Ethereum Price Strength: Bulls In Control, Upside Potential?

Table of Contents

Recent Price Action and Market Sentiment

Analyzing recent Ethereum price movements reveals a fascinating narrative. After a period of consolidation, the price has shown significant upward momentum, breaking through key resistance levels. This positive Ethereum price action has been accompanied by a generally bullish market sentiment. Investors seem increasingly optimistic about Ethereum's long-term prospects.

-

Specific Price Movements: For example, the Ethereum price surged by 15% in the week of October 23rd, 2023, following the successful implementation of a significant network upgrade. Conversely, a minor dip of 5% was observed on November 10th, 2023, potentially attributed to a period of broader market uncertainty. (Note: These are examples and should be replaced with accurate, up-to-date data.)

-

News Impact: Positive news regarding Ethereum network upgrades, such as the ongoing rollout of sharding in Ethereum 2.0, has significantly influenced the Ethereum price. Regulatory announcements, even if seemingly negative at first glance, can sometimes result in a "buy the dip" scenario, temporarily impacting the Ethereum price.

-

Social Sentiment and Volume: Social media platforms are buzzing with positive sentiment regarding Ethereum. Increased trading volume further supports the bullish narrative, indicating strong market interest in the cryptocurrency. Analyzing data from platforms like CoinGecko and CoinMarketCap helps gauge the overall market sentiment and trading activity, reflecting its influence on the Ethereum price chart. This data, combined with the Ethereum market cap, provides a clearer picture of market dynamics.

Fundamental Factors Driving Ethereum Price Strength

The current Ethereum price strength isn't solely based on speculation; strong fundamental factors are at play. The ongoing development and implementation of crucial network upgrades are key drivers. Furthermore, the flourishing decentralized finance (DeFi) ecosystem built on Ethereum plays a significant role.

-

Network Upgrades: Ethereum 2.0, with its sharding implementation, promises significantly improved scalability and reduced transaction fees. This directly impacts the user experience, attracting more developers and users, and positively influencing the Ethereum price.

-

DeFi Ecosystem Growth: The total value locked (TVL) in DeFi protocols on the Ethereum network continues to grow, reflecting the increasing popularity and adoption of decentralized applications (dApps) built on the platform. This demonstrates strong underlying usage and contributes significantly to the overall Ethereum price. The growth of Ethereum DeFi further strengthens the entire ecosystem.

-

Improved Scalability and Transaction Fees: Upgrades such as sharding directly address past criticisms regarding Ethereum scalability. The resulting reduction in transaction fees makes Ethereum more accessible and attractive to a wider range of users, fueling demand and pushing up the Ethereum price.

Technical Analysis: Indicators Suggesting Further Upside

A technical analysis of the Ethereum price chart reveals several bullish indicators supporting the potential for further upside.

-

Moving Averages: The 50-day and 200-day moving averages are currently trending upwards, suggesting a strong bullish momentum.

-

RSI (Relative Strength Index): The RSI is above 50, indicating bullish momentum.

-

MACD (Moving Average Convergence Divergence): A bullish crossover of the MACD lines suggests further price appreciation.

-

Support and Resistance Levels: The Ethereum price has successfully broken through key resistance levels, suggesting a potential move to higher price targets. Conversely, identifying significant support levels helps gauge potential downside risk. Analyzing these Ethereum support resistance levels, combined with Ethereum chart patterns, can help predict potential future price movements. Visual representations, like charts and graphs, significantly enhance the understanding of this Ethereum technical analysis.

Potential Risks and Challenges

Despite the positive outlook, several factors could impact the Ethereum price negatively.

-

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain. Changes in regulations could negatively impact the Ethereum price.

-

Competition from Other Layer-1 Blockchains: Ethereum faces competition from other layer-1 blockchain networks offering potentially faster transaction speeds or lower fees. These Ethereum competitors pose a challenge to its dominance, which could impact the Ethereum price.

-

Cryptocurrency Volatility: The inherent volatility of the cryptocurrency market presents a significant risk. Unexpected market downturns can significantly affect the Ethereum price. Understanding and mitigating this cryptocurrency volatility is crucial for investors.

Conclusion

The current Ethereum price strength presents a compelling case for potential upside, driven by fundamental improvements and positive market sentiment. While risks remain, a combination of ongoing network upgrades, a thriving DeFi ecosystem, and positive technical indicators suggest a bullish outlook for the short-to-medium term. However, investors should remain cautious and conduct thorough research before making any investment decisions in the volatile cryptocurrency market. Stay updated on the latest news and analysis regarding Ethereum price to make informed choices about your portfolio. Continue to monitor the Ethereum price and its related metrics for a comprehensive understanding of this dynamic market.

Featured Posts

-

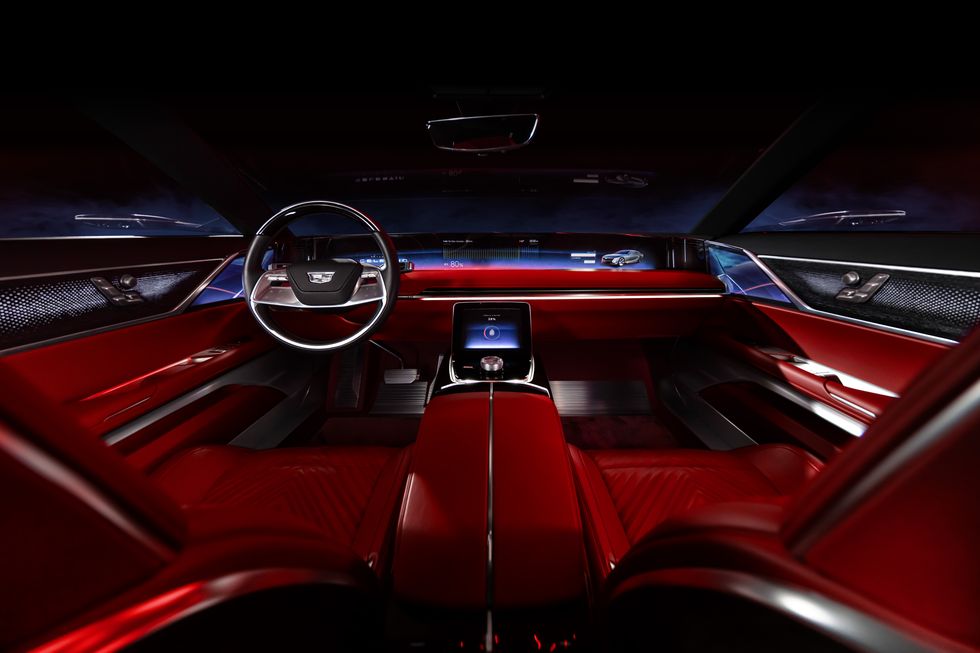

Cadillac Celestiq First Drive Luxury Technology And The Future Of Evs

May 08, 2025

Cadillac Celestiq First Drive Luxury Technology And The Future Of Evs

May 08, 2025 -

Dogecoin Shiba Inu And Sui A Deep Dive Into Their Recent Price Action

May 08, 2025

Dogecoin Shiba Inu And Sui A Deep Dive Into Their Recent Price Action

May 08, 2025 -

Avengers Or X Men Where Does Rogue Truly Belong

May 08, 2025

Avengers Or X Men Where Does Rogue Truly Belong

May 08, 2025 -

Xrp Regulatory Uncertainty The Secs Classification And Market Impact

May 08, 2025

Xrp Regulatory Uncertainty The Secs Classification And Market Impact

May 08, 2025 -

Could You Be Due A Universal Credit Payment Find Out Now

May 08, 2025

Could You Be Due A Universal Credit Payment Find Out Now

May 08, 2025