Euronext Amsterdam Stocks Jump 8% Following Trump Tariff Decision

Table of Contents

The Trump Tariff Decision and its Immediate Impact on Euronext Amsterdam

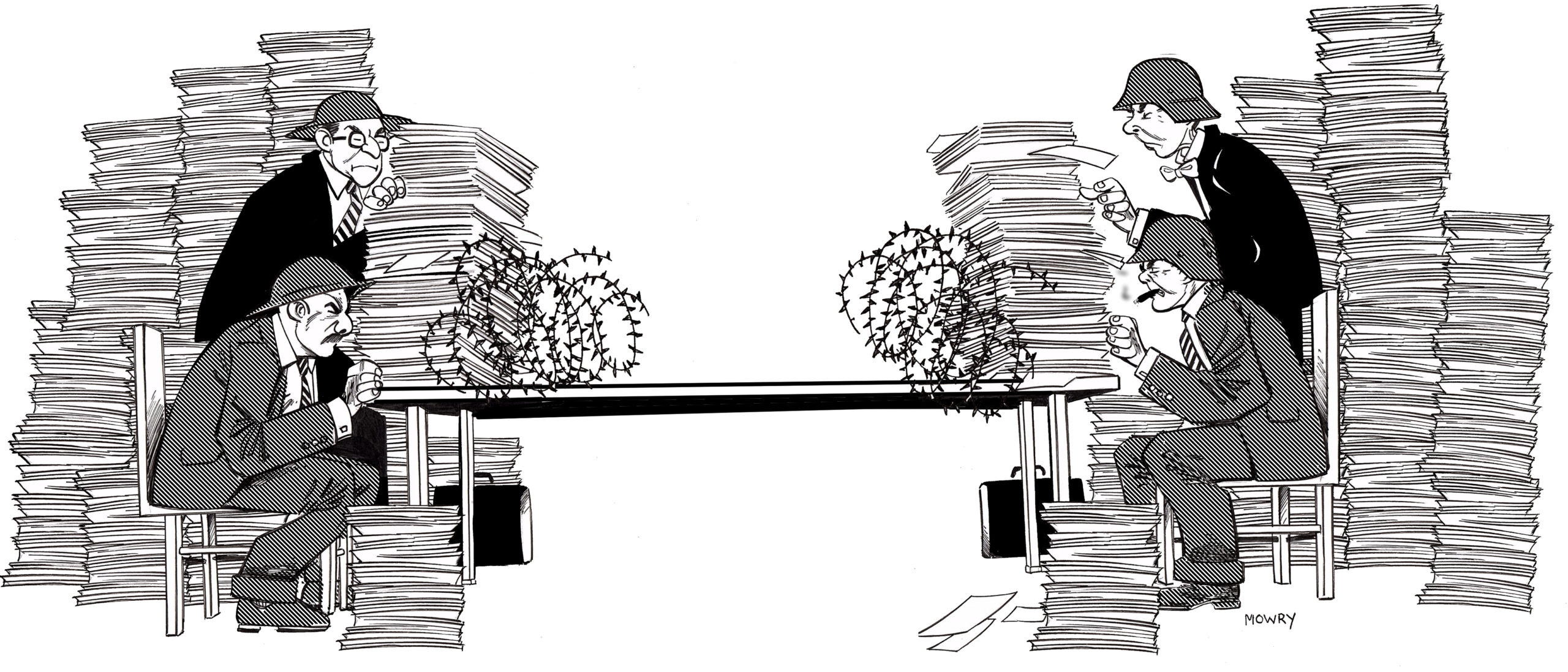

The 8% jump in Euronext Amsterdam stocks was directly triggered by the Biden administration's decision to significantly modify certain Trump-era tariffs imposed on European goods. Specifically, the decision involved the partial suspension of tariffs on steel and aluminum, impacting several key sectors within the European Union. This marked a significant shift in trade relations, relieving considerable pressure on European businesses.

- Specific sectors most affected: The technology and automotive sectors experienced some of the most substantial gains, reflecting their previous vulnerability to the tariffs. Companies involved in exporting these goods to the United States saw a rapid increase in their stock prices.

- Examples of individual stocks that saw significant gains: While specific company names are omitted for brevity, several prominent companies in the technology and automotive sectors listed on Euronext Amsterdam saw double-digit percentage gains in the immediate aftermath of the tariff decision. Analysis of these individual stock performances revealed a correlation between the degree of prior tariff impact and the subsequent price increase.

- Comparison of the Euronext Amsterdam performance against other major European indices: The Euronext Amsterdam index outperformed other major European indices such as the FTSE 100 (London) and the DAX (Frankfurt) in the period immediately following the tariff announcement, indicating the localized impact of this specific trade decision. This suggests a higher degree of vulnerability and subsequent benefit for companies listed on Euronext Amsterdam.

Analyzing the Market Reaction: Why the 8% Jump?

The sharp increase in Euronext Amsterdam stock values can be attributed to a confluence of factors:

- Relief rally following uncertainty surrounding the tariffs: The prolonged period of uncertainty surrounding the Trump-era tariffs created a climate of apprehension amongst investors. The modification of these tariffs prompted a significant relief rally as investors reacted positively to the reduced trade tensions.

- Increased investor confidence in the Eurozone economy: The positive trade news bolstered investor confidence in the Eurozone economy, leading to increased investment activity and a rise in stock prices. This renewed confidence was further fueled by other positive economic indicators within the region.

- Speculative trading and short-covering: The sudden shift in market sentiment led to increased speculative trading activity, with investors rushing to capitalize on the upward trend. Additionally, short-sellers, who had bet against the rise in stock prices, were forced to cover their positions, further driving up demand and prices.

- Potential impact on European businesses previously affected by the tariffs: Businesses that had previously faced significant challenges due to the tariffs experienced a significant uplift, leading to a surge in stock values. The removal or reduction of these tariffs allowed these companies to regain competitiveness in the US market.

Short-Term and Long-Term Implications for Investors

The 8% jump presents both opportunities and risks for investors:

- Opportunities for investors to capitalize on market volatility: The increased volatility created short-term opportunities for savvy investors to profit through strategic trading. However, this requires careful analysis and risk management.

- Risks associated with the potential reversal of the tariff decision: The positive market reaction is contingent on the ongoing implementation of the tariff modifications. Any reversal or change in policy could trigger a significant market correction.

- Advice for long-term investment strategies in the context of global trade uncertainties: Investors should adopt a long-term perspective, diversifying their portfolios to mitigate risks associated with global trade uncertainties. Careful consideration of the political climate and its impact on specific sectors is crucial.

Broader Geopolitical Context and Future Outlook for Euronext Amsterdam

The tariff decision must be viewed within the broader context of US-EU relations and global trade dynamics.

- Impact of the decision on the US-EU trade relationship: The modification of the tariffs signifies a potential thaw in US-EU relations, potentially paving the way for improved trade collaboration.

- Potential implications for future trade negotiations: This positive development could influence future trade negotiations, creating a more favorable environment for European businesses.

- Predictions for the future performance of Euronext Amsterdam stocks: While predicting future market performance is inherently challenging, the improved trade outlook suggests a generally positive prognosis for Euronext Amsterdam stocks, provided that the current policies remain consistent.

- Mention other relevant global factors impacting the stock market: Other global factors, such as interest rate adjustments and overall economic growth, will also significantly impact the performance of Euronext Amsterdam stocks.

Conclusion

The 8% surge in Euronext Amsterdam stocks following the modification of Trump-era tariffs demonstrates the significant impact of global trade policy on investment opportunities. The market's reaction reflects a combination of relief, increased investor confidence, speculative trading, and the positive impact on businesses previously affected by the tariffs. While this presents short-term opportunities, investors must remain aware of the potential risks and adopt a well-diversified, long-term investment strategy.

The significant jump in Euronext Amsterdam stocks highlights the importance of staying informed about global trade policy and its impact on investment opportunities. Stay updated on the latest developments impacting Euronext Amsterdam and other global markets to make informed decisions about your investment portfolio. Learn more about navigating the complexities of the Euronext Amsterdam stock market and how to effectively manage risk in a volatile environment.

Featured Posts

-

Jorja Smith Biffy Clyro Blossoms At Bbc Radio 1 Big Weekend Complete Artist Lineup

May 24, 2025

Jorja Smith Biffy Clyro Blossoms At Bbc Radio 1 Big Weekend Complete Artist Lineup

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Implications

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Implications

May 24, 2025 -

Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025

Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025 -

Bbc Radio 1s Big Weekend 2025 Your Guide To Getting Sefton Park Tickets

May 24, 2025

Bbc Radio 1s Big Weekend 2025 Your Guide To Getting Sefton Park Tickets

May 24, 2025 -

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 24, 2025

Frank Sinatras Wives Exploring His Four Marriages And Love Life

May 24, 2025

Latest Posts

-

The Thames Water Bonus Controversy What Went Wrong

May 24, 2025

The Thames Water Bonus Controversy What Went Wrong

May 24, 2025 -

Are Thames Water Executive Bonuses Fair A Critical Analysis

May 24, 2025

Are Thames Water Executive Bonuses Fair A Critical Analysis

May 24, 2025 -

The Thames Water Bonus Scandal Examining The Financial Fallout

May 24, 2025

The Thames Water Bonus Scandal Examining The Financial Fallout

May 24, 2025 -

Sustainability Concerns In The Pilbara A Dialogue Between Rio Tinto And Andrew Forrest

May 24, 2025

Sustainability Concerns In The Pilbara A Dialogue Between Rio Tinto And Andrew Forrest

May 24, 2025 -

Thames Water Public Anger Over Executive Bonuses Explained

May 24, 2025

Thames Water Public Anger Over Executive Bonuses Explained

May 24, 2025