G-7 Nations Discuss De Minimis Tariff Adjustments For Chinese Goods

Table of Contents

Current De Minimis Levels and Their Impact

Currently, de minimis levels for goods imported from China vary considerably across G-7 nations. These differing tariff thresholds directly impact businesses, especially those engaged in importing low-value goods. The current inconsistencies create complexities for businesses navigating international trade. For example, a small e-commerce business selling goods from China might face significantly different import costs depending on the destination country within the G-7.

- Variations in De Minimis Values: The lack of harmonization among G-7 countries leads to administrative burdens and uneven competitive landscapes. Some nations may have thresholds as low as $800, while others may be as high as $2,600.

- Impact on Import Costs: Higher de minimis thresholds generally reduce import costs for businesses, especially those dealing with numerous smaller shipments. Conversely, lower thresholds increase costs and administrative complexity.

- Effects on Consumer Prices: Changes in de minimis tariffs can directly influence consumer prices. Higher thresholds might lead to slightly lower prices for imported goods, while lower thresholds could result in higher prices.

- Existing Trade Disputes: Discrepancies in de minimis levels have been a source of friction in past trade negotiations, potentially leading to disputes and retaliatory measures.

Proposed Adjustments and Their Rationale

The proposed adjustments to de minimis tariffs on Chinese goods aim to address some of these inconsistencies and foster a more level playing field. The rationale behind these changes often revolves around boosting competitiveness, promoting economic growth, and enhancing consumer protection. However, the proposed changes are not without their detractors.

- Specific Proposed Changes: While the precise details are still under negotiation, proposals generally involve raising de minimis thresholds across the G-7, potentially moving towards a more unified standard.

- Economic Arguments: Proponents argue that harmonized and increased thresholds simplify customs procedures, reduce administrative burdens, and ultimately stimulate cross-border trade, benefiting both businesses and consumers.

- Counterarguments and Concerns: Concerns exist about the potential impact on domestic industries, particularly those competing directly with Chinese imports. There are also concerns about potential revenue losses for governments due to reduced import duties.

- Lobbying Efforts: Businesses, particularly SMEs and industry associations, are actively lobbying G-7 governments to advocate for their interests, with arguments ranging from the need for simplification to the importance of maintaining a competitive edge.

Impact on Businesses (Specifically SMEs)

SMEs are particularly vulnerable to changes in de minimis tariffs. These businesses often rely on low-cost imports from China to maintain competitiveness. Adjustments to de minimis thresholds can significantly impact their import costs, supply chains, and overall profitability.

- Challenges Faced by SMEs: SMEs often lack the resources to navigate complex customs regulations and manage fluctuating import costs. Higher thresholds can ease these burdens, while lower thresholds can create significant challenges.

- Potential Benefits of De Minimis Adjustments: Harmonized and higher de minimis levels can significantly reduce the administrative burden on SMEs, making it easier for them to participate in international trade. This can foster growth and competitiveness.

- Impact on Supply Chains: Changes in tariffs can disrupt carefully established supply chains, forcing businesses to re-evaluate their sourcing strategies and potentially incurring additional costs.

Potential Implications for Global Trade Relations

The G-7's decision on de minimis tariff adjustments for Chinese goods will have significant implications for global trade relations. The outcome could affect the US-China trade relationship, compliance with WTO rules, and potentially even lead to further geopolitical ramifications.

- Impact on Bilateral Trade Agreements: The decision could influence ongoing bilateral trade negotiations and agreements between G-7 nations and China.

- Risk of Escalating Trade Disputes: Disagreements over de minimis levels could escalate into broader trade disputes, potentially leading to retaliatory measures.

- Potential for Retaliatory Measures from China: If China perceives the G-7's decision as unfair or protectionist, it could implement retaliatory measures affecting other goods.

- Implications for Multilateral Trade Organizations: The G-7's decision could set a precedent for other countries and international organizations, impacting the future of multilateral trade agreements and regulations.

Conclusion

The G-7's discussion on adjusting de minimis tariffs on Chinese goods is a crucial development with far-reaching consequences. The changes, whatever they may be, will significantly impact businesses of all sizes, consumers, and the global trade landscape. Understanding the nuances of de minimis tariffs and their effects is critical for navigating this complex and evolving environment. Stay updated on G-7 de minimis tariff decisions and learn more about the impact of de minimis tariffs on Chinese goods to ensure your business remains competitive and informed. Follow the evolution of G-7 trade policies to understand how these shifts may affect your operations.

Featured Posts

-

Mehidy Hasan Stars With Bat And Ball As Bangladesh Dominates Zimbabwe In Second Test

May 23, 2025

Mehidy Hasan Stars With Bat And Ball As Bangladesh Dominates Zimbabwe In Second Test

May 23, 2025 -

Icc Rankings Jasprit Bumrah Remains Number One Test Bowler

May 23, 2025

Icc Rankings Jasprit Bumrah Remains Number One Test Bowler

May 23, 2025 -

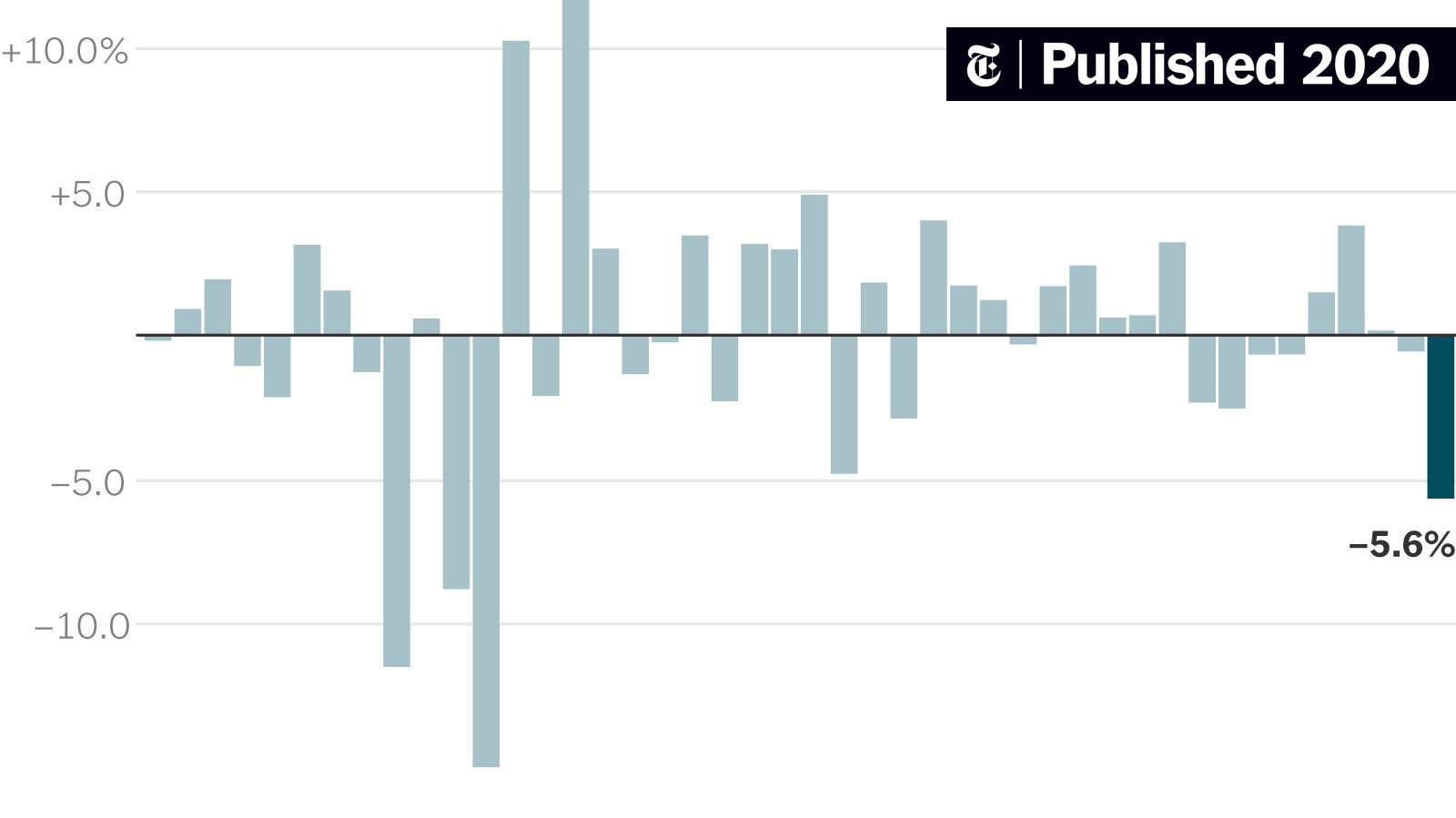

Us Fiscal Concerns Weigh On Stock Market Leading To Sharp Decline

May 23, 2025

Us Fiscal Concerns Weigh On Stock Market Leading To Sharp Decline

May 23, 2025 -

Kartels Restrictions A Police Source Explains The Safety Measures

May 23, 2025

Kartels Restrictions A Police Source Explains The Safety Measures

May 23, 2025 -

Strengthening The Bond Ooredoo Qatar And Qtspbf Extend Partnership

May 23, 2025

Strengthening The Bond Ooredoo Qatar And Qtspbf Extend Partnership

May 23, 2025

Latest Posts

-

Top Deals On Memorial Day 2025 Shopping Editors Selections

May 23, 2025

Top Deals On Memorial Day 2025 Shopping Editors Selections

May 23, 2025 -

Expert Curated Memorial Day Sales And Deals For 2025

May 23, 2025

Expert Curated Memorial Day Sales And Deals For 2025

May 23, 2025 -

Memorial Day 2025 Find The Best Sales And Deals Here

May 23, 2025

Memorial Day 2025 Find The Best Sales And Deals Here

May 23, 2025 -

Forbes Top Picks Memorial Day Appliance Sales 2025

May 23, 2025

Forbes Top Picks Memorial Day Appliance Sales 2025

May 23, 2025 -

The Last Rodeo Neal Mc Donoughs Unexpected Challenge

May 23, 2025

The Last Rodeo Neal Mc Donoughs Unexpected Challenge

May 23, 2025