Frankfurt Stock Market: DAX Climbs, Record High In Sight

Table of Contents

Factors Driving the DAX's Ascent

Several key factors are propelling the DAX's impressive climb, boosting investor sentiment and pushing the index towards a potential record high.

Strong Corporate Earnings

Positive financial reports from major DAX-listed companies are a significant driver of the current market strength. Many companies have exceeded earnings expectations, signaling robust economic activity in Germany.

- Examples of Success: Several automotive companies have reported record profits due to strong global demand and successful new product launches. The technology sector is also thriving, with several companies showing significant revenue increases driven by innovative products and services.

- Sectoral Strength: The automotive and technology sectors have been particularly strong contributors to the DAX's growth, indicating a diversified and healthy economic base.

- Investor Confidence: Strong corporate earnings significantly boost investor confidence, encouraging further investment and driving up share prices. This positive feedback loop is a key element in the DAX's current upward trajectory. Keywords: corporate earnings, profit growth, revenue increase, investor sentiment.

Global Economic Optimism

Positive global economic indicators are also contributing to the DAX's rise. Improved global trade, positive economic forecasts from leading institutions, and easing inflation concerns are all impacting market sentiment positively.

- Improving Global Trade: Increased global trade facilitates greater economic activity, benefiting German exporters and boosting corporate earnings.

- Positive Economic Forecasts: Optimistic forecasts from international organizations and financial institutions reassure investors, reducing uncertainty and encouraging investment.

- Easing Inflation Concerns: While inflation remains a concern, signs of easing inflationary pressures are bolstering investor confidence and supporting risk appetite. Keywords: global economy, economic growth, inflation, interest rates, market sentiment.

Geopolitical Stability (or Instability, depending on current events)

The impact of geopolitical events on the DAX is complex and constantly evolving. While the war in Ukraine and the ongoing energy crisis present significant challenges, the market has, to some extent, adapted. However, significant volatility remains, reflecting the inherent uncertainty in the geopolitical landscape.

- Ukraine Conflict Impact: The war in Ukraine continues to present significant headwinds, particularly regarding energy prices and supply chains. This contributes to market volatility.

- Energy Crisis Mitigation: Despite the challenges, Germany's efforts to diversify energy sources and mitigate the impacts of the energy crisis have partially offset negative impacts on the DAX. Keywords: geopolitical risks, market volatility, investor confidence, Ukraine conflict, energy crisis.

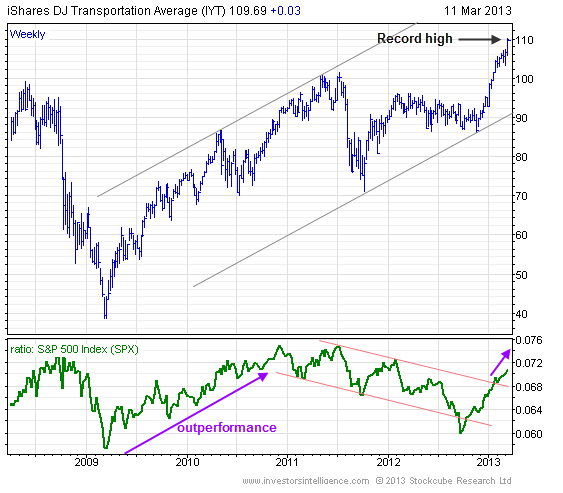

Technical Analysis: Indicators Suggesting a Record High

Technical analysis provides further insights into the potential for a new DAX record high. Several indicators suggest a strong upward trend.

Chart Patterns

Examination of DAX charts reveals several bullish chart patterns, indicating sustained upward momentum.

- Bullish Flags: The presence of bullish flag patterns suggests a temporary pause in the upward trend before a resumption of the rally.

- Support and Resistance Levels: The DAX has consistently broken through previous resistance levels, indicating strong upward pressure. Support levels have held firm, suggesting a solid foundation for continued growth.

- Trading Volume: High trading volume accompanying the price increases confirms the strength and validity of the upward trend. Keywords: technical analysis, chart patterns, support levels, resistance levels, trading volume.

Momentum Indicators

Momentum indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) also signal bullish momentum.

- RSI Readings: RSI readings above 70 often suggest overbought conditions, but in the current context, the sustained high RSI readings indicate powerful upward momentum.

- MACD Signals: A sustained positive MACD reading points to strong bullish momentum and suggests the upward trend is likely to continue. Keywords: momentum indicators, RSI, MACD, bullish momentum, market trend.

Potential Risks and Challenges

While the outlook for the DAX is currently positive, it's crucial to acknowledge potential risks and challenges.

Inflationary Pressures

Persistent inflationary pressures remain a significant threat. High inflation could force central banks to implement further interest rate hikes, potentially slowing economic growth and negatively impacting corporate profits.

- Interest Rate Hikes: Higher interest rates increase borrowing costs for companies, potentially hindering investment and reducing profitability.

- Economic Slowdown: Aggressive interest rate hikes could lead to an economic slowdown, dampening corporate earnings and negatively impacting the DAX. Keywords: inflation, interest rate hikes, monetary policy, economic slowdown.

Geopolitical Uncertainty

Geopolitical uncertainty continues to pose a significant risk. Unforeseen events could trigger sudden market volatility and negatively impact investor confidence.

- Unpredictability: Geopolitical events are inherently unpredictable and can quickly shift market sentiment, potentially reversing the current upward trend. Keywords: geopolitical risks, market volatility, uncertainty.

Conclusion: Frankfurt Stock Market Outlook and Call to Action

The Frankfurt Stock Market, as reflected by the DAX's performance, presents a compelling investment landscape. Strong corporate earnings, global economic optimism, and supportive technical indicators all point to the potential for a new record high. However, inflationary pressures and geopolitical uncertainty remain significant risks. Therefore, while the current trend is positive, a balanced and informed approach is crucial. Monitor the DAX closely, track the Frankfurt Stock Market's performance, and consider conducting thorough due diligence before making any investment decisions. Invest wisely in the German market, understanding both the potential for growth and the associated risks. Continue to track the DAX index analysis for the latest updates and insights.

Featured Posts

-

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Considerations

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Considerations

May 24, 2025 -

Massachusetts Authorities Seize Over 100 Firearms Arrest 18 Brazilian Nationals In Gun Trafficking Operation

May 24, 2025

Massachusetts Authorities Seize Over 100 Firearms Arrest 18 Brazilian Nationals In Gun Trafficking Operation

May 24, 2025 -

Joy Crookes Unveils New Single Carmen

May 24, 2025

Joy Crookes Unveils New Single Carmen

May 24, 2025 -

Memorial Day 2025 Air Travel When To Fly And When Not To

May 24, 2025

Memorial Day 2025 Air Travel When To Fly And When Not To

May 24, 2025 -

Bardellas Presidential Bid A Contender Or Outsider

May 24, 2025

Bardellas Presidential Bid A Contender Or Outsider

May 24, 2025

Latest Posts

-

Sergey Yurskiy Pominalniy Vecher V Teatre Mossoveta

May 24, 2025

Sergey Yurskiy Pominalniy Vecher V Teatre Mossoveta

May 24, 2025 -

Gryozy Lyubvi Ili Ilicha V Trude Istoriya I Analiz Publikatsii

May 24, 2025

Gryozy Lyubvi Ili Ilicha V Trude Istoriya I Analiz Publikatsii

May 24, 2025 -

Intervyu S Fedorom Lavrovym O Pavle I Trillerakh I Psikhologii Ostrykh Oschuscheniy

May 24, 2025

Intervyu S Fedorom Lavrovym O Pavle I Trillerakh I Psikhologii Ostrykh Oschuscheniy

May 24, 2025 -

Vospominaniya O Sergee Yurskom V Teatre Mossoveta

May 24, 2025

Vospominaniya O Sergee Yurskom V Teatre Mossoveta

May 24, 2025 -

Analiz Stati Gryozy Lyubvi Ili Ilicha Gazeta Trud

May 24, 2025

Analiz Stati Gryozy Lyubvi Ili Ilicha Gazeta Trud

May 24, 2025