Elon Musk's Net Worth Drops: Tesla's Challenges And Market Volatility

Table of Contents

Tesla's Production and Delivery Challenges

Tesla's ambitious growth targets have been hampered by significant production and delivery challenges, directly impacting its financial performance and, subsequently, Elon Musk's net worth.

Production Bottlenecks

Meeting production targets has proven increasingly difficult for Tesla. Several factors contribute to these bottlenecks:

- Supply chain disruptions: The global chip shortage and disruptions to raw material supplies have consistently hampered Tesla's manufacturing capacity.

- Factory issues: Production hiccups at Tesla's Gigafactories, including equipment malfunctions and logistical problems, have led to reduced output.

- Labor shortages: Finding and retaining skilled labor to operate and maintain complex manufacturing facilities has presented a significant challenge.

These issues have resulted in a noticeable decrease in Tesla's production output. For example, reports suggest a [insert percentage]% drop in production during [insert time period], directly impacting overall profitability and negatively influencing Tesla's stock price, which in turn affects Elon Musk's net worth.

Delivery Delays

Beyond production bottlenecks, delivery delays have further exacerbated the situation. These delays:

- Frustrate customers, potentially damaging Tesla's brand reputation.

- Lead to negative investor sentiment, impacting the company's valuation.

- Contribute to lower-than-expected quarterly earnings, putting further pressure on Tesla's stock price.

For instance, [cite an example of a significant delivery delay and its consequences]. These delays are often linked to broader economic factors, including port congestion and global shipping constraints, compounding the challenges faced by Tesla.

Increasing Competition in the EV Market

The once-dominant position of Tesla in the EV market is now facing increasing pressure from both established automakers and new EV startups.

Rise of Competitors

Established automakers like Ford, Volkswagen, and General Motors are aggressively investing in their EV portfolios, offering competitive models with similar features and technology. Meanwhile, new EV startups are emerging, further intensifying the competition.

- [Mention specific competitors and their market strategies, e.g., Ford's Mustang Mach-E, Volkswagen's ID.4].

- This increased competition is directly impacting Tesla's market share and forcing them to adopt more aggressive pricing strategies.

Data shows [cite data on market share changes, sales figures for competitors]. This intensified competitive landscape directly impacts Tesla's profitability and contributes to the volatility of its stock price.

Price Wars and Margin Pressure

The rise of competition has led to price wars, squeezing Tesla's profit margins. Tesla has responded with its own price cuts, aiming to maintain market share but at the expense of profitability.

- [Provide examples of price cuts implemented by Tesla and competitors].

- This price pressure poses a significant challenge to Tesla's long-term financial sustainability and erodes investor confidence, impacting Elon Musk’s net worth.

- Tesla will need to innovate and find new avenues for revenue generation to counteract the margin pressure.

The Impact of Market Volatility

Beyond Tesla's internal challenges, broader market forces have significantly impacted the company's stock price and, therefore, Elon Musk's net worth.

Global Economic Uncertainty

Global economic headwinds, such as inflation, recession fears, and rising interest rates, create uncertainty in the market and affect investor sentiment toward riskier assets like Tesla stock.

- The correlation between major market indices (e.g., S&P 500, Nasdaq) and Tesla's stock performance is strong, demonstrating the influence of overall market trends.

- [Include relevant charts and graphs to illustrate market trends and correlations].

- Negative investor sentiment leads to decreased demand for Tesla shares, causing price drops.

Elon Musk's Influence

Elon Musk's public pronouncements and actions have a considerable influence on Tesla's stock price and investor confidence. Controversial tweets or unexpected decisions can trigger significant market reactions.

- [Provide examples of instances where Musk's actions negatively impacted Tesla's stock].

- His leadership style, while innovative, also carries significant risk, as his public statements can directly affect investor perception and the company's valuation.

Conclusion

The recent drop in Elon Musk's net worth reflects a combination of internal challenges faced by Tesla, including production bottlenecks and delivery delays, as well as the increasing competition in the EV market and the broader impact of market volatility. These factors have created a perfect storm, putting pressure on Tesla's profitability and its stock price. Understanding these interconnected issues is crucial for assessing the future trajectory of Tesla and the fluctuating fortunes of its CEO. Stay informed about the ongoing developments impacting Elon Musk's net worth and Tesla's performance by following reputable financial news sources and industry analyses. Understanding these factors is crucial for navigating the complexities of the ever-changing electric vehicle market.

Featured Posts

-

Strictly Come Dancing Wynne Evans Unexpected Career Change

May 10, 2025

Strictly Come Dancing Wynne Evans Unexpected Career Change

May 10, 2025 -

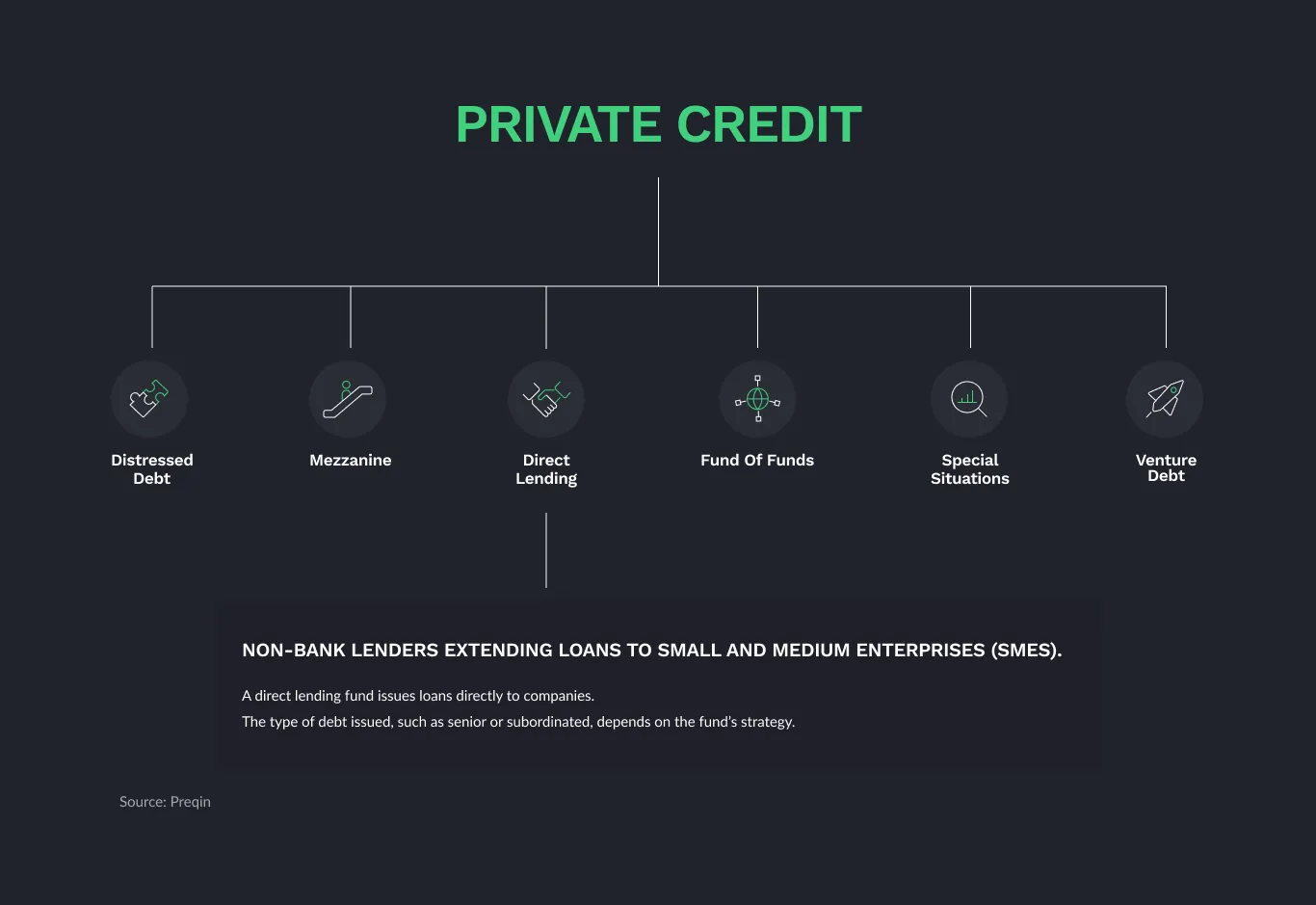

5 Key Strategies To Secure A Private Credit Role

May 10, 2025

5 Key Strategies To Secure A Private Credit Role

May 10, 2025 -

Family Devastated Unprovoked Racist Killing Leaves Loved Ones Broken

May 10, 2025

Family Devastated Unprovoked Racist Killing Leaves Loved Ones Broken

May 10, 2025 -

Go Compare Axe Wynne Evans Following Strictly Scandal

May 10, 2025

Go Compare Axe Wynne Evans Following Strictly Scandal

May 10, 2025 -

Perus Emergency Mining Ban A 200 Million Blow To Gold Production

May 10, 2025

Perus Emergency Mining Ban A 200 Million Blow To Gold Production

May 10, 2025