Gold Price Record Rally: Bullion As A Trade War Safe Haven

Table of Contents

Understanding the Gold Price Surge

Geopolitical Uncertainty and Gold

Trade wars introduce significant market volatility. Uncertainty surrounding tariffs, sanctions, and retaliatory measures causes investors to seek refuge in assets perceived as stable and less susceptible to market fluctuations. Historically, gold has consistently performed well during times of geopolitical instability. Its inherent value and limited supply make it an attractive haven.

- Example 1: The 1970s oil crisis and subsequent inflation saw a dramatic rise in gold prices.

- Example 2: The 2008 financial crisis led to a significant increase in gold investment as investors sought safety.

- Example 3: Recent trade disputes between major global economies have fueled a renewed interest in gold as a safe haven.

Inflationary Pressures and Gold

Trade wars can fuel inflation. Increased tariffs on imported goods raise prices for consumers. This inflationary pressure often drives investors towards gold, which is traditionally viewed as an inflation hedge. Gold's value tends to rise alongside inflation, preserving purchasing power.

- Statistic: Historically, gold prices have shown a strong positive correlation with inflation rates. (Include a relevant chart here if possible)

- Example: Periods of high inflation throughout history have often been accompanied by significant increases in gold prices.

Currency Devaluation and Gold

Trade wars can weaken currencies. When a country's currency depreciates, the purchasing power of its citizens decreases. Gold, denominated in various currencies, becomes a more attractive store of value, leading to increased demand and a subsequent price rise.

- Example: A weakening US dollar often boosts demand for gold, as investors seek to diversify away from a falling currency. (Include a chart showing the correlation between USD value and gold price)

- Data Point: (Insert data on currency devaluation and its impact on gold prices from a reliable source)

Gold as a Portfolio Diversification Tool

Hedging Against Market Volatility

Gold acts as a valuable hedge against market downturns. While stocks and bonds can experience significant losses during economic crises, gold often holds its value or even appreciates. Including gold in a diversified portfolio can help mitigate losses and improve overall portfolio resilience.

- Data Point: (Include historical data comparing gold performance against other asset classes during market crashes.)

- Example: During the 2008 financial crisis, gold provided a significant buffer against losses for investors who had included it in their portfolios.

Gold's Role in Risk Management

Gold plays a crucial role in risk management strategies. Its low correlation with other traditional asset classes helps reduce overall portfolio volatility. Investors use gold to reduce their exposure to market risks during uncertain times.

- Strategy 1: Allocate a percentage of your portfolio (e.g., 5-10%) to gold as a hedge against unforeseen events.

- Strategy 2: Increase your gold allocation during periods of heightened geopolitical uncertainty.

- Expert Opinion: (Quote a financial expert on the importance of gold in risk management.)

Investing in Gold: Strategies and Considerations

Different Ways to Invest in Gold

Investors have several options for gaining exposure to gold:

- Physical Gold: Buying gold bars or coins offers direct ownership but involves storage and security considerations.

- Gold ETFs (Exchange-Traded Funds): These funds track the price of gold, offering easier access and liquidity compared to physical gold.

- Gold Mining Stocks: Investing in companies involved in gold mining offers leverage to potential price increases, but also carries higher risk.

Each option has its own set of advantages and disadvantages regarding liquidity, security, and potential returns.

Understanding Gold Market Dynamics

Several factors influence gold prices:

- Supply and Demand: Changes in gold production and global demand significantly impact prices.

- Currency Fluctuations: A weaker US dollar typically boosts gold prices.

- Interest Rates: Rising interest rates can sometimes put downward pressure on gold prices.

Understanding fundamental and technical analysis is crucial for navigating the gold market effectively. However, remember that gold prices can be volatile and carry inherent risk.

Conclusion: Gold – A Strategic Asset During Trade Wars

This article highlighted gold's role as a safe haven asset during times of trade war uncertainty. Its importance in portfolio diversification and risk management is undeniable. The connection between trade wars, market uncertainty, and the subsequent rise in gold prices has been clearly demonstrated. While gold investments offer potential benefits, understanding its market dynamics and associated risks is crucial.

Invest wisely in gold and secure your portfolio with gold bullion. Learn more about gold as a trade war safe haven and explore the various investment options to find the strategy that best suits your financial goals.

Featured Posts

-

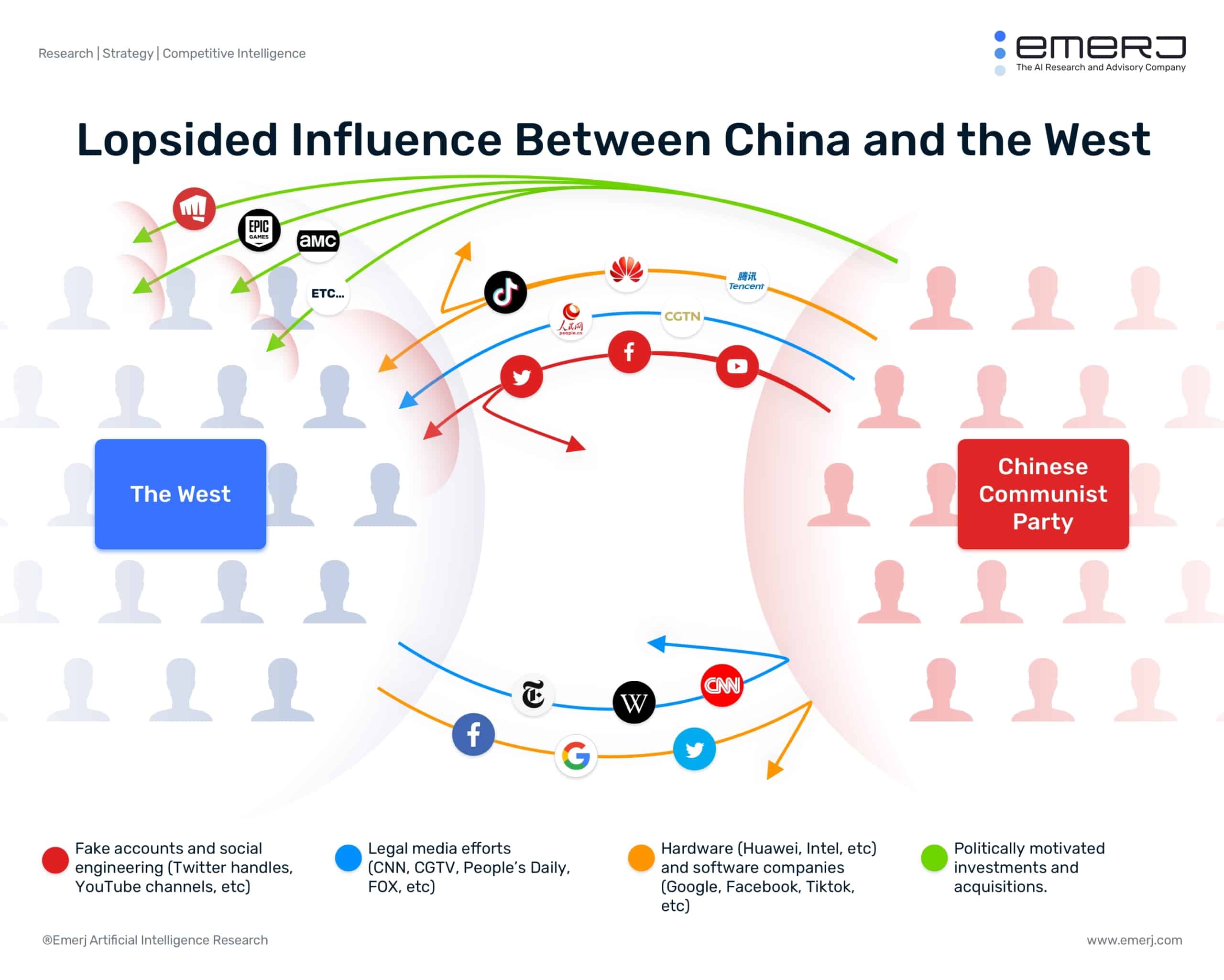

A Critical Military Installation The Epicenter Of Us China Influence

Apr 26, 2025

A Critical Military Installation The Epicenter Of Us China Influence

Apr 26, 2025 -

Stock Market Today Dow Futures Fluctuate Chinas Economic Support Amidst Tariff Tensions

Apr 26, 2025

Stock Market Today Dow Futures Fluctuate Chinas Economic Support Amidst Tariff Tensions

Apr 26, 2025 -

Building Voice Assistants Made Easy Open Ais Latest Announcement

Apr 26, 2025

Building Voice Assistants Made Easy Open Ais Latest Announcement

Apr 26, 2025 -

The Trump Factor Weighing The Odds Of Ukraine Joining Nato

Apr 26, 2025

The Trump Factor Weighing The Odds Of Ukraine Joining Nato

Apr 26, 2025 -

Gold Price Record Rally Bullion As A Trade War Safe Haven

Apr 26, 2025

Gold Price Record Rally Bullion As A Trade War Safe Haven

Apr 26, 2025