Foot Locker's Q4 2024 Financial Report: Assessing The Progress Of Its Lace Up Plan

Table of Contents

Sales Performance and Key Metrics

Foot Locker's Q4 2024 sales performance is a critical indicator of the "Lace Up" plan's success. Analyzing key metrics provides insights into consumer demand and the effectiveness of Foot Locker's strategies.

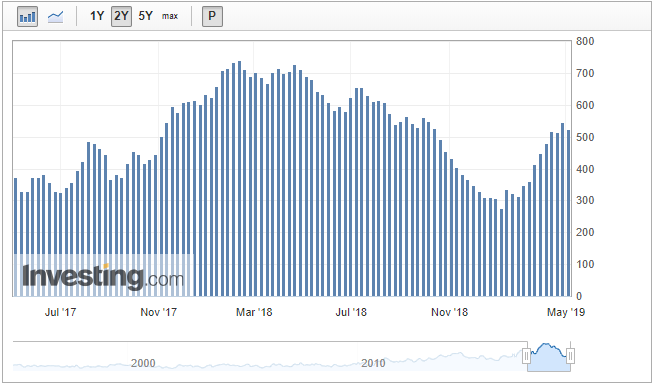

Overall Revenue Growth

Foot Locker's overall revenue growth in Q4 2024 will be compared to Q4 2023 and the same period in previous years. Factors influencing growth or decline include increased consumer demand for athletic footwear and apparel, the success of promotional campaigns, and broader economic conditions. A strong revenue increase suggests the "Lace Up" plan is positively impacting sales.

- Specific sales figures: (Insert hypothetical data here for demonstration: e.g., Total revenue increased by 8% to $2.1 billion compared to Q4 2023, exceeding industry benchmarks by 3%).

- Comparison to industry benchmarks: (Insert hypothetical comparison to competitors' growth rates)

- Regional performance variations: (Insert hypothetical data showing regional sales differences, e.g., stronger performance in North America compared to Europe)

Category-Specific Performance

Analyzing sales performance across different product categories reveals consumer preferences and the success of Foot Locker's product assortment strategies.

- Breakdown of sales by category: (Insert hypothetical data showing sales breakdown for basketball shoes, running shoes, apparel, etc.)

- Growth percentages: (Insert hypothetical growth percentages for each category, highlighting strong performers and areas needing improvement)

- Best-selling items: (Mention specific best-selling items and analyze their contribution to overall sales)

E-commerce Sales Contribution

The contribution of e-commerce sales reflects the effectiveness of Foot Locker's digital transformation efforts. Strong growth in online sales indicates a successful transition to a multi-channel retail strategy.

- Online sales figures: (Insert hypothetical data demonstrating the percentage of total sales driven by online channels)

- Website traffic data: (Mention data illustrating website visits and engagement metrics)

- Conversion rates: (Show the effectiveness of online marketing campaigns by presenting conversion rate data)

- Mobile app performance: (Highlight app downloads, user engagement, and sales generated through the app)

Inventory Management and Supply Chain Efficiency

Efficient inventory management is crucial for profitability and minimizing losses. Analyzing inventory levels and supply chain performance is essential in evaluating the "Lace Up" plan's impact.

Inventory Levels and Turnover

Foot Locker's inventory levels at the end of Q4 2024 and the inventory turnover rate provide insights into its efficiency in managing stock. High inventory levels can indicate overstocking and potential losses, while low inventory might mean stockouts and lost sales.

- Inventory value: (Insert hypothetical data showing the total value of inventory at the end of Q4 2024)

- Turnover rate: (Show the number of times inventory is sold and replaced during the period)

- Days of inventory on hand: (Provide the average number of days inventory remains in stock)

Supply Chain Optimization

Foot Locker's supply chain optimization efforts under the "Lace Up" plan will be evident in improved lead times, reduced transportation costs, and increased inventory accuracy.

- Improvements in lead times: (Highlight any improvements in the time it takes to get products from suppliers to stores)

- Reduced transportation costs: (Show cost savings achieved through optimized logistics)

- Inventory accuracy: (Present data reflecting the accuracy of inventory tracking and management systems)

Digital Transformation and Customer Engagement

Foot Locker's digital transformation is a key element of the "Lace Up" plan, focusing on enhancing its online presence, customer experience, and engagement.

Progress on Digital Initiatives

Assessing progress in digital initiatives includes analyzing website traffic, app downloads, social media engagement, and customer reviews.

- Website traffic: (Present data on website visits and user behavior)

- App downloads: (Show the number of mobile app downloads and user engagement)

- Social media engagement metrics: (Present social media engagement data, such as likes, shares, and comments)

- Customer reviews: (Highlight customer feedback and satisfaction scores)

Loyalty Program Effectiveness

A successful loyalty program improves customer retention and increases purchase frequency.

- Number of loyalty program members: (Show the growth in membership numbers)

- Average purchase value: (Present data on average spending by loyalty program members)

- Redemption rates: (Show the rate at which loyalty points are redeemed)

Overall Financial Health and Outlook

Foot Locker's overall financial health reflects the success of the "Lace Up" plan. Profitability, margins, and future outlook provide a comprehensive assessment.

Profitability and Margins

Analyzing gross profit margin, operating margin, and net income reveals the financial health and profitability of Foot Locker.

- Key profitability metrics: (Present gross profit margin, operating margin, and net income figures)

- Comparison to competitors: (Compare Foot Locker's profitability metrics to those of its competitors)

Future Outlook and Guidance

Foot Locker's guidance on future performance and identification of potential risks provide insights into the long-term outlook for the "Lace Up" plan.

- Management's statements on future expectations: (Summarize management's comments on future performance expectations)

- Key performance indicators (KPIs): (Highlight the key performance indicators that will be used to track progress)

Conclusion

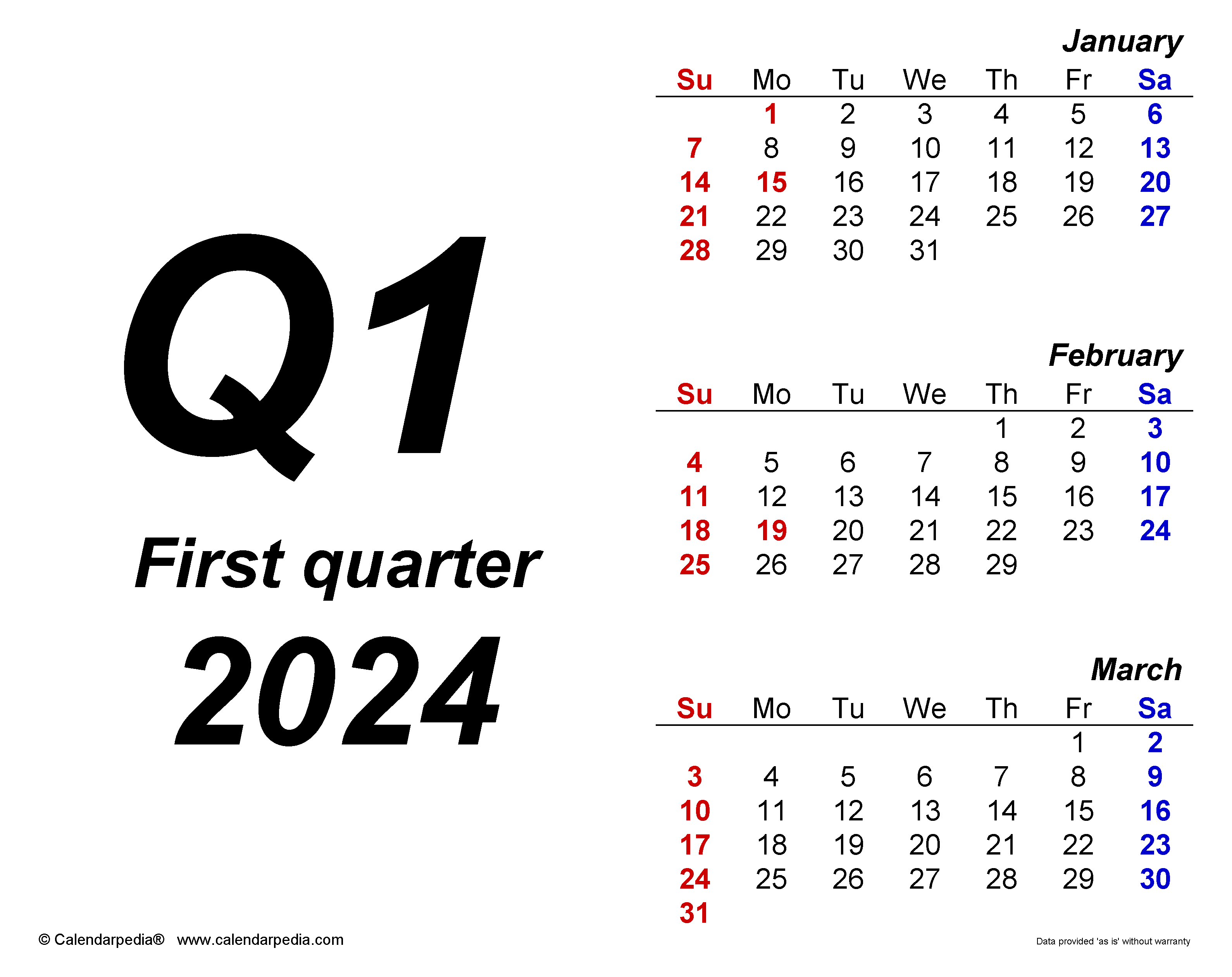

Foot Locker's Q4 2024 financial report offers valuable insights into the progress of its "Lace Up" plan. The analysis reveals (summarize key findings here, e.g., positive growth in e-commerce, improvements in supply chain efficiency, and challenges in maintaining certain profit margins). The long-term success of the "Lace Up" plan will depend on continued focus on digital enhancements, supply chain optimization, and customer engagement. To stay updated on Foot Locker's progress and the success of its "Lace Up" plan, regularly review future financial reports and industry analyses. Continue to monitor Foot Locker's Q1 2025 and subsequent reports for a more complete picture of the "Lace Up" plan's impact. Remember to check for the release of Foot Locker's Q1 2025 and subsequent reports for a more complete understanding of their progress.

Featured Posts

-

Elon Musk And Amber Heard New Twins Fuel Fatherhood Speculation

May 15, 2025

Elon Musk And Amber Heard New Twins Fuel Fatherhood Speculation

May 15, 2025 -

Is This Unknown App The Key To Weakening Metas Hold

May 15, 2025

Is This Unknown App The Key To Weakening Metas Hold

May 15, 2025 -

Hamer Bruins Moet Met Npo Toezichthouder Over Leeflang Praten

May 15, 2025

Hamer Bruins Moet Met Npo Toezichthouder Over Leeflang Praten

May 15, 2025 -

Goldman Sachs Deciphers Trumps Preferred Oil Price Range

May 15, 2025

Goldman Sachs Deciphers Trumps Preferred Oil Price Range

May 15, 2025 -

Microsofts 6 000 Employee Layoffs What We Know

May 15, 2025

Microsofts 6 000 Employee Layoffs What We Know

May 15, 2025

Latest Posts

-

Suri Cruises Birth Tom Cruises Unusual Response

May 16, 2025

Suri Cruises Birth Tom Cruises Unusual Response

May 16, 2025 -

Tom Cruises Reaction To Suri Cruises Arrival

May 16, 2025

Tom Cruises Reaction To Suri Cruises Arrival

May 16, 2025 -

Everton Vina Coquimbo Unido Reporte Del Partido 0 0

May 16, 2025

Everton Vina Coquimbo Unido Reporte Del Partido 0 0

May 16, 2025 -

0 0 Everton Vina Y Coquimbo Unido Igualan En Un Partido Sin Goles

May 16, 2025

0 0 Everton Vina Y Coquimbo Unido Igualan En Un Partido Sin Goles

May 16, 2025 -

Almeria Eldense Resumen Y Goles La Liga Hyper Motion

May 16, 2025

Almeria Eldense Resumen Y Goles La Liga Hyper Motion

May 16, 2025