HMRC's New Side Hustle Tax Rules: A US-Style Snooping System Explained

Table of Contents

What are the New HMRC Side Hustle Tax Rules?

HMRC's new rules aim to improve the collection of tax from the gig economy. These changes affect anyone earning income from a side hustle, significantly broadening the definition of what constitutes taxable income. Key changes include:

- New Reporting Obligations: HMRC is increasing its data collection, working more closely with online platforms to obtain information about earnings. This means you may no longer rely solely on self-reporting.

- Increased Penalties for Non-Compliance: The penalties for failing to declare side hustle income accurately and on time have become considerably harsher.

- Expanded Definition of "Side Hustle" Income: The definition of what constitutes a taxable side hustle has expanded, encompassing a wider range of activities and income streams than previously.

This impacts various platforms. If you're earning money through Airbnb rentals, selling crafts on Etsy, freelancing on Upwork, or using any similar platform, you need to be aware of these changes. These new HMRC side hustle tax rules are designed to ensure that everyone pays their fair share of gig economy tax and self-employment tax, bringing more consistency to the UK tax rules surrounding income reporting.

Data Collection and Privacy Concerns: The "US-Style Snooping" Allegations

The increased data sharing between HMRC and third-party platforms has sparked concerns about data privacy. Critics draw comparisons to US tax systems, citing potential infringements on personal data.

- Data Sharing: HMRC is now receiving direct data feeds from various online platforms detailing user earnings.

- Data Usage: This data is primarily used to identify unreported income and ensure accurate tax declarations.

- Similarities and Differences with US Systems: While the data sharing resembles certain aspects of US tax reporting, the UK operates under the GDPR, offering a different level of data protection than seen in some US jurisdictions. The key difference lies in the legal framework and the stronger emphasis on data protection rights within the EU.

These concerns around HMRC data collection highlight the importance of understanding your data privacy rights within the context of tax compliance. The new rules operate under existing data protection laws like GDPR, aiming to balance efficient tax collection with individual rights.

How to Stay Compliant with HMRC's New Side Hustle Tax Rules

Staying compliant with HMRC's new side hustle tax regulations is crucial. Here's how you can ensure you’re meeting your obligations:

- Accurate Record-Keeping: Maintain meticulous records of all your income and expenses. This includes invoices, receipts, bank statements, and any other relevant documentation.

- Filing Tax Returns: File your tax returns accurately and on time. Understanding your tax allowances and deductions is vital.

- Utilizing Tax Software or Professional Advice: Consider using tax software designed for self-assessment or seeking professional advice from a qualified tax advisor or accountant. They can guide you through the complexities of the new regulations and help with tax planning.

By following these steps, you can improve your HMRC tax compliance and avoid potential penalties. Remember, proactive tax planning is key to successful self-assessment.

Penalties for Non-Compliance with HMRC Side Hustle Tax Rules

Failing to comply with HMRC's new side hustle tax rules carries severe consequences. These include:

- Fines: Significant financial penalties can be levied for late filing, inaccurate reporting, or deliberate tax evasion.

- Interest Charges: Interest will accrue on any unpaid tax, increasing the overall financial burden.

- Criminal Prosecution: In cases of serious tax fraud or evasion, criminal prosecution is a possibility, leading to significant penalties and a criminal record.

The severity of these HMRC penalties underlines the importance of proactive tax management. Avoid the risks associated with tax evasion by ensuring you understand and meet your obligations.

Conclusion: Navigating the New Landscape of HMRC Side Hustle Tax Rules

HMRC's new side hustle tax rules represent a significant shift in how the UK taxes the gig economy. While concerns around data privacy and the perceived "US-style snooping" exist, understanding your obligations and taking proactive steps to comply is crucial. Ensure your side hustle tax compliance by maintaining accurate records, filing your tax returns promptly, and seeking professional advice if needed. Stay informed about HMRC's side hustle tax rules and understand your HMRC obligations to avoid penalties. Take control of your tax affairs and ensure your side hustle remains successful and compliant.

Featured Posts

-

Thousands Of Uk Households Receiving Hmrc Letters Income Tax Checks

May 20, 2025

Thousands Of Uk Households Receiving Hmrc Letters Income Tax Checks

May 20, 2025 -

Nyt Mini Crossword Answers March 13

May 20, 2025

Nyt Mini Crossword Answers March 13

May 20, 2025 -

Nyt Mini Crossword Answers April 25th Solutions

May 20, 2025

Nyt Mini Crossword Answers April 25th Solutions

May 20, 2025 -

Arsenal Transfer News Gunners Battle Liverpool For Premier League Star

May 20, 2025

Arsenal Transfer News Gunners Battle Liverpool For Premier League Star

May 20, 2025 -

Dont Ignore This Important Hmrc Child Benefit Update

May 20, 2025

Dont Ignore This Important Hmrc Child Benefit Update

May 20, 2025

Latest Posts

-

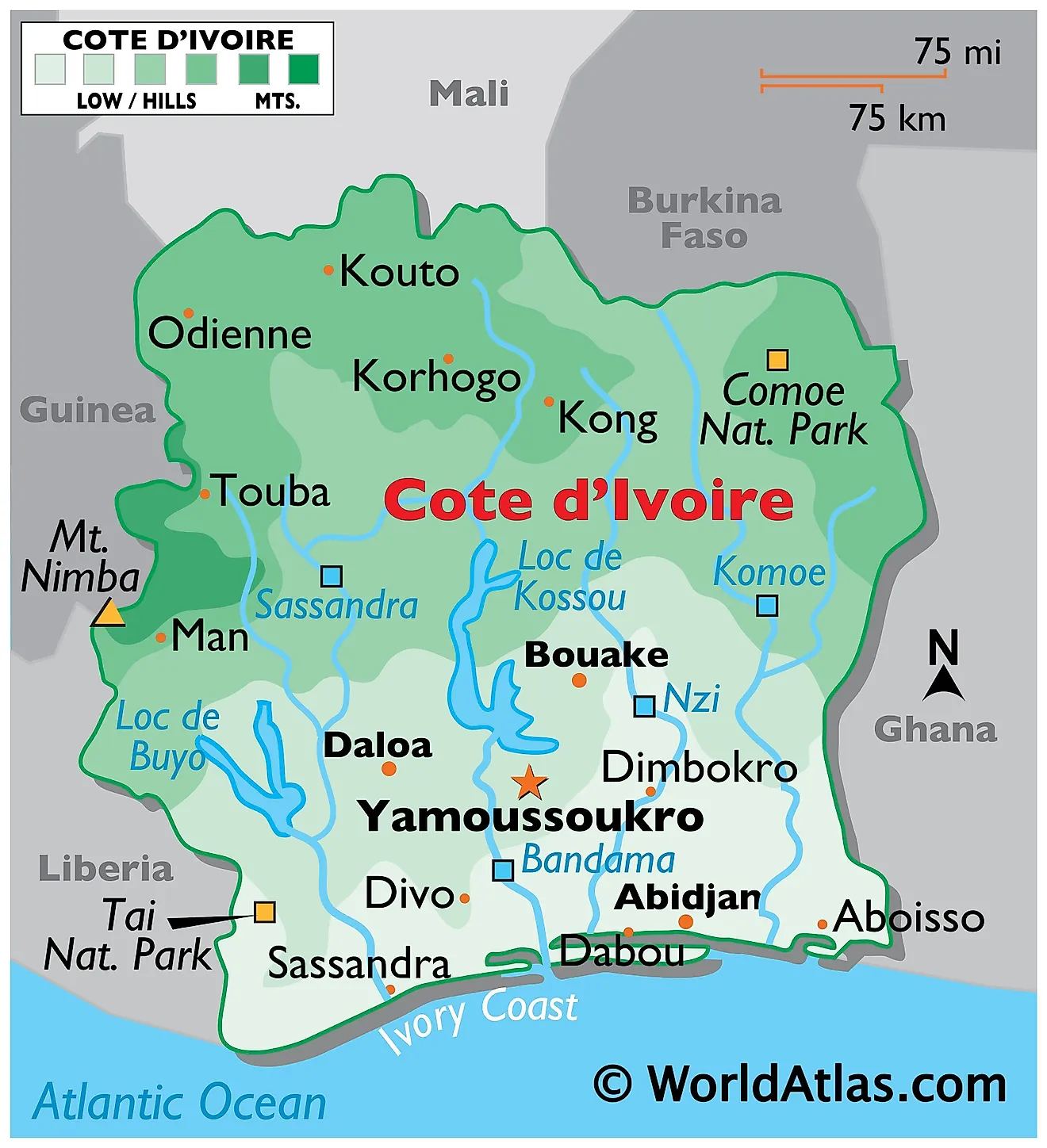

Focus Sur Le Mass Le Marche Africain Des Solutions Spatiales A Abidjan

May 20, 2025

Focus Sur Le Mass Le Marche Africain Des Solutions Spatiales A Abidjan

May 20, 2025 -

Presidence Ghaneenne Visite Officielle De John Dramani Mahama A Abidjan Pour Renforcer La Diplomatie

May 20, 2025

Presidence Ghaneenne Visite Officielle De John Dramani Mahama A Abidjan Pour Renforcer La Diplomatie

May 20, 2025 -

Marche Africain Des Solutions Spatiales Mass Abidjan Ouvre Ses Portes A L Innovation Spatiale

May 20, 2025

Marche Africain Des Solutions Spatiales Mass Abidjan Ouvre Ses Portes A L Innovation Spatiale

May 20, 2025 -

Le Ghana Et La Cote D Ivoire Diplomatie Et Cooperation Au C Ur De La Visite Du President Mahama

May 20, 2025

Le Ghana Et La Cote D Ivoire Diplomatie Et Cooperation Au C Ur De La Visite Du President Mahama

May 20, 2025 -

Premiere Edition Du Marche Africain Des Solutions Spatiales Mass Une Occasion Unique Pour L Innovation Spatiale En Afrique

May 20, 2025

Premiere Edition Du Marche Africain Des Solutions Spatiales Mass Une Occasion Unique Pour L Innovation Spatiale En Afrique

May 20, 2025