Federal Debt: A Looming Threat To Mortgage Borrowers?

Table of Contents

H2: The Relationship Between Federal Debt and Interest Rates

H3: How Government Borrowing Impacts Rates

The U.S. government finances its debt by borrowing money, primarily through the sale of Treasury bonds. When the federal debt increases, the government needs to borrow more, increasing the demand for loanable funds. This increased demand can push interest rates higher across the board, impacting everything from mortgages to car loans and credit cards. Furthermore, high levels of federal debt can contribute to inflation, which, in turn, forces the Federal Reserve to raise interest rates to control price increases.

- Increased Demand for Loanable Funds: As the government borrows more, it competes with private borrowers for available capital, driving up the price (interest rate) of borrowing.

- Inflationary Pressures: Excessive government spending, often funded by increased borrowing, can fuel inflation. Higher inflation erodes the purchasing power of money and necessitates interest rate hikes by the Federal Reserve to cool down the economy.

- Example: Imagine a scenario where the federal debt increases significantly. This could lead to a rise in the 10-year Treasury yield, a benchmark for many mortgage rates. A 0.5% increase in the 10-year Treasury yield could translate to a similar increase in your monthly mortgage payments, adding hundreds of dollars to your annual expenses.

H2: Inflation's Impact on Mortgage Affordability

H3: Rising Prices and Mortgage Payments

Inflation, often exacerbated by unsustainable levels of federal debt, erodes the purchasing power of your income. When prices rise faster than your wages, your ability to afford your mortgage payments diminishes. This impact is felt across multiple aspects of homeownership:

- Reduced Purchasing Power: Inflation makes everything more expensive, from groceries to gasoline. This leaves less disposable income available for your mortgage payments.

- Increased House Prices: Inflation can also drive up house prices, making it harder for potential buyers to enter the market and potentially impacting the value of your existing property.

- Higher Interest Rates (again!): As mentioned earlier, high inflation often leads to interest rate hikes by the Federal Reserve, further increasing your mortgage costs.

- Data Points: According to the Bureau of Labor Statistics (BLS), inflation is currently at [insert current inflation rate]%. If this trend continues, or worsens, your mortgage payments could become significantly more burdensome.

H2: The Uncertainty of the Debt Ceiling and its Effects

H3: Political Risk and Market Volatility

The debt ceiling, the legal limit on how much the U.S. government can borrow, creates periods of significant uncertainty in the financial markets. Negotiations surrounding the debt ceiling can cause volatility, influencing interest rates and access to credit.

- Potential Government Default: Failure to raise the debt ceiling could lead to a government default, a situation with severe economic consequences.

- Investor Confidence: Uncertainty surrounding the debt ceiling erodes investor confidence, causing them to demand higher returns on investments, including government bonds. This increased demand pushes interest rates higher.

- Reduced Lending Availability: Banks and other lenders may become more cautious during periods of debt ceiling uncertainty, making it harder to secure a mortgage or refinance at favorable rates.

H2: Strategies for Mortgage Borrowers in a High-Debt Environment

H3: Protecting Yourself from Rising Rates

While you can't directly control the federal debt, you can take steps to protect yourself and your mortgage:

- Lock in a Fixed-Rate Mortgage: If you're looking to buy a home, consider locking in a fixed-rate mortgage to protect yourself against rising interest rates.

- Explore Refinancing Options: If you already have a mortgage, explore refinancing options to potentially secure a lower interest rate.

- Build a Strong Financial Foundation: Strengthen your financial position by paying down debt, increasing your savings, and building an emergency fund.

- Diversify Investments: Diversify your investment portfolio to mitigate the risks associated with economic uncertainty.

Call to action (mini): Consulting with a financial advisor can help you create a personalized strategy to navigate these challenging economic times.

3. Conclusion

The rising federal debt presents a significant challenge to mortgage borrowers. The strong link between federal debt, interest rates, and inflation directly impacts mortgage affordability. The uncertainty surrounding the debt ceiling only adds to the economic volatility, making proactive financial planning essential. By understanding these connections and employing the strategies outlined above, you can better position yourself to navigate this complex financial landscape and protect your mortgage. Monitor federal debt levels, research different mortgage options, and consult with financial experts to secure your financial future. Don't let the rising federal debt jeopardize your homeownership; take control of your financial well-being today.

Featured Posts

-

Ftc Probe Into Open Ai Implications For Chat Gpt And Ai Development

May 19, 2025

Ftc Probe Into Open Ai Implications For Chat Gpt And Ai Development

May 19, 2025 -

Apofaseis Tis Synodoy Patriarxeio Ierosolymon

May 19, 2025

Apofaseis Tis Synodoy Patriarxeio Ierosolymon

May 19, 2025 -

Affordable Chateau Diy Budget Friendly Castle Decorating Ideas

May 19, 2025

Affordable Chateau Diy Budget Friendly Castle Decorating Ideas

May 19, 2025 -

5 Time Grammy Nominees Farewell Final Concert In May Amidst Health Concerns

May 19, 2025

5 Time Grammy Nominees Farewell Final Concert In May Amidst Health Concerns

May 19, 2025 -

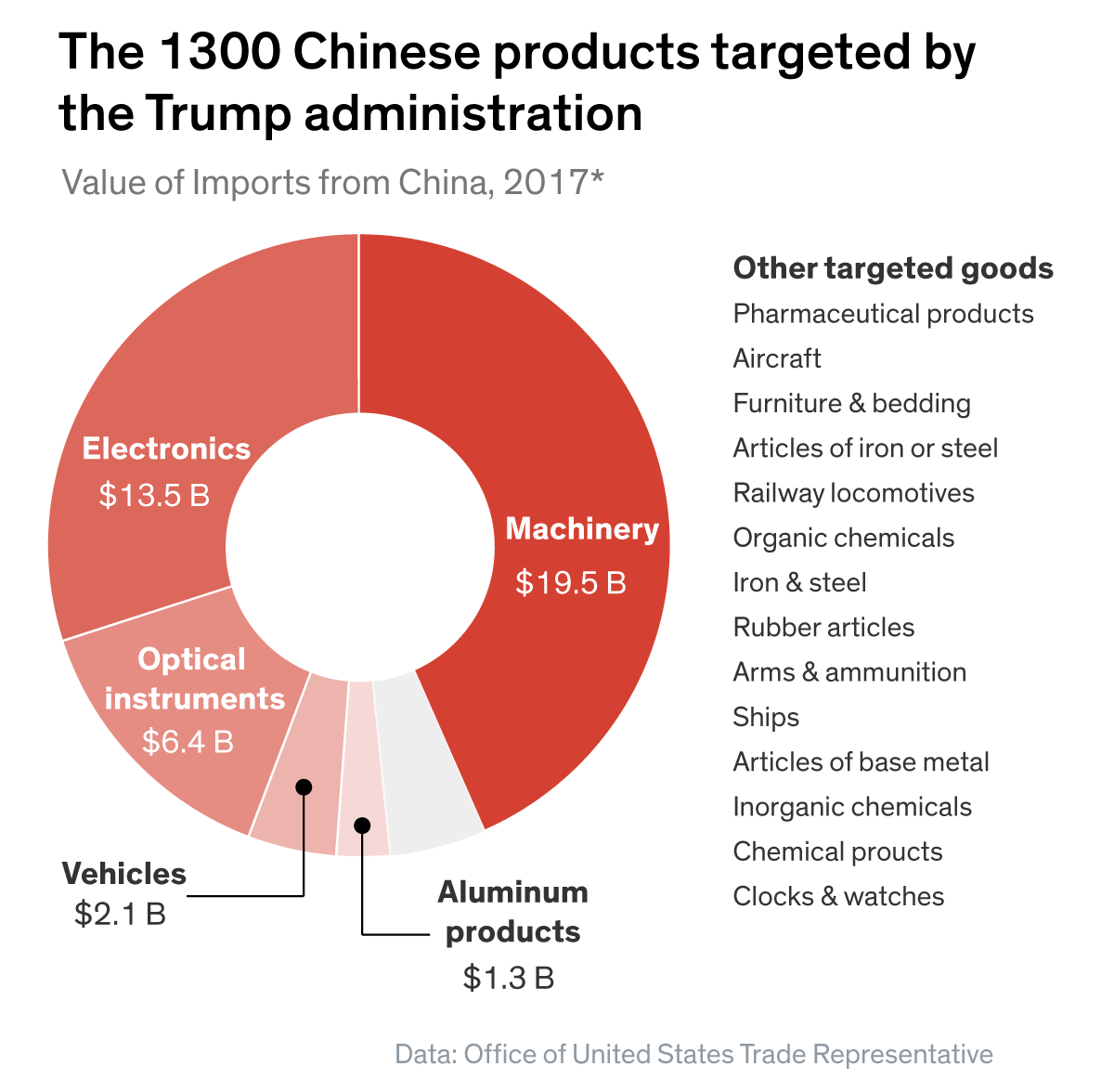

The Future Of Us China Trade 30 Tariffs Predicted To Last Until Late 2025

May 19, 2025

The Future Of Us China Trade 30 Tariffs Predicted To Last Until Late 2025

May 19, 2025