HMRC Speeds Up Calls With New Voice Recognition Technology

Table of Contents

How the New Voice Recognition Technology Works

HMRC's new voice recognition system utilizes advanced natural language processing to understand and interpret your requests. Instead of navigating complex phone menus, you'll simply explain your query in plain English. The system then uses sophisticated algorithms to analyze your voice input and automatically route your call to the appropriate department. This automated routing system is designed to drastically reduce call waiting times and ensure you speak to the right person immediately.

From a taxpayer's perspective, the process is remarkably simple. You call the HMRC helpline, and the system prompts you to state the nature of your inquiry. The system is designed to be intuitive and user-friendly, understanding various accents and dialects.

- Faster call connection times: Experience significantly shorter wait times compared to the traditional phone system.

- Improved accuracy in directing calls: Ensures your call reaches the correct department, minimizing delays.

- Reduced need for manual agent intervention in simple queries: The system can handle many basic queries independently, freeing up agents to tackle more complex issues.

- 24/7 availability for basic inquiries: Access to basic tax information and support is available around the clock (where applicable).

Benefits for Taxpayers

The primary benefit for taxpayers is undoubtedly the significant reduction in call waiting times. No more endless hours spent listening to hold music! The new voice recognition system offers greater convenience and efficiency, helping you resolve your tax issues promptly.

This improved telephone service also enhances accessibility. Features like natural language processing can be beneficial for individuals with disabilities, making HMRC services more inclusive.

- Shorter call wait times: Spend less time on hold and more time dealing with your tax matters.

- More efficient resolution of simple tax issues: Quick and easy answers to common questions, often without needing to speak to an agent.

- Increased availability of service: Access to support outside of typical business hours (where applicable).

- Improved customer satisfaction: A faster, more efficient service translates directly to a better overall customer experience.

Benefits for HMRC Staff

The new voice recognition technology isn't just beneficial for taxpayers; it also significantly improves efficiency and working conditions for HMRC staff. By handling many simple queries automatically, the system frees up agents to focus on more complex and demanding cases. This improved allocation of resources leads to increased productivity and potentially higher job satisfaction among HMRC employees. Furthermore, it offers the potential for significant cost savings for HMRC in the long run.

- Increased agent productivity: Agents can handle more complex cases, leading to greater efficiency.

- Improved call handling capacity: The system expands HMRC's capacity to manage a higher volume of calls.

- Reduced workload for agents: Fewer routine tasks mean agents can focus on providing more in-depth support.

- Better allocation of resources: Resources are deployed more effectively to address critical issues.

Addressing Concerns about Data Privacy and Security

Understandably, the use of voice recognition technology raises concerns about data privacy and security. HMRC is committed to protecting taxpayer information and has implemented robust security measures to safeguard all voice data.

- Data encryption protocols: HMRC uses industry-standard encryption protocols to protect the confidentiality of all voice data.

- Compliance with relevant data protection laws: The system fully complies with regulations such as GDPR, ensuring data is handled responsibly and ethically.

- Transparency about data usage: HMRC is transparent about how voice data is used and stored.

- Secure data storage and handling procedures: Data is stored securely, with strict access controls in place.

Conclusion: Experience Faster HMRC Service with Voice Recognition Technology

The new HMRC voice recognition technology offers a significant improvement in the efficiency and speed of its telephone service. Both taxpayers and HMRC staff benefit from reduced waiting times, increased productivity, and a more streamlined process for handling tax inquiries. The system also incorporates robust data protection measures to ensure taxpayer information is secure.

Experience the benefits of faster HMRC call service today! Utilize the new voice recognition technology for quicker resolution of your tax inquiries.

Featured Posts

-

L Integrale Agatha Christie Une Biographie Captivante

May 20, 2025

L Integrale Agatha Christie Une Biographie Captivante

May 20, 2025 -

Sir David Suchets Agatha Christie Journey A Documentary Review

May 20, 2025

Sir David Suchets Agatha Christie Journey A Documentary Review

May 20, 2025 -

Hmrc Tax Return Changes Whos Affected And What You Need To Know

May 20, 2025

Hmrc Tax Return Changes Whos Affected And What You Need To Know

May 20, 2025 -

Ecrire Comme Agatha Christie Grace A L Intelligence Artificielle

May 20, 2025

Ecrire Comme Agatha Christie Grace A L Intelligence Artificielle

May 20, 2025 -

Thousands Of Uk Households Receiving Hmrc Letters Income Tax Checks

May 20, 2025

Thousands Of Uk Households Receiving Hmrc Letters Income Tax Checks

May 20, 2025

Latest Posts

-

Premiere Edition Du Marche Africain Des Solutions Spatiales Mass Une Occasion Unique Pour L Innovation Spatiale En Afrique

May 20, 2025

Premiere Edition Du Marche Africain Des Solutions Spatiales Mass Une Occasion Unique Pour L Innovation Spatiale En Afrique

May 20, 2025 -

Abidjan Accueille Le President Mahama Une Visite Pour Consolider La Diplomatie Et Le Partenariat

May 20, 2025

Abidjan Accueille Le President Mahama Une Visite Pour Consolider La Diplomatie Et Le Partenariat

May 20, 2025 -

Technologies Spatiales En Afrique Debut Du Marche Africain Des Solutions Spatiales Mass A Abidjan

May 20, 2025

Technologies Spatiales En Afrique Debut Du Marche Africain Des Solutions Spatiales Mass A Abidjan

May 20, 2025 -

Diplomatie Ivoiro Ghaneenne Le President Mahama En Visite Officielle A Abidjan

May 20, 2025

Diplomatie Ivoiro Ghaneenne Le President Mahama En Visite Officielle A Abidjan

May 20, 2025 -

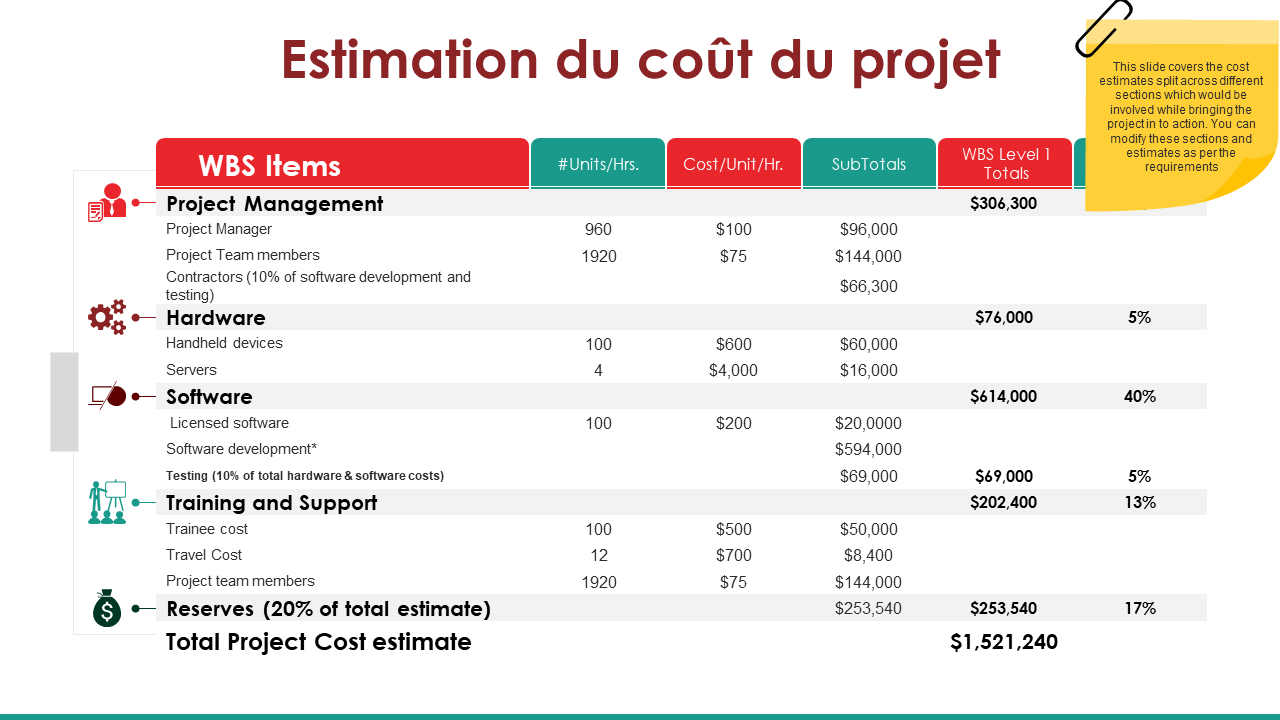

4eme Pont D Abidjan Analyse Du Cout Des Delais Et Du Financement Du Projet En Cote D Ivoire

May 20, 2025

4eme Pont D Abidjan Analyse Du Cout Des Delais Et Du Financement Du Projet En Cote D Ivoire

May 20, 2025