Investing In The Amundi Dow Jones Industrial Average UCITS ETF: NAV Considerations

Table of Contents

What is Net Asset Value (NAV) and Why is it Important for ETF Investors?

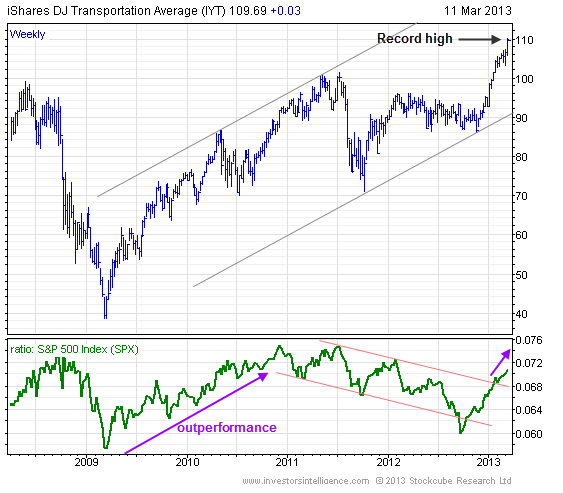

Net Asset Value (NAV) represents the intrinsic value of an ETF's holdings. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV is calculated daily by taking the total market value of all the underlying stocks in the DJIA held by the ETF, subtracting any liabilities (like management fees), and then dividing by the total number of outstanding ETF shares. This daily calculation provides a snapshot of the ETF's underlying asset value.

The significance of NAV for ETF investors like those using the Amundi Dow Jones Industrial Average UCITS ETF cannot be overstated. It serves as a fundamental metric for tracking performance over time. By monitoring NAV changes, you gain insight into the growth or decline of your investment. It's important to note the difference between NAV and the ETF's market price. The market price fluctuates throughout the trading day, influenced by supply and demand, while the NAV is calculated only once per day at the close of the market. This difference can create opportunities for savvy investors.

- NAV reflects the intrinsic value of the ETF's holdings. It shows the true worth of the assets held within the fund.

- Tracking NAV helps assess long-term performance. Consistent increases in NAV indicate strong underlying asset growth.

- Understanding NAV aids in comparative analysis of similar ETFs. You can compare the NAV performance of this ETF to others tracking the same index.

Analyzing NAV Trends in the Amundi Dow Jones Industrial Average UCITS ETF

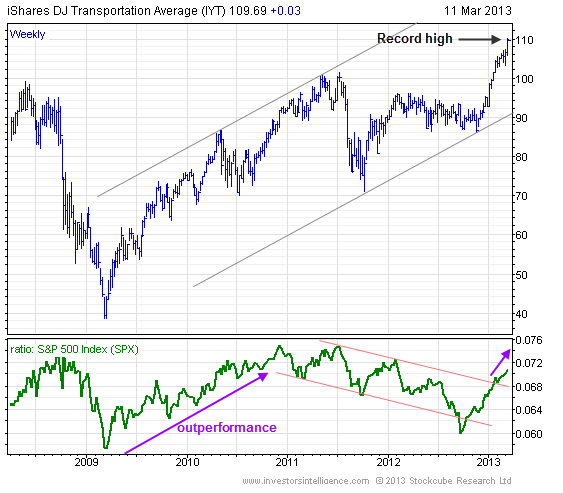

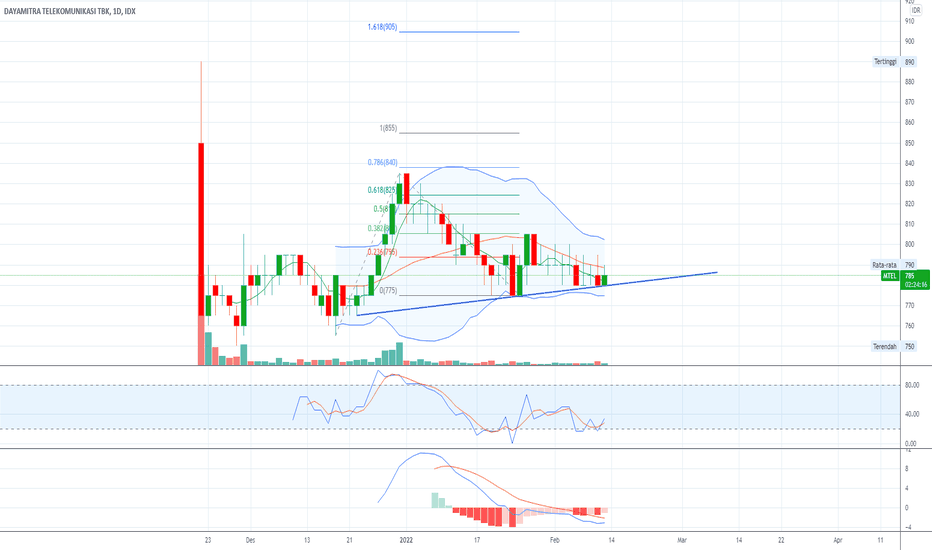

Analyzing historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF is essential for understanding its performance. (Include a chart or graph showing historical NAV data here. Source the data appropriately.) This visual representation helps identify periods of significant growth and decline. You'll notice correlations between NAV movements and the performance of the Dow Jones Industrial Average itself. When the DJIA rises, the ETF's NAV generally increases, and vice-versa.

Several factors influence NAV fluctuations:

- Market conditions: Bull or bear markets directly impact the prices of the underlying stocks, affecting the NAV.

- Economic indicators: Data releases like inflation reports or interest rate announcements can trigger market shifts and consequently alter the NAV.

- Component stock performance: Individual stock performance within the DJIA significantly influences the overall NAV of the ETF.

Understanding how to interpret these NAV changes in relation to broader market movements is key to making informed decisions. For instance, a dip in NAV during a market correction doesn't necessarily signal a long-term problem, particularly if the underlying fundamentals of the DJIA remain strong.

- Identify periods of significant NAV growth or decline. Look for trends and patterns to understand long-term performance.

- Correlate NAV changes with Dow Jones Industrial Average index performance. Observe how closely the ETF tracks the index.

- Discuss the impact of dividend payouts on NAV. Dividend payments from underlying stocks can slightly reduce the NAV, but they also provide income to the investor.

Using NAV to Make Informed Investment Decisions in the Amundi Dow Jones Industrial Average UCITS ETF

NAV data, when used effectively, is a powerful tool for making informed buy and sell decisions. A simple strategy is "buy low, sell high," using NAV trends as your guide. However, relying solely on NAV is risky. It's vital to consider other factors such as the ETF's expense ratio (fees), trading volume (liquidity), and your overall investment goals.

Other investment strategies can incorporate NAV:

- Buy low, sell high strategy based on NAV trends. Look for dips in the NAV to potentially buy and rises to potentially sell.

- Dollar-cost averaging approach using NAV as a reference point. Invest a fixed amount at regular intervals, regardless of NAV fluctuations.

- Considering NAV relative to the ETF's market price. A significant deviation between NAV and market price can indicate potential arbitrage opportunities.

Risks and Considerations Related to NAV and the Amundi Dow Jones Industrial Average UCITS ETF

While NAV is a critical metric, it's essential to acknowledge its limitations. It doesn't guarantee future returns. Market volatility can cause significant NAV fluctuations, even in seemingly stable ETFs like the Amundi Dow Jones Industrial Average UCITS ETF. Remember that relying solely on NAV for timing the market is risky. Successful investing requires a broader perspective.

- NAV doesn't guarantee future returns. Past performance is not indicative of future results.

- Market timing based on NAV can be risky. Trying to perfectly time the market based on NAV is difficult and often unsuccessful.

- Diversification reduces reliance on a single ETF's NAV performance. Spread your investments across different asset classes to mitigate risk.

Conclusion: Making the Most of NAV Information When Investing in the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for making informed investment decisions. While NAV provides a valuable indicator of the ETF's underlying asset value, it shouldn't be the sole factor influencing your investment strategy. Use NAV data in conjunction with other market analysis tools, considering factors like expense ratios, trading volume, and broader market conditions. Remember to diversify your portfolio to mitigate risks. Start leveraging NAV data to make smarter investment decisions with the Amundi Dow Jones Industrial Average UCITS ETF today!

Featured Posts

-

Czy Porsche Cayenne Gts Coupe To Suv Marzen Szczegolowy Test

May 24, 2025

Czy Porsche Cayenne Gts Coupe To Suv Marzen Szczegolowy Test

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Reporting

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc Daily Nav Updates And Reporting

May 24, 2025 -

Najvaecsie Nemecke Firmy Prepustaju Tisice Ludi Prichadzaju O Pracu

May 24, 2025

Najvaecsie Nemecke Firmy Prepustaju Tisice Ludi Prichadzaju O Pracu

May 24, 2025 -

90 Let Sergeyu Yurskomu Pamyati Velikogo Aktera Intellektuala I Ostroslova

May 24, 2025

90 Let Sergeyu Yurskomu Pamyati Velikogo Aktera Intellektuala I Ostroslova

May 24, 2025 -

Analisis Investasi Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap

May 24, 2025

Analisis Investasi Mtel And Mbma Setelah Termasuk Dalam Msci Small Cap

May 24, 2025

Latest Posts

-

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 24, 2025 -

Mia Farrow And Sadie Sink A Broadway Photo Opportunity

May 24, 2025

Mia Farrow And Sadie Sink A Broadway Photo Opportunity

May 24, 2025 -

Mia Farrows Warning Trump Address And The Fate Of American Democracy

May 24, 2025

Mia Farrows Warning Trump Address And The Fate Of American Democracy

May 24, 2025 -

Mia Farrow Visits Sadie Sink Backstage A Broadway Encounter

May 24, 2025

Mia Farrow Visits Sadie Sink Backstage A Broadway Encounter

May 24, 2025 -

Is Apple Vulnerable Examining The Impact Of Tariffs On Buffetts Holdings

May 24, 2025

Is Apple Vulnerable Examining The Impact Of Tariffs On Buffetts Holdings

May 24, 2025