German DAX Soars: A Wall Street Comeback Threat Looms

Table of Contents

DAX's Recent Performance and Driving Factors

The German DAX has exhibited impressive growth in recent months. For example, between [Insert Start Date] and [Insert End Date], the DAX index increased by [Insert Percentage]%, significantly outperforming many major US indices during the same period. (Insert a chart or graph visually representing this growth here) This surge isn't random; several key factors have contributed:

-

Strong German Economic Indicators: Germany's robust economic performance, evidenced by a growing GDP, increased industrial production, and rising consumer confidence, has provided a solid foundation for the DAX's growth. These positive economic signals demonstrate the resilience of the German economy.

-

DAX Company Performance: Several prominent DAX companies, such as Volkswagen, Siemens, and BASF, have reported strong earnings, bolstering the overall index performance. Their success reflects both domestic strength and global competitiveness.

-

Impact of Global Events: Geopolitical stability in Europe and relatively stable commodity prices have also positively impacted investor sentiment and contributed to the DAX's rise. These factors offer a more predictable environment for investment.

-

Investment Flows: Significant investment flows into the German market, driven by both domestic and international investors, have further fueled the DAX's upward trajectory. This influx of capital highlights the growing confidence in the German economy. This increased interest in the DAX indicates a shift in global investment strategies.

Comparison with Wall Street Performance

Contrasting the DAX's performance with major US indices reveals a striking divergence. While the DAX has shown substantial growth, the Dow Jones, S&P 500, and Nasdaq have experienced [Describe the performance of US indices – use specific data points and percentage changes]. (Insert a comparative chart or graph showing the performance of the DAX against US indices here). This difference can be attributed to several factors:

-

Differing Economic Landscapes: The US and German economies face different challenges, including varying inflation rates, interest rate policies, and regulatory environments. These differing landscapes influence investor decisions and market behavior.

-

Investor Sentiment: Investor sentiment plays a crucial role. Optimism surrounding the German economy and concerns about the US economy (e.g., inflation, recession risks) may have contributed to the contrasting performance of the two markets.

-

Sectoral Differences: The sectoral composition of the DAX and US indices differs significantly. The strength of specific sectors in Germany, such as the automotive industry, may have disproportionately contributed to the DAX's growth compared to the US.

The Implications of a Strong DAX for Global Markets

A sustained period of strong DAX performance could have profound implications for global markets:

-

Shift in Global Investment Flows: Investors may increasingly shift their focus towards European markets, potentially diverting capital away from Wall Street. This shift could reshape the global investment landscape.

-

Increased Competition: The DAX's growth increases competition for global capital between European and US markets, potentially impacting long-term investment strategies and market valuations.

-

Currency Exchange Rates: A stronger DAX could lead to fluctuations in currency exchange rates, particularly between the US dollar and the Euro, influencing international trade and investment.

-

Market Volatility: While the current trend is positive, a rapid rise in the DAX could lead to increased market volatility as investors adjust to the shifting power dynamics.

Potential Risks and Challenges

Despite the impressive performance, it’s crucial to acknowledge potential risks:

-

Overvaluation: The rapid rise of the DAX raises concerns about potential overvaluation, increasing the risk of a significant correction in the future. Careful analysis is crucial to avoid market bubbles.

-

Geopolitical Instability: Unforeseen geopolitical events could negatively impact the German economy and, consequently, the DAX's performance. Maintaining geopolitical stability is crucial for long-term growth.

-

Rising Inflation: Persistent inflation in Germany or Europe could dampen economic growth and negatively affect investor confidence, potentially reversing the current upward trend.

Conclusion: Is the German DAX a Threat to Wall Street's Dominance?

The significant rise of the German DAX undeniably presents a noteworthy challenge to Wall Street's traditional dominance. While it doesn't necessarily signal an immediate overthrow of Wall Street's position, the DAX's growth highlights a significant shift in global market dynamics. The factors driving this performance – a strong German economy, favorable global events, and investor sentiment – need to be carefully considered. However, potential risks, such as overvaluation and geopolitical uncertainties, should also be accounted for. The future relationship between the German DAX and Wall Street remains dynamic and warrants continuous monitoring. Stay tuned for further updates on the German DAX and its continued impact on global markets. Monitor the performance of the German DAX index to understand the evolving dynamics of global finance.

Featured Posts

-

Major Gun Trafficking Bust In Massachusetts 18 Brazilian Nationals Face Charges

May 25, 2025

Major Gun Trafficking Bust In Massachusetts 18 Brazilian Nationals Face Charges

May 25, 2025 -

Lady Gaga Spotted With Fiance Michael Polansky At Snl Afterparty

May 25, 2025

Lady Gaga Spotted With Fiance Michael Polansky At Snl Afterparty

May 25, 2025 -

Brest Urban Trail Portrait Des Acteurs Cles

May 25, 2025

Brest Urban Trail Portrait Des Acteurs Cles

May 25, 2025 -

Brazils Banking Landscape Transformed Brb And Banco Master Unite

May 25, 2025

Brazils Banking Landscape Transformed Brb And Banco Master Unite

May 25, 2025 -

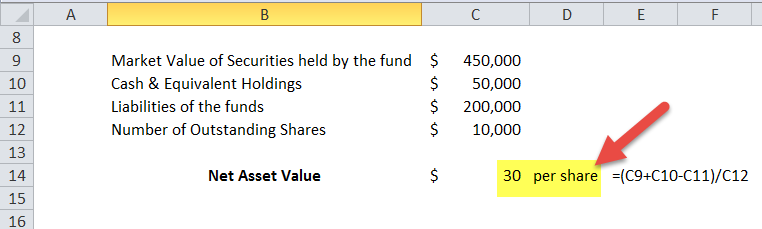

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

How To Track The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Latest Posts

-

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 25, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 25, 2025 -

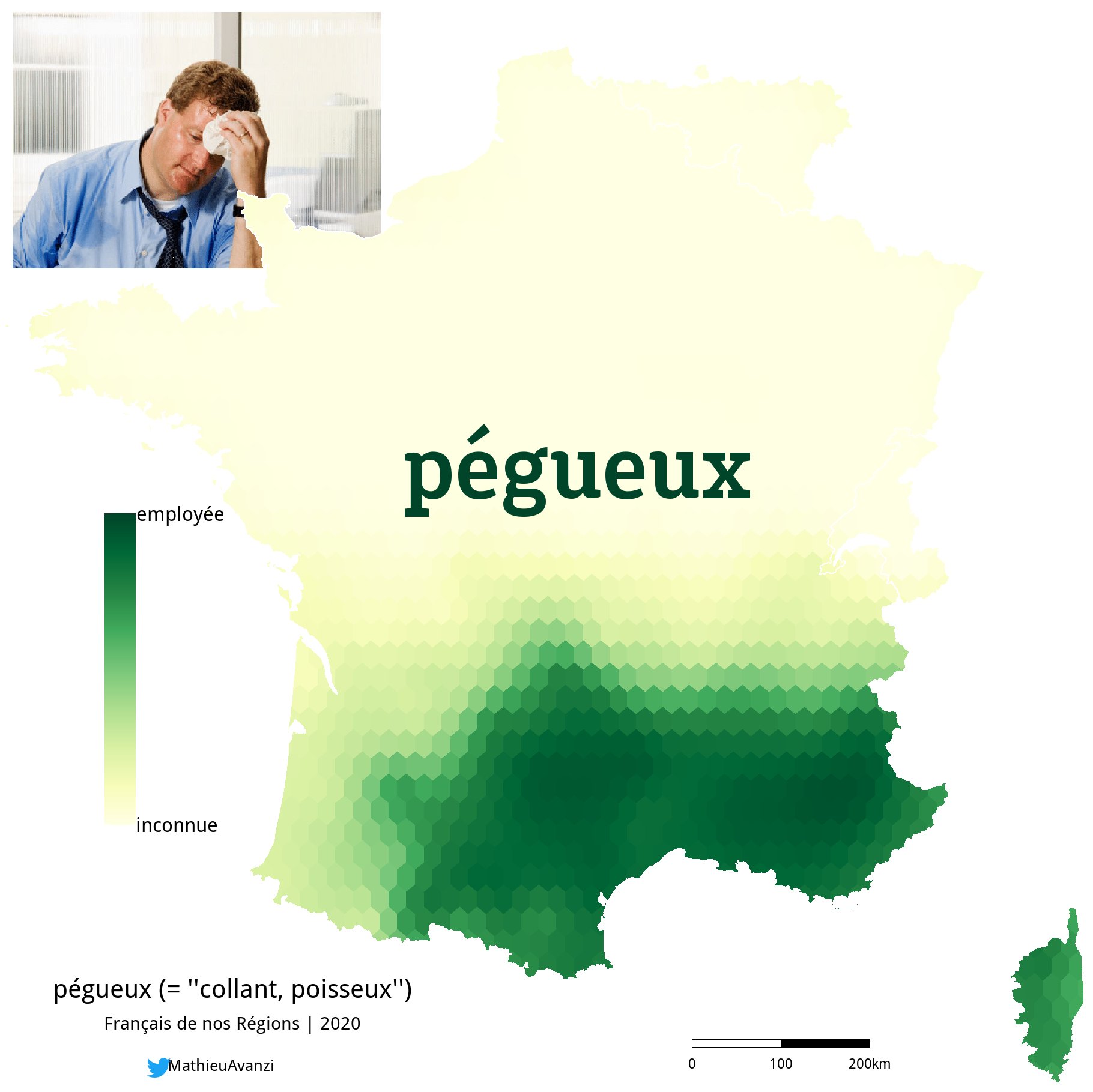

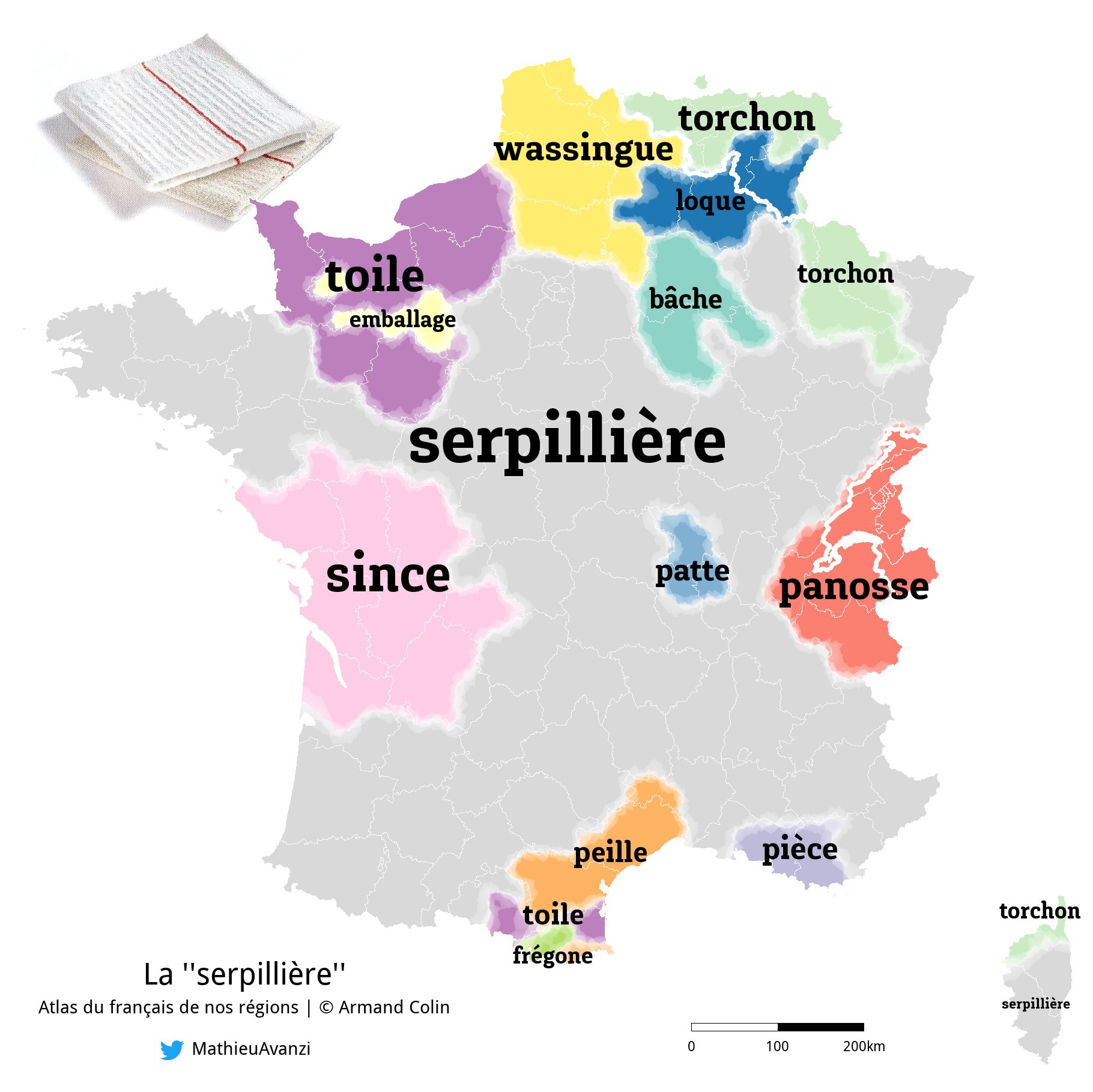

Le Francais Selon Mathieu Avanzi Bien Plus Qu Une Matiere Scolaire

May 25, 2025

Le Francais Selon Mathieu Avanzi Bien Plus Qu Une Matiere Scolaire

May 25, 2025 -

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 25, 2025

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 25, 2025 -

Bangladeshs Strategic European Partnerships Growth And Collaboration

May 25, 2025

Bangladeshs Strategic European Partnerships Growth And Collaboration

May 25, 2025 -

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 25, 2025

Mathieu Avanzi Et L Evolution De La Langue Francaise

May 25, 2025