HMRC Refund Check: Millions May Be Eligible For A Payout

Table of Contents

Who Might Be Eligible for an HMRC Refund?

Many people are unaware they might be eligible for an HMRC refund. Understanding your HMRC eligibility is the first step. Several scenarios could mean you're owed money. Knowing your tax refund eligibility could put extra money back in your pocket.

-

Overpaid Tax: This is a common reason for HMRC refunds. You might have overpaid income tax due to a change in circumstances, such as a job loss or a decrease in income. Corporation tax overpayments can also occur due to accounting errors or changes in legislation.

-

Pension Contributions: If you contribute to a pension scheme, you may be able to claim tax relief on your contributions, potentially resulting in a significant tax refund. The amount of tax relief depends on your income and the type of pension scheme.

-

Marriage Allowance: If you're married or in a civil partnership and one partner earns less than the personal allowance, you might be able to transfer some of your unused allowance to your higher-earning partner, resulting in a tax refund.

-

Child Benefit: While Child Benefit is generally not taxable, there are situations, particularly if one partner earns over a certain threshold, where a tax repayment might be due.

-

Self-Assessment Errors: Errors on your self-assessment tax return are a frequent cause of underpayment or overpayment. Reviewing previous self-assessment forms carefully is crucial for identifying potential HMRC repayments.

Bullet Points:

- Are you self-employed and claimed all allowable expenses?

- Have you recently changed jobs or your employment status?

- Have you made significant charitable donations that qualify for tax relief?

- Have you received any untaxed income?

How to Check Your Eligibility for an HMRC Refund

Checking your eligibility for an HMRC refund is straightforward thanks to HMRC's online services. Here's a step-by-step guide on how to conduct your HMRC refund check:

-

Accessing Your Online Account: Visit the Gov.uk website and log in to your HMRC online account using your Government Gateway ID. This is your key to accessing all your tax information.

-

Reviewing Your Tax History: Once logged in, navigate to your tax history. Carefully review your past tax returns for any potential overpayments. Pay close attention to the details of your tax calculations and payments.

-

Using HMRC's Online Tools: HMRC offers various online tools and resources to help you identify potential refunds. Explore these tools to ensure you haven't missed anything.

-

Contacting HMRC Directly: If you encounter any difficulties accessing your information online or have questions about your tax return check, don't hesitate to contact HMRC directly. They can provide assistance and guidance.

Bullet Points:

- Visit the Gov.uk website.

- Log in to your online account using your Government Gateway ID.

- Check your tax calculations and payments for any errors.

- Review your Self Assessment tax returns (if applicable).

- Contact HMRC directly if you can't find the information you need.

Common Mistakes That Prevent People From Claiming Refunds

Many people miss out on potential tax refunds due to simple mistakes. Avoiding these common pitfalls will increase your chances of receiving your HMRC payout.

-

Not Submitting a Tax Return: If you're self-employed or a freelancer, failing to submit your self-assessment tax return on time could mean you miss out on potential refunds.

-

Incorrectly Claiming Expenses: Ensure you accurately record and claim all allowable business expenses. Inaccurate or incomplete expense claims can delay or prevent refunds.

-

Missing Deadlines: Be aware of all relevant deadlines for claiming refunds. Missing deadlines can unfortunately mean you miss out on claiming your HMRC tax refund.

Claiming Your HMRC Tax Refund

Once you've confirmed your eligibility, claiming your HMRC tax refund is relatively simple. Here's a quick guide to getting your money:

-

Gather Necessary Documentation: Gather all relevant documentation, such as payslips, tax statements, and any supporting evidence for expenses claimed.

-

Complete the Relevant HMRC Forms: You’ll need to complete the appropriate HMRC forms, which will guide you through the claiming process.

-

Submit Your Claim: Submit your claim online through your HMRC account or by post, according to the instructions provided.

-

Be Patient: Processing times for tax refunds can vary. Be patient and allow sufficient time for HMRC to process your claim.

Conclusion:

Don't miss out on potentially thousands of pounds! Millions could be eligible for an HMRC refund. Use this guide to check your eligibility and claim your rightful payout. Take action today and conduct your HMRC refund check to see if you are owed money. Don't delay, start your HMRC tax refund claim now! Visit the official HMRC website for more information and to begin the process.

Featured Posts

-

Guide Des Meilleurs Nouveaux Restaurants De Biarritz

May 20, 2025

Guide Des Meilleurs Nouveaux Restaurants De Biarritz

May 20, 2025 -

Hmrc Tax Code Update Impact On Your Savings And Income

May 20, 2025

Hmrc Tax Code Update Impact On Your Savings And Income

May 20, 2025 -

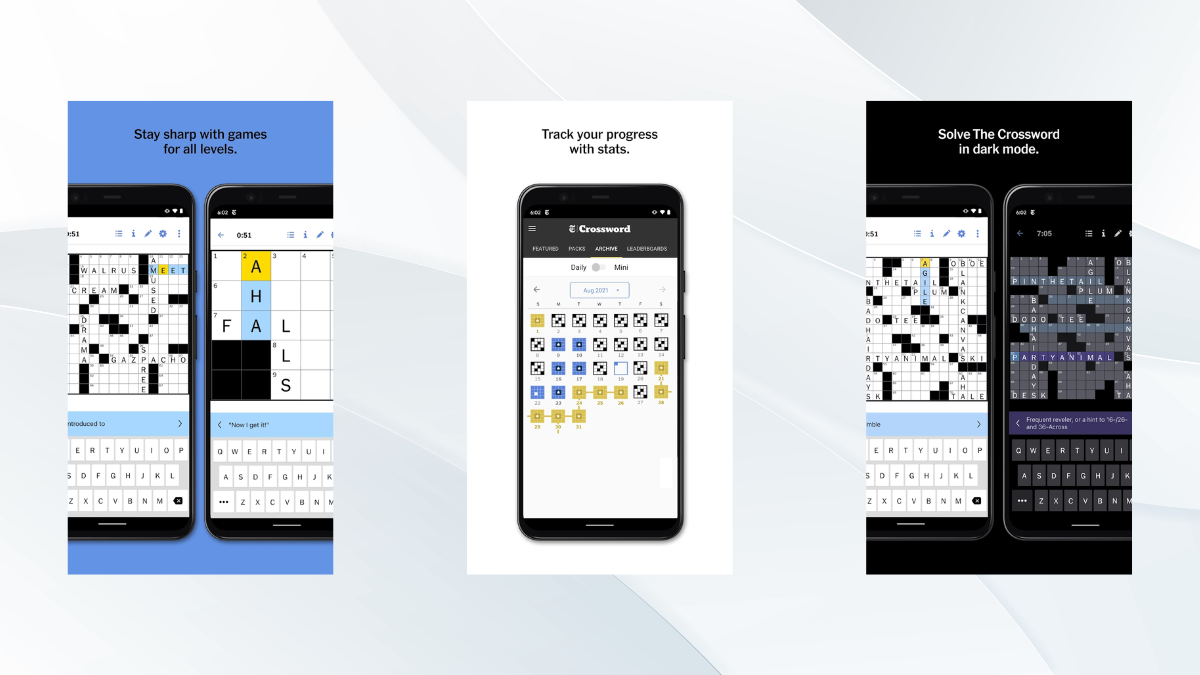

April 13th Nyt Mini Crossword Solutions

May 20, 2025

April 13th Nyt Mini Crossword Solutions

May 20, 2025 -

Abidjan 2025 Le Rendez Vous De La Transformation Numerique En Cote D Ivoire

May 20, 2025

Abidjan 2025 Le Rendez Vous De La Transformation Numerique En Cote D Ivoire

May 20, 2025 -

March 8 Nyt Mini Crossword Solutions

May 20, 2025

March 8 Nyt Mini Crossword Solutions

May 20, 2025

Latest Posts

-

Philippines And Us To Hold Massive Balikatan Military Exercises

May 20, 2025

Philippines And Us To Hold Massive Balikatan Military Exercises

May 20, 2025 -

Eurovision 2025 Definitive Ranking Of Finalists From Best To Worst

May 20, 2025

Eurovision 2025 Definitive Ranking Of Finalists From Best To Worst

May 20, 2025 -

Eurovision 2025 Meet The Contestants

May 20, 2025

Eurovision 2025 Meet The Contestants

May 20, 2025 -

Hypnotic To Atrocious Ranking The Eurovision 2025 Finalists

May 20, 2025

Hypnotic To Atrocious Ranking The Eurovision 2025 Finalists

May 20, 2025 -

Meet The Eurovision Song Contest 2025 Artists A Complete Guide

May 20, 2025

Meet The Eurovision Song Contest 2025 Artists A Complete Guide

May 20, 2025