The Importance Of Net Asset Value (NAV) For Amundi Dow Jones Industrial Average UCITS ETF Investors

Table of Contents

How NAV is Calculated for the Amundi Dow Jones Industrial Average UCITS ETF

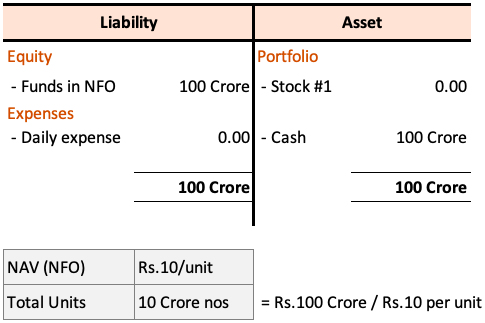

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF represents the total value of the ETF's underlying assets, minus its liabilities, per share. Understanding how this is calculated is vital for monitoring your investment.

Understanding the Components of NAV:

The Amundi DJIA UCITS ETF holds shares in the 30 companies that make up the Dow Jones Industrial Average. Therefore, the primary assets in the ETF are these stocks.

- Asset Valuation: The market value of each holding is determined daily based on the closing prices of those shares on major stock exchanges.

- Liability Calculation: Liabilities include the ETF's management fees, administrative expenses, and any other outstanding obligations. These are deducted from the total asset value.

- Simplified NAV Formula: The basic formula for calculating NAV is straightforward: Assets - Liabilities = NAV.

Frequency of NAV Calculation:

The NAV of the Amundi DJIA UCITS ETF is typically calculated daily, reflecting the closing market prices of its underlying assets.

- Daily NAV: You can usually find the daily NAV on Amundi's official website, as well as through major financial news providers and your brokerage account.

- NAV Updates: The timing of NAV updates is typically standardized, but minor delays are possible due to factors such as market closing times and data processing. You should always check with your provider for the exact publication schedule.

- Price Transparency: The daily publication of the NAV ensures price transparency, allowing investors to accurately track their investment's performance.

Using NAV to Track Your Amundi Dow Jones Industrial Average UCITS ETF Performance

Monitoring the NAV of your Amundi DJIA UCITS ETF is crucial for assessing its performance and making informed decisions.

Monitoring NAV Changes:

Changes in the NAV directly reflect the collective performance of the underlying Dow Jones Industrial Average companies.

- Performance Tracking: A rising NAV indicates positive performance, while a falling NAV indicates negative performance.

- Benchmark Comparison: Compare the NAV changes against the Dow Jones Industrial Average itself to assess how well the ETF tracks its benchmark.

- Return on Investment (ROI): You can calculate your return on investment by comparing your initial investment cost with the current NAV per share.

NAV and Investment Decisions:

Careful observation of NAV trends can inform your buy and sell decisions.

- Buy Signals: A consistently increasing NAV could indicate a favorable time to buy or increase your holdings, especially when the ETF’s price is trading near the NAV.

- Sell Signals: A consistently declining NAV, coupled with potential market uncertainties, might be a signal to consider selling or reducing your investment.

- Capital Gains/Losses: The difference between the purchase price and the current NAV reflects your capital gains or losses.

Potential Discrepancies Between NAV and Market Price & Dealing with them

While the NAV and market price of an ETF should be very close, minor discrepancies can occur.

Understanding Bid-Ask Spread:

The bid-ask spread is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

- Market Liquidity: A high trading volume generally results in a tighter spread, while low volume may lead to a wider spread.

- Market Fluctuations: Market volatility can also impact the spread, causing temporary discrepancies between NAV and market price.

Dealing with Price Discrepancies:

Minor differences between NAV and market price are usually temporary.

- Long-Term Focus: Focus on the long-term NAV trends, rather than short-term price fluctuations.

- Multiple Data Sources: Check the NAV and market price from multiple reputable sources (e.g., Amundi's website, your brokerage platform, financial news websites) to ensure consistency.

- Price Volatility: Understand that short-term price volatility is normal, especially in dynamic markets.

Conclusion: The Crucial Role of NAV in Your Amundi Dow Jones Industrial Average UCITS ETF Strategy

The Net Asset Value is a cornerstone for understanding the performance and value of your Amundi DJIA UCITS ETF investment. Regularly monitoring the NAV allows for informed investment decisions, helping you track performance against benchmarks and ultimately contribute to investment success. Actively monitor the Net Asset Value of your Amundi Dow Jones Industrial Average UCITS ETF holdings. Learn more about NAV calculation and its impact on your investment strategy. For personalized guidance, consult with a financial advisor for further assistance with Net Asset Value management.

Featured Posts

-

Konchita Vurst Yiyi Peredbachennya Peremozhtsiv Yevrobachennya 2025

May 25, 2025

Konchita Vurst Yiyi Peredbachennya Peremozhtsiv Yevrobachennya 2025

May 25, 2025 -

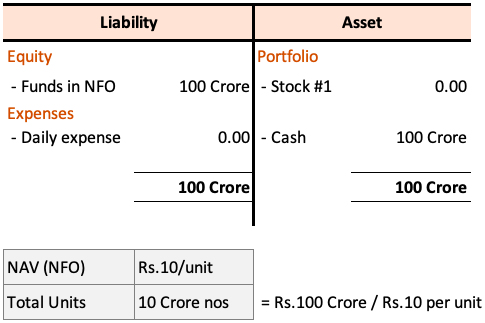

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 25, 2025

L Impact De Mathieu Avanzi Sur La Perception Du Francais

May 25, 2025 -

The Ultimate Escape To The Country Practical Advice And Inspiration

May 25, 2025

The Ultimate Escape To The Country Practical Advice And Inspiration

May 25, 2025 -

Severe Congestion On M6 Due To Van Crash

May 25, 2025

Severe Congestion On M6 Due To Van Crash

May 25, 2025 -

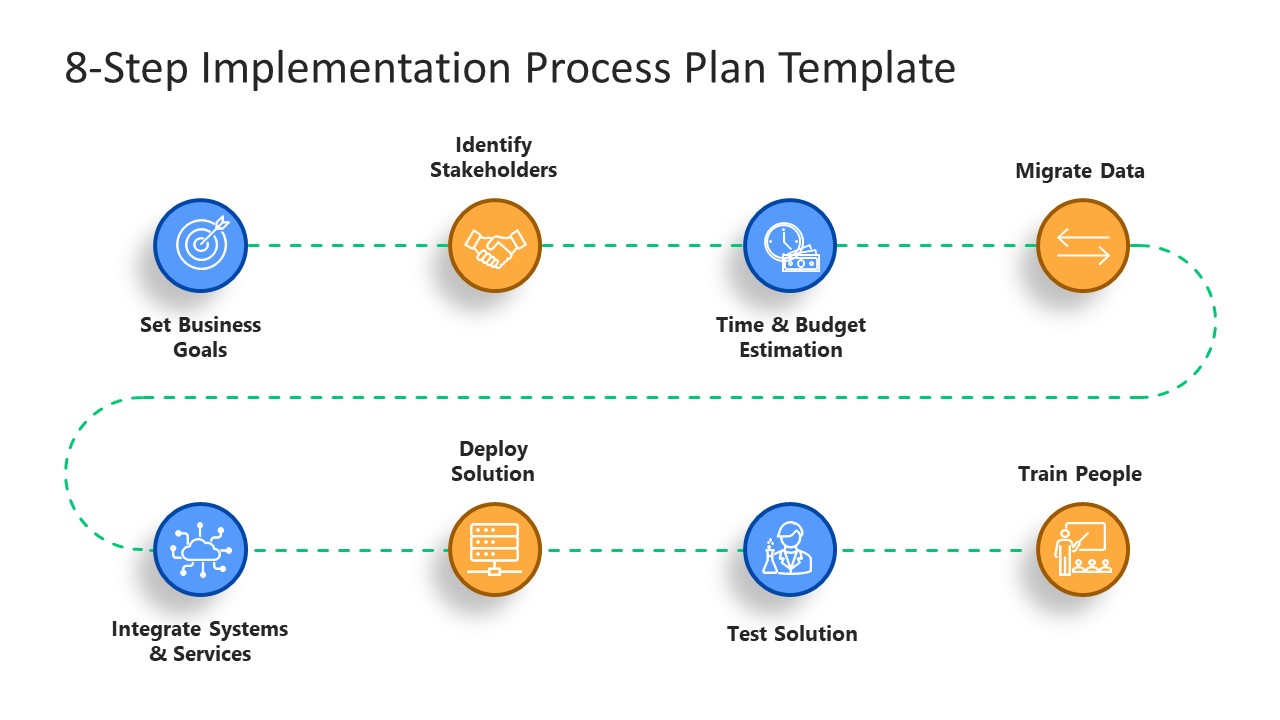

Your Dream Country Escape A Step By Step Plan

May 25, 2025

Your Dream Country Escape A Step By Step Plan

May 25, 2025

Latest Posts

-

Berkshire Hathaways Apple Stock Analyzing The Post Buffett Era

May 25, 2025

Berkshire Hathaways Apple Stock Analyzing The Post Buffett Era

May 25, 2025 -

The Future Of Berkshire Hathaways Apple Holdings Post Buffett

May 25, 2025

The Future Of Berkshire Hathaways Apple Holdings Post Buffett

May 25, 2025 -

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 25, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 25, 2025 -

Ces Unveiled Europe Devoilement Des Innovations A Amsterdam

May 25, 2025

Ces Unveiled Europe Devoilement Des Innovations A Amsterdam

May 25, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Innovation Et Technologie

May 25, 2025

Amsterdam Accueille Le Ces Unveiled Europe Innovation Et Technologie

May 25, 2025