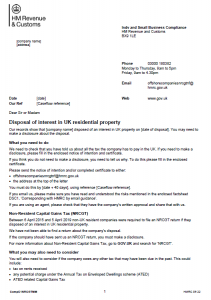

HMRC Tax Letters: Are You Affected? (Income Over £23,000)

Table of Contents

Common HMRC Tax Letters for Higher Earners (£23,000+)

Higher earners often receive specific types of HMRC tax letters. Understanding these is crucial for avoiding penalties and maintaining good standing with HMRC.

Self-Assessment Tax Return Reminders

If you're self-employed or have untaxed income exceeding certain thresholds, you'll need to complete a self-assessment tax return annually. HMRC sends reminders to ensure timely submission. Missing the deadline incurs penalties, escalating with each week of delay.

- Deadlines: The self-assessment tax return deadline is typically 31 January following the tax year (6 April to 5 April).

- Penalties: Late filing penalties can be significant, starting at £100 and increasing to a percentage of the tax owed. Late payment penalties also apply.

- Reasons for Reminders: You might receive a reminder if your return is overdue, incomplete, or if HMRC hasn't received your payment. Common reasons for late filing include procrastination, complex tax situations, and lack of understanding. Keywords: Self-assessment tax return, HMRC deadline, late filing penalty, tax return reminder, online tax return.

Tax Assessment Letters

A tax assessment letter outlines your tax liability for the year. It details the tax you owe based on your income, deductions, and allowances.

- Information Included: Your total income, allowable deductions, tax rates applied, total tax due, payment deadlines, and payment methods are all included in this crucial letter.

- Understanding Your Liability: Carefully review the assessment to ensure accuracy. Check that all income sources and allowable deductions are correctly reported.

- Appealing an Assessment: If you disagree with the assessment, you have the right to appeal. This requires submitting a formal appeal within a specified timeframe, providing evidence to support your claim. Keywords: Tax assessment, tax liability, tax assessment appeal, HMRC tax assessment letter, income tax.

Tax Code Changes

Your tax code dictates how much income tax is deducted from your salary or wages through the PAYE (Pay As You Earn) system. Changes can occur due to various factors.

- How Tax Codes Work: Your tax code reflects your personal allowances and any other tax reliefs you're entitled to.

- Reasons for Changes: Changes might result from a new job, altered circumstances (e.g., marriage, starting a pension), or adjustments based on previous tax returns.

- Checking Your Tax Code: You can easily check your tax code online via the HMRC website using your Government Gateway account. Keywords: Tax code, PAYE, tax code change, HMRC tax code, understanding your tax code, tax allowance.

Payment Reminders and Demand Letters

If you haven't paid your tax on time, HMRC will send payment reminders, escalating to demand letters if payment remains outstanding.

- Stages of Reminders: HMRC typically sends several reminders before taking further action.

- Consequences of Non-Payment: Non-payment can lead to further penalties, interest charges, and even legal action.

- Payment Arrangements: If you're facing difficulties, contact HMRC to discuss payment arrangements or setting up a payment plan. Keywords: Tax payment reminder, HMRC payment, tax arrears, payment plan, tax debt, tax payment.

What to Do When You Receive an HMRC Tax Letter

Receiving an HMRC tax letter shouldn't cause undue alarm, but prompt action is essential.

- Check the Details Carefully: Verify all details against your own records to ensure accuracy. Report any discrepancies immediately.

- Respond Promptly: Respond to all HMRC correspondence within the specified timeframe to avoid penalties.

- Seek Professional Advice: For complex tax situations or if you're unsure how to proceed, consult a qualified accountant or tax advisor.

- Understanding Your Rights: HMRC provides information on taxpayer rights and the appeals process on its website. Keywords: HMRC response, tax appeal, tax advisor, accountancy services, tax professional.

Avoiding HMRC Tax Letter Issues

Proactive steps can minimise the risk of receiving unwanted HMRC correspondence.

- Accurate Record-Keeping: Maintain meticulous financial records, including invoices, receipts, and bank statements.

- Regular Tax Return Submissions: Submit your self-assessment tax return on time, every year.

- Understanding Your Tax Obligations: Familiarize yourself with your tax responsibilities and seek advice when needed.

- Using HMRC Online Services: Utilise HMRC's online services to manage your tax affairs efficiently. Keywords: Tax record-keeping, self-assessment, online tax services, tax compliance.

Conclusion: Taking Action on Your HMRC Tax Letters

Understanding HMRC tax letters and responding appropriately is crucial for maintaining good standing with HMRC and avoiding penalties. Accurate record-keeping, timely tax return submissions, and proactive engagement with HMRC are key to preventing issues. Don't ignore HMRC tax letters! Understanding your tax obligations is paramount. If you're unsure about anything, seek professional advice. Learn more about managing your HMRC tax affairs today.

Featured Posts

-

Discover Your Inner Explorer A Guide To Solo Adventures

May 20, 2025

Discover Your Inner Explorer A Guide To Solo Adventures

May 20, 2025 -

Abidjan Guide Pratique De L Adressage Des Batiments

May 20, 2025

Abidjan Guide Pratique De L Adressage Des Batiments

May 20, 2025 -

Restaurant Panoramique Biarritz Imanol Harinordoquy And Jean Michel Suhubiette Aux Galeries Lafayette

May 20, 2025

Restaurant Panoramique Biarritz Imanol Harinordoquy And Jean Michel Suhubiette Aux Galeries Lafayette

May 20, 2025 -

Miami Hedge Fund Manager Banned From Us For Alleged Immigration Fraud

May 20, 2025

Miami Hedge Fund Manager Banned From Us For Alleged Immigration Fraud

May 20, 2025 -

The Los Angeles Wildfires A Glimmer Of A Disturbing Trend In Disaster Betting

May 20, 2025

The Los Angeles Wildfires A Glimmer Of A Disturbing Trend In Disaster Betting

May 20, 2025

Latest Posts

-

Brexits Toll The Struggle Of Uk Luxury Exports To The Eu

May 20, 2025

Brexits Toll The Struggle Of Uk Luxury Exports To The Eu

May 20, 2025 -

The Bof A Perspective Why High Stock Market Valuations Are Not A Threat

May 20, 2025

The Bof A Perspective Why High Stock Market Valuations Are Not A Threat

May 20, 2025 -

Post Brexit Challenges For Uk Luxury Exports To The Eu

May 20, 2025

Post Brexit Challenges For Uk Luxury Exports To The Eu

May 20, 2025 -

Uk Luxury Sector Brexits Lingering Export Problems

May 20, 2025

Uk Luxury Sector Brexits Lingering Export Problems

May 20, 2025 -

Ignoring High Stock Valuations A Bof A Supported Investment Strategy

May 20, 2025

Ignoring High Stock Valuations A Bof A Supported Investment Strategy

May 20, 2025