Impact Of Proposed De Minimis Tariff Changes On Chinese Goods (G-7)

Table of Contents

Current De Minimis Tariff System and its Impact on Chinese Imports

The current de minimis tariff system in G-7 nations varies but generally allows for small import shipments to enter with minimal or no tariffs. This system, designed to simplify customs procedures and reduce burdens on small businesses, has significantly impacted the volume of Chinese goods entering these markets. Many small packages and individual purchases fall under this threshold, leading to a surge in imports of consumer products from China.

- Examples of popular Chinese imports affected: Consumer electronics (smartphones, headphones), clothing and apparel, textiles, home goods, toys, and various smaller manufactured items.

- Statistical data on import value from China under the current system: While precise figures require detailed analysis across all G7 nations, it's widely acknowledged that a substantial portion of Chinese imports benefit from the current low de minimis thresholds. Reports from organizations like the OECD could provide more specific data on this aspect.

- Analysis of how the current system benefits both importers and consumers: Importers enjoy reduced customs costs, simplifying their operations, while consumers benefit from lower prices on a wide range of products. This system fosters competition and contributes to lower retail prices.

Proposed Changes to De Minimis Tariffs and their Rationale

The G-7's proposed de minimis tariff changes generally involve raising the current thresholds. This means that more shipments will be subject to tariffs, potentially impacting the volume of Chinese goods entering the market. The rationale behind these changes is multifaceted:

- Specific numerical changes to the threshold value: The exact changes vary across G-7 nations, but the general trend is an increase – for example, from $800 to $2000 or similar increases. Specific details are available on individual government websites or through trade organization publications.

- Timeline for implementation of the proposed changes: Implementation timelines are also nation-specific and vary widely. Some nations aim to implement changes swiftly, while others might have phased rollouts.

- Statements from G-7 officials justifying the proposed modifications: G-7 officials justify these changes by citing concerns about fair trade practices, the need to address trade imbalances with China, and the desire to protect domestic industries from unfair competition. Official statements can be found on the websites of relevant government ministries and international trade organizations.

Economic Impacts on Businesses Importing Chinese Goods

The proposed changes will have significant economic repercussions for businesses importing Chinese goods.

- Increased costs for importers due to higher tariffs: The most immediate impact is a rise in import costs, potentially affecting profitability for small businesses and reducing competitiveness for larger companies.

- Potential for reduced competitiveness of businesses relying on Chinese imports: Businesses heavily reliant on low-cost Chinese imports may find themselves at a disadvantage, needing to adapt their pricing or sourcing strategies to remain profitable.

- Opportunities for businesses to diversify sourcing beyond China: The shift presents an opportunity for businesses to diversify their supply chains, exploring alternative sourcing locations in Southeast Asia, Latin America, or elsewhere to mitigate risks associated with increased tariffs on Chinese goods. This strategy requires careful planning and analysis of various factors.

Impact on Consumers and Retail Prices

The increased tariffs on Chinese goods resulting from de minimis tariff changes are likely to impact consumers.

- Examples of goods where price increases are likely to be most significant: Products with low profit margins, high import volumes from China, and limited domestic alternatives are likely to experience the most significant price increases. These could include many consumer electronics and clothing items.

- Potential for a shift in consumer purchasing habits: Consumers may respond to price increases by purchasing less, seeking substitutes, or shifting their preferences towards domestically produced goods.

- Comparison of price changes across different product categories: The impact on prices will vary across different product categories, with the price elasticity of demand playing a crucial role in determining the extent of price changes.

Geopolitical Implications and Trade Relations with China

These de minimis tariff changes have significant geopolitical implications:

- Analysis of China's likely response to the proposed changes: China is likely to respond to these changes through diplomatic channels, potentially initiating retaliatory measures or engaging in trade negotiations.

- Potential for diplomatic negotiations and trade agreements: The proposed changes could lead to renewed negotiations between the G-7 and China to address underlying trade concerns and potentially find mutually beneficial solutions.

- Long-term consequences for the global trading system: The long-term effects of these changes could include further fragmentation of global trade, potential shifts in global supply chains, and an intensified focus on regional trade agreements.

Conclusion

The proposed de minimis tariff changes present a complex scenario with significant ramifications for businesses, consumers, and international trade relations. Understanding the potential impacts of these changes on Chinese goods is crucial for navigating the evolving global economic landscape. The changes will influence pricing, supply chains, and geopolitical relations.

Call to Action: Stay informed about the ongoing developments regarding de minimis tariff changes and their implications for Chinese goods within the G-7. Thorough research and strategic planning are essential to mitigate potential risks and capitalize on opportunities presented by these adjustments to the global trade system. Monitor official government announcements and trade organization reports for the latest updates and analyses.

Featured Posts

-

Apple Stock Prediction 254 Is Aapl A Buy Near 200

May 25, 2025

Apple Stock Prediction 254 Is Aapl A Buy Near 200

May 25, 2025 -

Official Opening Ferraris First Service Centre In Bengaluru

May 25, 2025

Official Opening Ferraris First Service Centre In Bengaluru

May 25, 2025 -

Aex Stijgt Ondanks Onrust Op De Amerikaanse Beurs

May 25, 2025

Aex Stijgt Ondanks Onrust Op De Amerikaanse Beurs

May 25, 2025 -

Manny Garcias Lego Workshop At Veterans Memorial Elementary School

May 25, 2025

Manny Garcias Lego Workshop At Veterans Memorial Elementary School

May 25, 2025 -

Mia Farrow Trump Must Be Held Accountable For Venezuelan Gang Deportations

May 25, 2025

Mia Farrow Trump Must Be Held Accountable For Venezuelan Gang Deportations

May 25, 2025

Latest Posts

-

North Myrtle Beach Water Usage Public Safety Concerns

May 25, 2025

North Myrtle Beach Water Usage Public Safety Concerns

May 25, 2025 -

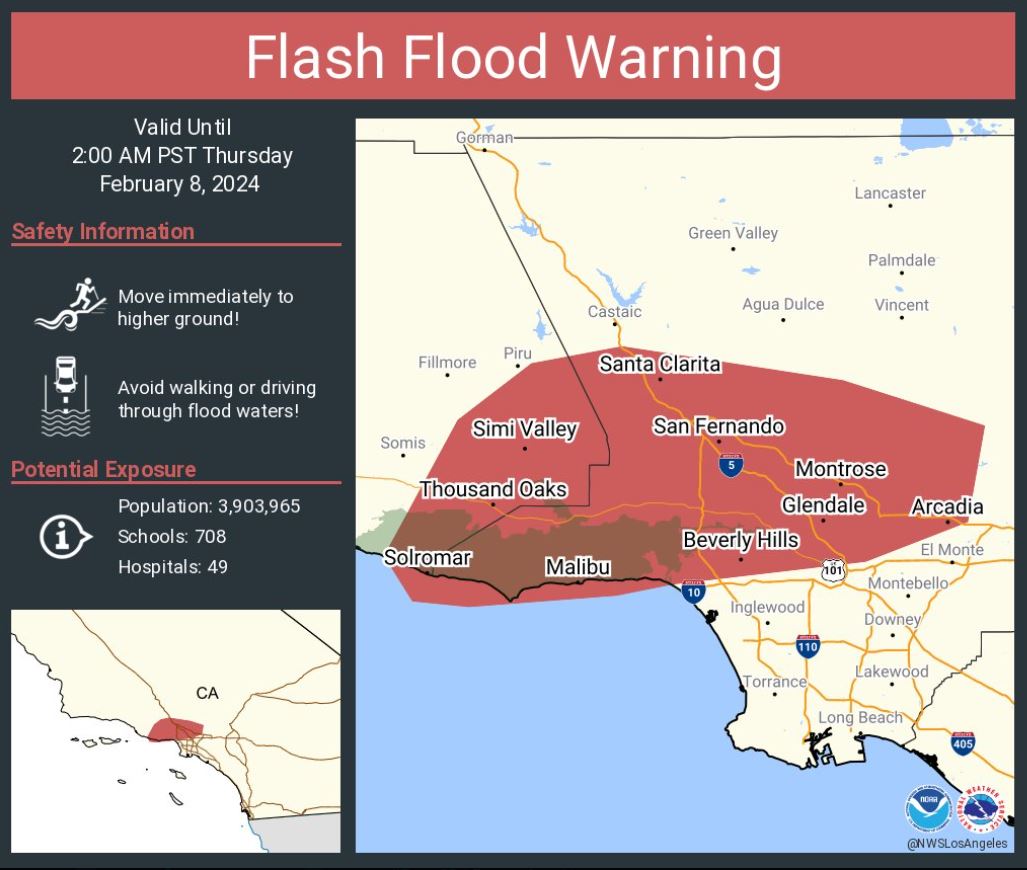

Urgent Flash Flood Warning Active For Cayuga County Tuesday Night

May 25, 2025

Urgent Flash Flood Warning Active For Cayuga County Tuesday Night

May 25, 2025 -

Flood Alerts Types Meanings And Actions To Take

May 25, 2025

Flood Alerts Types Meanings And Actions To Take

May 25, 2025 -

Severe Thunderstorms Trigger Flash Flood Warning In Cayuga County

May 25, 2025

Severe Thunderstorms Trigger Flash Flood Warning In Cayuga County

May 25, 2025 -

Flash Flood Emergency Definition Causes And Prevention

May 25, 2025

Flash Flood Emergency Definition Causes And Prevention

May 25, 2025