Ethereum Price Outlook: Factors Influencing Future Growth

Table of Contents

Technological Advancements Driving Ethereum's Value

Ethereum's technological advancements are pivotal to its long-term value proposition. Two key areas significantly impact its price outlook: Ethereum 2.0 and layer-2 scaling solutions.

Ethereum 2.0 and its Impact

The transition to Ethereum 2.0 (now referred to as the "Consensus Layer") marks a paradigm shift for the network. The move to a proof-of-stake (PoS) consensus mechanism has several profound implications:

- Improved transaction speeds and lower fees: PoS significantly reduces transaction costs and speeds up processing times compared to the previous proof-of-work (PoW) system. This enhanced efficiency is a major draw for users and developers.

- Enhanced security and network stability: The PoS mechanism strengthens the network's security and resilience against attacks, contributing to greater investor confidence.

- Increased staking rewards and potential for passive income: Users who stake their ETH earn rewards, creating a new income stream and incentivizing network participation. This passive income potential attracts more investors.

- Attracting more developers and applications to the network: The improved performance and security make Ethereum a more attractive platform for developers building decentralized applications (dApps) and other blockchain-based solutions. This increased activity fuels network growth.

Layer-2 Scaling Solutions

Layer-2 scaling solutions, such as Optimism, Arbitrum, and Polygon, address Ethereum's scalability challenges. These solutions operate on top of the main Ethereum blockchain, processing transactions off-chain before settling them on the main chain. This approach offers several advantages:

- Reduced transaction costs for users: Layer-2 solutions drastically reduce gas fees, making Ethereum more accessible to a wider range of users.

- Increased throughput and faster transaction times: They significantly increase the number of transactions the network can handle per second, improving overall performance.

- Expansion of decentralized applications (dApps) and DeFi possibilities: Lower costs and faster speeds enable the growth of complex decentralized applications and DeFi protocols, boosting network activity.

- Positive impact on the overall user experience: The improved speed, cost-effectiveness, and scalability enhance the user experience, making Ethereum more user-friendly.

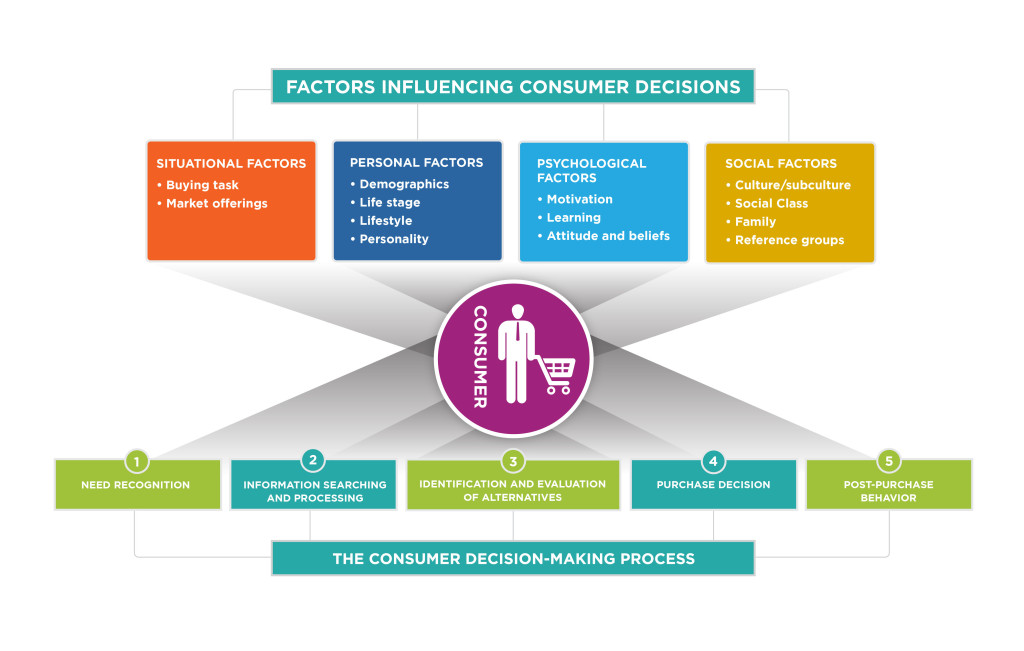

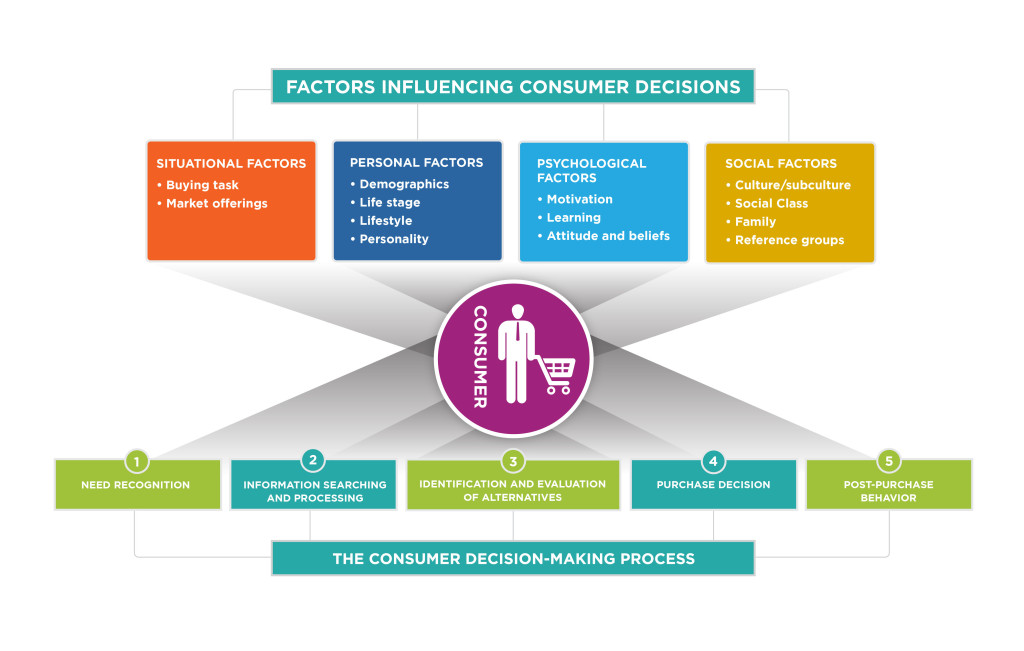

Market Sentiment and Investor Confidence

Market sentiment and investor confidence are crucial drivers of ETH price fluctuations. Both institutional and retail investor behavior plays a significant role.

Adoption by Institutional Investors

The growing interest from large financial institutions is a positive sign for Ethereum's long-term prospects. Their involvement brings several benefits:

- Increased liquidity and market depth: Institutional investments increase trading volume and liquidity, making the market more stable and less prone to manipulation.

- Greater price stability and reduced volatility: Larger, more established players tend to stabilize prices, reducing extreme price swings.

- Positive sentiment from mainstream financial markets: Institutional adoption signals a growing acceptance of cryptocurrencies within the traditional finance sector.

- Increased legitimacy and acceptance of cryptocurrencies: Institutional participation legitimizes cryptocurrencies in the eyes of regulators and the public.

Retail Investor Demand and Speculation

Retail investors and speculative trading also significantly influence ETH's price. While this can lead to rapid growth, it also introduces volatility:

- Potential for rapid price increases driven by hype: Positive news and social media buzz can trigger rapid price appreciation.

- Increased risk of significant price drops during market corrections: Speculative bubbles are inherently unstable and prone to sudden crashes.

- Impact of social media and news coverage on investor sentiment: News articles, social media trends, and influencer opinions significantly impact investor behavior.

- Influence of fear, uncertainty, and doubt (FUD) on the market: Negative news or perceived risks can trigger panic selling and price drops.

Regulatory Landscape and Governmental Policies

The regulatory environment significantly impacts Ethereum's price outlook. Clarity and consistent policies are essential for attracting institutional investment.

Regulatory Clarity and its Effects

Clear regulatory frameworks are essential for fostering growth and stability in the cryptocurrency market:

- Reduced uncertainty and increased stability in the market: Well-defined regulations reduce uncertainty and encourage institutional participation.

- Potential for increased regulatory scrutiny and potential restrictions: However, stricter regulations could also limit the growth and adoption of cryptocurrencies.

- Impact of varying regulatory approaches across different jurisdictions: Different countries' regulatory approaches create complexities for international crypto businesses.

- Influence on institutional participation and investment strategies: Regulatory clarity influences institutional investment decisions and risk assessments.

Governmental Initiatives and Support

Governmental support (or lack thereof) significantly impacts the cryptocurrency market:

- Governmental support for blockchain technology and digital assets: Positive government initiatives can boost investor confidence and encourage innovation.

- Potential for tax benefits or incentives for crypto investments: Tax benefits can encourage investment and adoption.

- Impact of regulatory hurdles and potential bans on cryptocurrency usage: Restrictive policies can hinder growth and adoption.

- Influence of national security concerns on regulatory decisions: National security concerns can influence regulatory decisions, sometimes negatively impacting cryptocurrency markets.

Competitive Landscape and Technological Competition

Ethereum faces competition from other blockchain platforms, impacting its market dominance and price.

Competition from Other Blockchains

Competing blockchains like Solana, Cardano, Avalanche, and others present challenges to Ethereum's dominance:

- Pressure on Ethereum’s market share and dominance: Competition forces Ethereum to continuously innovate and improve.

- Innovation spurred by competition and the potential for technological breakthroughs: The competitive landscape drives innovation and technological advancements across the entire blockchain ecosystem.

- Attracting developers and users to alternative platforms: Competing blockchains offer alternative solutions, potentially attracting developers and users away from Ethereum.

- Potential for strategic partnerships and collaborations: Competition can also lead to strategic partnerships and collaborations to enhance overall blockchain technology.

Technological Innovation and Advancement

Continuous innovation within the Ethereum ecosystem is vital for maintaining its competitive edge:

- Maintaining a competitive edge in the blockchain industry: Continuous development and improvement are crucial for staying ahead of the competition.

- Attracting and retaining top developers and talent: Ethereum needs to attract and retain top talent to continue its technological advancements.

- Potential for new functionalities and use cases for the Ethereum network: Innovation can unlock new applications and use cases for Ethereum, expanding its potential.

- Continued innovation and expansion of the Ethereum ecosystem: A vibrant and expanding ecosystem is essential for attracting users and developers.

Conclusion

The Ethereum price outlook is multifaceted, shaped by a complex interplay of technological advancements, market sentiment, regulatory frameworks, and competition. While Ethereum 2.0 and layer-2 solutions offer significant improvements, understanding market sentiment, regulatory clarity, and competitive pressures is crucial for making informed investment decisions. To stay informed on the latest developments and the evolving Ethereum price outlook, diligent research and continuous market monitoring are essential. Remember to always conduct your own thorough due diligence before investing in Ethereum or any other cryptocurrency.

Featured Posts

-

Dwp Updates Universal Credit New Claim Verification Procedures Explained

May 08, 2025

Dwp Updates Universal Credit New Claim Verification Procedures Explained

May 08, 2025 -

Could You Be Due A Universal Credit Payment Find Out Now

May 08, 2025

Could You Be Due A Universal Credit Payment Find Out Now

May 08, 2025 -

Grayscales Xrp Etf Filing Impact On Xrp Price And Potential Record High

May 08, 2025

Grayscales Xrp Etf Filing Impact On Xrp Price And Potential Record High

May 08, 2025 -

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Ka Nwtyfkyshn Jary

May 08, 2025

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Ka Nwtyfkyshn Jary

May 08, 2025 -

Enhancing Crime Control Through Efficient Directives

May 08, 2025

Enhancing Crime Control Through Efficient Directives

May 08, 2025