House Republicans Detail Trump's Proposed Tax Cuts

Table of Contents

Key Provisions of the Proposed Tax Cuts

The House Republicans' plan for Trump's proposed tax cuts includes several key provisions designed to stimulate economic growth and provide tax relief. These provisions significantly impact individual taxpayers and corporations alike.

-

Individual Income Tax Rates: The plan may propose adjustments to existing individual income tax brackets, potentially lowering rates for specific income levels. This could lead to increased disposable income for certain segments of the population, boosting consumer spending. The specific changes to tax brackets would need to be analyzed for their effect on different income levels.

-

Corporate Tax Rates: A reduction in the corporate tax rate is a central feature. Lowering this rate aims to enhance business investment, increase competitiveness, and encourage job creation. However, critics argue this could exacerbate income inequality. The extent of corporate tax reform is crucial to understanding the overall effect.

-

Standard Deduction Adjustments: Modifications to the standard deduction could influence the number of taxpayers itemizing their deductions. This could simplify tax filing for many but potentially reduce tax benefits for high-income individuals who currently itemize extensively. Understanding the impact of these adjustments on individual tax relief is essential.

-

Capital Gains Taxes: Changes to capital gains taxes could impact investment behavior. Lowering these taxes could incentivize investment and potentially boost economic activity, although it may also raise concerns about fairness and income distribution. The proposed changes need to be closely examined for their effect on capital gains tax rates.

-

Estate Tax Changes: Potential adjustments to the estate tax could significantly affect high-net-worth families. Reducing or eliminating this tax could have major implications for wealth transfer and intergenerational wealth. Debate around the estate tax often involves discussions of fairness and economic efficiency. Analyzing the proposed changes to estate tax is crucial for understanding the overall impact.

Economic Projections and Analysis

The economic consequences of Trump's proposed tax cuts are subject to considerable debate. Proponents argue the cuts will stimulate GDP growth, foster job creation, and lead to increased investment. However, critics express concerns about potential inflationary pressure and increased national debt.

-

GDP Growth: Various economic models predict different levels of GDP growth resulting from the proposed tax cuts. Some forecasts suggest a substantial increase in economic output, while others predict a more modest effect, or even a negative impact in the long run.

-

Job Creation: Supporters claim the tax cuts will create numerous jobs by encouraging business expansion and investment. Opponents argue that job creation may be limited or that the benefits may accrue disproportionately to high-income earners.

-

Inflationary Pressure: A significant concern is the potential for increased inflation due to increased consumer spending and business investment fueled by the tax cuts. The Federal Reserve's response to inflationary pressure would be a critical factor.

-

Fiscal Responsibility: The long-term fiscal impact of these tax cuts raises questions about fiscal responsibility. The increased national debt resulting from reduced tax revenue could have significant implications for future economic stability. The debate around fiscal responsibility is central to the discussion of tax cuts.

Political Implications and Reactions

The political landscape surrounding Trump's proposed tax cuts is deeply divided. Republicans largely support the plan, viewing it as a crucial step towards economic growth and tax relief. Democrats, however, largely oppose the cuts, citing concerns about income inequality and the national debt.

-

Bipartisan Support (or Lack Thereof): The likelihood of bipartisan support remains uncertain. The level of compromise and negotiation required to pass the legislation will largely determine the final form of any tax cuts.

-

Congressional Approval: The legislative process will inevitably involve compromises and negotiations. The ability of the administration and House Republicans to secure congressional approval for their proposed plan will be a significant test of their political power.

-

Lobbying Efforts: Interest groups and lobbying organizations are actively engaged in shaping the legislative process. Their efforts will undoubtedly influence the outcome and the specific provisions of any final tax legislation.

-

Political Debate: The public debate surrounding the tax cuts is intense, reflecting strong opinions on economic policy, income inequality, and the role of government. Understanding the nature of the political debate is key to understanding the political context.

Comparison with Previous Tax Legislation

Comparing Trump's proposed tax cuts with previous tax legislation, such as the Tax Cuts and Jobs Act of 2017, reveals both similarities and key differences. Both aimed to stimulate economic growth through tax reductions, but the specifics of the proposed cuts differ significantly. Analyzing the historical context is crucial for evaluating the potential impact of the proposed changes.

-

Similarities and Differences: The focus on corporate tax rates is a similarity; however, the specifics of the proposed individual tax rate changes, the standard deduction adjustments, and other provisions distinguish these proposed cuts from prior legislation.

-

Projected Outcomes: Comparing the projected economic outcomes of previous tax legislation with the projections for Trump’s proposed cuts offers valuable insights for assessing their potential impact. Analyzing previous successes and failures of tax reforms helps shape expectations.

Understanding the Implications of Trump's Proposed Tax Cuts – A Call to Action

Trump's proposed tax cuts, as detailed by House Republicans, present a complex picture with potential for significant economic and political consequences. The key provisions—including adjustments to individual and corporate tax rates, standard deductions, and estate taxes—are projected to have wide-ranging impacts on various segments of the population. The economic projections remain highly debated, and the political implications are deeply intertwined with broader discussions about income inequality and fiscal responsibility. By understanding the historical context and comparing them to past tax legislation, we can better assess their potential effects. Stay updated on the latest developments regarding Trump's proposed tax cuts and their impact on your finances. Learn more about the ongoing debate and how you can participate in shaping the future of tax policy.

Featured Posts

-

Predicting The San Jose Earthquakes A Quakes Epicenter Preview

May 15, 2025

Predicting The San Jose Earthquakes A Quakes Epicenter Preview

May 15, 2025 -

Deep Dive Microsofts Extensive Layoff Of 6 000 Workers

May 15, 2025

Deep Dive Microsofts Extensive Layoff Of 6 000 Workers

May 15, 2025 -

Jimmy Butler Playing Today Warriors Game Status Update

May 15, 2025

Jimmy Butler Playing Today Warriors Game Status Update

May 15, 2025 -

Navigating The New Landscape How Ind As 117 Is Reshaping Indian Insurance

May 15, 2025

Navigating The New Landscape How Ind As 117 Is Reshaping Indian Insurance

May 15, 2025 -

The Dodgers Decision To Recall Hyeseong Kim A Deeper Look

May 15, 2025

The Dodgers Decision To Recall Hyeseong Kim A Deeper Look

May 15, 2025

Latest Posts

-

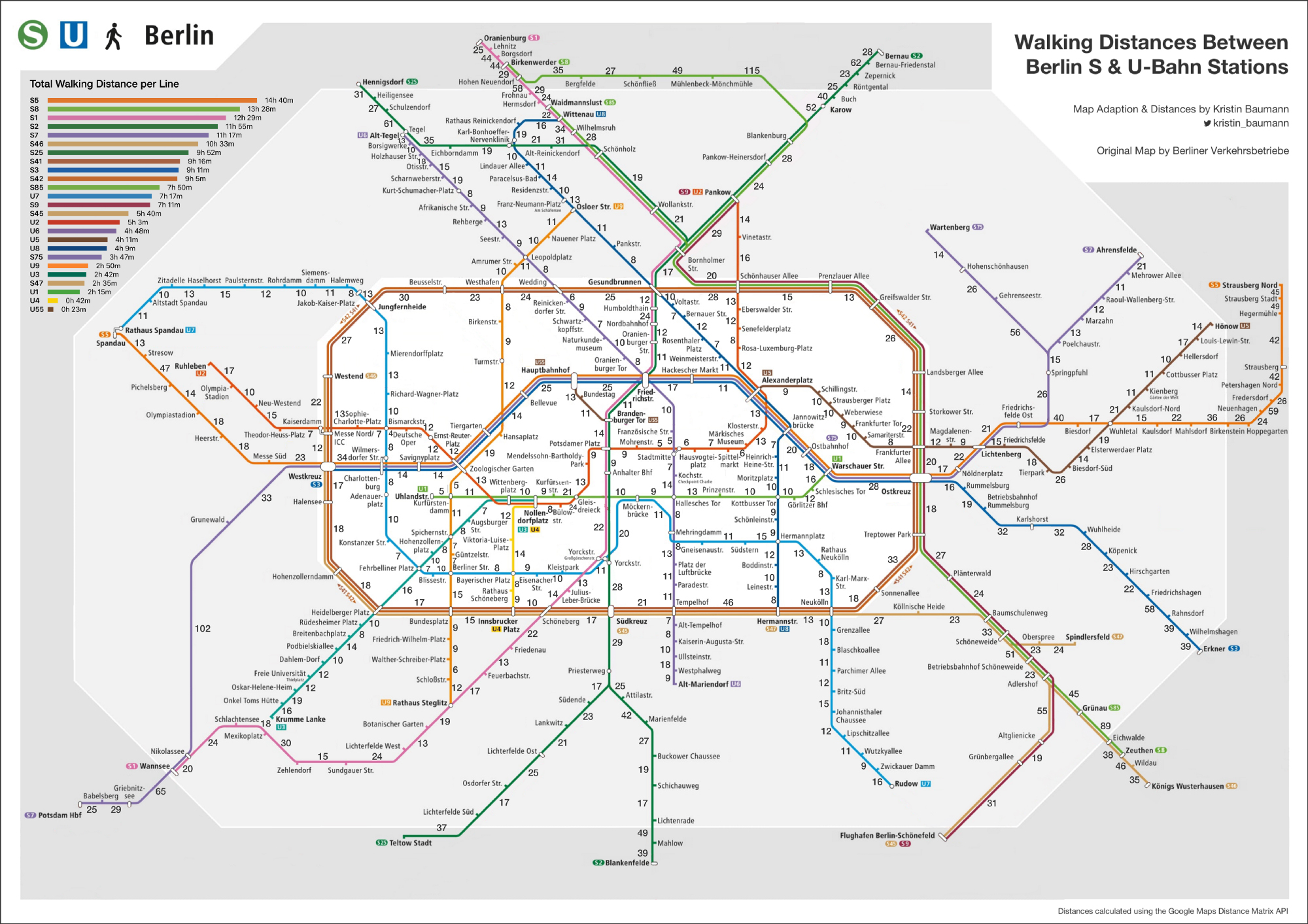

Techno Comes To The Tracks Berlin U Bahn Stations Explore Dj Sets

May 15, 2025

Techno Comes To The Tracks Berlin U Bahn Stations Explore Dj Sets

May 15, 2025 -

Drohende Bvg Streiks Die Folgen Gescheiterter Verhandlungen Nach Schlichtung

May 15, 2025

Drohende Bvg Streiks Die Folgen Gescheiterter Verhandlungen Nach Schlichtung

May 15, 2025 -

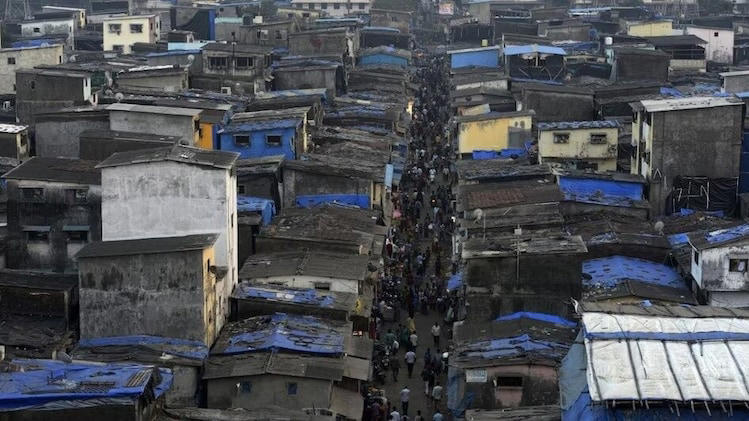

Dial 108 Ambulance Project Bombay High Court Upholds Contract

May 15, 2025

Dial 108 Ambulance Project Bombay High Court Upholds Contract

May 15, 2025 -

Schlichtung Gescheitert Was Bedeuten Streiks Und Entlassungen Beim Bvg

May 15, 2025

Schlichtung Gescheitert Was Bedeuten Streiks Und Entlassungen Beim Bvg

May 15, 2025 -

Mumbai Dial 108 Ambulance Contract Bombay Hc Ruling

May 15, 2025

Mumbai Dial 108 Ambulance Contract Bombay Hc Ruling

May 15, 2025