How Will QBTS Stock Perform After The Next Earnings Report?

Table of Contents

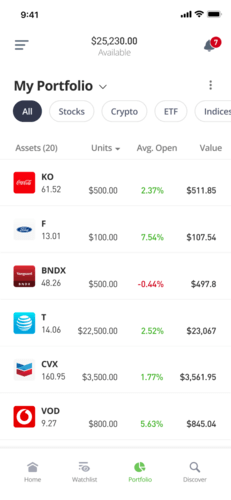

Analyzing QBTS's Recent Financial Performance

To predict QBTS stock performance after the earnings report, we must first examine its recent financial health. Analyzing key metrics from previous quarters provides valuable insight into the company's trajectory. Let's delve into the numbers:

-

Revenue Growth: Compare QBTS's revenue growth rate to industry benchmarks. A growth rate exceeding industry averages suggests strong market positioning and potential for future expansion. Conversely, a slower-than-average growth rate might signal challenges in the competitive landscape.

-

Earnings Per Share (EPS): Analyzing EPS trends reveals the profitability of QBTS. A consistent increase in EPS indicates strong financial health, while a decline raises concerns. Look for consistent upward trends or any significant deviations from the norm.

-

Profit Margins: Tracking profit margins highlights the efficiency of QBTS's operations. Improving profit margins suggest cost-cutting measures or increased pricing power. Declining margins may signify challenges related to operational efficiency or competition.

-

Operating Expenses: Significant changes in operating expenses can impact profitability. An increase in expenses without corresponding revenue growth could negatively affect EPS and stock performance. Decreases in expenses can have the opposite effect.

-

Key Factors Influencing Financial Performance: Consider external factors like supply chain disruptions, raw material costs, and macroeconomic conditions that have influenced QBTS's recent financial performance.

Factors Influencing QBTS Stock Post-Earnings

Several factors beyond QBTS's internal performance influence its stock price following the earnings report. Let's examine some crucial elements:

Market Sentiment and Overall Economic Conditions

The overall market sentiment towards the technology sector significantly impacts QBTS stock. A positive market outlook generally boosts investor confidence, while negative sentiment can lead to sell-offs. Furthermore, broader economic conditions like interest rates and inflation play a pivotal role.

-

Positive Influences: Strong economic growth, low interest rates, and positive investor sentiment toward the tech sector.

-

Negative Influences: Recessions, high interest rates, inflation, and negative investor sentiment.

Competition and Industry Dynamics

The competitive landscape within the technology industry is constantly evolving. QBTS's performance is intricately linked to its competitors' success or failure.

-

Key Competitors and Their Performance: Research the performance of QBTS's main rivals. Are they gaining market share? Are they introducing disruptive technologies? These factors directly impact QBTS's prospects.

-

Industry Disruptions and Innovations: Monitor any technological advancements or industry shifts that could affect QBTS's market position and profitability.

Company-Specific News and Developments

Recent events significantly influence investor perception and QBTS stock price.

-

Strategic Partnerships: New partnerships can expand QBTS's market reach and revenue streams.

-

Product Launches: Successful product launches can boost sales and market share.

-

Regulatory Changes: Favorable regulatory changes can create new opportunities, while unfavorable changes can create obstacles.

Analyst Predictions and Price Targets for QBTS Stock

Financial analysts provide valuable insights into the future performance of QBTS stock. While these are not guarantees, they offer a consensus view:

-

Consensus Opinion: Summarize the general opinion of analysts covering QBTS – bullish, bearish, or neutral.

-

Price Targets: List a range of price targets from various analysts, noting high, low, and average predictions.

-

Divergence in Opinions: Identify any significant discrepancies between analyst predictions and reasons for differing viewpoints. This highlights the uncertainty inherent in stock market predictions.

Risk Assessment and Potential Challenges

Investing in QBTS stock involves inherent risks:

-

Increased Competition: Intensifying competition could erode QBTS's market share and profitability.

-

Economic Downturns: A general economic downturn could negatively impact consumer spending and demand for QBTS's products or services.

-

Regulatory Hurdles: Changes in regulations could impose additional costs or limit QBTS's operational flexibility.

Conclusion: Making Informed Investment Decisions on QBTS Stock

The QBTS stock performance after the next earnings report hinges on a multitude of factors, including its financial health, market sentiment, competitive landscape, and company-specific developments. While potential upside exists, investors must acknowledge the inherent risks. Conduct thorough due diligence, considering the information presented here. Consult a financial advisor before making any investment decisions regarding QBTS stock. Regularly monitor QBTS stock performance and closely analyze the next earnings report for a better understanding of QBTS investment opportunities and the QBTS earnings analysis. Remember, a well-informed QBTS stock outlook is key to successful investing.

Featured Posts

-

Gaite Lyrique Occupation Illegale Et Demande D Intervention De La Mairie

May 20, 2025

Gaite Lyrique Occupation Illegale Et Demande D Intervention De La Mairie

May 20, 2025 -

Fenerbahce De Tadic Doenemi Basarilar Ve Tarihi Etki

May 20, 2025

Fenerbahce De Tadic Doenemi Basarilar Ve Tarihi Etki

May 20, 2025 -

Sabalenka Defeats Mertens In Madrid Open Top Ranked Showdown

May 20, 2025

Sabalenka Defeats Mertens In Madrid Open Top Ranked Showdown

May 20, 2025 -

Why Is Clean Energy Facing Increased Attacks Despite Its Growth

May 20, 2025

Why Is Clean Energy Facing Increased Attacks Despite Its Growth

May 20, 2025 -

Big Bear Ai Bbai Stock Buy Rating Maintained Amidst Defense Sector Growth

May 20, 2025

Big Bear Ai Bbai Stock Buy Rating Maintained Amidst Defense Sector Growth

May 20, 2025

Latest Posts

-

Kriti Esperida Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025

Kriti Esperida Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025 -

Dimosia Synantisi Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025

Dimosia Synantisi Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025 -

Esperida Stin Patriarxiki Akadimia Kritis T Hemata Megalis Tessarakostis

May 20, 2025

Esperida Stin Patriarxiki Akadimia Kritis T Hemata Megalis Tessarakostis

May 20, 2025 -

Adas

May 20, 2025

Adas

May 20, 2025 -

Programma Esperidas Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025

Programma Esperidas Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia

May 20, 2025