HMRC Tax Code Update: Impact On Your Savings And Income

Table of Contents

Understanding Your HMRC Tax Code

Your HMRC tax code is a crucial element of the UK tax system. It's a combination of letters and numbers that tells your employer or pension provider how much Income Tax to deduct from your salary or pension. The code essentially dictates your tax-free allowance for the tax year. Understanding your tax code is the first step to managing your finances effectively.

The components of a tax code usually include:

- Numbers: These represent your Personal Allowance, the amount you can earn tax-free. For example, a tax code of 1257L has a Personal Allowance of £12,570.

- Letters: These letters often indicate additional factors or adjustments to your tax code. For example, 'L' often denotes a student loan repayment. Other letters may indicate things like marriage allowance or other adjustments.

Examples of common tax codes and their implications:

-

1257L: Standard Personal Allowance with student loan deductions.

-

12570: Standard Personal Allowance without any deductions.

-

BR: Basic rate taxpayer with no Personal Allowance.

-

D0: Indicates no tax code has been assigned yet.

-

Check your tax code regularly: It's vital to verify your tax code on the HMRC website () to ensure accuracy.

-

Find your tax code online: Your tax code is readily available via your online HMRC account.

-

Incorrect tax code: If you believe your tax code is incorrect, contact HMRC immediately to rectify it. Delaying this could lead to overpayment or underpayment of tax.

How an HMRC Tax Code Update Affects Your Income

Changes in your tax code directly influence your net pay (take-home pay). An update can lead to an increase or decrease in your take-home income depending on the changes made to your Personal Allowance or other adjustments.

Several scenarios can trigger a tax code update:

- Change in employment: Starting a new job, changing jobs, or ceasing employment can all result in a tax code update.

- Additional income: Receiving additional income from sources like rental properties, investments, or self-employment may necessitate a tax code alteration.

- Changes to personal circumstances: Marriage, divorce, or changes to student loan repayments can also affect your tax code.

Understanding the difference between overpayment and underpayment of tax is crucial:

-

Underpayment: If your tax code is incorrect and you've paid less tax than you owe, you'll receive a tax bill from HMRC.

-

Overpayment: If you've paid more tax than you owe, HMRC will usually refund the overpaid amount.

-

Example: A change from tax code 1257L to 1100L would mean a reduction in your Personal Allowance, resulting in a lower net pay.

-

Incorrect tax code and tax returns: An incorrect tax code can lead to inaccuracies in your self-assessment tax return, potentially resulting in penalties.

-

Rectifying tax code errors: Contact HMRC immediately if you identify an error. They will guide you through the process of correction.

Impact of HMRC Tax Code Update on Your Savings

Changes in disposable income, directly influenced by tax code updates, significantly affect your savings potential. A tax code update leading to a higher net income provides more money for saving and investing, while a lower net income may necessitate adjustments to your savings plan.

Strategies for adjusting savings plans in response to tax code updates include:

-

Reviewing your budget: Analyze your income and expenses to determine how much you can realistically save after the tax code update.

-

Adjusting savings targets: Based on your updated disposable income, recalculate your savings goals for the year.

-

Exploring tax-efficient savings: Consider utilizing tax-efficient savings vehicles like ISAs and pensions to maximize your savings potential within the framework of your revised tax code.

-

Investment strategies: Increased disposable income allows for increased investments, potentially higher-risk options. Decreased disposable income may require a more conservative investment approach.

-

Savings targets: Adjust your savings goals based on the new post-update net income; maintain realistic and attainable targets.

-

Tax-efficient savings: ISAs and pensions offer tax advantages, maximizing your returns even after a tax code update.

Tax Code Updates and Self-Assessment

For self-assessment taxpayers, accurately reporting your income is paramount for ensuring your tax code reflects your actual earnings. Discrepancies between estimated and actual income can lead to incorrect tax codes and potential tax liabilities or refunds.

- Accurate self-assessment: Submitting a precise self-assessment tax return is crucial for receiving the correct tax code.

- Updating your tax code (Self-Employed): If self-employed, you need to inform HMRC of any changes in your income or circumstances that may affect your tax code.

- HMRC guidance: Refer to HMRC's comprehensive guidance on self-assessment for detailed information and assistance. ([Link to relevant HMRC self-assessment page])

Conclusion

Staying informed about your HMRC tax code update is vital for managing your finances effectively. Understanding how changes to your tax code directly impact your net income and, consequently, your savings potential is crucial for informed financial planning. Regularly review your tax code, utilize online resources provided by HMRC, and don't hesitate to contact HMRC directly if you have any questions or concerns regarding your HMRC tax code update. Take control of your financial future – understand your HMRC tax code update today!

Featured Posts

-

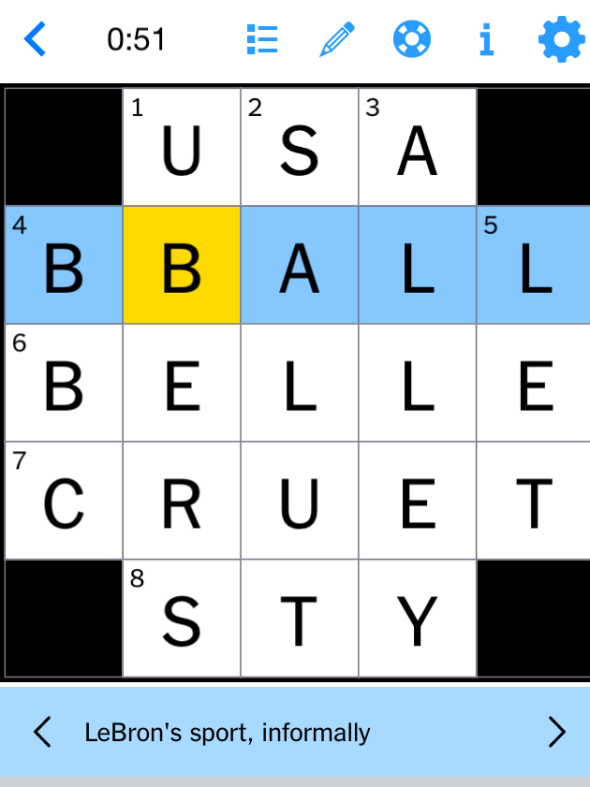

Nyt Mini Crossword Answers For February 25th

May 20, 2025

Nyt Mini Crossword Answers For February 25th

May 20, 2025 -

March 18 Nyt Mini Crossword Answers Solve The Puzzle Today

May 20, 2025

March 18 Nyt Mini Crossword Answers Solve The Puzzle Today

May 20, 2025 -

Accord Financier Conclu Entre Jaminet Et Le Stade Toulousain

May 20, 2025

Accord Financier Conclu Entre Jaminet Et Le Stade Toulousain

May 20, 2025 -

Journee Internationale Des Droits Des Femmes A Biarritz Programme Complet

May 20, 2025

Journee Internationale Des Droits Des Femmes A Biarritz Programme Complet

May 20, 2025 -

Rio De Janeiro Incendio Em Escola Na Tijuca Comove Comunidade

May 20, 2025

Rio De Janeiro Incendio Em Escola Na Tijuca Comove Comunidade

May 20, 2025

Latest Posts

-

Glamorous Miami Hedge Funder Faces Us Ban After Immigration Lie Allegations

May 20, 2025

Glamorous Miami Hedge Funder Faces Us Ban After Immigration Lie Allegations

May 20, 2025 -

Hedge Fund Executives Us Ban Accusations Of Lying To Immigration Officials

May 20, 2025

Hedge Fund Executives Us Ban Accusations Of Lying To Immigration Officials

May 20, 2025 -

Miami Hedge Fund Manager Banned From Us For Alleged Immigration Fraud

May 20, 2025

Miami Hedge Fund Manager Banned From Us For Alleged Immigration Fraud

May 20, 2025 -

The Impact Of The Us Typhon Missile System On Regional Security In The Philippines

May 20, 2025

The Impact Of The Us Typhon Missile System On Regional Security In The Philippines

May 20, 2025 -

Analyzing The Us Typhon Missile Systems Role In Philippine China Relations

May 20, 2025

Analyzing The Us Typhon Missile Systems Role In Philippine China Relations

May 20, 2025