Foot Locker Earnings Data: Nike's Turnaround Gains Momentum

Table of Contents

Foot Locker's Overall Financial Performance

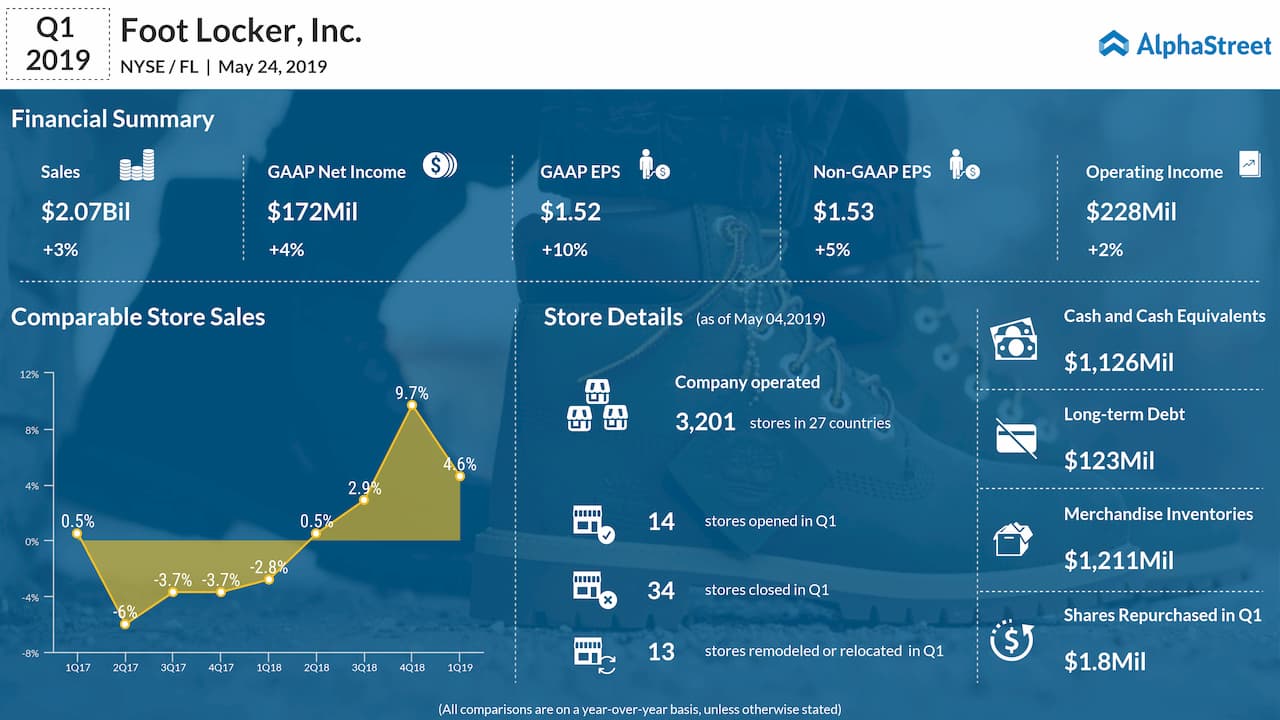

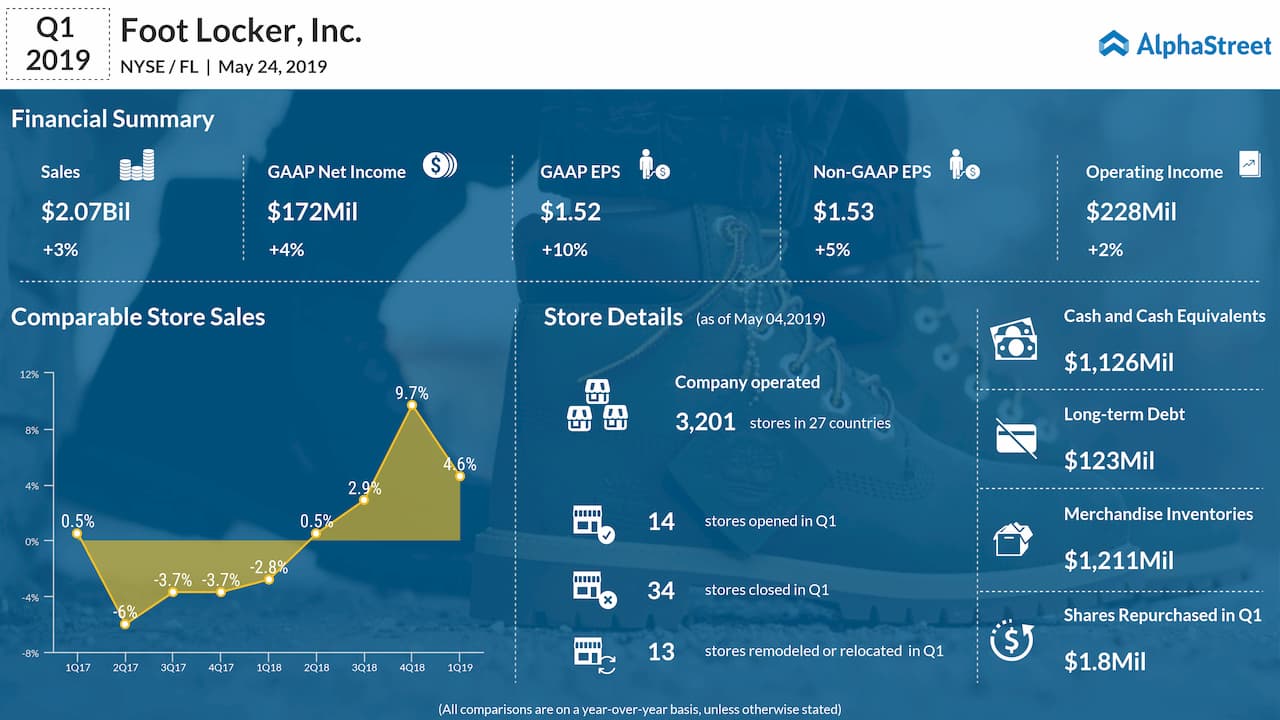

Foot Locker's overall financial performance provides a crucial backdrop for understanding Nike's contribution. Key metrics like revenue, profit, same-store sales, gross margin, and operating income all paint a picture of the retailer's health. Analyzing these figures helps us gauge the overall strength of the athletic footwear market and consumer spending trends.

-

Revenue and Profit: Foot Locker's [insert actual figures from the report] in revenue and [insert actual figures from the report] in profit demonstrate [positive/negative] growth compared to the previous quarter and the same period last year. This indicates [positive/negative] market sentiment and consumer demand for athletic footwear. Specific mention of any unexpected spikes or dips is crucial to understanding the nuances of the data.

-

Same-Store Sales: Same-store sales growth is a particularly important indicator, showing the performance of existing stores, excluding the impact of new store openings. A [positive/negative] percentage change in same-store sales indicates [positive/negative] performance in core markets. This is a key measure of the success of Foot Locker’s merchandising strategies.

-

Gross Margin and Operating Income: The gross margin, representing the profitability of sales before deducting operating expenses, and operating income, representing profits after operating expenses, are critical to assess Foot Locker's operational efficiency. Trends in these metrics provide insights into cost management and pricing strategies. Any significant changes from previous periods deserve detailed analysis. A chart showing these trends over time would enhance understanding.

Nike's Contribution to Foot Locker's Success

Nike's performance is inextricably linked to Foot Locker's success. The contribution of Nike sales to Foot Locker's overall revenue is significant, making an analysis of Nike's performance within Foot Locker crucial.

-

Nike Sales Data: The earnings report should detail Nike footwear and apparel sales separately. Examining these figures highlights which product categories are driving growth. [Insert actual data from report if available, e.g., "Nike footwear sales accounted for X% of Foot Locker's total revenue, representing a Y% increase year-over-year."]

-

Nike Inventory Levels: Tracking Nike inventory levels at Foot Locker provides insights into demand and supply chain management. High inventory might suggest weaker demand, while low inventory might signal strong sales and potential stockouts.

-

Impact of New Nike Product Releases: The success of new Nike product launches significantly impacts Foot Locker's sales. Analyzing the sales performance of specific new products provides an indication of the effectiveness of Nike's innovation and marketing strategies. Mention specific examples if possible.

-

Nike Brand Strength: The earnings report may provide qualitative data about consumer preference for the Nike brand within Foot Locker. Strong brand loyalty translates to consistent sales and resilience against market fluctuations.

Analysis of Nike's Turnaround Strategy and its Impact

Nike's recent resurgence can be attributed to a multi-pronged turnaround strategy. Analyzing the effectiveness of these initiatives is key to understanding Foot Locker's success.

-

Nike's Turnaround Initiatives: Detail Nike's strategic initiatives, including new product lines, marketing campaigns, and supply chain improvements. Mention specific examples like the success of new sneaker models or targeted marketing campaigns.

-

Marketing and Product Launches: Discuss the role of Nike's marketing campaigns in boosting brand awareness and driving sales. Successful product launches contribute significantly to revenue growth, showing the impact of Nike's innovation.

-

Product Diversification and Innovation: Analyze how Nike's diversification into different product categories and its continuous innovation in technology and design have impacted its performance.

-

Supply Chain Improvements: Improvements in Nike's supply chain efficiency can significantly impact the availability of products and subsequently sales. Discuss any positive changes in this area.

-

Competitive Landscape: Evaluate Nike's competitive positioning within the athletic footwear market, considering competitors like Adidas and Under Armour. How has Nike differentiated itself and gained market share?

Implications for Investors

The performance of Nike, as reflected in Foot Locker's earnings, has significant implications for investors.

-

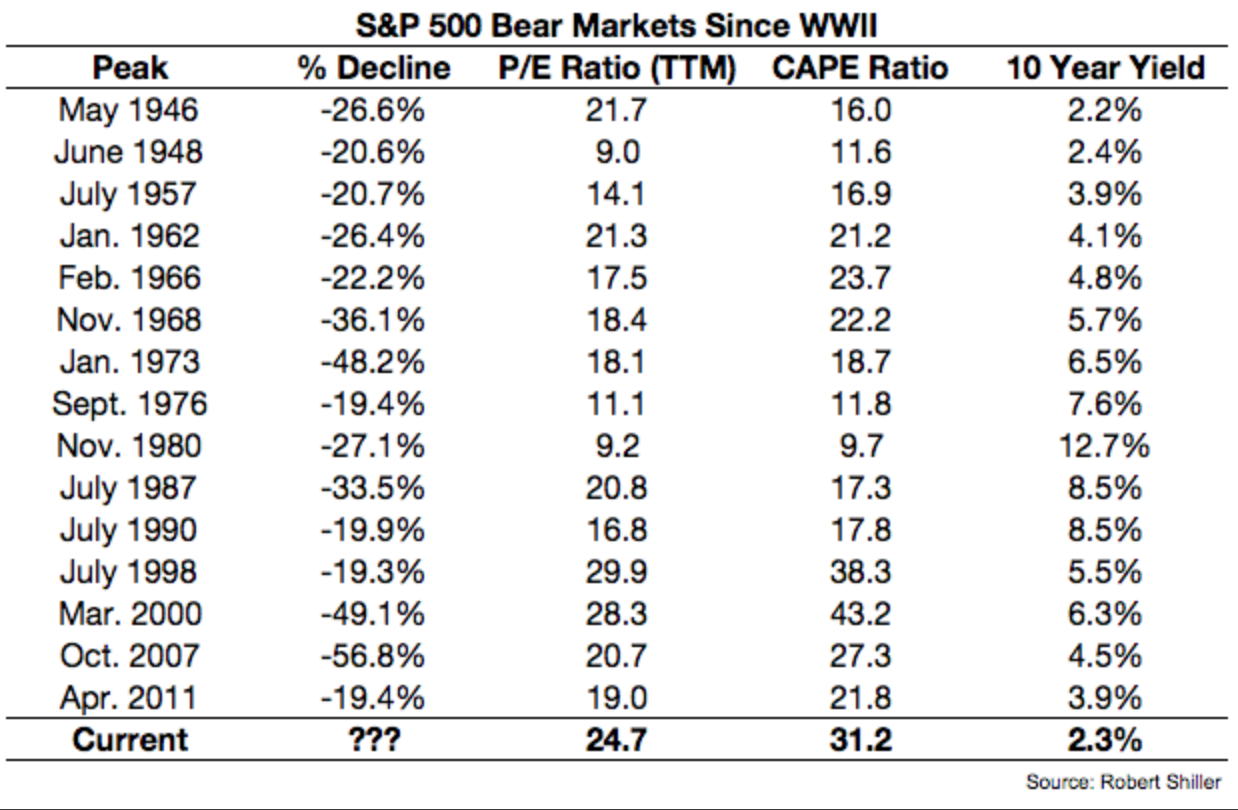

Nike Stock Price: Analyze the correlation between Foot Locker's earnings and Nike's stock price. Positive results in Foot Locker's report generally indicate positive sentiment towards Nike's stock.

-

Long-Term Growth Potential: Assess Nike's long-term growth potential based on current trends and future projections. Consider factors like market saturation, consumer preferences, and technological advancements.

-

Risks and Challenges: Discuss potential risks and challenges, such as economic downturns, changing consumer preferences, and competitive pressure. Highlight any potential headwinds that could impact future performance.

-

Investment Strategies: Offer insights into potential investment strategies based on the analysis. This could involve holding or buying Nike stock, investing in other companies within the athletic footwear sector, or diversifying investments across different sectors.

Conclusion

Foot Locker's latest earnings data strongly supports the narrative of Nike's successful turnaround. The significant contribution of Nike sales to Foot Locker's overall financial performance suggests a positive outlook for Nike's future growth, propelled by its strategic initiatives and sustained consumer demand. Nike's innovative products, effective marketing, and improved supply chain are key factors driving this success. The strong performance in the athletic footwear sector, as seen through Foot Locker’s earnings, indicates continued potential for growth and makes understanding Foot Locker earnings data crucial for investors.

Call to Action: Stay informed on the latest developments in the athletic footwear market and the crucial relationship between Foot Locker earnings data and Nike's performance by regularly checking back for our continued analysis. Understanding Foot Locker's financial reports is key to tracking Nike's progress and identifying potential investment opportunities in this dynamic sector.

Featured Posts

-

Former Cnn Employee Exposes Alleged Biden Health Information Concealment

May 16, 2025

Former Cnn Employee Exposes Alleged Biden Health Information Concealment

May 16, 2025 -

Albanese And Dutton Face Off Dissecting Their Key Policy Proposals

May 16, 2025

Albanese And Dutton Face Off Dissecting Their Key Policy Proposals

May 16, 2025 -

Farq Alemr 26 Eama Twm Krwz Wana Dy Armas Elaqt Mhtmlt

May 16, 2025

Farq Alemr 26 Eama Twm Krwz Wana Dy Armas Elaqt Mhtmlt

May 16, 2025 -

Gurriels Pinch Hit Rbi Single Propels Padres Past Braves

May 16, 2025

Gurriels Pinch Hit Rbi Single Propels Padres Past Braves

May 16, 2025 -

Stock Market Valuations Bof As Reassurance For Concerned Investors

May 16, 2025

Stock Market Valuations Bof As Reassurance For Concerned Investors

May 16, 2025