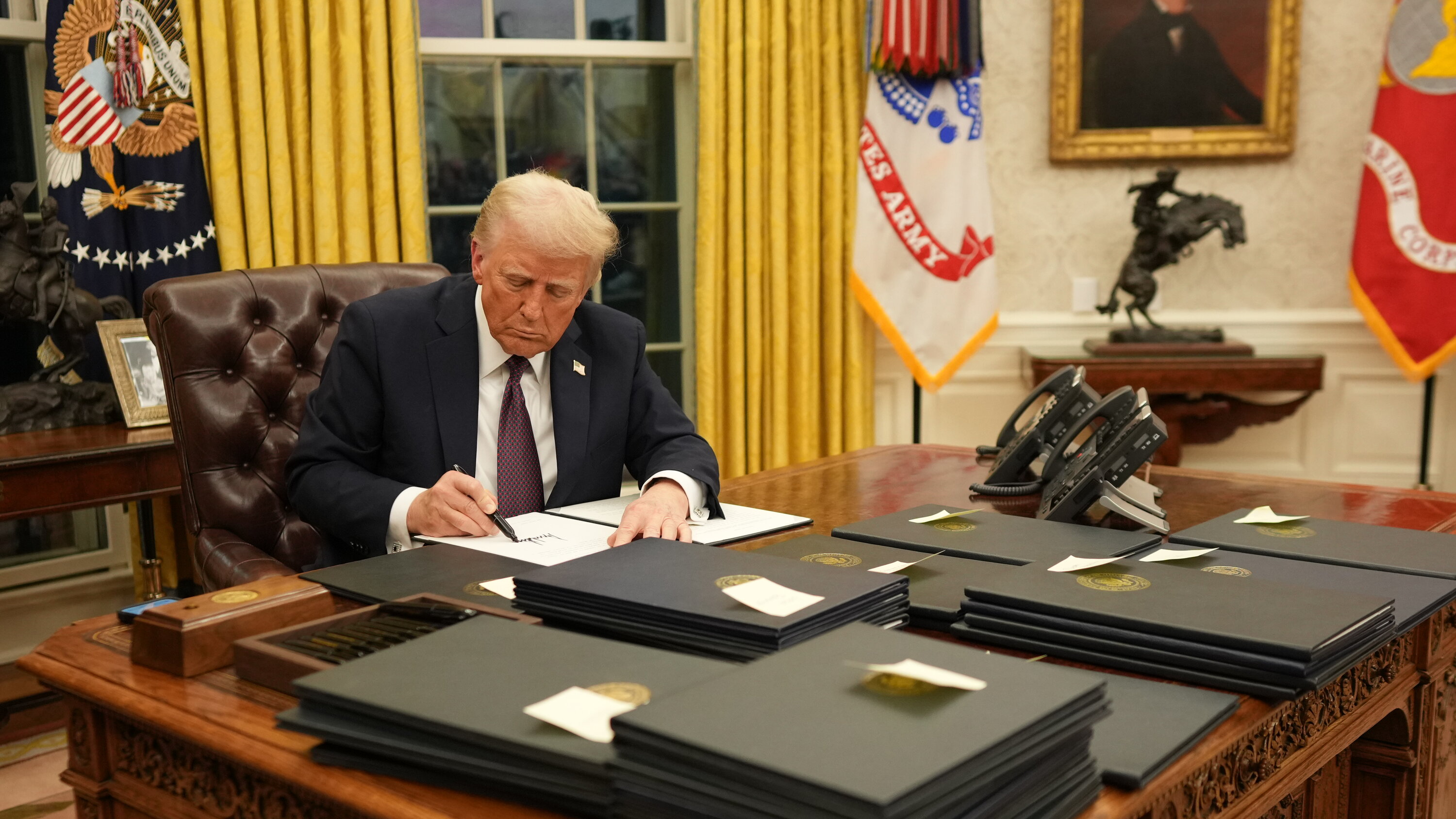

How Trump's Tariffs Impact Fintech IPOs: The Affirm Holdings Example

Table of Contents

The impact of Trump's tariffs extended far beyond traditional manufacturing, significantly influencing sectors like Fintech. The uncertainty created by trade wars affected investor sentiment and market volatility, impacting the success and valuation of Initial Public Offerings (IPOs), particularly within the burgeoning Fintech industry. This article analyzes how Trump's tariffs impacted Fintech IPOs, using Affirm Holdings as a compelling case study. We will explore the broader economic consequences, examine Affirm's IPO in detail, compare it to other Fintech IPOs during that period, and assess the long-term effects on the Fintech landscape. Keywords: Trump's Tariffs, Fintech IPOs, Affirm Holdings, Trade Wars, Economic Uncertainty, Investor Sentiment, IPO Valuation.

H2: The Broader Economic Impact of Trump's Tariffs on Investment:

Trump's tariffs created a climate of significant economic uncertainty. The imposition of tariffs triggered a ripple effect throughout the global economy, impacting investor confidence and market stability. This uncertainty directly influenced the success and valuation of Initial Public Offerings (IPOs) across various sectors, especially in the sensitive Fintech space.

- Increased inflation impacting consumer spending: Tariffs led to increased prices for imported goods, contributing to inflation and reducing consumer disposable income. This reduced consumer spending directly impacted businesses reliant on consumer demand.

- Supply chain disruptions affecting business operations: The imposition of tariffs disrupted global supply chains, leading to delays, increased costs, and uncertainty for businesses. This instability made it difficult for companies to accurately forecast future revenue.

- Reduced investor confidence leading to market volatility: The uncertainty surrounding trade policy led to decreased investor confidence and increased market volatility. Investors became more risk-averse, making it challenging for companies to attract investment and secure favorable IPO valuations.

- Increased borrowing costs impacting company profitability: The economic uncertainty fueled by trade wars often leads to increased borrowing costs for companies, negatively impacting profitability and potentially hindering growth. This made securing financing for expansion more difficult.

This macro-economic environment of uncertainty directly affected IPO valuations and investor appetite. Investors became more cautious, demanding higher returns to compensate for the increased risk associated with uncertain economic conditions.

H2: Affirm Holdings' IPO and the Tariff Context:

Affirm Holdings, a Buy Now, Pay Later (BNPL) fintech company, went public during a period significantly influenced by Trump's tariffs. Affirm's business model is heavily reliant on consumer spending.

- Affirm's reliance on the US consumer market: Affirm's primary market is the US consumer market, making it highly sensitive to changes in consumer spending habits and economic sentiment.

- The impact of reduced consumer spending on Affirm's revenue projections: The reduced consumer spending resulting from increased inflation and economic uncertainty directly impacted Affirm's revenue projections, creating uncertainty for potential investors.

- The timing of Affirm's IPO relative to tariff implementation and market uncertainty: Affirm's IPO timing coincided with a period of heightened market volatility and uncertainty caused by the ongoing trade wars. This timing likely impacted investor perception of risk.

The tariff-related economic uncertainty likely affected Affirm's IPO valuation. The increased risk perception may have resulted in a lower valuation than might have been achieved in a more stable economic environment.

H3: Analyzing the Investor Sentiment During Affirm's IPO:

Investor sentiment during Affirm's IPO was significantly shaped by concerns surrounding trade wars and their potential impact on Fintech valuations.

- Risk assessment by investors concerning future economic forecasts: Investors carefully assessed the potential risks associated with future economic forecasts, considering the uncertainty generated by Trump's tariffs and their impact on consumer spending.

- Potential for lower-than-expected IPO performance due to market conditions: The prevailing market conditions, characterized by uncertainty, increased the potential for lower-than-expected IPO performance.

- Comparison to other Fintech IPOs during the same period: A comparison of Affirm's IPO performance with other Fintech IPOs during the same period provides valuable context, indicating whether its experience was unique or representative of a broader trend.

This cautious investor sentiment likely translated into a more conservative IPO pricing and a potentially lower initial market performance compared to what might have been achieved under different economic circumstances.

H2: Comparative Analysis: Other Fintech IPOs Affected by Tariffs:

Several other Fintech companies went public during the period of Trump's tariffs. Examining their performance offers valuable insights into the broader impact of the trade wars on the sector.

- Examples of other Fintech IPOs and their performance: Analyzing the performance of other Fintech IPOs, such as [insert examples here], allows for a comparative analysis of how different business models and market segments within the Fintech industry were impacted by the economic uncertainty.

- A comparison of their performance to pre-tariff IPOs in the Fintech sector: Comparing the performance of these IPOs to those that occurred before the imposition of tariffs helps to highlight the impact of the trade wars on investor sentiment and market valuation.

- Identifying any common trends observed in the performance of these companies: Identifying common trends among these companies helps determine whether Affirm's experience was an outlier or reflective of a wider pattern within the Fintech sector during this period of economic uncertainty.

This comparative analysis clarifies whether Affirm's experience was unique or representative of a broader trend affecting Fintech IPOs during the era of Trump's tariffs.

H2: Long-Term Effects of Trump's Tariffs on the Fintech Industry:

The long-term effects of Trump's tariffs on the Fintech industry are still unfolding, but some key impacts are already discernible.

- Changes in investor strategies related to risk assessment in Fintech: Investors have likely adjusted their risk assessment strategies in the Fintech sector, considering the vulnerability of some Fintech business models to macroeconomic shocks.

- Adjustment of business models within the Fintech industry: Fintech companies may have adjusted their business models to mitigate risks associated with economic uncertainty and global trade instability.

- Long-term effects on global Fintech expansion: The trade wars could have long-term effects on global Fintech expansion, impacting the ability of Fintech companies to expand into new international markets.

The continued impact on Fintech IPOs and investor confidence will be shaped by the ongoing adaptation of the industry to these long-term effects.

Conclusion:

Trump's tariffs created significant economic uncertainty, impacting investor sentiment and significantly influencing the valuations of Fintech IPOs. Affirm Holdings' IPO serves as a compelling case study, illustrating the challenges faced by Fintech companies during this period. The reduced consumer spending, supply chain disruptions, and increased market volatility all contributed to a more conservative investor approach. A comparative analysis with other Fintech IPOs during this period reveals whether Affirm's experience was unique or indicative of a broader trend. Understanding the long-term effects on risk assessment, business models, and global expansion remains crucial.

Call to Action: Understanding the impact of geopolitical events like Trump's tariffs is crucial for anyone involved in or considering investment in Fintech IPOs. Further research into the interplay between global trade policies and the Fintech sector is essential to navigate future market uncertainties. Stay informed about the effects of trade policies and their potential impact on your Fintech investments. Analyzing the effects of future trade policies and their influence on Fintech IPOs will be vital for successful investment strategies.

Featured Posts

-

When Can I Stream Captain America Brave New World On Disney

May 14, 2025

When Can I Stream Captain America Brave New World On Disney

May 14, 2025 -

Urgent Walmart Recall Check If Your Orv Oysters Or Electric Scooter Is Affected

May 14, 2025

Urgent Walmart Recall Check If Your Orv Oysters Or Electric Scooter Is Affected

May 14, 2025 -

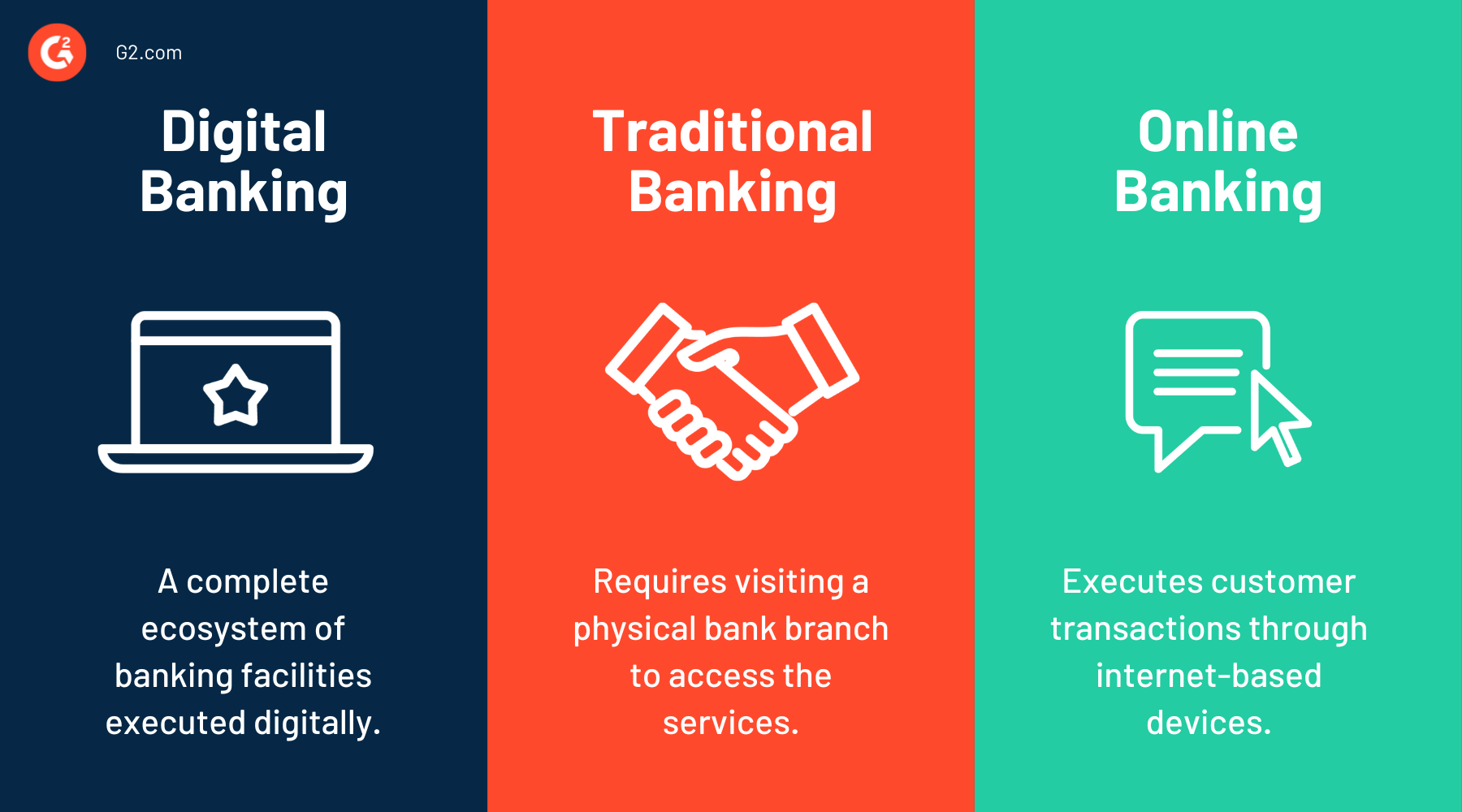

Chimes Ipo Plans Examining The Rise Of The Digital Banking Challenger

May 14, 2025

Chimes Ipo Plans Examining The Rise Of The Digital Banking Challenger

May 14, 2025 -

Tommy Furys Tassel Shorts A Stage Frolic Molly Might Regret

May 14, 2025

Tommy Furys Tassel Shorts A Stage Frolic Molly Might Regret

May 14, 2025 -

Enquete Sur Le Derapage Budgetaire Le Cas Alexis Kohler Clos Sans Suite

May 14, 2025

Enquete Sur Le Derapage Budgetaire Le Cas Alexis Kohler Clos Sans Suite

May 14, 2025