Ethereum Market Volatility: The Significance Of The $67 Million Liquidation

Table of Contents

Understanding the $67 Million Liquidation Event

In the context of crypto trading, a liquidation occurs when a trader's margin account balance falls below the required maintenance margin. This typically happens when the price of the asset moves against the trader's position, forcing the exchange to automatically sell the assets to cover the losses. The $67 million liquidation event, which unfolded rapidly, involved a significant number of leveraged positions in ETH.

- Date and time of the event: [Insert specific date and time if available. Otherwise, use a timeframe like "late July 2024"]

- Approximate amount liquidated: $67 million USD (this figure can fluctuate slightly depending on the source)

- Types of trading positions liquidated: Primarily long positions, indicating that traders who bet on the price of Ethereum going up were heavily impacted by a sudden price drop.

- Impact on the overall Ethereum market price: The liquidation event contributed to a temporary dip in the Ethereum price, further exacerbating losses for some traders. This exemplifies the interconnectedness of the crypto market and how large liquidations can have cascading effects.

Factors Contributing to Ethereum Market Volatility

Ethereum's price is subject to considerable volatility, influenced by various interacting factors.

Macroeconomic Factors: Global economic uncertainty, inflation rates, and interest rate hikes by central banks significantly impact investor sentiment and risk appetite. Fear of a recession often leads to investors moving away from riskier assets like cryptocurrencies, resulting in price drops.

- Specific examples: The recent inflation reports, interest rate decisions by the Federal Reserve, and overall global economic slowdown have all played a role in impacting Ethereum's price.

Regulatory News and Announcements: Government regulations and announcements concerning cryptocurrencies can significantly influence market sentiment. Positive news often leads to price increases, while negative news or regulatory uncertainty can trigger sell-offs.

- Regulatory changes impacting Ethereum: Ongoing debates and regulations around crypto taxation, security, and market manipulation directly affect investor confidence and price stability.

Market Sentiment and Social Media: The cryptocurrency market is highly susceptible to hype and fear. Social media narratives, influencer opinions, and news articles can dramatically impact market sentiment, leading to significant price swings. FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt) are powerful forces driving volatility.

- Examples of social media narratives: Viral tweets from influential figures or widespread negative news about a specific exchange can drastically influence the price of Ethereum.

Whale Activity: Large holders of Ethereum ("whales") can significantly impact market prices through their buying and selling activities. Their actions can trigger cascading effects, particularly in a market characterized by relatively low liquidity.

The Implications of this Liquidation for Ethereum Investors

The $67 million liquidation serves as a stark reminder of the inherent risks associated with leveraged trading. Leveraged trading amplifies both profits and losses, meaning that even small price movements can result in substantial gains or devastating losses.

- Risks associated with leveraged trading: The use of leverage magnifies the impact of market volatility, making it crucial for traders to understand their risk tolerance and implement appropriate risk management strategies.

Risk Management Strategies: Diversification, stop-loss orders, and thorough due diligence are critical for mitigating risk in the volatile Ethereum market. Avoid over-leveraging and always trade with capital you can afford to lose.

- Strategies for mitigating risk: Diversifying your crypto portfolio beyond Ethereum, setting stop-loss orders to limit potential losses, and conducting thorough research before making any investment decisions are crucial.

Market Analysis: Successful Ethereum investment requires a combination of fundamental and technical analysis. Understanding the underlying technology, adoption rate, and future development plans is as crucial as analyzing price charts and trading indicators.

-

Importance of fundamental analysis: Examining Ethereum's technological advancements, adoption by businesses, and future development roadmap are key to a well-rounded investment strategy.

-

Assessing personal risk tolerance: Before investing in Ethereum, honestly evaluate your risk tolerance and investment goals to ensure your strategy aligns with your financial situation.

Long-Term Outlook for Ethereum Despite Volatility

Despite the short-term volatility, Ethereum's underlying technology and network strength remain compelling. The ongoing development and adoption of Ethereum, particularly in decentralized finance (DeFi) and non-fungible tokens (NFTs), suggest a potentially bright long-term outlook.

-

Upcoming Ethereum upgrades: Future upgrades like [mention specific upgrades, e.g., sharding] are expected to improve scalability and efficiency, making Ethereum more attractive for businesses and developers.

-

Adoption rate of Ethereum: The increasing integration of Ethereum in various sectors, including supply chain management and digital identity, points towards continued growth.

-

Predictions about Ethereum's price: While predicting future prices is impossible, analyzing market trends and expert opinions can provide insights into potential future price movements.

-

Comparison of Ethereum's volatility with other cryptocurrencies: It's important to remember that Ethereum, like other cryptocurrencies, is inherently volatile. Comparing its volatility to other major cryptocurrencies can provide context.

Conclusion

The $67 million liquidation event underscores the significant Ethereum market volatility inherent in the cryptocurrency market. This volatility is influenced by a complex interplay of macroeconomic factors, regulatory developments, market sentiment, and leveraged trading practices. Understanding and managing risk is paramount for navigating this volatility. Stay informed about the latest developments influencing Ethereum market volatility to make well-informed investment decisions. Learn more about mitigating risk in volatile crypto markets and navigate the complexities of Ethereum price volatility effectively.

Featured Posts

-

Nba Playoffs Triple Doubles The Ultimate Quiz Challenge

May 08, 2025

Nba Playoffs Triple Doubles The Ultimate Quiz Challenge

May 08, 2025 -

Jayson Tatum Game Status Celtics Vs Nets Injury Report And Prediction

May 08, 2025

Jayson Tatum Game Status Celtics Vs Nets Injury Report And Prediction

May 08, 2025 -

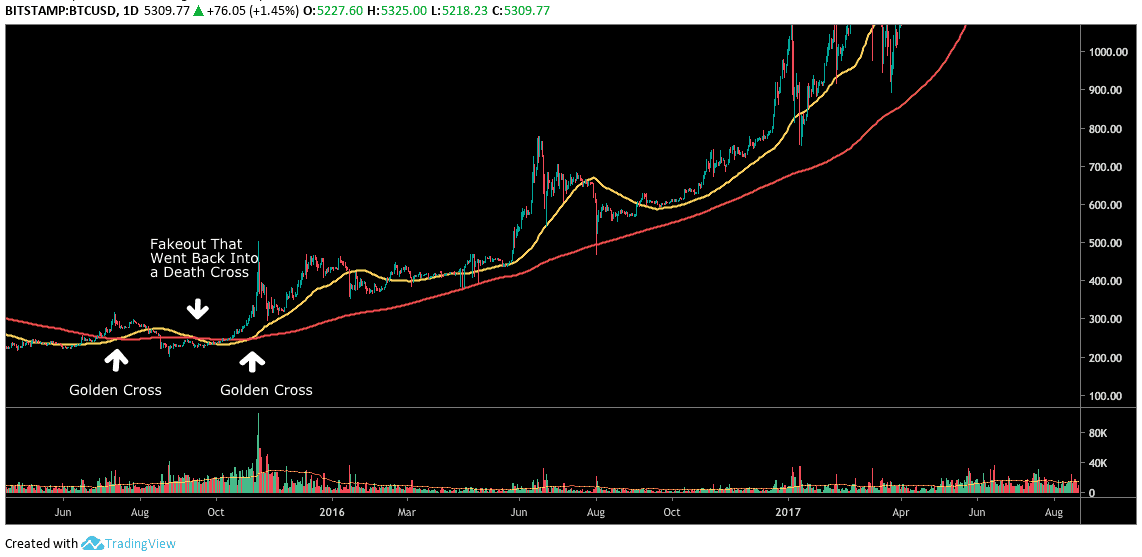

Bitcoin Price Golden Cross What It Means For Investors

May 08, 2025

Bitcoin Price Golden Cross What It Means For Investors

May 08, 2025 -

Fetterman Responds To Ny Magazines Fitness Concerns

May 08, 2025

Fetterman Responds To Ny Magazines Fitness Concerns

May 08, 2025 -

March 7th Nba Thunder Vs Trail Blazers Game Time Tv Broadcast And Streaming Guide

May 08, 2025

March 7th Nba Thunder Vs Trail Blazers Game Time Tv Broadcast And Streaming Guide

May 08, 2025