Freepoint Eco-Systems And ING Announce New Project Finance Agreement

Table of Contents

Key Terms of the Project Finance Agreement

This groundbreaking project finance agreement outlines a substantial financial commitment to accelerate the development of several key renewable energy projects. The agreement's specifics demonstrate a forward-thinking approach to sustainable investment.

- Specific projects funded: The agreement will primarily finance the construction of several large-scale solar farms across the Southwestern United States and several onshore wind energy projects in the Midwest. These projects are strategically located to maximize energy generation and minimize environmental impact. This detailed approach to project financing is crucial for success.

- Total funding amount: ING has committed €500 million in funding to support these ambitious renewable energy ventures. This substantial investment highlights the significant potential for returns in the sustainable energy sector.

- Loan terms: The loan terms are structured to provide Freepoint Eco-Systems with flexible repayment options, recognizing the inherent challenges in renewable energy project timelines. Interest rates are competitive and reflect ING's commitment to supporting sustainable development. The repayment schedule is tailored to match the projected revenue streams of each project.

- Sustainability criteria: A key feature of this project finance agreement is the inclusion of stringent sustainability criteria. These criteria cover environmental impact assessments, social responsibility commitments, and adherence to international sustainability standards. This ensures that the projects are truly sustainable, minimizing their environmental footprint.

- Innovative financial instruments: The agreement utilizes a combination of traditional loan financing and innovative green bonds, further demonstrating ING's dedication to environmental sustainability. The use of green bonds enhances transparency and attracts investors focused on ESG (Environmental, Social, and Governance) principles.

Benefits for Freepoint Eco-Systems

This Project Finance Agreement offers numerous advantages to Freepoint Eco-Systems, fueling significant growth and expansion.

- Increased capital for project development: The €500 million injection allows Freepoint Eco-Systems to accelerate its development pipeline, significantly increasing the scale and impact of its renewable energy projects. This project financing will enable them to undertake larger and more complex projects than previously possible.

- Expansion into new markets and technologies: The additional capital will enable Freepoint Eco-Systems to explore new markets and potentially invest in emerging renewable energy technologies, strengthening its position as a leader in the sector. This strategic expansion is a direct result of this successful project finance agreement.

- Enhanced credibility and reputation: Securing such a substantial investment from a globally respected institution like ING enhances Freepoint Eco-Systems' credibility and reputation within the industry, attracting further investment and partnerships. This improved reputation is a crucial intangible benefit of this project financing.

- Reduced reliance on other funding sources: The agreement reduces Freepoint Eco-Systems' reliance on potentially less favorable funding sources, providing greater financial stability and flexibility. This secure funding stream is a hallmark of a well-structured project finance agreement.

Benefits for ING

For ING, this agreement represents a strategic investment aligning perfectly with its broader ESG goals.

- Diversification of investment portfolio: The investment diversifies ING's portfolio into the rapidly growing renewable energy sector, mitigating risks and generating attractive returns. This strategic diversification is a key element of successful project finance.

- Alignment with ESG investment goals: The agreement strongly aligns with ING's commitment to sustainable finance and ESG principles, enhancing its reputation as a responsible and forward-thinking financial institution. This project financing exemplifies their dedication to environmental responsibility.

- Opportunities for future collaboration: The success of this project finance agreement paves the way for future collaborations between ING and Freepoint Eco-Systems, establishing a strong and mutually beneficial long-term partnership.

- Positive brand image and increased market share: The association with a leading sustainable energy company enhances ING's brand image and strengthens its position as a frontrunner in sustainable finance, attracting both clients and investors. This improved market standing is a significant indirect outcome of this innovative project finance agreement.

Implications for the Renewable Energy Sector

The Project Finance Agreement between Freepoint Eco-Systems and ING has wide-ranging implications for the renewable energy sector.

- Increased investment in renewable energy projects: The agreement serves as a powerful example for other financial institutions, encouraging increased investment in renewable energy projects and accelerating the transition to a cleaner energy future. This project financing model can be replicated for similar ventures.

- Accelerated growth of the sustainable energy sector: The substantial financial commitment accelerates the growth of the sustainable energy sector, contributing to a faster reduction in greenhouse gas emissions. This project finance agreement is a catalyst for broader industry growth.

- Positive influence on other financial institutions: This agreement is likely to influence other financial institutions to adopt similar strategies, increasing the overall funding available for renewable energy projects. The successful implementation of this project finance agreement sets a new precedent.

- Potential for lower energy costs and reduced carbon emissions: The increased capacity for renewable energy generation resulting from this agreement has the potential to lower energy costs for consumers and significantly reduce carbon emissions. This project finance agreement contributes to a cleaner and more affordable energy future.

Conclusion

The Project Finance Agreement between Freepoint Eco-Systems and ING signifies a significant milestone in the renewable energy sector. This collaboration showcases the increasing commitment of major financial institutions to invest in sustainable energy solutions, paving the way for more ambitious and impactful projects in the future. The agreement offers substantial benefits to both parties, bolstering Freepoint Eco-Systems’ growth and solidifying ING's position as a leader in sustainable finance. This successful project finance agreement demonstrates the potential for significant progress in the renewable energy sector.

Call to Action: Learn more about this groundbreaking Project Finance Agreement and how it is shaping the future of sustainable energy. Explore investment opportunities in green initiatives and discover how you can contribute to a greener future. Contact us to learn more about project finance agreements and how we can help you make a difference.

Featured Posts

-

Novedades En La Citacion De Instituto Como Formara Ante Lanus

May 23, 2025

Novedades En La Citacion De Instituto Como Formara Ante Lanus

May 23, 2025 -

Us Penny Circulation To End Preparing For A Penniless Future

May 23, 2025

Us Penny Circulation To End Preparing For A Penniless Future

May 23, 2025 -

Valerie Rodriguez Erazo Nueva Secretaria Del Daco

May 23, 2025

Valerie Rodriguez Erazo Nueva Secretaria Del Daco

May 23, 2025 -

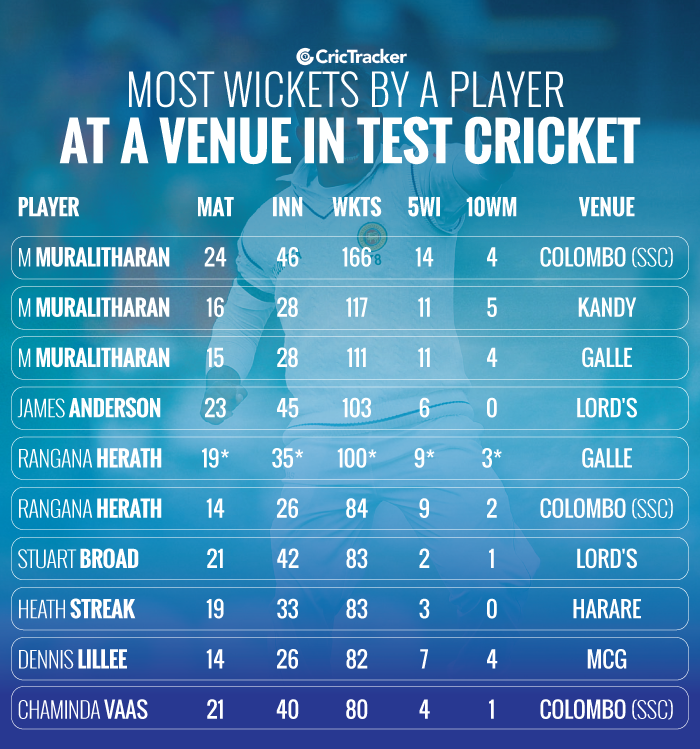

100 Test Wickets Blessing Muzarabanis Ambitious Goal

May 23, 2025

100 Test Wickets Blessing Muzarabanis Ambitious Goal

May 23, 2025 -

Increased Us China Trade Exporters Capitalize On Trade Deal Window

May 23, 2025

Increased Us China Trade Exporters Capitalize On Trade Deal Window

May 23, 2025

Latest Posts

-

At And T Reveals Extreme Cost Implications Of Broadcoms V Mware Deal

May 23, 2025

At And T Reveals Extreme Cost Implications Of Broadcoms V Mware Deal

May 23, 2025 -

Posthaste Trouble Brewing In The Global Bond Market

May 23, 2025

Posthaste Trouble Brewing In The Global Bond Market

May 23, 2025 -

Desjardins Forecasts Three Further Bank Of Canada Rate Cuts

May 23, 2025

Desjardins Forecasts Three Further Bank Of Canada Rate Cuts

May 23, 2025 -

New Bipartisan Resolution Strengthens Canada U S Relations

May 23, 2025

New Bipartisan Resolution Strengthens Canada U S Relations

May 23, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Cost Increases

May 23, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Cost Increases

May 23, 2025