Ethereum Price Forecast: Conquering Resistance Towards $2,000

Table of Contents

Analyzing Current Market Conditions for Ethereum

To accurately assess the Ethereum price forecast and its potential to reach $2,000, we need to examine the current market conditions. This involves analyzing both technical and fundamental aspects, as well as considering the broader macroeconomic environment.

Technical Analysis: Chart Patterns and Indicators

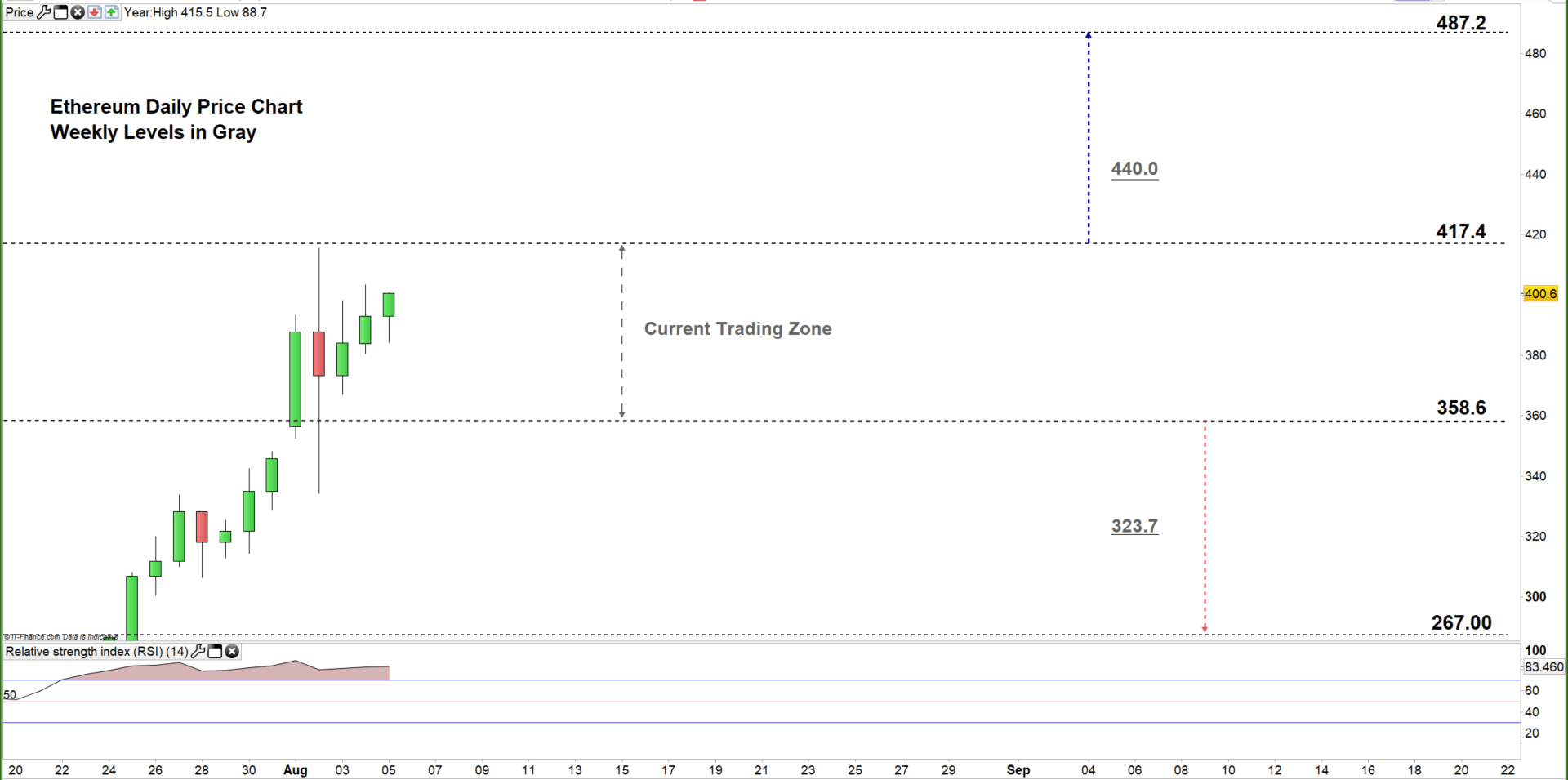

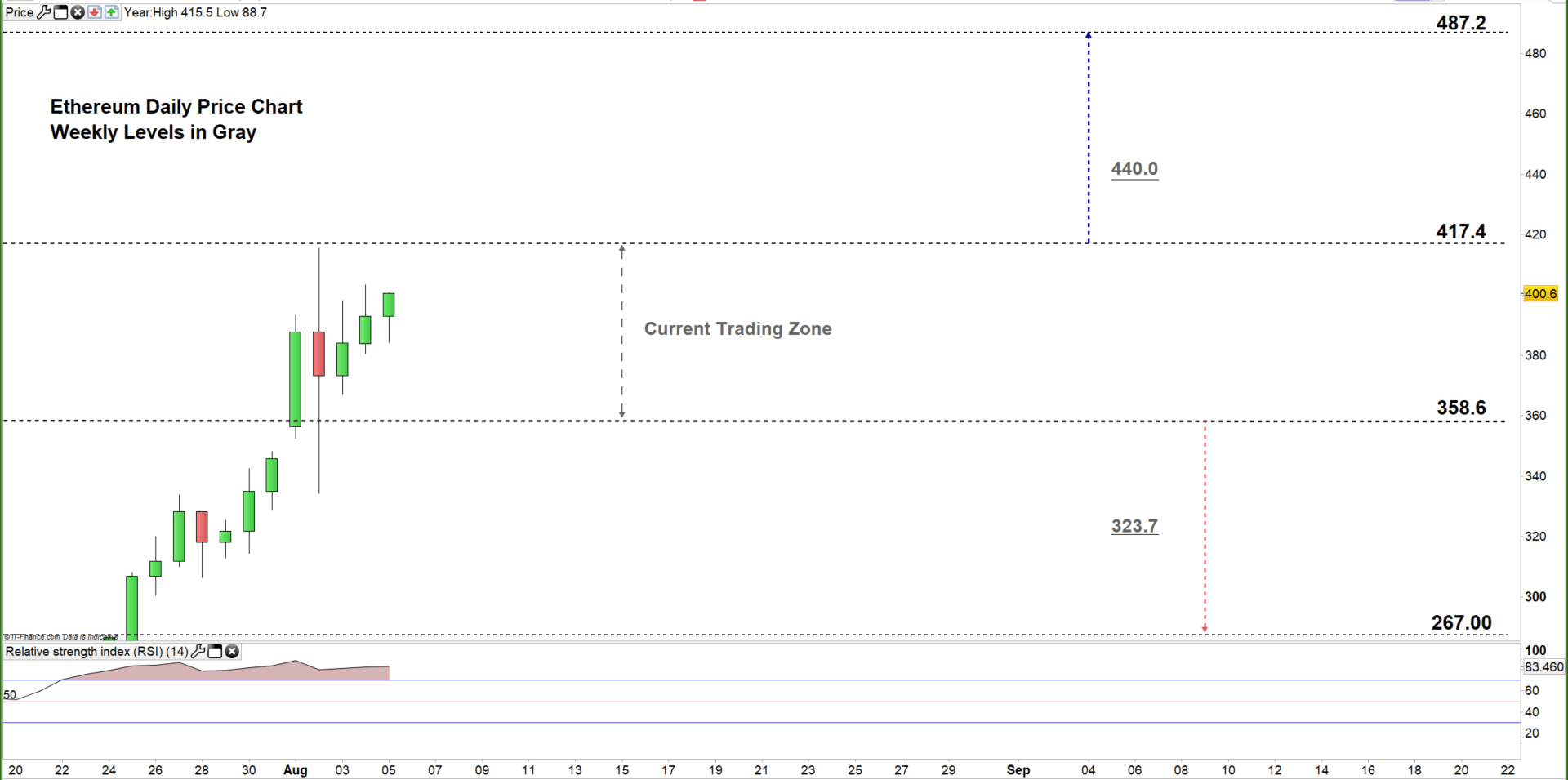

Technical analysis of Ethereum's price charts provides valuable insights into potential price movements. Examining key indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and various moving averages (e.g., 50-day, 200-day) can reveal important trends. Chart patterns, such as head and shoulders or triangles, can also signal potential breakouts or reversals.

- Key Support Levels: Identifying crucial support levels is vital for understanding potential price floors. Recent support has been observed around [insert price level] and [insert price level].

- Key Resistance Levels: The $2,000 mark represents a significant resistance level. Breaking through this level would signal a strong bullish trend. Other key resistance levels may exist at [insert price level] and [insert price level].

- Trend Analysis: The current trend can be identified by observing the direction of moving averages and overall price action. Is the trend bullish, bearish, or sideways? (Include a chart illustrating these levels and trends here).

Keywords: Ethereum technical analysis, Ethereum chart patterns, Ethereum support resistance.

Fundamental Analysis: Ethereum Network Growth and Development

Beyond technical indicators, fundamental factors significantly influence Ethereum's price. The Ethereum network's growth, development, and adoption rate are crucial elements in our Ethereum price prediction.

- Ethereum 2.0 Progress: The ongoing transition to Ethereum 2.0, with its enhanced scalability and security, is a major positive factor. The successful implementation of sharding and other upgrades could significantly boost Ethereum's value.

- DeFi Ecosystem Growth: The thriving Decentralized Finance (DeFi) ecosystem built on Ethereum is a key driver of its demand. Continued growth in DeFi applications and total value locked (TVL) will likely support Ethereum's price.

- NFT Market Trends: The Non-Fungible Token (NFT) market, largely built on Ethereum, continues to evolve. Sustained interest and innovation in NFTs could positively impact Ethereum's price.

- Network Congestion and Fees: High transaction fees and network congestion can be deterrents to adoption. Solutions to these issues are essential for long-term growth.

Keywords: Ethereum fundamentals, Ethereum 2.0 price prediction, DeFi impact on Ethereum.

Macroeconomic Factors Influencing Crypto Prices

Global macroeconomic conditions play a significant role in the performance of cryptocurrencies, including Ethereum.

- Inflation and Interest Rates: High inflation and rising interest rates can negatively impact risk assets like cryptocurrencies, potentially leading to a price decline.

- Regulatory Changes: Government regulations and policies concerning cryptocurrencies can heavily influence market sentiment and price volatility. Positive regulatory developments could boost Ethereum's price, while stricter regulations could have the opposite effect.

- General Market Sentiment: The overall sentiment in the broader financial markets can significantly impact the crypto market. Fear, uncertainty, and doubt (FUD) can drive prices down, while optimism and positive news can trigger price increases.

Keywords: Ethereum macroeconomic factors, crypto market sentiment, regulation impact on Ethereum.

Potential Pathways to $2,000: Bullish and Bearish Scenarios

Based on our analysis, several scenarios could unfold, leading to either a surge towards $2,000 or a more bearish outlook.

Bullish Scenario: Factors Favoring a Price Surge

Several positive factors could contribute to Ethereum reaching $2,000:

- Widespread Adoption: Increased institutional and individual adoption of Ethereum could drive demand and push the price higher.

- Positive Regulatory News: Favorable regulatory developments could significantly boost market confidence and lead to a price surge.

- Continued DeFi Growth: Continued growth and innovation in the DeFi ecosystem would further increase Ethereum's utility and value.

- Successful Ethereum 2.0 Transition: The successful completion of the Ethereum 2.0 upgrade would enhance scalability and attract more users.

Keywords: Ethereum bull run, $2000 Ethereum target, Ethereum price surge.

Bearish Scenario: Challenges and Potential Drawbacks

Conversely, several factors could prevent Ethereum from reaching $2,000:

- Regulatory Crackdowns: Stringent government regulations could dampen market enthusiasm and lead to price declines.

- Broader Crypto Market Downturn: A general downturn in the broader cryptocurrency market could drag down Ethereum's price.

- Technical Challenges: Unforeseen technical issues with the Ethereum network could negatively impact its performance and price.

- Increased Competition: The emergence of competing blockchain platforms could erode Ethereum's market share.

Keywords: Ethereum bear market, Ethereum price decline, Ethereum risks.

Ethereum Price Forecast: Our Predictions and Timeline

Considering the factors discussed above, our Ethereum price prediction suggests a potential path to $2,000 within [insert timeframe, e.g., the next 12-18 months]. However, this is contingent on several factors aligning favorably. A prolonged bear market or unexpected negative events could significantly delay or prevent this outcome. It's crucial to remember that this is a forecast, not a guaranteed outcome. Cryptocurrency investments are inherently risky.

Keywords: Ethereum price prediction 2024, Ethereum long-term forecast, Ethereum future price.

Conclusion: Navigating the Ethereum Market Towards $2,000

Our analysis of the Ethereum price forecast indicates a complex interplay of technical, fundamental, and macroeconomic factors that will ultimately determine whether Ethereum reaches $2,000. While a bullish scenario is certainly possible, fueled by factors like DeFi growth and Ethereum 2.0, potential bearish pressures such as regulatory uncertainty and macroeconomic headwinds cannot be ignored. Thorough research and a diversified investment strategy are crucial for navigating this volatile market. Continue to monitor the Ethereum price forecast and stay informed about the latest developments to make informed decisions. Regularly review your investment strategy and consider seeking professional financial advice before making any investment decisions related to Ethereum or any other cryptocurrency.

Featured Posts

-

Understanding The Uber Uber Investment Landscape

May 08, 2025

Understanding The Uber Uber Investment Landscape

May 08, 2025 -

Ma Qalh Alshmrany En Antqal Jysws Almhtml Lflamnghw

May 08, 2025

Ma Qalh Alshmrany En Antqal Jysws Almhtml Lflamnghw

May 08, 2025 -

Affordable United Center Transportation New 5 Uber Shuttle

May 08, 2025

Affordable United Center Transportation New 5 Uber Shuttle

May 08, 2025 -

Predicting Ethereums Future A Deep Dive Into Market Trends And Price Dynamics

May 08, 2025

Predicting Ethereums Future A Deep Dive Into Market Trends And Price Dynamics

May 08, 2025 -

Jayson Tatum Opens Up Grooming Confidence And A Meaningful Coaching Connection

May 08, 2025

Jayson Tatum Opens Up Grooming Confidence And A Meaningful Coaching Connection

May 08, 2025