Impact Of Tariff Truce On US-China Trade Relations

Table of Contents

Short-Term Economic Effects of Tariff Truces

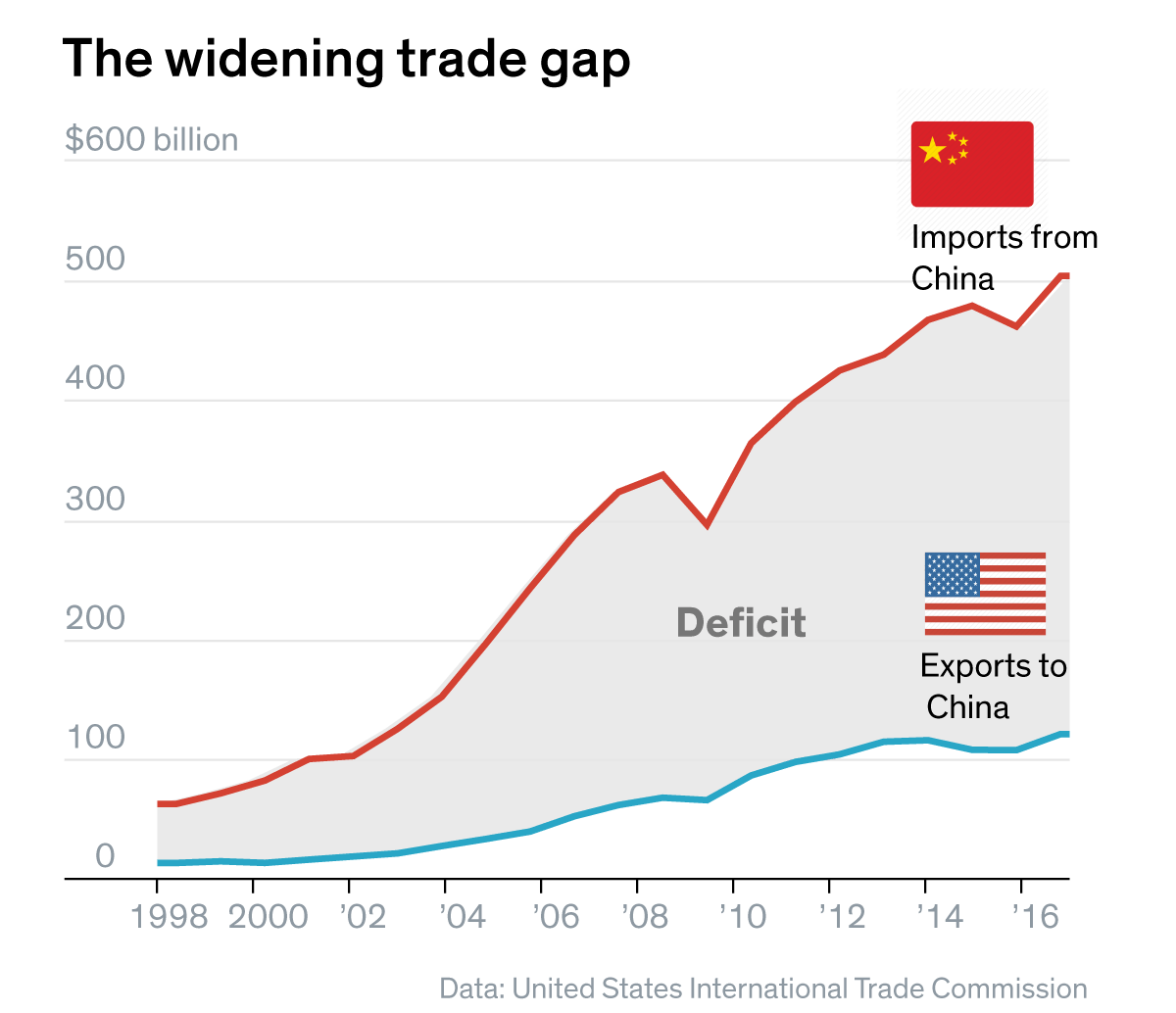

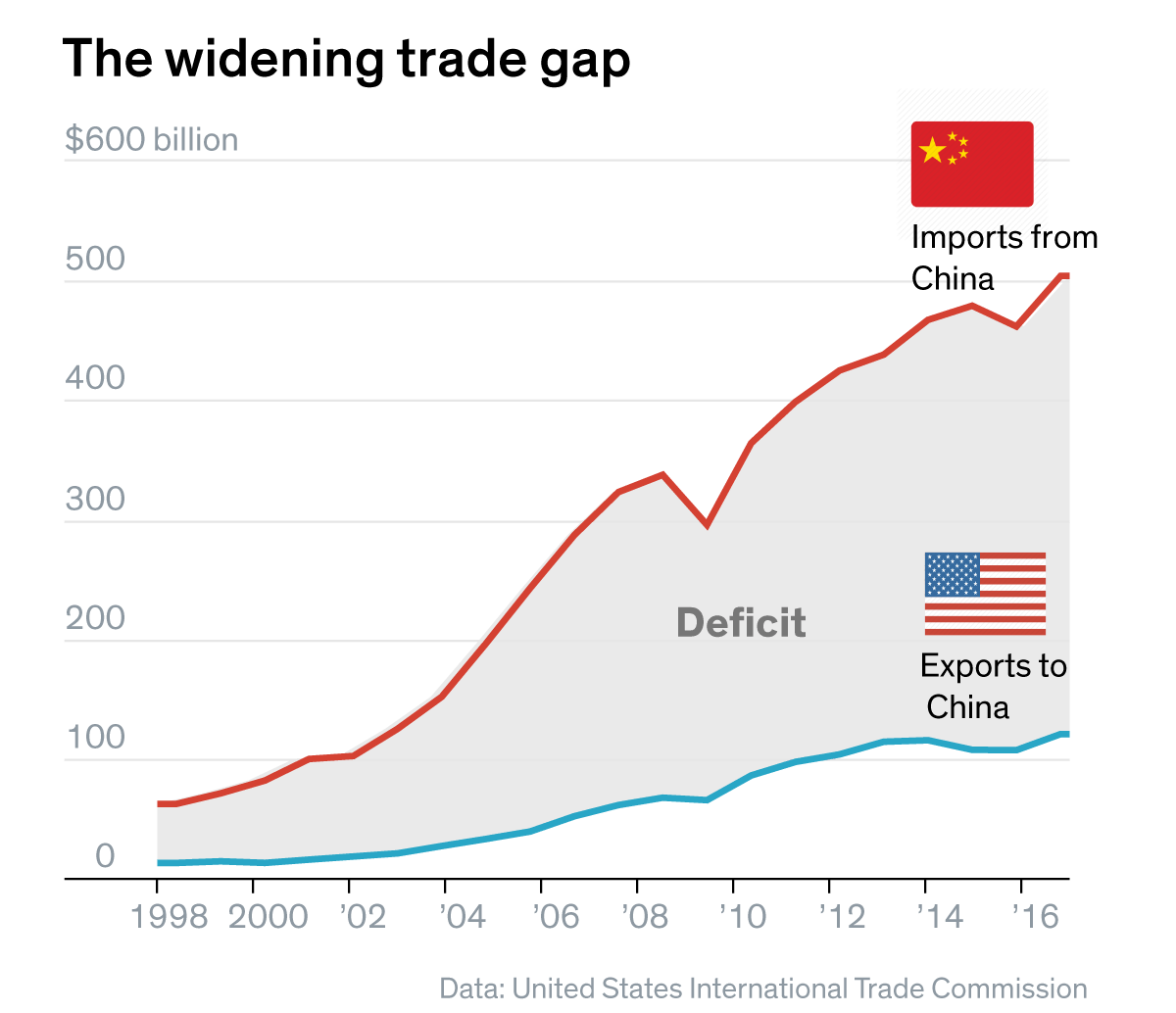

Temporary ceasefires in the US-China trade war, often referred to as Tariff Truces, offer immediate, albeit often temporary, economic benefits.

Reduced Uncertainty and Market Stability

The uncertainty inherent in a trade war significantly dampens business investment and consumer confidence. A Tariff Truce reduces this volatility, creating a more predictable environment.

- Increased Investment: Businesses, relieved from the looming threat of further tariff hikes, are more likely to invest in expansion and innovation.

- Boosted Consumer Spending: Reduced uncertainty leads to increased consumer confidence, resulting in higher spending levels. For example, the temporary reduction in tariffs on certain consumer goods during a truce can lead to a noticeable increase in retail sales.

- Market Stabilization: Indices like the S&P 500 often show positive reactions to news of a trade truce, reflecting improved investor sentiment and reduced market volatility. Studies have shown a correlation between trade truce announcements and short-term increases in stock prices, indicating a return to some level of market stability.

Impact on Specific Industries

The impact of Tariff Truces varies significantly across different industries. Some sectors emerge as winners, while others continue to grapple with the lingering effects of the trade war.

- Agriculture Exports: American farmers, particularly soybean producers, have been heavily impacted by tariffs imposed by China. A Tariff Truce can lead to a significant increase in agricultural exports, providing much-needed relief to this vital sector.

- Tech Sector: The tech sector, encompassing companies like Apple and Qualcomm, has experienced disruptions due to trade tensions. Tariff reductions can positively affect supply chains and reduce the costs of components.

- Manufacturing: Manufacturing industries in both countries have faced challenges due to trade disruptions. A truce can ease these pressures, but the long-term effects depend on the broader trade landscape. The impact is often uneven, with some manufacturers benefiting from decreased import costs while others face increased competition.

Fluctuations in Currency Exchange Rates

Tariff Truces can significantly influence currency exchange rates. The relationship between trade policies and currency values is complex and multifaceted.

- Yuan Appreciation: A truce often leads to a strengthening of the Chinese Yuan against the US dollar, reflecting increased investor confidence in the Chinese economy.

- US Dollar Volatility: The US dollar may experience fluctuations depending on the specifics of the trade agreement and investor sentiment. Uncertainty surrounding trade negotiations can continue to influence exchange rate volatility, even during periods of truce.

- Impact on Global Trade: Currency fluctuations resulting from trade agreements have broader implications for global trade flows, impacting the competitiveness of various nations in international markets.

Long-Term Implications for US-China Trade Relations

While Tariff Truces offer short-term benefits, their long-term implications for US-China trade relations are multifaceted and uncertain.

Shifting Global Supply Chains

Trade tensions have forced many companies to reassess their global supply chains.

- Reshoring: Some companies are bringing production back to their home countries (reshoring) to reduce reliance on China. This, however, often proves costly and complex.

- Nearshoring: Others are shifting production to countries geographically closer, like Mexico or Vietnam (nearshoring), to mitigate risks and reduce transportation costs. This strategy also necessitates investment in new infrastructure and relationships.

- Supply Chain Resilience: The overall goal is to create more resilient and diversified supply chains less vulnerable to future trade disruptions. This requires significant investment and a long-term strategic vision.

Technological Competition and De-coupling

The trade war has intensified technological competition between the US and China.

- 5G Technology: The competition for dominance in 5G technology is a key aspect of the broader trade conflict, with significant geopolitical implications.

- Artificial Intelligence: The US and China are vying for leadership in AI, leading to potential decoupling in certain technological sectors.

- Geopolitical Risks: The trade war has heightened geopolitical risks, as both countries seek to maintain technological advantages and influence.

The Role of International Trade Organizations

International organizations like the WTO play a crucial role in mediating trade disputes.

- WTO Dispute Resolution: The WTO provides a framework for resolving trade disputes, but its effectiveness can be limited by the political complexities involved.

- Trade Agreements: Multilateral trade agreements can help to foster cooperation and reduce trade barriers, but their implementation and enforcement often face challenges.

- International Cooperation: International cooperation is essential for addressing global trade challenges and creating a stable and predictable trading environment.

Conclusion

Tariff Truces offer temporary relief from the US-China Trade War, providing short-term economic benefits like reduced uncertainty and market stability. However, the long-term implications are complex, involving shifts in global supply chains, intensified technological competition, and the ongoing role of international trade organizations. Understanding the ongoing impacts of the US-China Trade War and the ramifications of any Tariff Truce remains crucial for navigating the complexities of the global economy. Stay updated on the latest developments in the US-China trade relationship and the implications of any future tariff truces.

Featured Posts

-

Skywarn Spring Training With Meteorologist Tom Atkins

May 31, 2025

Skywarn Spring Training With Meteorologist Tom Atkins

May 31, 2025 -

Emergency Relocation Rogart Vets In Tain Following Fire

May 31, 2025

Emergency Relocation Rogart Vets In Tain Following Fire

May 31, 2025 -

Summer Arts And Entertainment Guide 2024 Plan Your Summer Now

May 31, 2025

Summer Arts And Entertainment Guide 2024 Plan Your Summer Now

May 31, 2025 -

Bannatyne Supports Childrens Charity In Morocco A Life Changing Initiative

May 31, 2025

Bannatyne Supports Childrens Charity In Morocco A Life Changing Initiative

May 31, 2025 -

Newfoundland Wildfires Force Evacuations Cause Widespread Home Destruction

May 31, 2025

Newfoundland Wildfires Force Evacuations Cause Widespread Home Destruction

May 31, 2025