Heineken Reaffirms Financial Outlook Amidst Global Tariff Challenges

Table of Contents

Heineken's Robust Performance Despite Tariff Impacts

Strong Revenue and Profit Growth

Heineken has demonstrated strong revenue and profit growth despite the headwinds created by global tariffs. While precise figures require referencing Heineken's official financial reports (which should be consulted for the most up-to-date information), the company has consistently highlighted its ability to maintain positive momentum. This suggests effective strategies to offset tariff-related increases in production costs.

- Revenue Growth: Heineken's revenue growth has outpaced industry averages in several key markets, indicating strong brand performance and consumer demand.

- Profit Margin Maintenance: Despite increased input costs due to tariffs, Heineken has successfully managed to maintain or even improve its profit margins, suggesting efficient cost management and pricing strategies.

- Geographic Performance: While some regions may have experienced more significant tariff impacts than others, Heineken's diversified global presence allows it to offset regional weaknesses with strengths in other markets. For example, strong performance in Asia might mitigate challenges faced in Europe due to specific import tariffs.

- Pricing Strategies: Heineken has likely implemented strategic pricing adjustments to offset increased costs related to tariffs, demonstrating agility in responding to market changes.

Effective Cost Management Strategies

Heineken's success in navigating the challenging economic environment is largely attributed to its effective cost management strategies. The company has implemented various measures to mitigate the impact of rising costs associated with tariffs and inflation.

- Supply Chain Optimization: Heineken has likely optimized its supply chain to reduce inefficiencies and minimize transportation costs, a crucial element given the impact of tariffs on international trade. This might involve exploring alternative sourcing options or streamlining logistics.

- Efficiency Improvements: Internal efficiency improvements within breweries and distribution networks are likely contributing factors to the company's ability to maintain profitability despite higher input costs.

- Cost-Cutting Measures: While specific details are generally not publicly released, cost-cutting measures across various aspects of the business are likely in place to offset tariff impacts and preserve profit margins. This might include streamlining operations or negotiating better terms with suppliers.

Navigating Global Tariff Challenges

Impact of Tariffs on Raw Materials and Distribution

Global tariffs have significantly impacted Heineken's operations, affecting both the cost of raw materials and the efficiency of distribution.

- Raw Material Tariffs: Tariffs imposed on imported raw materials such as barley, hops, and other agricultural products directly increase production costs. The specific impact varies depending on the source country and the type of tariff implemented.

- Finished Goods Tariffs: Tariffs on exported finished goods can reduce competitiveness in certain markets and impact overall revenue. This is particularly important for Heineken's international distribution network.

- Geographic Impact: The impact of tariffs varies geographically. Regions heavily reliant on imported raw materials or facing high export tariffs will experience a more significant effect on profitability than those with more localized production and distribution.

Heineken's Strategic Response to Tariffs

Heineken has implemented a range of strategies to effectively mitigate the negative consequences of tariffs.

- Hedging Strategies: Financial hedging strategies are likely used to mitigate risks associated with fluctuating tariff rates and currency exchange.

- Sourcing Diversification: Diversifying sourcing of raw materials to countries with more favorable trade agreements helps minimize the impact of tariffs on input costs.

- Lobbying Efforts: Heineken, like other multinational corporations, engages in lobbying efforts to influence trade policy and advocate for favorable tariff adjustments.

Future Outlook and Market Implications

Maintaining the Financial Outlook

Heineken's confidence in maintaining its financial outlook stems from several key factors.

- Resilient Consumer Demand: Strong consumer demand for premium beer brands suggests a degree of resilience to price increases.

- Brand Strength: Heineken's strong brand recognition and market share provide a buffer against competitive pressures and tariff-related price increases.

- Potential Risks and Uncertainties: However, risks remain, including further escalation of global tariffs, economic downturns in key markets, and unforeseen supply chain disruptions.

Implications for the Broader Beer Industry

Heineken's experience offers valuable insights for the broader beer industry.

- Industry Best Practices: Heineken's strategies for managing tariffs – including cost management, supply chain optimization, and pricing strategies – offer valuable lessons for competitors.

- Market Dynamics: The ongoing impact of tariffs will likely lead to shifts in market dynamics, with some players consolidating and others adapting to changing trade patterns.

- Future Outlook: The future of the global beer market will continue to be shaped by global trade policies, economic conditions, and evolving consumer preferences.

Conclusion

Heineken's reaffirmation of its financial outlook underscores the company's resilience amidst considerable global tariff challenges. Despite headwinds, effective cost management, strategic responses to tariffs, and robust brand strength have enabled Heineken to maintain a positive trajectory. To stay informed about Heineken's performance and the impact of global tariffs on the beer industry, follow their financial reports and industry news. Learn more about Heineken's strategies for managing global tariff challenges by visiting their investor relations page. Understanding how Heineken is navigating these complex issues provides valuable insight into the future of the global beer market and the broader impact of international trade policies.

Featured Posts

-

La Chine En France Une Repression Impitoyable Des Dissidents

May 25, 2025

La Chine En France Une Repression Impitoyable Des Dissidents

May 25, 2025 -

The Ultimate Escape To The Country Practical Advice And Inspiration

May 25, 2025

The Ultimate Escape To The Country Practical Advice And Inspiration

May 25, 2025 -

M56 Accident Real Time Traffic Updates And Congestion

May 25, 2025

M56 Accident Real Time Traffic Updates And Congestion

May 25, 2025 -

The Ultimate Escape To The Country Properties And Lifestyle Choices

May 25, 2025

The Ultimate Escape To The Country Properties And Lifestyle Choices

May 25, 2025 -

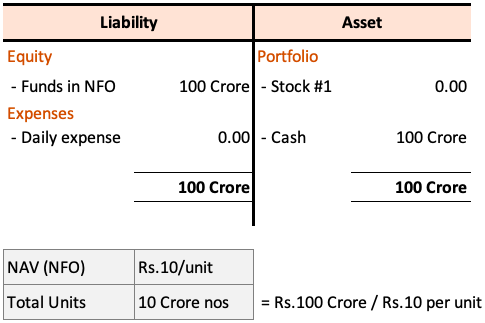

The Importance Of Net Asset Value Nav For Amundi Dow Jones Industrial Average Ucits Etf Investors

May 25, 2025

The Importance Of Net Asset Value Nav For Amundi Dow Jones Industrial Average Ucits Etf Investors

May 25, 2025

Latest Posts

-

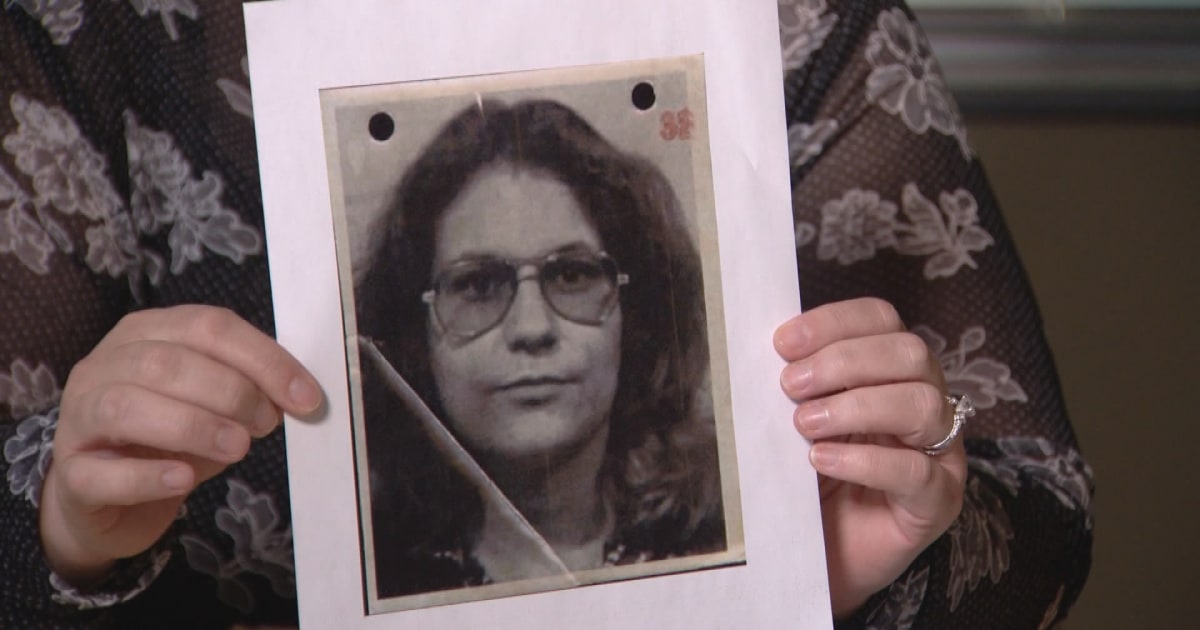

Cold Case Solved Georgia Husband Charged In Wifes Death After 19 Year Manhunt

May 25, 2025

Cold Case Solved Georgia Husband Charged In Wifes Death After 19 Year Manhunt

May 25, 2025 -

Trump Approves Nippon U S Steel Deal What It Means For Businesses

May 25, 2025

Trump Approves Nippon U S Steel Deal What It Means For Businesses

May 25, 2025 -

Trumps Trade War With Europe Understanding The Reasons Behind His Outrage

May 25, 2025

Trumps Trade War With Europe Understanding The Reasons Behind His Outrage

May 25, 2025 -

Georgia Man Indicted For Murder After 19 Year Flight With Nanny

May 25, 2025

Georgia Man Indicted For Murder After 19 Year Flight With Nanny

May 25, 2025 -

The Sutton Hoo Ship Burial A Closer Look At The Sixth Century Cremation Vessel

May 25, 2025

The Sutton Hoo Ship Burial A Closer Look At The Sixth Century Cremation Vessel

May 25, 2025