Frankfurt Stock Exchange: DAX Ends Trading Below 24,000

Table of Contents

Factors Contributing to the DAX Decline

Several interconnected factors contributed to the DAX's fall below 24,000. Analyzing these elements is vital for understanding the current market climate and anticipating future trends.

Global Economic Uncertainty

Global economic uncertainty plays a significant role in influencing investor behavior and market performance. The current environment is characterized by several interconnected challenges:

- Inflation: Persistent high inflation rates across many developed economies erode purchasing power and increase uncertainty about future economic growth. This leads to investors seeking safer havens, potentially contributing to sell-offs in the stock market, including the DAX.

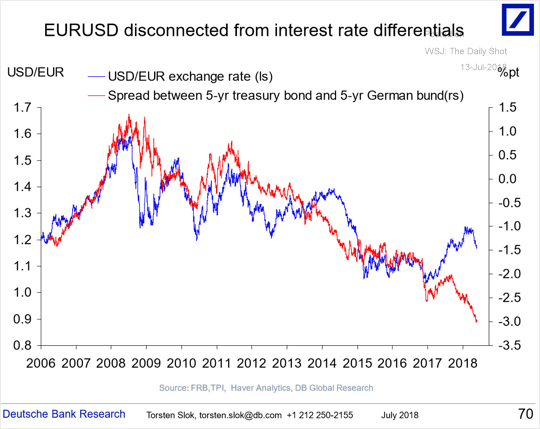

- Rising Interest Rates: Central banks worldwide, including the European Central Bank (ECB), are aggressively raising interest rates to combat inflation. Higher interest rates increase borrowing costs for companies, impacting profitability and potentially slowing economic growth. This makes investing in stocks appear less attractive.

- Geopolitical Tensions: The ongoing war in Ukraine, coupled with rising tensions between the US and China, contribute to global uncertainty. Geopolitical instability often leads to risk aversion among investors, impacting market performance.

- Energy Prices: Soaring energy prices, particularly natural gas, significantly impact businesses and consumer spending. This can lead to reduced economic activity and decreased corporate profits, impacting stock valuations.

The correlation between global market trends and the DAX performance is undeniable. A downturn in global markets typically translates into a negative impact on the DAX, as German companies are heavily involved in international trade.

Performance of Key DAX Companies

The decline in the DAX is not solely attributable to macro-economic factors; the performance of individual companies also plays a critical role. Several key DAX companies experienced significant losses, contributing to the overall index decline.

- Automotive Industry: Companies in the automotive sector, a major component of the DAX, have faced challenges related to ongoing supply chain disruptions, especially semiconductor shortages, impacting production and sales.

- Energy Companies: While some energy companies have benefited from high energy prices, others have faced challenges related to regulatory changes and the transition towards renewable energy sources.

- Technology Companies: The technology sector, often sensitive to interest rate hikes, saw mixed results, with some companies experiencing significant declines due to decreased investor confidence.

Impact of Rising Interest Rates

The ECB's monetary policy tightening significantly impacts the DAX. Increased interest rates affect the stock market through several channels:

- Increased Borrowing Costs: Higher interest rates make borrowing more expensive for companies, reducing their ability to invest and expand. This can lead to reduced profitability and lower stock valuations.

- Investor Behavior: Higher interest rates make bonds and other fixed-income securities more attractive relative to stocks, potentially leading investors to shift their portfolios towards less risky investments. This can cause a decrease in demand for stocks, thus impacting the DAX.

- Future Rate Hikes: The prospect of further interest rate increases creates uncertainty in the market, as investors try to anticipate the future direction of monetary policy and its potential impact on corporate earnings.

Analysis of Trading Volume and Volatility

Analyzing trading volume and volatility provides additional insights into market sentiment during the DAX's fall below 24,000.

Trading Volume Changes

The trading volume on the Frankfurt Stock Exchange increased significantly during the period when the DAX fell below 24,000. This high trading volume suggests that investors were actively reacting to the unfolding situation, either selling off assets or attempting to capitalize on the perceived decline. High volume, in this context, points to a strong and potentially volatile market reaction.

Market Volatility and Risk Assessment

The DAX experienced increased volatility as it fell below 24,000. Metrics like the VDAX (volatility index), which measures the implied volatility of the DAX, showed a clear spike during this period. This heightened volatility suggests that investors perceive a higher level of risk in the market, leading to increased price fluctuations. Increased volatility is a considerable concern for short-term investors, who may face more significant losses. Long-term investors, however, may see it as an opportunity to buy assets at discounted prices, assuming the underlying issues are temporary.

Conclusion

The DAX closing below 24,000 reflects a confluence of factors, including global economic uncertainty, the performance of key DAX companies, and the impact of rising interest rates. The increased trading volume and volatility further highlight the market's reaction to these challenges. The ongoing economic uncertainty, including the possibility of further interest rate hikes, indicates that the outlook for the DAX remains uncertain. To effectively navigate this dynamic market, it is crucial to remain informed.

Call to Action: Monitor the DAX closely, stay updated on Frankfurt Stock Exchange news, and analyze DAX performance regularly to understand the factors affecting this vital market index. Conduct thorough research before making any investment decisions. Informed decision-making is paramount in the dynamic Frankfurt Stock Exchange market. Understanding the intricacies of the DAX and its relationship to broader economic indicators will be key to navigating the ever-evolving investment landscape.

Featured Posts

-

Princess Road Accident Emergency Services Respond To Pedestrian Hit By Vehicle

May 25, 2025

Princess Road Accident Emergency Services Respond To Pedestrian Hit By Vehicle

May 25, 2025 -

Post Record High Frankfurt Stock Market Opening And Dax Performance

May 25, 2025

Post Record High Frankfurt Stock Market Opening And Dax Performance

May 25, 2025 -

Massachusetts Gun Trafficking Ring Dismantled 18 Brazilians Charged 100 Firearms Confiscated

May 25, 2025

Massachusetts Gun Trafficking Ring Dismantled 18 Brazilians Charged 100 Firearms Confiscated

May 25, 2025 -

Punished For Seeking Change Understanding The Consequences Of Dissent

May 25, 2025

Punished For Seeking Change Understanding The Consequences Of Dissent

May 25, 2025 -

Evroviziya 2014 Kde E Sega Konchita Vurst

May 25, 2025

Evroviziya 2014 Kde E Sega Konchita Vurst

May 25, 2025

Latest Posts

-

Marktdraai Europese Aandelen Een Vergelijking Met Wall Street En Toekomstverwachtingen

May 25, 2025

Marktdraai Europese Aandelen Een Vergelijking Met Wall Street En Toekomstverwachtingen

May 25, 2025 -

Europese En Amerikaanse Aandelen Analyse Van De Recente Marktdraai

May 25, 2025

Europese En Amerikaanse Aandelen Analyse Van De Recente Marktdraai

May 25, 2025 -

7 Drop In Amsterdam Stock Market Trade War Fears Fuel Market Volatility

May 25, 2025

7 Drop In Amsterdam Stock Market Trade War Fears Fuel Market Volatility

May 25, 2025 -

Zal De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 25, 2025

Zal De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 25, 2025 -

Vervolg Snelle Marktdraai Europese Aandelen Ten Opzichte Van Wall Street Analyse And Voorspelling

May 25, 2025

Vervolg Snelle Marktdraai Europese Aandelen Ten Opzichte Van Wall Street Analyse And Voorspelling

May 25, 2025