Thousands Of UK Households Receiving HMRC Letters: Income Tax Checks

Table of Contents

Understanding the Reason Behind HMRC Letters

HMRC correspondence isn't always cause for alarm. However, understanding the reasons behind these letters is the first step in addressing any potential issues. Several factors can trigger an HMRC letter, ranging from routine checks to more focused investigations. These include:

-

Routine Checks: HMRC conducts regular automated checks to ensure tax compliance across the UK. These checks often flag minor discrepancies that may require further investigation or clarification. Think of it as a routine health check for your tax affairs.

-

Specific Enquiries: A more targeted review of your tax return signifies a more serious enquiry. This might be triggered by inconsistencies in your self-assessment, suspected underpayment of tax, or information received from third parties.

-

Self-Assessment Issues: Problems with your self-assessment tax return are a common cause for HMRC letters. This includes:

- Missing the self-assessment deadline.

- Inaccuracies or inconsistencies within your tax return.

- Outstanding tax payments.

-

PAYE Discrepancies: Differences between your reported income and the tax deducted at source (PAYE) by your employer will often lead to an HMRC letter requiring further explanation. This could be due to a change in circumstances or an error in reporting.

Types of HMRC Letters and How to Identify Them

Recognising the type of HMRC letter you've received is vital for determining the appropriate response. HMRC uses various types of letters, each with different implications:

-

Routine Correspondence: These are often simple information updates, reminders about deadlines for submitting your tax return, or notifications about changes to your tax code. They usually don't require immediate action beyond reading and acknowledging the information.

-

Formal Enquiry Letters: These are more serious. They indicate a formal tax enquiry and will request further information or clarification regarding aspects of your tax return or income. You must respond to these letters promptly and thoroughly.

-

Tax Demand Notices: These letters outline the amount of tax you owe, often due to underpayment or errors in your self-assessment. They usually state a deadline for payment. Failure to pay can result in penalties.

-

Penalty Notices: These are issued for late submission of your tax return, non-compliance, or failure to provide requested information during a tax investigation. Penalties can be significant, so prompt action is crucial.

Responding to HMRC Letters: A Step-by-Step Guide

Responding correctly to HMRC letters is crucial. Here's a step-by-step guide to ensure you handle the situation efficiently:

-

Read the letter carefully: Understand the specific request or issue raised in the letter. Note all deadlines and reference numbers.

-

Gather necessary documents: Collect all relevant documents, including previous tax returns, payslips, bank statements, and any other supporting evidence that relates to the enquiry.

-

Respond promptly: Meet all deadlines set out in the letter to avoid further penalties. A prompt response demonstrates cooperation.

-

Seek professional help: If you are unsure how to respond or if the issue is complex, consider consulting a tax advisor or accountant. They can offer expert advice and help ensure compliance.

-

Contact HMRC directly: If you need clarification on any aspect of the letter, contact the HMRC helpline. Keep a record of all your communication with HMRC.

Avoiding Future HMRC Letters: Proactive Tax Planning

Proactive tax planning is the best way to avoid future HMRC letters and the stress they bring. Consider these steps:

-

Keep accurate records: Maintain meticulously detailed financial records throughout the year. This includes receipts, invoices, and bank statements. Digital record-keeping is recommended.

-

File your tax return on time: Meeting the self-assessment deadline is essential to avoid late filing penalties. Set reminders well in advance.

-

Understand your tax obligations: Familiarize yourself with your tax responsibilities. Utilize online resources from HMRC and seek advice if needed.

-

Seek professional advice: For complex tax situations, or if you're unsure about any aspect of your tax affairs, seek advice from a qualified tax professional.

Conclusion

Receiving an HMRC letter regarding income tax checks can be daunting, but understanding the process and responding appropriately is key. By knowing the potential reasons for these letters and taking prompt action, you can resolve any issues efficiently and avoid unnecessary stress. Don't ignore HMRC correspondence. If you've received an HMRC letter concerning income tax checks, act immediately. Seek professional advice if needed and ensure you are fully compliant with your tax obligations to avoid further complications. Contact a tax professional today for assistance with your HMRC income tax checks.

Featured Posts

-

Was Michael Schumachers Comeback A Pointless Endeavor Red Bulls Perspective

May 20, 2025

Was Michael Schumachers Comeback A Pointless Endeavor Red Bulls Perspective

May 20, 2025 -

Dont Ignore This Important Hmrc Child Benefit Update

May 20, 2025

Dont Ignore This Important Hmrc Child Benefit Update

May 20, 2025 -

Projet D Adressage D Abidjan Systeme De Numerotation Des Immeubles

May 20, 2025

Projet D Adressage D Abidjan Systeme De Numerotation Des Immeubles

May 20, 2025 -

La Cruda Verdad El Regreso De Schumacher A La F1 En 2010

May 20, 2025

La Cruda Verdad El Regreso De Schumacher A La F1 En 2010

May 20, 2025 -

Aldhkae Alastnaey Yeyd Ihyae Aghatha Krysty Thlyl Lltqnyat Almstkhdmt

May 20, 2025

Aldhkae Alastnaey Yeyd Ihyae Aghatha Krysty Thlyl Lltqnyat Almstkhdmt

May 20, 2025

Latest Posts

-

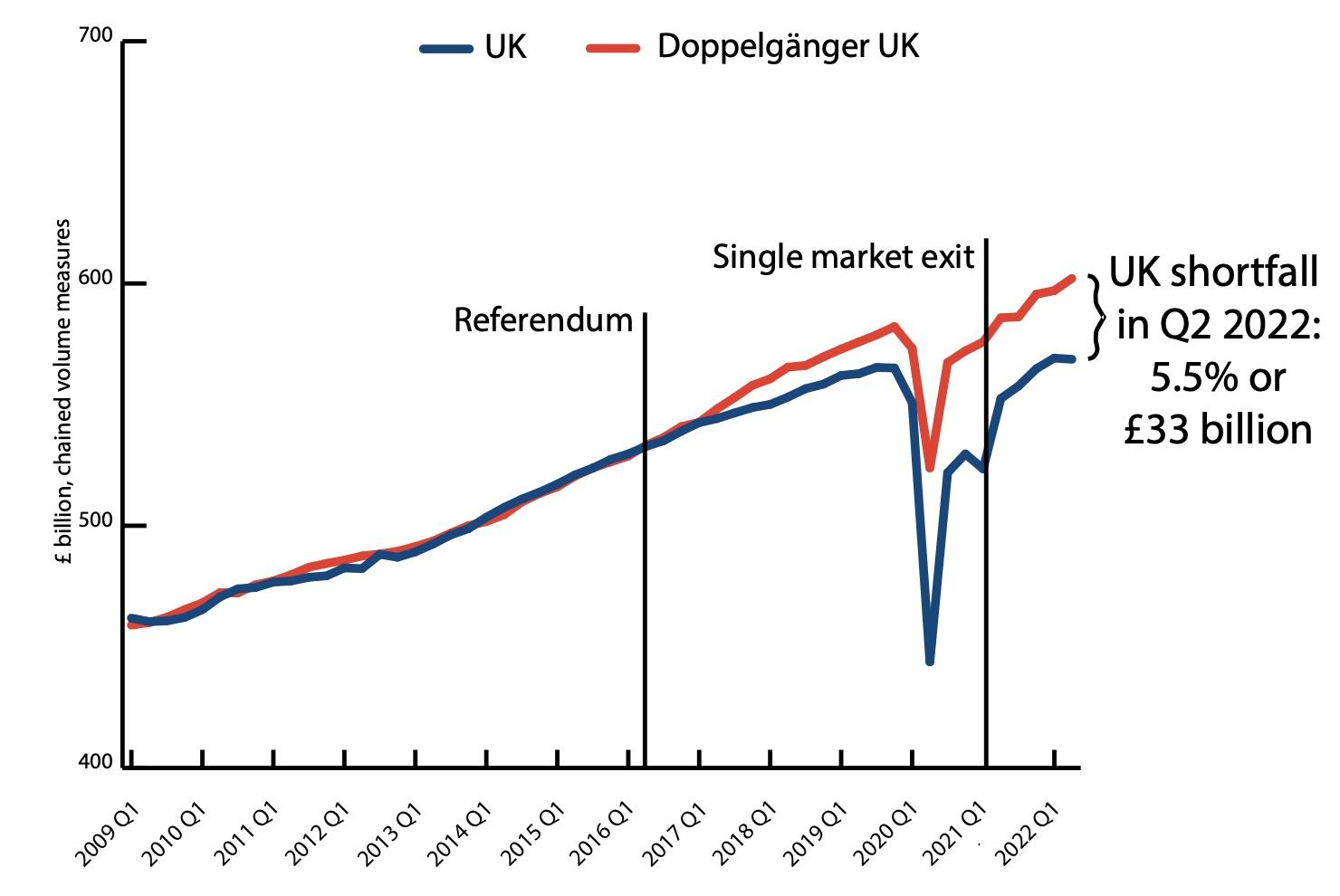

Brexits Toll The Struggle Of Uk Luxury Exports To The Eu

May 20, 2025

Brexits Toll The Struggle Of Uk Luxury Exports To The Eu

May 20, 2025 -

The Bof A Perspective Why High Stock Market Valuations Are Not A Threat

May 20, 2025

The Bof A Perspective Why High Stock Market Valuations Are Not A Threat

May 20, 2025 -

Post Brexit Challenges For Uk Luxury Exports To The Eu

May 20, 2025

Post Brexit Challenges For Uk Luxury Exports To The Eu

May 20, 2025 -

Uk Luxury Sector Brexits Lingering Export Problems

May 20, 2025

Uk Luxury Sector Brexits Lingering Export Problems

May 20, 2025 -

Ignoring High Stock Valuations A Bof A Supported Investment Strategy

May 20, 2025

Ignoring High Stock Valuations A Bof A Supported Investment Strategy

May 20, 2025