases borrowing costs for the US government, leading to higher interest rates across the board, impacting everything from mortgages to corporate debt.

- Historical Context: While rare, similar downgrades in other countries have historically led to market volatility and increased borrowing costs, demonstrating the significant implications of such a move.

Dow Futures Plummet: Immediate Market Reaction

The immediate market reaction to Moody's announcement was swift and dramatic. Dow futures experienced a significant decline, reflecting a broad-based sell-off across major indices. The sheer magnitude of the drop underscores the severity of the situation and the market's sensitivity to perceived increases in risk. Trading volume surged, indicating high levels of activity as investors reacted to the news.

- Dow Jones Industrial Average (DJIA) Percentage Change: The Dow futures experienced a [insert percentage]% drop within hours of the announcement, indicating significant investor anxiety.

- Other Major Indices' Performance: The S&P 500 and Nasdaq also experienced substantial declines, mirroring the negative sentiment affecting the broader market.

- Specific Sectors Most Affected: Financials and technology sectors were among the hardest hit, reflecting their sensitivity to changes in interest rates and investor sentiment.

- Investor Sentiment Analysis – Fear, Uncertainty, Doubt (FUD): The prevailing sentiment was one of fear, uncertainty, and doubt, leading to increased risk aversion and a flight to safety.

The Weakening Dollar: A Consequence of the Downgrade

The decline in Dow futures was closely intertwined with a weakening US dollar. The downgrade increased uncertainty about the US economy, making investors less inclined to hold dollar-denominated assets. This resulted in a decrease in demand for the dollar, pushing its value down against major global currencies.

- USD Exchange Rate Changes Against Major Currencies: The dollar weakened against the Euro (EUR), British Pound (GBP), and Japanese Yen (JPY), reflecting the reduced confidence in the US economy.

- Impact on Import/Export Costs for US Businesses: The weaker dollar can make imports more expensive for US businesses, potentially increasing inflation. Conversely, exports could become more competitive.

- The Federal Reserve's Likely Response: The Federal Reserve may respond to the situation by adjusting monetary policy, potentially influencing interest rates to stabilize the economy.

- Potential for Further Currency Volatility: The uncertainty surrounding the US economic outlook suggests the potential for continued volatility in the dollar's value in the coming weeks and months.

Looking Ahead: Navigating Market Volatility After the Downgrade

The Moody's downgrade and its subsequent market impact underscore the importance of careful risk management and a well-diversified investment strategy. While the short-term outlook remains uncertain, it's crucial for investors to remain informed and adapt their strategies to the evolving economic landscape.

- Predictions for Short-Term and Long-Term Market Performance: The short-term outlook suggests continued volatility, while the long-term impact depends on how effectively the US government addresses its fiscal challenges.

- Recommendations for Investors: Investors should consider hedging strategies, carefully review their asset allocation, and potentially increase their holdings in less risky assets.

- Discussion of Potential Opportunities Amidst the Volatility: While risk remains, opportunities may arise for savvy investors who can identify undervalued assets and navigate the market effectively.

- Importance of Staying Informed About Economic News and Analysis: Continuous monitoring of economic news, market trends, and expert analysis is critical for making informed investment decisions.

Conclusion: Understanding and Responding to Dow Futures Falls

The Moody's downgrade has created a significant impact, causing Dow futures to fall, the dollar to weaken, and overall market uncertainty to increase. These factors are interconnected, highlighting the systemic nature of global finance. Understanding the interplay between these elements is crucial for navigating this volatile period. To make informed investment decisions, it’s vital to stay updated on Dow futures movements and related news. Follow reputable financial news sources for the latest updates on Moody's downgrade and its ongoing effect on global markets. Staying informed is key to mitigating risk and capitalizing on potential opportunities.

Featured Posts

-

Ing Provides Project Finance To Freepoint Eco Systems

May 21, 2025

Ing Provides Project Finance To Freepoint Eco Systems

May 21, 2025 -

Is The Goldbergs Still Relevant Today A Critical Analysis

May 21, 2025

Is The Goldbergs Still Relevant Today A Critical Analysis

May 21, 2025 -

How To Deal With Love Monster Behaviors

May 21, 2025

How To Deal With Love Monster Behaviors

May 21, 2025 -

Abn Amro Rapporteert Forse Groei In Occasionverkoop

May 21, 2025

Abn Amro Rapporteert Forse Groei In Occasionverkoop

May 21, 2025 -

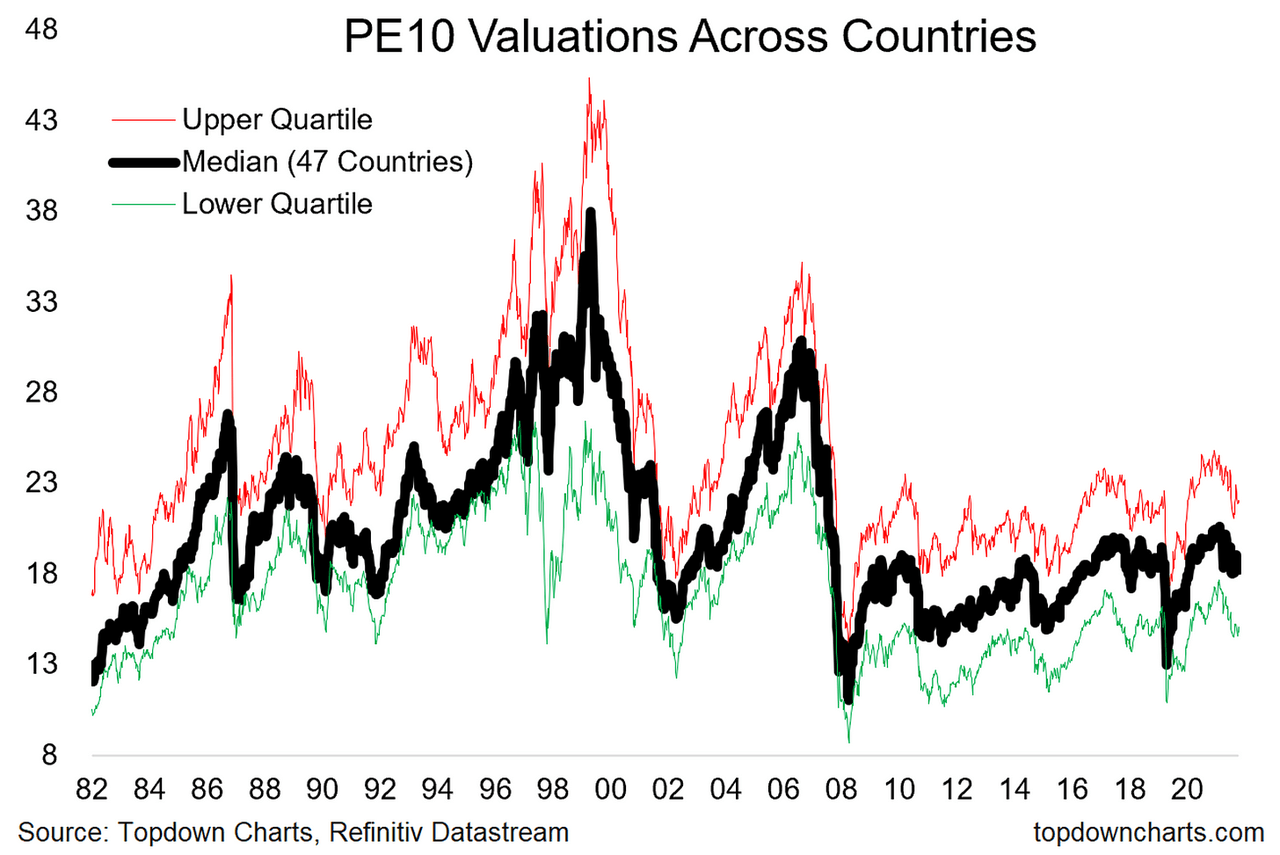

Bof As Analysis Addressing Concerns About Elevated Stock Market Valuations

May 21, 2025

Bof As Analysis Addressing Concerns About Elevated Stock Market Valuations

May 21, 2025

Latest Posts

-

Understanding Ftv Lives A Hell Of A Run Report

May 21, 2025

Understanding Ftv Lives A Hell Of A Run Report

May 21, 2025 -

Resilience And Mental Wellness From Setback To Success

May 21, 2025

Resilience And Mental Wellness From Setback To Success

May 21, 2025 -

A Hell Of A Run Examining The Ftv Live Report

May 21, 2025

A Hell Of A Run Examining The Ftv Live Report

May 21, 2025 -

Ftv Lives A Hell Of A Run A Deep Dive Into The Controversy

May 21, 2025

Ftv Lives A Hell Of A Run A Deep Dive Into The Controversy

May 21, 2025 -

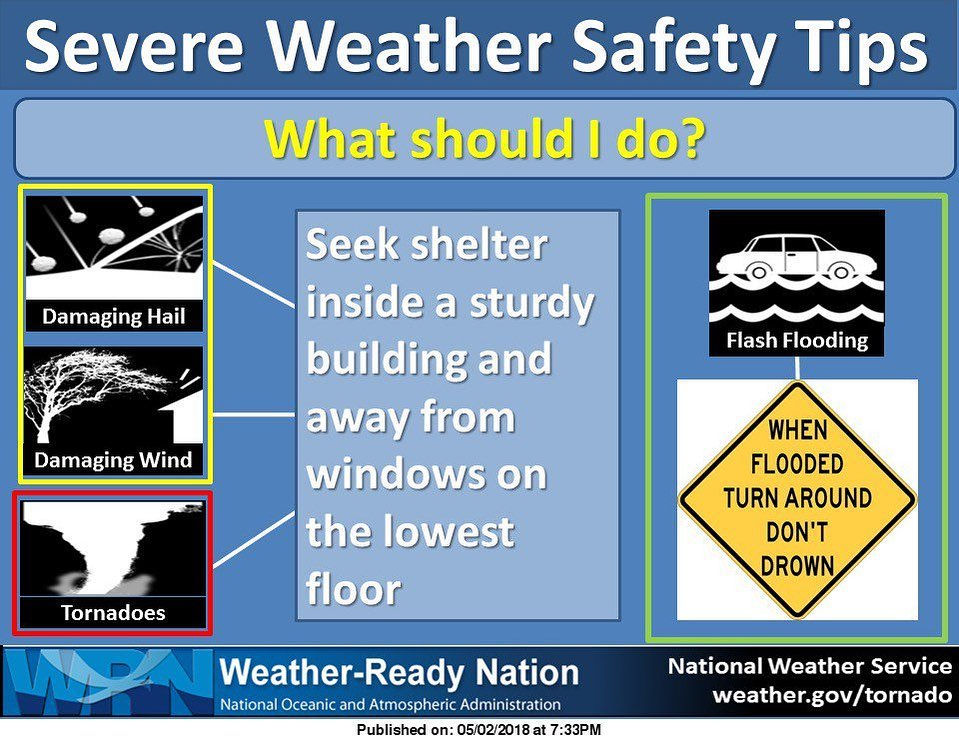

Increased Storm Chance Overnight Severe Weather Alert For Monday

May 21, 2025

Increased Storm Chance Overnight Severe Weather Alert For Monday

May 21, 2025