Ind AS 117 And The Future Of The Indian Insurance Industry

Table of Contents

Impact of Ind AS 117 on Insurance Accounting Practices in India

Ind AS 117 fundamentally alters insurance accounting practices in India. The shift from traditional premium allocation methods to a performance-based model significantly impacts how insurers recognize revenue, manage liabilities, and report profitability.

Changes in Revenue Recognition

The most significant change under Ind AS 117 is the shift in revenue recognition. Instead of recognizing premiums evenly over the policy period, insurers now recognize revenue based on the performance of the insurance contract. This means considering factors like the likelihood of claims and the time value of money.

- Premiums: Premium recognition is now tied to the insurer's performance in fulfilling the contract's obligations.

- Claims: The timing of claims payments directly affects revenue recognition.

- Insurance Expenses: Expenses are recognized in line with the revenue generated from the insurance contract.

This performance-based approach necessitates a more sophisticated approach to insurance premium allocation and significantly impacts profitability reporting compared to previous methods. This contrasts with the simpler model often used prior to Ind AS 117 adoption, and brings India more in line with IFRS 17 used globally.

Enhanced Transparency and Disclosure Requirements

Ind AS 117 mandates significantly enhanced transparency and disclosure requirements in insurance accounting. Insurers must now provide far more detailed information about their insurance contracts, risk profiles, and financial performance.

- Financial Statement Presentation: Financial statements must clearly reflect the impact of Ind AS 117.

- Detailed Information: Disclosures encompass contract details, risk assessment methodologies, and sensitivity analyses.

- Risk Profile: A comprehensive picture of an insurer's risk exposure is mandatory, enhancing transparency for stakeholders.

This increased level of disclosure improves the quality of financial reporting, leading to greater accountability and a more informed investor base. The enhanced transparency also supports better regulatory oversight and risk management.

Impact on Capital Adequacy and Solvency

The implementation of Ind AS 117 has significant implications for insurers' capital adequacy and solvency ratios. The new accounting standard’s emphasis on performance-based revenue recognition and detailed risk assessment will lead to a more accurate reflection of insurers' financial positions, potentially affecting capital requirements.

- Regulatory Compliance: Insurers must adapt their capital management strategies to comply with regulatory requirements under Ind AS 117.

- Solvency Ratios: The impact on solvency ratios needs to be carefully analyzed and managed.

- Obligation Fulfillment: The new standard aims to ensure insurers have sufficient capital to meet their obligations.

This necessitates a more rigorous approach to risk management and capital planning. Meeting regulatory compliance will be paramount for all insurers operating under this new standard.

Challenges and Opportunities for the Indian Insurance Industry under Ind AS 117

While Ind AS 117 offers significant benefits, its implementation presents substantial challenges and opportunities for the Indian insurance industry.

Implementation Challenges

Adopting Ind AS 117 requires significant investment and effort from Indian insurers.

- System Upgrades: Existing IT systems often require major upgrades to handle the complexities of the new standard.

- Data Management: Insurers must gather and manage vast amounts of data to support the new accounting requirements.

- Specialized Expertise: Significant expertise in actuarial science and insurance accounting is necessary.

- Costs: The costs associated with implementation, including system upgrades, training, and consulting fees, can be substantial.

These challenges necessitate careful planning and substantial investment in infrastructure and expertise.

Opportunities for Improved Risk Management and Decision-Making

Despite the challenges, Ind AS 117 offers significant opportunities for improved risk management and decision-making.

- Better Understanding of Liabilities: The new standard encourages a more thorough understanding of insurance liabilities and their associated risks.

- Improved Pricing Strategies: Accurate liability assessment allows for more informed and effective pricing strategies.

- Enhanced Risk Assessment: A more detailed and nuanced approach to risk assessment is now required, leading to better risk management practices.

This enhanced understanding facilitates more effective risk mitigation, improved capital allocation, and more accurate pricing decisions.

Competitive Advantage

Insurers who successfully navigate the implementation challenges and efficiently adapt to Ind AS 117 can gain a significant competitive advantage.

- Enhanced Transparency: Increased transparency builds greater trust with investors and stakeholders.

- Investor Confidence: This improved trust attracts more investment and enhances market standing.

- Improved Financial Reporting: Clear and accurate financial reporting enhances operational efficiency and strategic decision making.

Early and efficient adoption positions insurers favorably in the increasingly competitive Indian insurance market.

Conclusion: Navigating the Future with Ind AS 117

Ind AS 117 represents a transformative shift for the Indian insurance industry. While implementing the new standard presents considerable challenges—requiring significant investments in technology, data management, and expertise—it also paves the way for increased transparency, improved risk management, and enhanced competitiveness. Mastering Ind AS 117 is not merely about compliance; it’s about embracing a future of more robust financial reporting and informed decision-making. To successfully navigate this change, insurers need to prioritize strategic planning, invest in the necessary resources, and develop the expertise to effectively leverage the opportunities presented by this new accounting standard. Begin exploring further resources on Ind AS 117 implementation best practices today, and embrace the future of Ind AS 117 in the Indian insurance industry.

Featured Posts

-

Npo Toezichthouder Gesprek Essentieel Hamer En Bruins Over Leeflang

May 15, 2025

Npo Toezichthouder Gesprek Essentieel Hamer En Bruins Over Leeflang

May 15, 2025 -

Npo En Bruins Onder Druk Hamers Aangifte Over Leeflang Vereist Actie

May 15, 2025

Npo En Bruins Onder Druk Hamers Aangifte Over Leeflang Vereist Actie

May 15, 2025 -

Former Vp Of Correa Indicted In Ecuadorian Presidential Candidates Death

May 15, 2025

Former Vp Of Correa Indicted In Ecuadorian Presidential Candidates Death

May 15, 2025 -

Kaysima Kyproy Poy Tha Breite Tis Xamiloteres Times

May 15, 2025

Kaysima Kyproy Poy Tha Breite Tis Xamiloteres Times

May 15, 2025 -

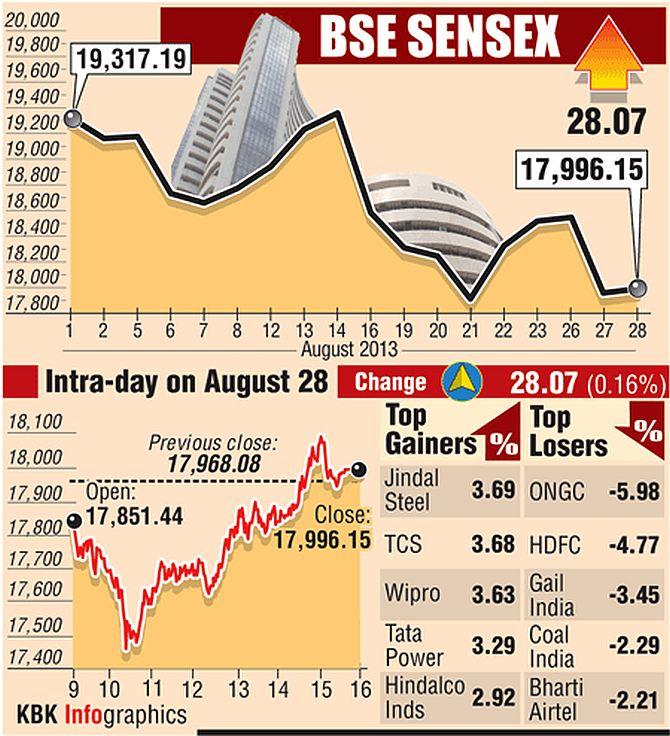

Bse Stocks Surge Sensexs Rise And Top 10 Gainers

May 15, 2025

Bse Stocks Surge Sensexs Rise And Top 10 Gainers

May 15, 2025

Latest Posts

-

Chinas Xi Enlists Top Advisers For Crucial Us Deal

May 15, 2025

Chinas Xi Enlists Top Advisers For Crucial Us Deal

May 15, 2025 -

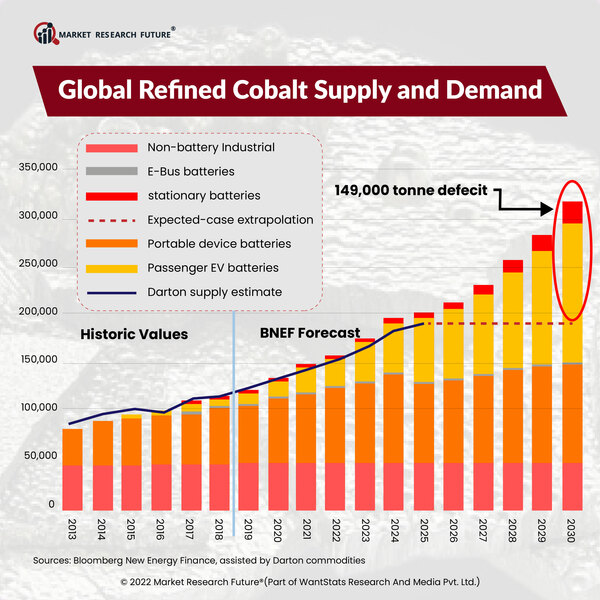

Analyzing Congos Cobalt Export Policy The Quota Plan And Market Recovery

May 15, 2025

Analyzing Congos Cobalt Export Policy The Quota Plan And Market Recovery

May 15, 2025 -

Pboc Daily Yuan Support Below Estimates First Time In 2024

May 15, 2025

Pboc Daily Yuan Support Below Estimates First Time In 2024

May 15, 2025 -

Middle Managers The Bridge Between Leadership And Employees

May 15, 2025

Middle Managers The Bridge Between Leadership And Employees

May 15, 2025 -

The Growing Problem Of Wildfire Betting A Los Angeles Perspective

May 15, 2025

The Growing Problem Of Wildfire Betting A Los Angeles Perspective

May 15, 2025