Heineken's Revenue: Above Forecast, Outlook Confirmed Amid Trade Uncertainty

Table of Contents

Heineken Revenue Surpasses Predictions

Heineken's strong Q2 2024 results demonstrate significant growth across various key performance indicators. This success can be attributed to a combination of factors, including robust sales volume increases and effective pricing strategies.

Stronger-Than-Expected Sales Volumes

Heineken experienced stronger-than-expected sales volume growth across several key markets:

- Europe: A 5% increase in sales volume compared to Q2 2023, driven by strong demand for premium brands and successful marketing campaigns targeting younger demographics.

- Asia: A 7% increase in sales volume, fueled by expansion into new markets and increased consumer spending in key regions.

- Americas: A 3% increase, showcasing resilience despite economic headwinds in some areas. Growth was particularly strong in the premium segment.

The Heineken brand itself contributed significantly to this growth, with a 6% increase in volume. Other premium brands within the Heineken portfolio also performed exceptionally well, exceeding initial sales projections. This overall increase represents a 5% jump compared to the same period last year and a 2% exceedance of the initial forecast. This success is largely attributed to targeted marketing campaigns, successful new product launches, and a general rise in consumer demand for premium beer.

Pricing Strategies and their Impact on Revenue

Heineken implemented strategic pricing adjustments during the quarter, balancing the need to maintain market share with the necessity to offset inflationary pressures. The average selling price increased by 2%, contributing positively to the overall Heineken revenue. This careful balancing act reflects the company's ability to navigate the challenging economic environment while maintaining profitability. While challenges remain due to inflation and consumer sensitivity to price increases, Heineken's approach appears to have been highly effective.

Heineken's Outlook Remains Positive Despite Trade Headwinds

Despite navigating significant global trade uncertainties, Heineken maintains a positive outlook for the remainder of 2024.

Navigating Global Trade Uncertainties

Heineken faces various global trade uncertainties, including:

- Geopolitical Instability: Conflicts and tensions in various regions impact supply chains and consumer confidence.

- Tariffs and Trade Restrictions: Changes in trade policies create uncertainty and potential costs.

- Supply Chain Disruptions: Ongoing challenges persist in securing raw materials and ensuring timely delivery.

To mitigate these risks, Heineken employs several strategies:

- Supply Chain Diversification: The company actively works to diversify its sources of raw materials and production facilities to reduce reliance on any single region.

- Currency Hedging: Strategies are in place to minimize the impact of currency fluctuations on profitability.

- Geographic Diversification: Heineken's broad global presence helps spread risk and capitalize on opportunities in various markets.

Maintaining Profitability and Growth Targets

Heineken has reaffirmed its forecast for the year, demonstrating confidence in its ability to deliver strong financial results. The company plans to achieve its targets through:

- Innovation: Continued investment in research and development to launch new products and enhance existing ones.

- Cost Optimization: Streamlining operations and improving efficiency across the value chain.

- Market Expansion: Exploring new growth opportunities in emerging markets.

Heineken's operating profit margin remains healthy, and net income is projected to increase, reflecting the effectiveness of its strategies. Significant investments are planned for the coming years, further bolstering growth prospects.

Key Factors Contributing to Heineken's Success

Heineken's strong Q2 performance is a result of several contributing factors beyond simply reacting to market fluctuations.

Successful Marketing and Branding

Heineken's marketing efforts have played a pivotal role in driving sales growth. Successful campaigns have focused on:

- Targeted Advertising: Reaching key demographic groups through effective digital and traditional channels.

- Brand Storytelling: Connecting with consumers on an emotional level and building brand loyalty.

- Experiential Marketing: Creating memorable experiences that reinforce brand affinity.

Effective Supply Chain Management

Heineken's effective supply chain management has been critical in navigating global disruptions. This includes:

- Strong Supplier Relationships: Collaborating closely with suppliers to ensure consistent access to quality raw materials.

- Efficient Logistics: Optimizing transportation and distribution networks for timely delivery.

- Sustainable Sourcing: Committing to environmentally and socially responsible sourcing practices.

Conclusion

Heineken's exceeding revenue expectations for Q2 2024 demonstrates the company’s robust performance and strategic resilience, even in the face of significant global trade uncertainties. The company's positive outlook for the remainder of the year is testament to its effective management strategies and strong brand portfolio. The impressive Heineken sales figures and overall Heineken revenue demonstrate a remarkable ability to adapt and thrive.

Call to Action: Stay informed about Heineken's continued financial performance and future market strategies by following our updates on Heineken revenue and the global beer market. Learn more about the factors driving Heineken's success and its response to global challenges.

Featured Posts

-

Dayamitra Mtel Dan Merdeka Battery Mbma Prospek Pasca Penambahan Msci Small Cap

May 24, 2025

Dayamitra Mtel Dan Merdeka Battery Mbma Prospek Pasca Penambahan Msci Small Cap

May 24, 2025 -

Indian Wells Triumph Draper Secures Maiden Atp Masters 1000 Victory

May 24, 2025

Indian Wells Triumph Draper Secures Maiden Atp Masters 1000 Victory

May 24, 2025 -

Was The National Rallys Sunday Demonstration A Success For Le Pen An Analysis

May 24, 2025

Was The National Rallys Sunday Demonstration A Success For Le Pen An Analysis

May 24, 2025 -

Bardellas Presidential Bid A Contender Or Outsider

May 24, 2025

Bardellas Presidential Bid A Contender Or Outsider

May 24, 2025 -

Mia Farrows Warning Trump Address And The Fate Of American Democracy

May 24, 2025

Mia Farrows Warning Trump Address And The Fate Of American Democracy

May 24, 2025

Latest Posts

-

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025

Impact Of Sses 3 Billion Spending Reduction On Energy Sector And Consumers

May 24, 2025 -

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025

Understanding Elevated Stock Market Valuations Bof As Insight For Investors

May 24, 2025 -

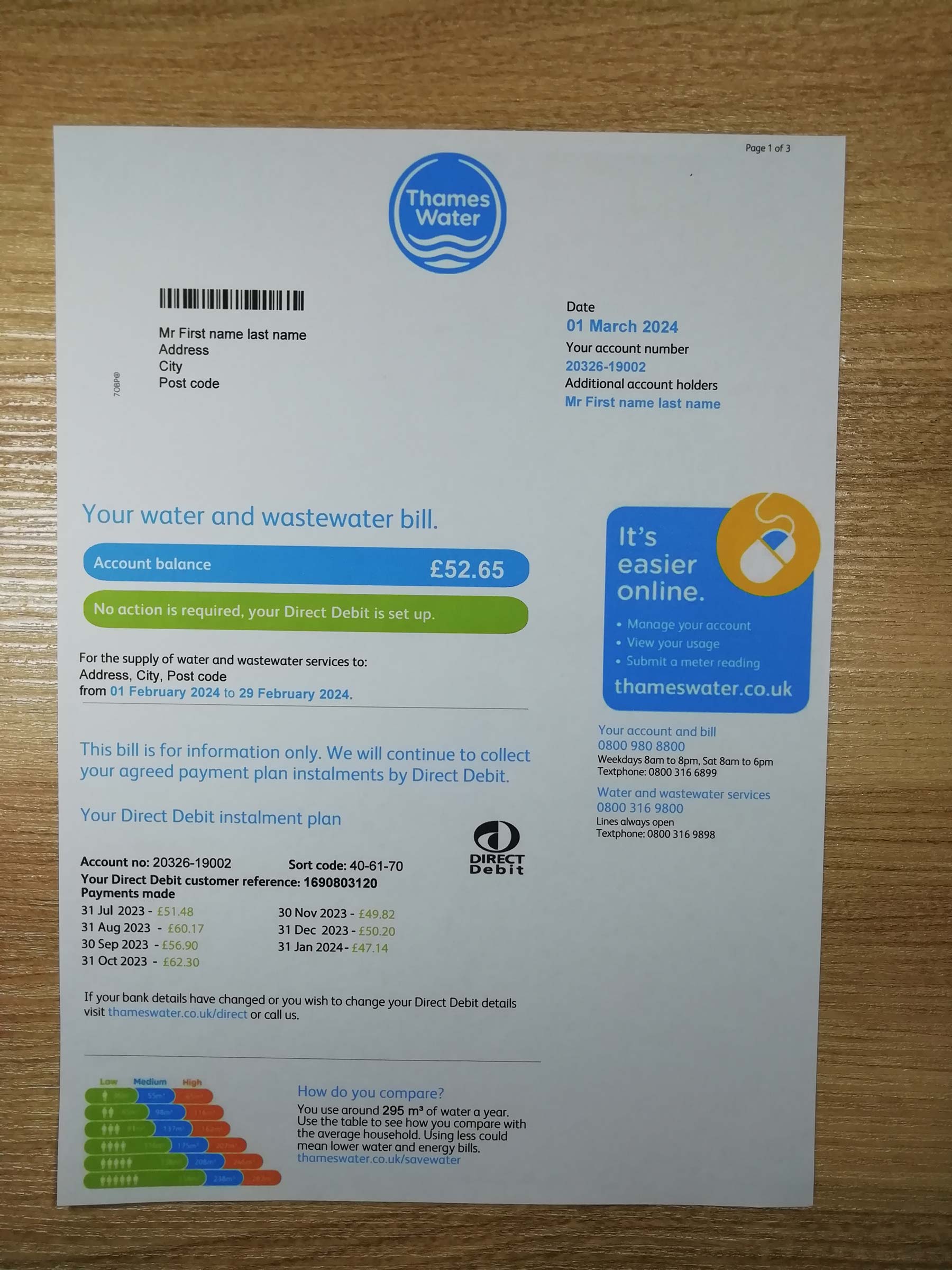

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025

Investigating Thames Water The Issue Of Executive Bonuses

May 24, 2025 -

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025

Thames Water Understanding The Debate Surrounding Executive Pay

May 24, 2025 -

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025

Analysis Of Sses 3 Billion Spending Cut And Its Long Term Effects

May 24, 2025