HMRC Debt: Are You One Of Thousands With Unpaid Savings Tax?

Table of Contents

Understanding Savings Tax and HMRC's Role

What is Savings Tax?

Savings tax applies to the interest earned on various savings accounts. It's crucial to understand that not all savings accounts are tax-free. The most common types include:

- Individual Savings Accounts (ISAs): These accounts offer tax-free savings, meaning you don't pay income tax on the interest earned. However, there are annual contribution limits.

- Premium Bonds: These are savings bonds where you have a chance to win prizes instead of earning a fixed interest rate. Prizes are tax-free.

- Standard Savings Accounts: Interest earned in standard savings accounts is taxable and subject to your personal income tax allowance. This means HMRC will tax the interest earned above your Personal Savings Allowance (PSA).

HMRC's Responsibility:

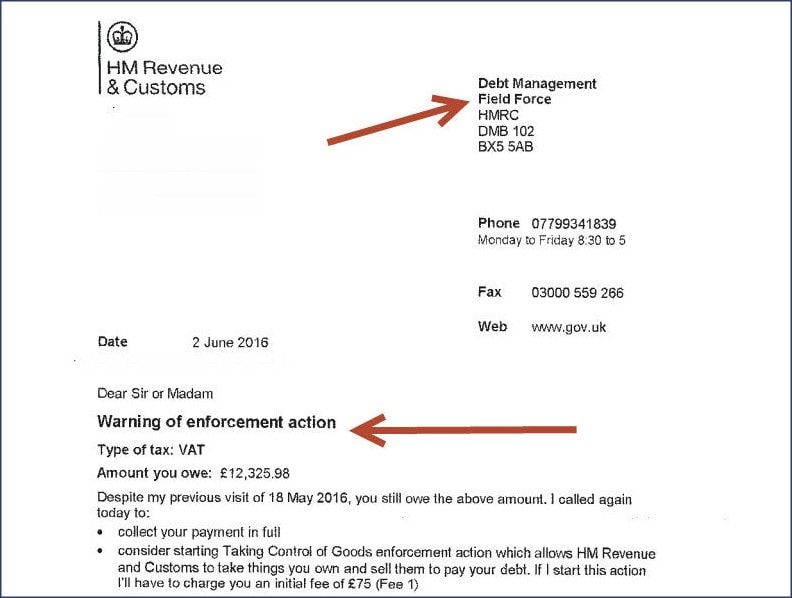

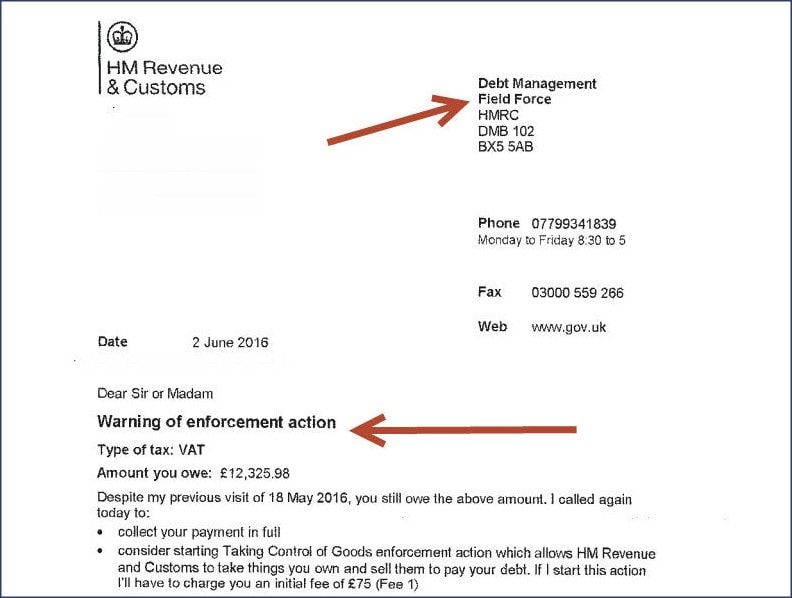

HMRC (Her Majesty's Revenue and Customs) is responsible for collecting savings tax. They are responsible for calculating the amount of tax due based on your interest earnings and your tax code. Failure to pay your savings tax can result in:

- Penalties: Late payment penalties can be substantial, increasing the longer the debt remains unpaid.

- Interest Charges: HMRC will add interest to your outstanding debt, further increasing the total amount you owe.

- Legal Action: In severe cases of non-payment, HMRC may take legal action to recover the debt, including seizing assets.

Key Tax Thresholds and Deadlines:

- Personal Savings Allowance (PSA): This is the amount of savings interest you can earn tax-free each year. The PSA for the 2023/24 tax year is £1,000 for basic-rate taxpayers and £500 for higher-rate taxpayers.

- Tax Year: The UK tax year runs from 6 April to 5 April the following year. You'll usually need to declare your savings interest and pay any tax due by the following January.

- Tax Return: You are required to declare your savings interest on your self-assessment tax return if your savings income exceeds your Personal Savings Allowance or if you receive a tax notification from your bank.

HMRC Contact Methods:

- HMRC will typically contact you via post (letter), sometimes by email, but rarely by phone. Be wary of unsolicited phone calls claiming to be from HMRC.

Common Reasons for Unpaid Savings Tax

Lack of Awareness: Many people are simply unaware that they need to pay tax on savings interest, especially if it's a small amount.

Complex Tax System: The UK tax system can be complex and confusing, making it difficult for individuals to understand their obligations.

Missed Deadlines: Overlooking tax deadlines is a common reason for accumulating unpaid savings tax.

Examples of Unintentional Unpaid Tax:

- Forgetting to declare interest from multiple savings accounts.

- Misunderstanding the Personal Savings Allowance (PSA).

- Failing to submit a self-assessment tax return on time.

Tips to Avoid Missing Deadlines:

- Set reminders for tax deadlines.

- Keep accurate records of your savings interest.

- Consider using tax software to help manage your tax affairs.

Resolving HMRC Debt from Unpaid Savings Tax

Contacting HMRC:

If you have outstanding savings tax, contact HMRC immediately. You can do this through:

- Their online portal

- Writing a letter

- Calling their helpline (be prepared for potential wait times)

Payment Options:

HMRC offers several payment methods:

- Online payment

- Bank transfer

- Direct debit

- Cheque

Payment Plans:

If you have a large debt, you may be able to arrange a payment plan with HMRC.

Seeking Professional Help:

If you're struggling to manage your HMRC debt or find the process overwhelming, seek help from a qualified tax advisor or accountant.

Consequences of Ignoring HMRC Debt:

- Increased penalties and interest charges

- Legal action

- Damage to credit rating

Helpful HMRC Resources:

- [Link to relevant HMRC webpage on savings tax]

- [Link to HMRC helpline number]

Conclusion:

Paying your savings tax is a crucial aspect of being a compliant UK taxpayer. Ignoring unpaid savings tax can lead to significant financial penalties and potential legal action. Understanding your Personal Savings Allowance, keeping accurate records, and meeting tax deadlines are vital steps in avoiding HMRC debt. However, if you do find yourself facing an HMRC debt related to unpaid savings tax, contacting them promptly and arranging a payment plan can mitigate further penalties and interest charges. Don't let unpaid savings tax become a burden. Take action today and resolve your HMRC debt. Contact HMRC now to avoid further penalties and interest charges. Remember, early action is key to managing your tax obligations effectively.

Featured Posts

-

Was Michael Schumachers Comeback A Pointless Endeavor Red Bulls Perspective

May 20, 2025

Was Michael Schumachers Comeback A Pointless Endeavor Red Bulls Perspective

May 20, 2025 -

Cours D Ecriture D Agatha Christie Propulse Par L Ia

May 20, 2025

Cours D Ecriture D Agatha Christie Propulse Par L Ia

May 20, 2025 -

Nyt Mini Crossword Answers For March 18 Complete Solution Guide

May 20, 2025

Nyt Mini Crossword Answers For March 18 Complete Solution Guide

May 20, 2025 -

Cronin Appointed Highfield Rugby Clubs New Coaching Leadership

May 20, 2025

Cronin Appointed Highfield Rugby Clubs New Coaching Leadership

May 20, 2025 -

Hmrc Speeds Up Calls With Voice Recognition Technology

May 20, 2025

Hmrc Speeds Up Calls With Voice Recognition Technology

May 20, 2025

Latest Posts

-

Us Typhon Missile System In The Philippines Alarming China

May 20, 2025

Us Typhon Missile System In The Philippines Alarming China

May 20, 2025 -

Glamorous Miami Hedge Funder Faces Us Ban After Immigration Lie Allegations

May 20, 2025

Glamorous Miami Hedge Funder Faces Us Ban After Immigration Lie Allegations

May 20, 2025 -

Hedge Fund Executives Us Ban Accusations Of Lying To Immigration Officials

May 20, 2025

Hedge Fund Executives Us Ban Accusations Of Lying To Immigration Officials

May 20, 2025 -

Miami Hedge Fund Manager Banned From Us For Alleged Immigration Fraud

May 20, 2025

Miami Hedge Fund Manager Banned From Us For Alleged Immigration Fraud

May 20, 2025 -

The Impact Of The Us Typhon Missile System On Regional Security In The Philippines

May 20, 2025

The Impact Of The Us Typhon Missile System On Regional Security In The Philippines

May 20, 2025