Increased Retail Sales Reduce Pressure For Bank Of Canada Interest Rate Reduction

Table of Contents

Strong Retail Sales Indicate Economic Resilience

The recent surge in retail sales offers a compelling snapshot of Canada's economic health, potentially influencing the Bank of Canada's approach to interest rate reduction.

Analyzing the Recent Retail Sales Data

The latest data reveals a robust increase in retail sales. For instance, September 2024 saw a 1.5% month-over-month increase, exceeding economists' predictions of a 0.8% rise. This follows a 1% increase in August, painting a picture of sustained growth. Year-over-year growth sits at a healthy 4%, significantly higher than the previous year's figures. Several sectors contributed to this positive performance. The automotive sector experienced a particularly strong rebound, while clothing sales also saw significant gains, indicating improved consumer confidence.

- Specific retail sales figures: September 2024: +1.5% MoM, +4% YoY; August 2024: +1% MoM

- Year-over-year and month-over-month comparisons: Significant positive growth compared to the previous year and the preceding month.

- Contributing factors: Increased consumer confidence, government stimulus programs, and pent-up demand following periods of economic uncertainty likely contributed to the strong performance.

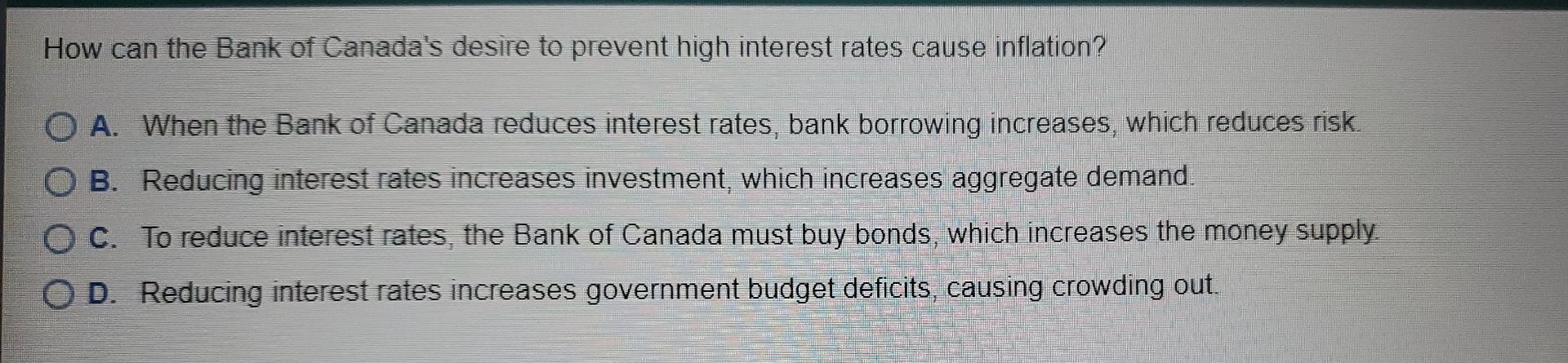

Implications for Inflation

Robust retail sales, while positive for economic growth, also have implications for inflation. Increased consumer spending translates directly into higher demand for goods and services. When supply struggles to keep pace with this elevated demand, prices tend to rise, fueling inflationary pressures.

- Impact of increased demand on prices: Higher demand puts upward pressure on prices across various sectors.

- Potential inflationary pressures: The strong retail sales data could lead to renewed inflationary concerns, potentially influencing the Bank of Canada's decision-making process.

- Relevant inflation indicators: Close monitoring of the Consumer Price Index (CPI) and other relevant inflation metrics will be crucial in assessing the situation.

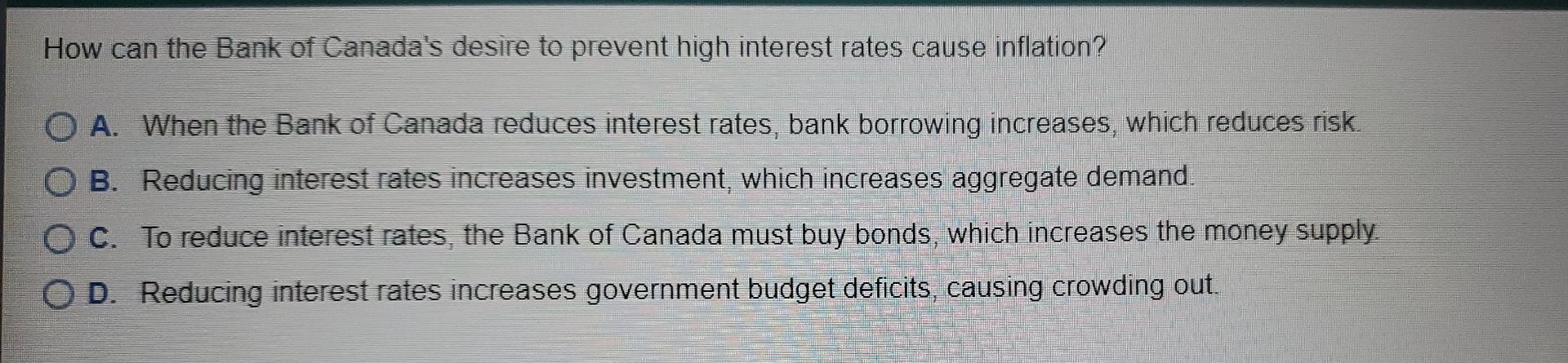

The Bank of Canada's Response to Economic Data

The Bank of Canada's reaction to the strong retail sales figures is a key element in understanding the potential for a Bank of Canada interest rate reduction.

Current Monetary Policy Stance

Currently, the Bank of Canada maintains its key interest rate at 5%. This rate reflects the Bank's assessment of the current economic climate, aiming to balance economic growth with inflation control. The Bank's mandate focuses on maintaining price stability and promoting sustainable economic growth. Their inflation target is 2%, and current figures are being closely scrutinized.

- Current interest rate target: 5%

- The Bank's inflation target: 2%

- The Bank's mandate and objectives: Maintaining price stability and fostering sustainable economic growth.

Reduced Urgency for Interest Rate Cuts

The strong retail sales data significantly lessens the immediate pressure on the Bank of Canada to reduce interest rates. The robust economic activity suggests that the economy is more resilient than previously anticipated, reducing the need for immediate stimulative measures.

- Reasoning behind reduced pressure for rate cuts: Strong retail sales indicate sustained economic momentum, lessening the need for interest rate cuts to stimulate the economy.

- Potential scenarios depending on future economic indicators: Future economic data will be crucial in determining the Bank of Canada's future course of action. Continued strong sales might delay rate cuts further. A slowdown in sales, however, could prompt a re-evaluation.

- Statements made by the Bank of Canada officials: Official statements from the Bank of Canada will provide further clarity on their assessment of the economic situation and their future policy decisions.

Impact on Consumers and Businesses

The implications of the strong retail sales and the Bank of Canada's likely response extend to consumers and businesses alike.

Effect on Consumer Spending

Sustained interest rates at the current level will continue to influence consumer behavior and borrowing patterns.

- Impact of higher interest rates on mortgages and loans: Higher interest rates will make borrowing more expensive, impacting mortgage payments and the cost of other loans.

- Potential changes in consumer spending habits: Consumers may adjust their spending habits in response to higher borrowing costs, potentially leading to a slowdown in consumer spending.

- Potential shift in savings behavior: Higher interest rates could encourage increased savings as individuals seek higher returns on their deposits.

Influence on Business Investment

The prevailing interest rate environment will also have significant consequences for businesses across various sectors.

- Impact on borrowing costs for businesses: Higher interest rates increase the cost of borrowing for businesses, impacting investment decisions and expansion plans.

- Potential effects on investment and expansion: Businesses may postpone or scale back investments and expansion projects in response to higher borrowing costs.

- Potential consequences for job creation and economic growth: Reduced business investment could potentially lead to slower job creation and dampened economic growth.

Conclusion

Strong retail sales data reduces immediate pressure on the Bank of Canada to lower interest rates, suggesting economic resilience. This, however, might also lead to sustained inflationary pressures. The current economic strength impacts both consumer spending and business investment. While positive economic indicators are welcome, it is crucial to monitor the situation closely. The interplay between retail sales, inflation, and the Bank of Canada's monetary policy continues to be a critical factor shaping the Canadian economic landscape.

Call to Action: Stay informed about the Bank of Canada's monetary policy decisions and their implications for your personal finances and business. Keep monitoring retail sales data and economic indicators to understand the future trajectory of Bank of Canada interest rate reduction possibilities. Follow our blog for regular updates on the Bank of Canada's interest rate decisions and their impact on the Canadian economy.

Featured Posts

-

Atletico Madrid Zorlu Savaslar Ve Geriden Gelis Zaferleri

May 25, 2025

Atletico Madrid Zorlu Savaslar Ve Geriden Gelis Zaferleri

May 25, 2025 -

How To Interpret The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 25, 2025

How To Interpret The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 25, 2025 -

Dax Soars Frankfurt Equities Open Higher Record High In Sight

May 25, 2025

Dax Soars Frankfurt Equities Open Higher Record High In Sight

May 25, 2025 -

Gold Investment Soars Impact Of Trumps Latest Trade Actions

May 25, 2025

Gold Investment Soars Impact Of Trumps Latest Trade Actions

May 25, 2025 -

Paris Fashion Week Amira Al Zuhairs Debut For Zimmermann

May 25, 2025

Paris Fashion Week Amira Al Zuhairs Debut For Zimmermann

May 25, 2025

Latest Posts

-

Atletico Madrid In Geriden Gelme Stratejileri Ve Basarilari

May 25, 2025

Atletico Madrid In Geriden Gelme Stratejileri Ve Basarilari

May 25, 2025 -

Atletico Madrid Zorlu Savaslar Ve Geriden Gelis Zaferleri

May 25, 2025

Atletico Madrid Zorlu Savaslar Ve Geriden Gelis Zaferleri

May 25, 2025 -

Geriden Gelen Dev Atletico Madrid In Yuekselisi

May 25, 2025

Geriden Gelen Dev Atletico Madrid In Yuekselisi

May 25, 2025 -

Atletico Madrid In Geriden Gelis Oeykuesue Basariya Giden Yol

May 25, 2025

Atletico Madrid In Geriden Gelis Oeykuesue Basariya Giden Yol

May 25, 2025 -

Atletico Madrid Geriden Gelip Zirveye Ulasma Hikayesi

May 25, 2025

Atletico Madrid Geriden Gelip Zirveye Ulasma Hikayesi

May 25, 2025