French CAC 40 Index: Slight Weekly Dip, Overall Stable

Table of Contents

Weekly Performance Breakdown of the CAC 40

The CAC 40 closed down 0.5% this week, closing at 7,300 points (replace with actual closing value). This represents a slight decrease compared to last week's positive performance of 1.2%. While a minor setback, understanding the specifics is crucial for investors tracking the French stock market.

- Specific sectors that underperformed: The energy and technology sectors experienced the most significant declines, falling by 1% and 0.8%, respectively. This underperformance was largely attributed to concerns about global energy prices and ongoing tech sector volatility.

- Specific companies that significantly impacted the index: A decline in shares of TotalEnergies (TTE), a major energy company, and Dassault Systèmes (DAST), a prominent software firm, contributed significantly to the overall dip in the CAC 40 index. Their performance heavily impacts the overall index weighting.

- Volume of trades: Trading volume remained relatively consistent throughout the week, suggesting that the dip wasn't driven by panic selling but rather a cautious adjustment to current market conditions affecting the Paris Stock Exchange and the wider French economy.

Factors Contributing to the CAC 40's Slight Dip

Several factors contributed to the CAC 40's slight dip this week. These factors highlight the interconnected nature of global and domestic influences on the French stock market.

-

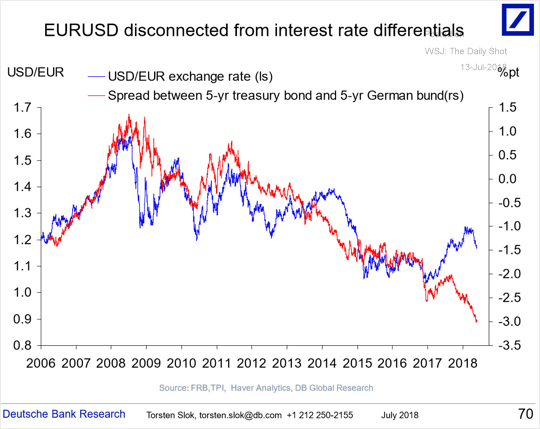

Macroeconomic factors: Concerns about rising inflation and interest rates globally contributed to the market's cautious sentiment. Investors are increasingly wary of potential economic slowdowns and the impact on corporate earnings. This sentiment impacted the CAC 40 index, reflecting broader global concerns.

-

Geopolitical influences: Geopolitical instability in Eastern Europe continues to add to investor uncertainty. The ongoing conflict and its impact on energy prices and supply chains are weighing on market sentiment, affecting investor confidence in the Paris Stock Exchange and the CAC 40 index.

-

Sector-specific news: Negative news regarding a major player in the banking sector impacted investor confidence. Reports of increased loan defaults and tighter credit conditions dampened investor optimism about this crucial sector.

-

Bullet Points:

- The release of slightly weaker-than-expected French GDP growth figures for Q2 2024 may have pressured the index.

- A profit warning from a major French retailer likely added to the downward pressure on the CAC 40 index.

- Negative performance of other major global indices, such as the Dow Jones and DAX, contributed to the overall market sentiment, influencing the direction of the French stock market and subsequently the CAC 40 index.

Long-Term Outlook and Implications for Investors

Despite the minor dip, the long-term outlook for the French economy and the CAC 40 index remains relatively positive. Analyzing the index performance requires considering multiple factors beyond this week's slight decline.

-

Overall health of the French economy: The French economy shows signs of resilience, driven by a strong services sector and government initiatives aimed at supporting businesses. However, challenges remain.

-

Potential for future growth: Analysts remain optimistic about the long-term growth potential of the CAC 40, citing the country's strong industrial base and ongoing efforts to promote innovation. However, external risks need to be considered when evaluating investment opportunities in the French stock market and the CAC 40.

-

Advice for investors: Investors are encouraged to maintain a long-term perspective and consider diversifying their portfolios to mitigate risk. A balanced approach, considering various sectors within the CAC 40 and other global indices, is recommended.

-

Bullet Points:

- Government initiatives aimed at boosting renewable energy and digital technologies could positively impact the CAC 40 index.

- Rising energy costs and potential supply chain disruptions continue to pose significant challenges to the French economy, and therefore the performance of the CAC 40 index.

- Investors with a high-risk tolerance may consider selectively adding to their positions in specific, resilient sectors of the CAC 40. More risk-averse investors might choose to wait and see how the current market conditions influencing the Paris Stock Exchange evolve.

Conclusion

This week's slight dip in the French CAC 40 index, while noteworthy, does not necessarily signal a significant shift in the overall market trend. Macroeconomic factors, geopolitical events, and sector-specific news all played a role in this minor fluctuation. The long-term outlook for the CAC 40 remains relatively positive, although investors should remain vigilant and consider the risks involved when investing in the French stock market and the CAC 40 index.

Call to Action: Stay informed on the latest developments impacting the French CAC 40 index and adjust your investment strategy accordingly. Regularly monitor the CAC 40 index performance and other relevant economic indicators for a comprehensive understanding of French market trends. Consider consulting a financial advisor for personalized investment guidance regarding the CAC 40 and other market indices. Careful analysis of the CAC 40 index is crucial for informed investment decisions in the French stock market.

Featured Posts

-

The Phone Rings A Story Of Waiting

May 25, 2025

The Phone Rings A Story Of Waiting

May 25, 2025 -

Planned M62 Closure Warrington Bound Resurfacing Manchester

May 25, 2025

Planned M62 Closure Warrington Bound Resurfacing Manchester

May 25, 2025 -

Zal De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 25, 2025

Zal De Snelle Marktdraai Van Europese Aandelen Ten Opzichte Van Wall Street Aanhouden

May 25, 2025 -

Recent Photos Annie Kilners Sparkling New Ring And Its Significance

May 25, 2025

Recent Photos Annie Kilners Sparkling New Ring And Its Significance

May 25, 2025 -

Should You Buy Apple Stock At 200 Analyst Sees 254 Potential

May 25, 2025

Should You Buy Apple Stock At 200 Analyst Sees 254 Potential

May 25, 2025

Latest Posts

-

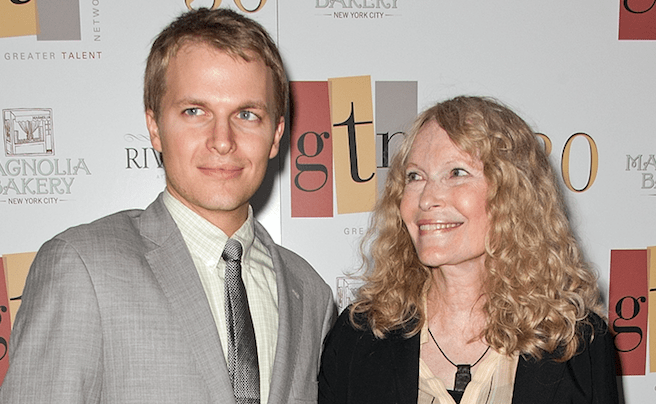

Will Ronan Farrow Orchestrate Mia Farrows Showbiz Return

May 25, 2025

Will Ronan Farrow Orchestrate Mia Farrows Showbiz Return

May 25, 2025 -

Michael Caines Shocking Mia Farrow Sex Scene Story A Bloody Hell Recounting

May 25, 2025

Michael Caines Shocking Mia Farrow Sex Scene Story A Bloody Hell Recounting

May 25, 2025 -

Analysis Mia Farrows Comments On Trump And The Future Of American Democracy

May 25, 2025

Analysis Mia Farrows Comments On Trump And The Future Of American Democracy

May 25, 2025 -

Mia Farrows Career Revival Is Ronan Farrow The Key

May 25, 2025

Mia Farrows Career Revival Is Ronan Farrow The Key

May 25, 2025 -

Florida Film Festival A Star Studded Event Featuring Mia Farrow And Christina Ricci

May 25, 2025

Florida Film Festival A Star Studded Event Featuring Mia Farrow And Christina Ricci

May 25, 2025