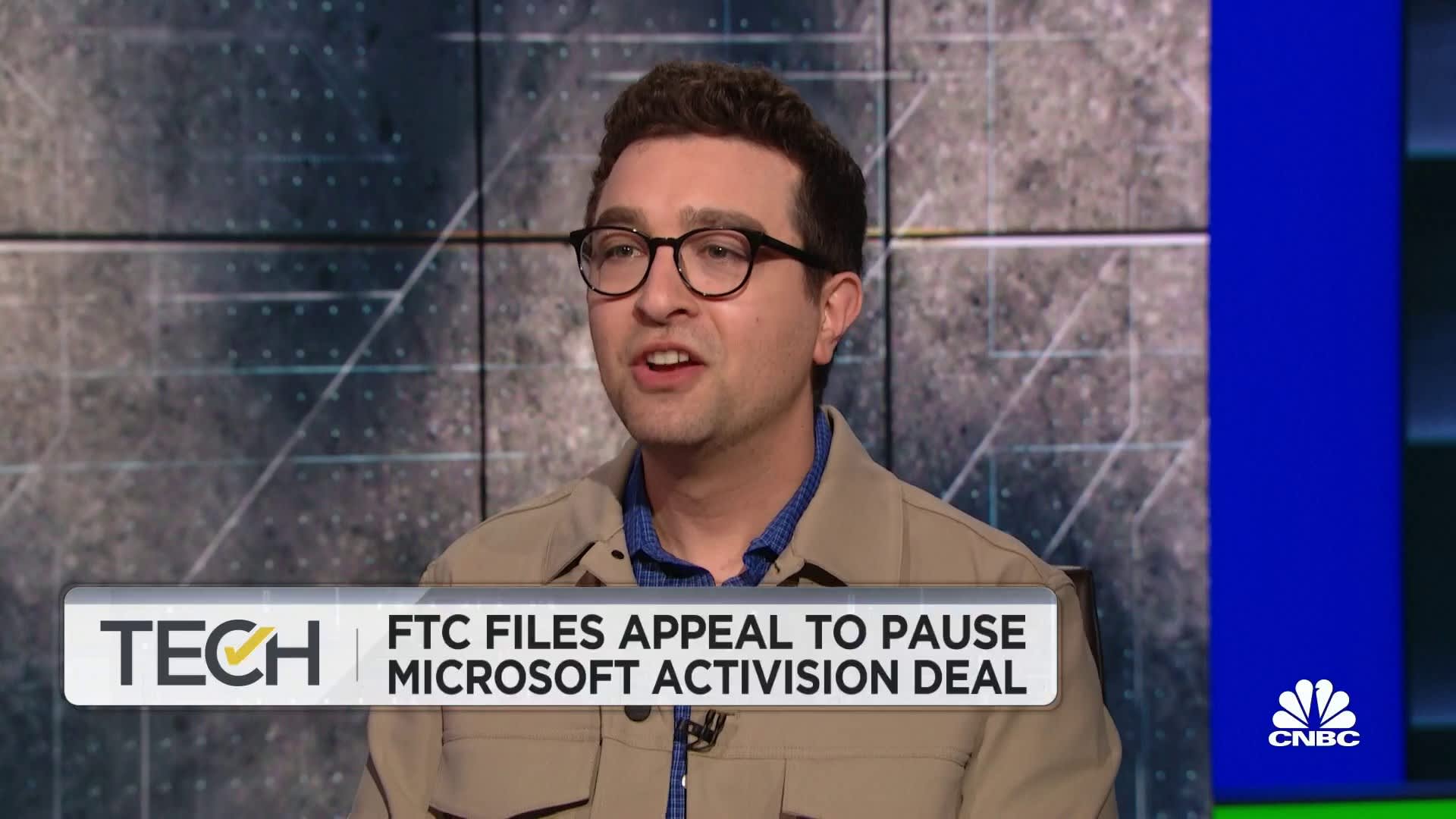

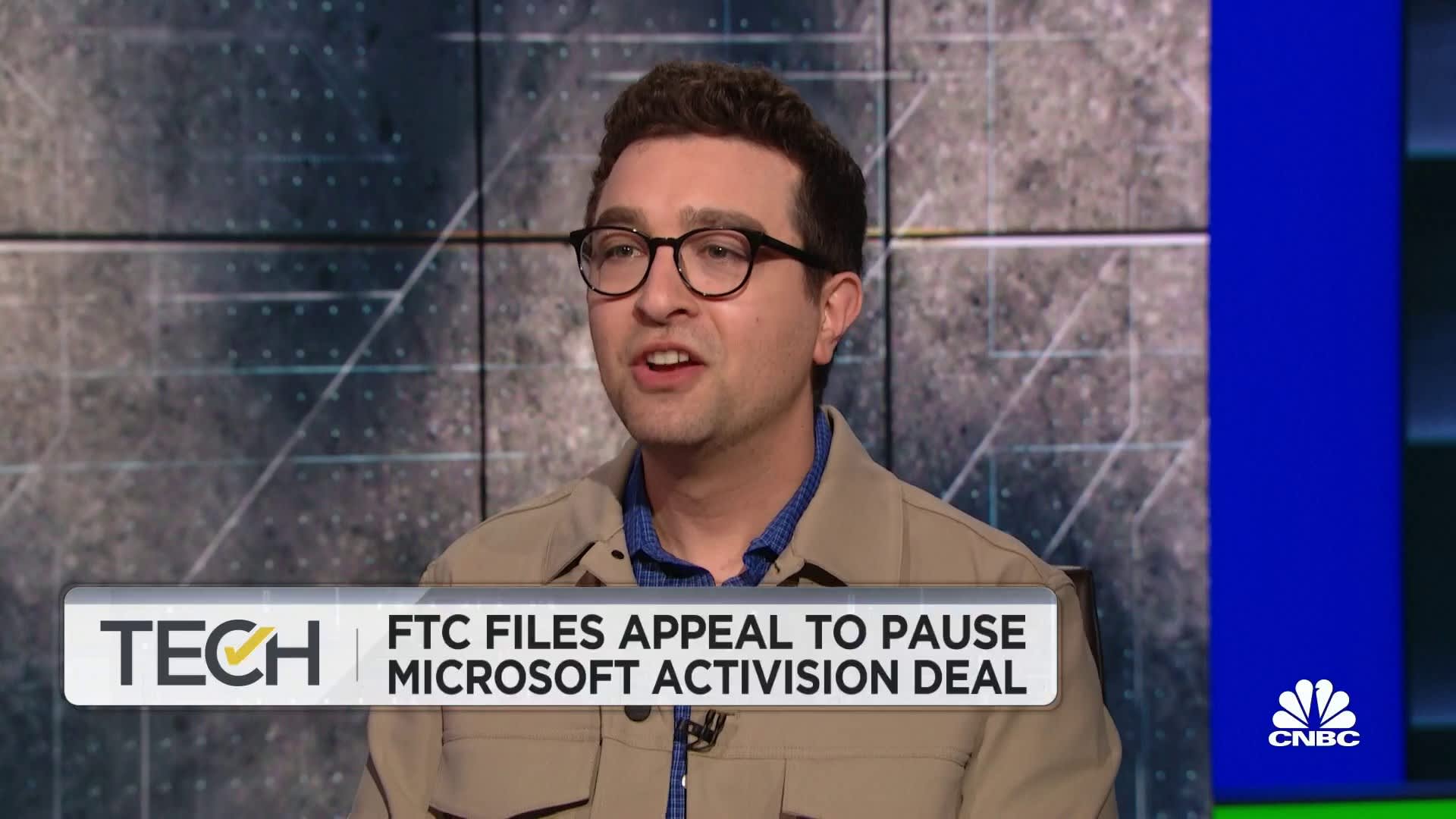

FTC's Appeal Against Microsoft-Activision Merger Approval

Table of Contents

The FTC's Core Concerns Regarding Competition

The FTC's primary concern centers around the potential for reduced competition within the gaming market, particularly concerning the immensely popular Call of Duty franchise. The commission argues that the merger would grant Microsoft an unfair competitive advantage, leading to a stifled market and potentially harming consumers. Their core arguments revolve around several key points:

- Monopolization of game consoles: The FTC fears Microsoft could leverage its ownership of Activision Blizzard to make Call of Duty and other Activision titles exclusive to Xbox, effectively stifling competition from PlayStation and other platforms. This could lead to a significant shift in market share and potentially harm consumers who prefer other consoles.

- Restriction of access to popular game franchises for competitors: By controlling Activision Blizzard's titles, Microsoft could restrict access to popular franchises for competitors, limiting their ability to create compelling alternatives and reducing consumer choice. This could manifest as higher prices, fewer innovative titles, and less competition in the gaming market.

- Impact on subscription services and pricing: The FTC worries the merger could lead to higher prices and less attractive subscription services, as Microsoft could bundle Activision Blizzard games into its Game Pass subscription service, making it less appealing or more expensive for competitors to offer similar services. This could limit consumer choices and drive up overall gaming costs.

These concerns are underpinned by existing antitrust laws designed to prevent monopolies and promote healthy competition. The FTC cites legal precedents, arguing the merger violates established principles of fair competition and could create a harmful monopoly. Keywords like "antitrust," "monopoly," "competition," and "market dominance" are central to the FTC's case.

Microsoft's Defense of the Merger

Microsoft vehemently refutes the FTC's claims, arguing that the merger will ultimately benefit consumers through increased innovation and expanded access to gaming. Their key arguments include:

- Commitment to keeping Call of Duty on multiple platforms: Microsoft has repeatedly pledged to continue releasing Call of Duty on PlayStation and other platforms, emphasizing their commitment to maintaining a competitive gaming landscape. This promise attempts to address the FTC's concerns about monopolization.

- Plans for expanding gaming access and affordability: Microsoft highlights its plans to expand access to gaming through initiatives like Game Pass, arguing that the merger will allow them to bring more high-quality games to a wider audience at a more affordable price.

- Investment in game development and technological advancements: Microsoft claims the merger will fuel significant investment in game development and technological advancements, ultimately enriching the gaming experience for everyone.

These arguments focus on keywords like "market expansion," "innovation," and "consumer benefits," aiming to demonstrate the positive impact of the merger on the industry and gamers.

The Potential Outcomes and Implications

The FTC's appeal could result in several different outcomes: a complete reversal of the initial approval, leading to a blocked merger; a compromise agreement with conditions imposed on Microsoft; or a confirmation of the original approval, allowing the merger to proceed. The implications are profound:

- FTC victory and merger blockage: This outcome would establish a significant legal precedent, potentially influencing future mergers and acquisitions in the gaming industry and other sectors.

- Compromise agreement with conditions: This could involve Microsoft agreeing to certain concessions, such as commitments to keep Call of Duty on competing platforms or restrictions on pricing practices, in exchange for the merger's approval.

- Microsoft victory and merger completion: This would likely embolden other tech giants to pursue large-scale acquisitions, possibly leading to further consolidation within the gaming industry.

The impact extends beyond the immediate players; the outcome will significantly shape the regulatory landscape for future mergers and acquisitions, influencing "regulatory oversight" and the overall "industry impact."

The Role of Regulatory Bodies and Public Opinion

The FTC's appeal isn't isolated; other regulatory bodies worldwide, such as the Competition and Markets Authority (CMA) in the UK and the European Union's regulatory bodies, are also scrutinizing the merger. Furthermore, public opinion and gamer sentiment play a considerable role:

- The impact of consumer advocacy groups: Consumer advocacy groups have weighed in, arguing for or against the merger based on their assessment of its potential impact on consumers.

- The role of expert testimony: Expert witnesses from both sides present evidence and arguments, shaping the legal narrative and influencing the judge's decision.

- The influence of media coverage: Media coverage significantly influences public perception and can indirectly impact the legal proceedings and the regulatory decisions.

This highlights the importance of "regulatory scrutiny" and "public opinion" in shaping the outcome of this complex legal battle.

Conclusion: The Future of the FTC's Appeal Against Microsoft-Activision Merger Approval

The FTC's appeal against Microsoft-Activision merger approval is a pivotal moment for the gaming industry. The FTC's concerns about reduced competition and potential monopolization are countered by Microsoft's arguments regarding innovation and consumer benefits. The outcome will create a significant legal precedent, influencing future mergers and the broader regulatory landscape. While predicting the exact outcome remains challenging, the case underscores the increasing scrutiny of large tech acquisitions and the critical role of regulatory bodies in maintaining fair competition. Stay informed about further developments by following reputable news sources covering antitrust law and regulatory updates related to the Microsoft-Activision merger and the FTC's appeal. Understanding the intricacies of this case is crucial for anyone invested in the future of the gaming industry and its regulations.

Featured Posts

-

Jennifer Lopez Set To Host 2025 American Music Awards

May 28, 2025

Jennifer Lopez Set To Host 2025 American Music Awards

May 28, 2025 -

Acheter Le Samsung Galaxy S25 256 Go Bon Plan A 699 90 E

May 28, 2025

Acheter Le Samsung Galaxy S25 256 Go Bon Plan A 699 90 E

May 28, 2025 -

Unannounced Lorde Performance Electrifies Dedicated Fans At Themed Night

May 28, 2025

Unannounced Lorde Performance Electrifies Dedicated Fans At Themed Night

May 28, 2025 -

South Koreas Next President A Guide To The Candidates And Election

May 28, 2025

South Koreas Next President A Guide To The Candidates And Election

May 28, 2025 -

Rute And Jadwal Km Lambelu Nunukan Makassar 4x Perjalanan Tiba Maumere 4 And 18 Juni 2025

May 28, 2025

Rute And Jadwal Km Lambelu Nunukan Makassar 4x Perjalanan Tiba Maumere 4 And 18 Juni 2025

May 28, 2025

Latest Posts

-

Stock Market Valuation Concerns Why Bof A Remains Optimistic

May 30, 2025

Stock Market Valuation Concerns Why Bof A Remains Optimistic

May 30, 2025 -

Addressing Investor Concerns Bof As Analysis Of Current Stock Market Valuations

May 30, 2025

Addressing Investor Concerns Bof As Analysis Of Current Stock Market Valuations

May 30, 2025 -

Bof As Take On Stretched Stock Market Valuations A Guide For Investors

May 30, 2025

Bof As Take On Stretched Stock Market Valuations A Guide For Investors

May 30, 2025 -

Understanding Stock Market Valuations Bof As View And Investor Implications

May 30, 2025

Understanding Stock Market Valuations Bof As View And Investor Implications

May 30, 2025 -

High Stock Market Valuations A Bof A Perspective For Investors

May 30, 2025

High Stock Market Valuations A Bof A Perspective For Investors

May 30, 2025