Navigating The New Landscape: How Ind AS 117 Is Reshaping Indian Insurance

Table of Contents

Understanding the Core Principles of Ind AS 117

Ind AS 117, based on IFRS 17, fundamentally alters how insurance contracts are recognized and measured. Unlike previous standards, it emphasizes a more comprehensive and principle-based approach. A key concept introduced is the 'contractual service margin,' representing the insurer's expected profit from fulfilling its contractual obligations. This margin is calculated considering various factors, including estimated claims, expenses, and the time value of money.

The recognition and measurement of insurance contracts under Ind AS 117 are significantly more complex. Instead of simply recognizing premiums as revenue, insurers must now allocate the revenue over the life of the contract based on the fulfillment of contractual services. This necessitates a granular understanding of the contract's terms and conditions.

- Emphasis on the fulfillment of contractual obligations: Revenue recognition is directly linked to the services provided to the policyholder.

- Detailed explanation of the revenue recognition model: The model employs a combination of approaches, including the general insurance model and the long-term insurance model.

- Clarification on the treatment of premiums and claims: Premiums are now recognized as income over the contract period, while claims are recognized when the insurer incurs a liability.

Impact on Financial Reporting and Disclosure

Ind AS 117 significantly impacts financial statement presentation, leading to enhanced transparency and improved comparability across insurance companies. The new standard necessitates more detailed disclosures, providing stakeholders with a clearer picture of an insurer's financial position and performance.

- Changes in balance sheet presentation: Insurance liabilities are now presented more comprehensively, reflecting the time value of money and the uncertainty inherent in insurance contracts.

- Impact on profit and loss statements: Profit recognition is spread over the life of the contract, providing a more accurate reflection of the insurer's long-term profitability.

- New disclosures required for insurance liabilities and assets: Detailed breakdowns of various liability components, including unearned premiums, claims reserves, and contractual service margin, are mandatory. This increased transparency fosters better decision-making by investors and regulators. This enhanced transparency and comparability allows for more effective benchmarking and improved understanding of the financial health of insurers.

Challenges and Opportunities for Indian Insurers

Implementing Ind AS 117 presents numerous challenges for Indian insurers. Significant investments are needed in IT infrastructure, data management systems, and actuarial expertise. However, the transition also unlocks opportunities for improved risk management and increased efficiency.

- Data management and system upgrades: Insurers need robust systems to capture and process the vast amounts of data required for accurate calculations under Ind AS 117.

- Need for specialized actuarial expertise: The complex calculations and estimations involved in the new standard demand highly skilled actuaries.

- Potential impact on pricing and profitability: Changes in revenue recognition and the increased transparency may impact pricing strategies and overall profitability in the short-term, but lead to better long-term financial health.

- Improved risk assessment and management: The enhanced reporting requirements provide insurers with better insights into their risk exposures, enabling proactive risk management strategies.

Best Practices for Ind AS 117 Compliance

Effective Ind AS 117 implementation requires proactive planning, strong internal controls, and collaboration with external experts. Insurers should prioritize early engagement with consultants and auditors to ensure a smooth transition.

- Early planning and implementation strategies: Begin preparations well in advance of the implementation deadline to allow ample time for system upgrades, staff training, and data migration.

- Regular training and staff development: Invest in comprehensive training programs to equip staff with the necessary knowledge and skills to work under the new standard.

- Collaboration with external consultants and auditors: Engage experienced professionals to guide the implementation process, ensuring compliance with all regulatory requirements. This includes utilizing specialist software and systems for efficient data processing and reporting.

Conclusion: Navigating the Future with Ind AS 117

Ind AS 117 represents a fundamental shift in the accounting landscape for the Indian insurance sector. While the implementation presents significant challenges, it also unlocks opportunities for improved transparency, enhanced risk management, and a more accurate reflection of financial performance. Proactive adoption and robust compliance strategies are crucial for insurers to navigate this new landscape successfully. To ensure seamless Ind AS 117 implementation and compliance, seek professional guidance from experienced consultants and auditors. A well-managed transition will not only ensure regulatory compliance but also position your organization for long-term success in a rapidly evolving market. For further resources and in-depth information on Ind AS 117, explore resources available from the Institute of Chartered Accountants of India (ICAI) and other regulatory bodies.

Featured Posts

-

Leeflang Affaire Npo Toezichthouder Vereist Gesprek Met Bruins

May 15, 2025

Leeflang Affaire Npo Toezichthouder Vereist Gesprek Met Bruins

May 15, 2025 -

Stocks Up Over 10 On Bse Sensexs Significant Increase

May 15, 2025

Stocks Up Over 10 On Bse Sensexs Significant Increase

May 15, 2025 -

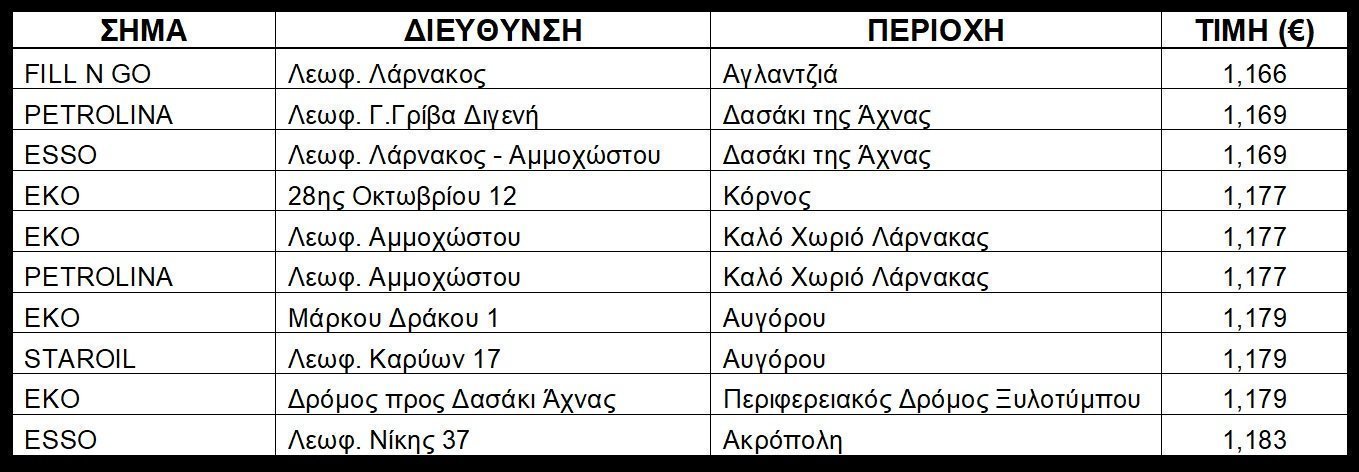

Times Kaysimon Kypros Breite Ta Fthinotera Pratiria

May 15, 2025

Times Kaysimon Kypros Breite Ta Fthinotera Pratiria

May 15, 2025 -

Leeflang En De Npo Klachten Over Angstcultuur Van Medewerkers

May 15, 2025

Leeflang En De Npo Klachten Over Angstcultuur Van Medewerkers

May 15, 2025 -

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025

Latest Posts

-

Onderzoek Naar Angstcultuur Bij De Npo Na Klachten Van Medewerkers Over Leeflang

May 15, 2025

Onderzoek Naar Angstcultuur Bij De Npo Na Klachten Van Medewerkers Over Leeflang

May 15, 2025 -

Npo Werknemers Melden Angstcultuur Onder Leiding Van Leeflang

May 15, 2025

Npo Werknemers Melden Angstcultuur Onder Leiding Van Leeflang

May 15, 2025 -

Leeflang En De Npo Klachten Over Angstcultuur Van Medewerkers

May 15, 2025

Leeflang En De Npo Klachten Over Angstcultuur Van Medewerkers

May 15, 2025 -

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025

Angstcultuur Bij De Npo Medewerkers Spreken Zich Uit Over Leeflangs Leiderschap

May 15, 2025 -

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025

Npo Medewerkers Beschrijven Angstcultuur Onder Leiding Leeflang

May 15, 2025