Dow Jones's Measured Rise: PMI Data Provides Support

Table of Contents

Understanding the PMI and its Influence on the Dow Jones

What is the PMI?

The Purchasing Managers' Index (PMI) is a leading economic indicator that tracks the change in the prevailing business conditions as perceived by purchasing managers. It's a diffusion index, meaning it reflects the proportion of respondents reporting improvement versus deterioration. The PMI is calculated separately for the manufacturing and services sectors, providing a comprehensive view of economic activity.

- Manufacturing PMI: Focuses on industrial production, new orders, employment, and supplier deliveries within the manufacturing sector.

- Services PMI: Measures similar aspects but within the services industry, including areas like retail, transportation, and finance.

Key components of the PMI include:

- New Orders: Indicates the level of demand for goods and services.

- Production: Measures the output of goods and services.

- Employment: Tracks changes in employment levels within the sector.

- Supplier Deliveries: Reflects the speed of deliveries from suppliers, providing insights into supply chain pressures.

A PMI reading above 50 generally indicates economic expansion, while a reading below 50 suggests contraction.

The Correlation Between PMI and Dow Jones Performance

Historically, there's a strong correlation between strong PMI readings and positive Dow Jones movement. Positive PMI data boosts investor sentiment because it indicates a healthy economy, leading to increased corporate profits and higher stock valuations.

- Data Points: (Insert specific data points here, if available, showing correlations between PMI and Dow Jones performance over a specific period. For example: "Over the past five years, a PMI reading above 55 has been associated with an average Dow Jones increase of X% within Y months.")

- Investor Interpretation: Investors closely monitor PMI data to adjust their investment strategies. Strong PMI readings often encourage investment in equities, while weak readings might prompt a shift towards more conservative assets.

- Limitations: While the correlation is generally positive, it's not absolute. Other factors, such as geopolitical events or unexpected economic shocks, can also significantly influence the Dow Jones.

Recent PMI Data and its Impact on the Dow Jones

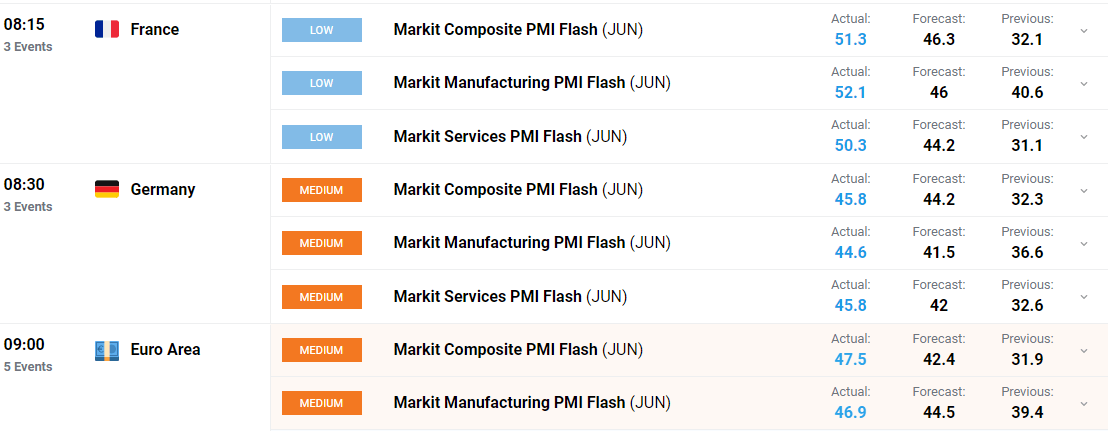

Analyzing the Latest PMI Reports

(Insert the latest PMI reports here, including specific numbers and dates. For example: "The August 2023 Manufacturing PMI came in at 52.5, exceeding analysts' expectations of 52.0. The Services PMI reached 53.0, also surpassing forecasts.")

- Significance: Explain the significance of these numbers in relation to the previous month's readings and market expectations. Emphasize if the numbers were a positive surprise or if they confirmed existing trends. (e.g., "This positive surprise signaled continued strength in the US economy, exceeding analysts' predictions and contributing to improved market sentiment.")

- Positive Aspects: Highlight specific details within the reports that contributed to market confidence. (e.g., "The increase in new orders within the manufacturing sector indicated strong consumer and business demand, furthering investor optimism.")

Market Reaction to the PMI Data

The release of the positive PMI data resulted in a noticeable upward movement in the Dow Jones.

- Upward Movement: Quantify the increase in the Dow Jones following the PMI release. (e.g., "Following the release of the PMI data, the Dow Jones experienced a X point increase, representing a Y% gain.")

- Contributing Factors: Discuss other factors that may have contributed to the rise, beyond the PMI data. (e.g., "Positive earnings reports from major corporations and easing concerns about inflation also contributed to the positive market sentiment.")

- Analyst Quotes: Include relevant quotes from financial analysts supporting this analysis (if available).

Potential Risks and Future Outlook for the Dow Jones

Factors that Could Affect Future Growth

Despite the positive PMI data, several factors could impact future Dow Jones growth.

- Geopolitical Factors: Global conflicts, trade wars, or political instability can negatively affect market confidence and lead to Dow Jones volatility.

- Inflationary Pressures: Persistent inflation can erode corporate profits and lead to interest rate hikes, potentially dampening economic growth.

- Interest Rate Hikes: Aggressive interest rate hikes by central banks to combat inflation can slow down economic activity and negatively impact stock prices.

Predicting Future Trends Based on PMI and Other Indicators

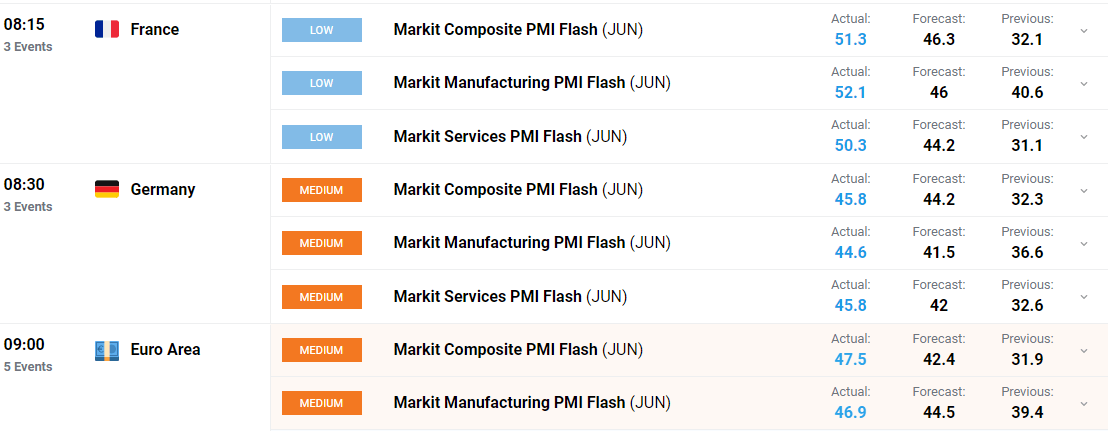

Predicting the future movement of the Dow Jones requires considering the PMI data alongside other economic indicators.

- Possible Scenarios: Outline potential scenarios for future market movement, considering both positive and negative factors. (e.g., "A continued strong PMI combined with easing inflation could lead to sustained Dow Jones growth, while a sudden spike in inflation or a geopolitical crisis might trigger a correction.")

- Other Indicators: Mention other crucial economic indicators to monitor, such as GDP growth, unemployment rates, and consumer confidence indices.

- Diversification: Emphasize the importance of diversification in investment strategies to mitigate risks.

Conclusion

The recent measured rise in the Dow Jones Industrial Average is strongly linked to positive PMI data, signaling robust economic activity and improved investor confidence. While the positive PMI readings are encouraging, investors should remain aware of potential risks such as geopolitical uncertainties, persistent inflation, and interest rate hikes. A diversified investment strategy is crucial for navigating the complexities of the market.

Call to Action: Stay informed on the latest PMI data and its impact on the Dow Jones to make informed investment decisions. Continue monitoring key economic indicators and adjust your investment strategy based on the evolving economic landscape. Understanding the interplay between the Dow Jones and PMI is crucial for successful investing.

Featured Posts

-

News Corps Undervalued Assets A Potential Investment Opportunity

May 25, 2025

News Corps Undervalued Assets A Potential Investment Opportunity

May 25, 2025 -

Aktery Filma O Bednom Gusare Zamolvite Slovo Vozrast I Roli

May 25, 2025

Aktery Filma O Bednom Gusare Zamolvite Slovo Vozrast I Roli

May 25, 2025 -

Kuda Propali Pobediteli Evrovideniya Poslednie 10 Let

May 25, 2025

Kuda Propali Pobediteli Evrovideniya Poslednie 10 Let

May 25, 2025 -

Philips Shareholders Key Information On The 2025 Agm Agenda

May 25, 2025

Philips Shareholders Key Information On The 2025 Agm Agenda

May 25, 2025 -

Camunda Con 2025 Amsterdam Orchestrating Ai And Automation For Business Success

May 25, 2025

Camunda Con 2025 Amsterdam Orchestrating Ai And Automation For Business Success

May 25, 2025

Latest Posts

-

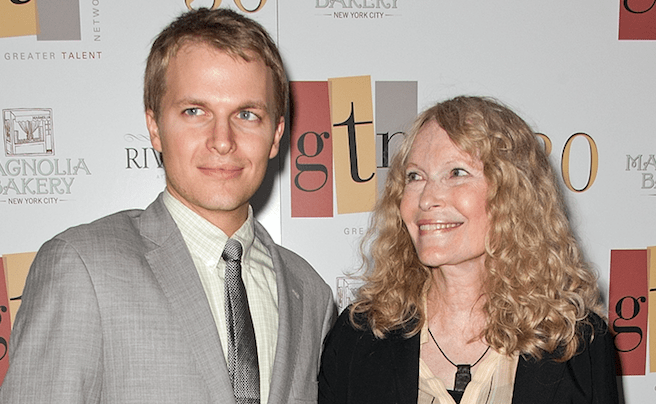

Will Ronan Farrow Orchestrate Mia Farrows Showbiz Return

May 25, 2025

Will Ronan Farrow Orchestrate Mia Farrows Showbiz Return

May 25, 2025 -

Michael Caines Shocking Mia Farrow Sex Scene Story A Bloody Hell Recounting

May 25, 2025

Michael Caines Shocking Mia Farrow Sex Scene Story A Bloody Hell Recounting

May 25, 2025 -

Analysis Mia Farrows Comments On Trump And The Future Of American Democracy

May 25, 2025

Analysis Mia Farrows Comments On Trump And The Future Of American Democracy

May 25, 2025 -

Mia Farrows Career Revival Is Ronan Farrow The Key

May 25, 2025

Mia Farrows Career Revival Is Ronan Farrow The Key

May 25, 2025 -

Florida Film Festival A Star Studded Event Featuring Mia Farrow And Christina Ricci

May 25, 2025

Florida Film Festival A Star Studded Event Featuring Mia Farrow And Christina Ricci

May 25, 2025