Hudson's Bay Company Receives Court Approval To Extend Creditor Protection Until July 31st

Table of Contents

Court Approval and the Terms of Extension

The court's decision to grant Hudson's Bay Company an extension of its creditor protection until July 31st represents a crucial step in the company's ongoing financial restructuring efforts. The ruling, delivered on [Insert Date of Ruling], outlines specific conditions that HBC must meet during this extended period. These conditions likely include:

- Regular Reporting Requirements: HBC is obligated to provide the court with frequent updates on its progress in implementing its restructuring plan. This ensures transparency and accountability.

- Continued Operations: The court may have stipulated that HBC maintain its core operations, minimizing disruptions to its retail activities and preserving jobs where possible.

- Negotiation with Creditors: A key condition likely involves ongoing negotiations with creditors to reach mutually agreeable terms for debt repayment or restructuring.

- Financial Transparency: Detailed financial statements demonstrating HBC's financial health and the effectiveness of its restructuring initiatives will be required.

This creditor protection, sometimes referred to as bankruptcy protection, shields HBC from lawsuits while it works to reorganize its finances. This legal safeguard provides the company with breathing room to negotiate with creditors and develop a sustainable path forward, without the immediate pressure of creditor claims. This extension also sets key deadlines and milestones that must be achieved by July 31st. Keywords associated with this section are: Court ruling, creditor protection extension, conditions of approval, legal proceedings, bankruptcy court.

Impact on Hudson's Bay Company Operations

The extension of creditor protection will undoubtedly influence HBC's daily operations. While the court's approval aims to minimize disruption, some changes are likely. The immediate impact may include:

- Store Closures: Although not explicitly stated in the court ruling, some HBC-owned stores (including those under the Hudson's Bay, Saks Fifth Avenue, and Lord & Taylor banners) might face closure as part of the restructuring strategy.

- Job Security: The restructuring process could result in job losses, although HBC may strive to minimize these through attrition and other measures. Employee uncertainty is a significant challenge during this period.

- Changes in Retail Strategy: HBC is expected to adjust its retail strategy to improve profitability and adapt to the evolving market landscape. This might involve focusing on specific brands or shifting towards online sales to enhance efficiency.

The impact will vary across HBC's different brands. For example, higher-end brands like Saks Fifth Avenue may face different challenges compared to more mainstream brands like Hudson's Bay. The long-term effect on each brand will depend on the success of HBC’s overall restructuring plan. Keywords relevant to this section: HBC operations, store closures, job security, retail strategy, brand impact, financial restructuring plan.

Financial Restructuring Plan and its Implications

HBC's financial restructuring plan is central to its survival. Key elements are likely to include:

- Debt Reduction: A major focus will be on reducing its overall debt burden through negotiations with creditors, potentially involving debt-for-equity swaps or other forms of debt restructuring.

- Asset Sales: The sale of non-core assets is a common tactic in financial restructuring. HBC might sell off underperforming stores or property to generate cash.

- Investment Acquisition: Seeking new investment or a strategic partnership could provide the capital needed to support its operations and implement its restructuring strategy.

Several scenarios could unfold, ranging from a successful turnaround and return to profitability to a sale of the company or, in a worst-case scenario, liquidation. The success of the restructuring hinges on the company's ability to secure sufficient funding, streamline its operations, and regain market share. Keywords for this section include: Financial restructuring, debt reduction, asset sales, investment opportunities, potential buyers, liquidation, company turnaround.

Analysis of the Situation and Predictions for the Future

Experts anticipate that HBC's success hinges on several factors, including its ability to effectively negotiate with creditors, adapt to evolving consumer preferences, and implement a well-defined restructuring strategy. Market analysts offer varied predictions:

- Positive Outlook: Some believe that HBC has the potential to emerge stronger, with a more streamlined and profitable operation after the restructuring. This requires effective execution and successful debt reduction.

- Cautious Outlook: Others express concern about the challenges facing the company, citing the competitive retail landscape and the increasing dominance of e-commerce.

The long-term impact on the broader retail industry will depend largely on the outcome of HBC's restructuring efforts. A successful turnaround could boost confidence within the sector, while a failure could have broader implications. Keywords used here: Retail industry outlook, financial forecasts, industry experts, market analysis, future predictions, HBC prospects.

Conclusion: The Future of Hudson's Bay Company After Creditor Protection Extension

The court's approval to extend creditor protection until July 31st provides Hudson's Bay Company with a critical window of opportunity to address its financial challenges. The success of its restructuring plan remains uncertain but hinges on its ability to negotiate favorably with creditors, streamline operations, and adapt to changing market conditions. The next few months will be pivotal in determining the future trajectory of this iconic Canadian retailer. Staying informed about further developments regarding the Hudson's Bay Company's financial restructuring and creditor protection is crucial. Keep an eye on the company’s news releases and check back for updates on this article to stay abreast of the situation. Keywords: Hudson's Bay Company future, creditor protection update, financial recovery, retail industry news, stay informed.

Featured Posts

-

Vyvedet Li Turtsiya Voyska S Kipra Analiz Diskussii Na Haqqin Az

May 15, 2025

Vyvedet Li Turtsiya Voyska S Kipra Analiz Diskussii Na Haqqin Az

May 15, 2025 -

Analyzing The Impact Of Reciprocal Tariffs On Key Indian Sectors

May 15, 2025

Analyzing The Impact Of Reciprocal Tariffs On Key Indian Sectors

May 15, 2025 -

Moras Goal Not Enough Timbers Fall To Earthquakes 4 1

May 15, 2025

Moras Goal Not Enough Timbers Fall To Earthquakes 4 1

May 15, 2025 -

Kibris Ta Direkt Ucuslar Tatar In Sonuclari Ve Etkileri

May 15, 2025

Kibris Ta Direkt Ucuslar Tatar In Sonuclari Ve Etkileri

May 15, 2025 -

Paddy Pimbletts Ufc 314 Callout Ilia Topuria And Two Others

May 15, 2025

Paddy Pimbletts Ufc 314 Callout Ilia Topuria And Two Others

May 15, 2025

Latest Posts

-

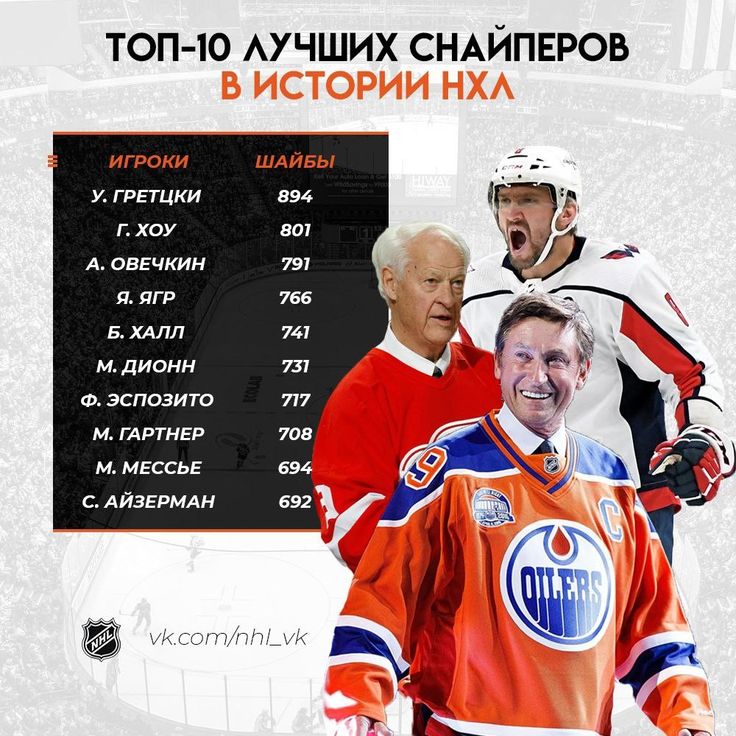

Ovechkin Pobil Rekord Leme V Pley Off N Kh L

May 15, 2025

Ovechkin Pobil Rekord Leme V Pley Off N Kh L

May 15, 2025 -

Rekord Ovechkina Prevzoyden Rekord Leme V Pley Off N Kh L

May 15, 2025

Rekord Ovechkina Prevzoyden Rekord Leme V Pley Off N Kh L

May 15, 2025 -

Florida I Bobrovskiy Vratar Vydal Pyatiy Shataut V Pley Off N Kh L

May 15, 2025

Florida I Bobrovskiy Vratar Vydal Pyatiy Shataut V Pley Off N Kh L

May 15, 2025 -

Aleksandr Ovechkin Luchshiy Snayper Pley Off N Kh L

May 15, 2025

Aleksandr Ovechkin Luchshiy Snayper Pley Off N Kh L

May 15, 2025 -

Ovechkin Oboshel Leme Rekordnoe Chislo Golov V Pley Off

May 15, 2025

Ovechkin Oboshel Leme Rekordnoe Chislo Golov V Pley Off

May 15, 2025