The Future Of US-China Trade: 30% Tariffs Predicted To Last Until Late 2025

Table of Contents

The Lingering Impact of 30% Tariffs on US Businesses

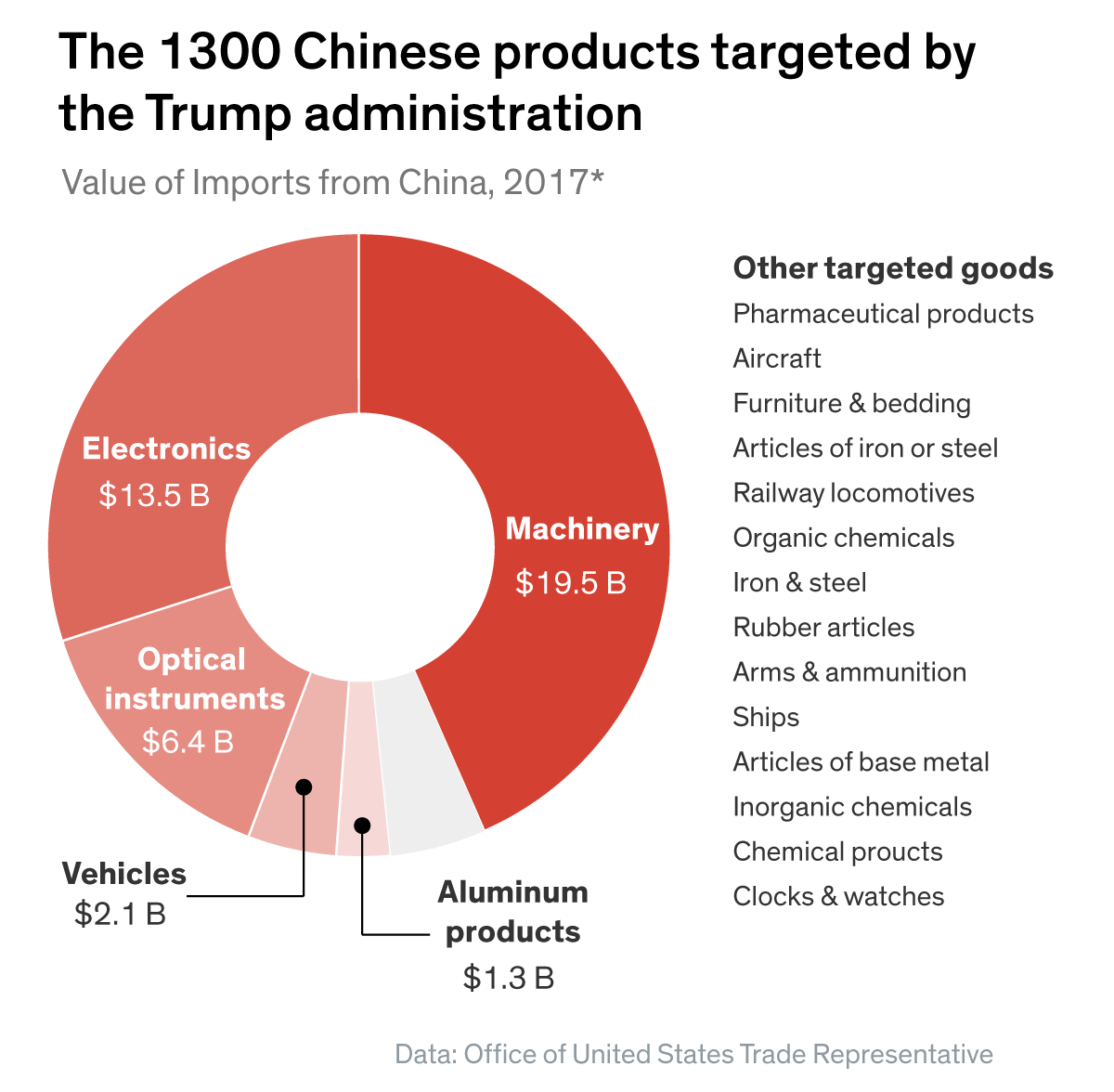

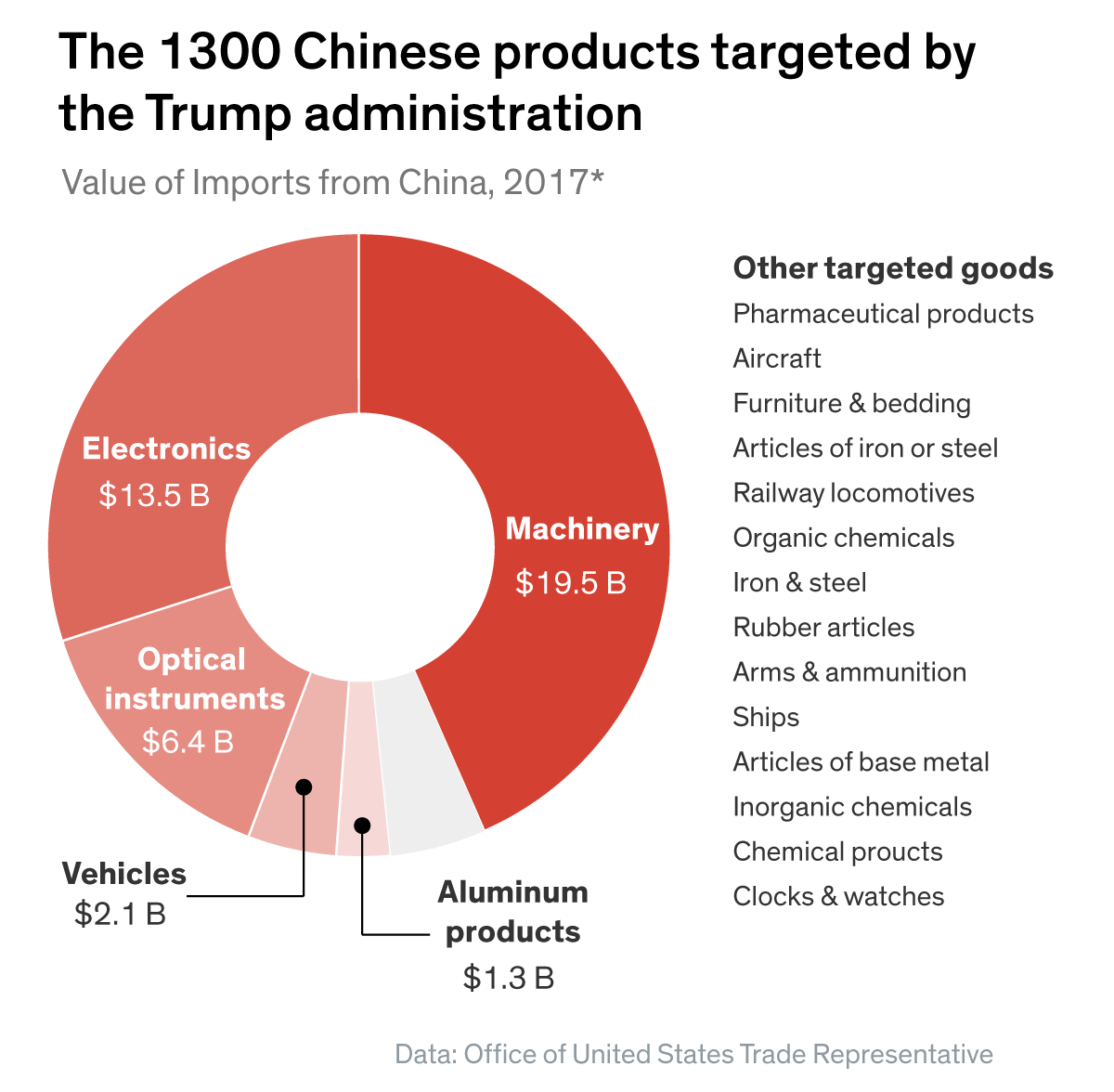

The persistent 30% tariffs imposed on various goods imported from China have significantly impacted US businesses. The effects extend beyond simple cost increases, disrupting supply chains and forcing strategic re-evaluations.

Increased Costs and Reduced Competitiveness

- Increased Import Costs: Tariffs directly increase the cost of imported goods from China, impacting profit margins for US businesses relying on Chinese-made products. This is particularly true for businesses importing raw materials, components, and finished goods. These increased costs can make US businesses less competitive both domestically and internationally.

- Industries Heavily Impacted: Manufacturing, particularly in sectors like electronics, textiles, and furniture, has been heavily affected by these import tariffs. The consumer goods industry also faces challenges, with higher prices for imported goods leading to reduced consumer demand.

- Reduced Global Competitiveness: Higher production costs due to tariffs make US businesses less competitive in the global market. They struggle to compete with companies sourcing from other countries with lower tariffs or those not affected by the US-China trade war.

- Price Increases for Consumers: Ultimately, the increased costs for US businesses are often passed on to consumers in the form of higher prices. This can lead to reduced consumer spending and slower economic growth.

Supply Chain Disruptions and Restructuring

- Shifting Suppliers: Many US businesses are forced to seek alternative suppliers outside of China to mitigate the impact of tariffs. This process can be lengthy and expensive.

- Relocating Supply Chains: Relocating supply chains is a complex and costly undertaking, involving significant investment in new facilities, logistics, and workforce training. This adds to the overall financial burden of businesses.

- Increased Logistics and Transportation Costs: Shifting supply chains increases logistics and transportation costs, adding another layer of expenses for businesses already grappling with increased import tariffs.

- Adapting Supply Chains: Successful companies are proactively adapting their supply chains, diversifying their sourcing, and investing in automation and technology to minimize their reliance on any single country. This requires significant upfront investment, however.

The Economic Fallout in China and Beyond

The impact of US tariffs extends far beyond US borders, creating ripple effects throughout the global economy. China, as a major exporter, faces significant challenges, and the global trade landscape is undergoing a transformation.

Impact on Chinese Exports and Economic Growth

- Reduction in Chinese Exports to the US: The 30% tariffs have led to a significant reduction in Chinese exports to the US, hurting Chinese businesses and impacting employment.

- Implications for Chinese Economic Growth: Reduced exports impact China's economic growth and the overall stability of its economy.

- Retaliatory Measures: China has implemented retaliatory tariffs on US goods, further escalating the trade war and impacting businesses in both countries.

- Global Economic Implications: The US-China trade war has created uncertainty in global markets and impacted global economic growth.

Ripple Effects on Global Trade and Investment

- Uncertainty in Global Investment: The ongoing trade tensions create uncertainty, impacting investment decisions globally as businesses hesitate to commit significant capital in the face of unpredictable trade policies.

- Impact on Other Countries: Countries that are heavily reliant on trade with either the US or China are experiencing significant disruptions in their economies.

- Shifting Global Trade Patterns: The trade war has the potential to reshape global trade patterns, with businesses seeking to diversify their supply chains and reduce their reliance on any single country.

- Role of International Organizations: International organizations are playing a crucial role in attempting to mitigate the negative impacts of the trade war and promote dialogue between the US and China.

Potential Scenarios and Mitigation Strategies

Predicting the future of US-China trade is challenging, but understanding potential scenarios and developing mitigation strategies is crucial for businesses.

Scenarios for the Future of US-China Trade

- Optimistic Scenario: A significant breakthrough in trade negotiations could lead to the removal of tariffs and a return to more stable trade relations.

- Pessimistic Scenario: Prolonged trade tensions could lead to further escalation of tariffs and a significant restructuring of global supply chains. The 30% tariffs could remain in place longer than predicted.

- Stalemate Scenario: A prolonged stalemate, with neither side making significant concessions, may lead to a period of continued uncertainty and disruption.

Strategies for Businesses to Navigate Uncertainty

- Diversify Supply Chains: Businesses should actively diversify their supply chains, reducing their reliance on any single country or supplier.

- Hedge Against Tariff Increases: Implementing strategies to hedge against potential tariff increases, such as securing long-term contracts with alternative suppliers, is essential.

- Lobbying and Advocacy: Engaging in lobbying efforts and advocating for policies that support businesses affected by tariffs can influence trade policy decisions.

- Proactive Risk Management: Proactive risk management strategies are essential to prepare for various scenarios, including prolonged trade tensions.

Conclusion

The predicted persistence of 30% tariffs on US-China trade until late 2025 presents significant challenges for businesses worldwide. The impact extends far beyond increased costs, affecting supply chains, global economic growth, and investment decisions. Businesses must actively monitor the situation, diversify their supply chains, and implement proactive risk management strategies to navigate this complex landscape. Understanding the potential scenarios and implementing appropriate mitigation strategies is crucial for surviving and thriving in this uncertain environment. Stay informed about the latest developments concerning US-China trade and 30% tariffs by subscribing to our newsletter [link to newsletter].

Featured Posts

-

Three Sentenced To Death In Iran Over Mosque Attack

May 19, 2025

Three Sentenced To Death In Iran Over Mosque Attack

May 19, 2025 -

Why Did Uber Stock Jump Double Digits In April

May 19, 2025

Why Did Uber Stock Jump Double Digits In April

May 19, 2025 -

Jennifer Lawrence And Cooke Maroney Recent Photos Spark Baby No 2 Speculation

May 19, 2025

Jennifer Lawrence And Cooke Maroney Recent Photos Spark Baby No 2 Speculation

May 19, 2025 -

Alfonso Arus Sin Pelos En La Lengua Sobre Melody Y Eurovision 2025 En Arusero

May 19, 2025

Alfonso Arus Sin Pelos En La Lengua Sobre Melody Y Eurovision 2025 En Arusero

May 19, 2025 -

Mark Rylances Criticism Of Music Festivals Prison Camp Conditions In London Parks

May 19, 2025

Mark Rylances Criticism Of Music Festivals Prison Camp Conditions In London Parks

May 19, 2025

Latest Posts

-

Hmrcs New Tax Codes Understanding Changes For Savers

May 20, 2025

Hmrcs New Tax Codes Understanding Changes For Savers

May 20, 2025 -

The Ultimate Guide To Solo Travel From Planning To Packing

May 20, 2025

The Ultimate Guide To Solo Travel From Planning To Packing

May 20, 2025 -

Solo Travel Safety Budget And Itinerary Planning

May 20, 2025

Solo Travel Safety Budget And Itinerary Planning

May 20, 2025 -

Aghatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Wthdyat

May 20, 2025

Aghatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Wthdyat

May 20, 2025 -

Discover Your Inner Explorer A Guide To Solo Adventures

May 20, 2025

Discover Your Inner Explorer A Guide To Solo Adventures

May 20, 2025