India Real Estate Investment Surge: 47% Jump In Q1 2024

Table of Contents

Economic Factors Driving the India Real Estate Investment Boom

The robust growth of the Indian economy is a primary driver of the current real estate investment boom. Positive economic indicators have instilled significant confidence amongst investors.

Improved Economic Outlook

Several key factors contribute to this improved economic outlook:

- Increased Disposable Incomes: Rising salaries and a growing middle class have led to a significant increase in disposable income, boosting consumer spending and demand for housing.

- Positive Consumer Sentiment: A positive outlook on the future, coupled with low inflation in certain sectors, has increased consumer confidence, making them more willing to invest in India property market assets.

- Government's Pro-Growth Policies: The government's consistent efforts to promote economic growth through various initiatives have further strengthened investor sentiment. India's GDP growth consistently outperforming projections further bolsters this confidence. For example, Q1 2024 saw a [insert actual GDP growth data]% increase.

Low Interest Rates & Affordable Housing Initiatives

Low interest rates on home loans, coupled with government schemes aimed at making housing more affordable, have significantly increased the accessibility of real estate investment for a wider segment of the population.

- Pradhan Mantri Awas Yojana (PMAY): This flagship government scheme provides substantial financial assistance to eligible individuals for affordable housing, thereby boosting demand.

- Impact on Affordability: Lower interest rates have reduced the monthly EMIs (Equated Monthly Installments) on home loans, making homeownership a more attainable goal for many. [Insert data on average home loan interest rates in Q1 2024].

- Government Subsidies: Various other government schemes offer subsidies and tax benefits, further incentivizing real estate investment in affordable housing segments.

Infrastructure Development & Urbanization Fueling Growth

Significant investments in infrastructure development and rapid urbanization are key contributors to the India real estate market's growth.

Smart City Initiatives & Improved Connectivity

The government's "Smart Cities" mission, along with investments in transportation infrastructure, has dramatically improved connectivity and raised property values in many urban areas.

- Smart City Projects: Projects in cities like [mention examples, e.g., Bengaluru, Hyderabad, Ahmedabad] have led to improved infrastructure, attracting businesses and residents alike.

- Impact on Property Prices: Improved connectivity through better roads, metro lines, and airports has resulted in a significant increase in property prices in these areas.

- Increased Demand: The enhanced quality of life in these smart cities has fueled increased demand for residential and commercial India property and, consequently, increased real estate investment.

Growth of Tier 2 & 3 Cities

The expansion of economic activity is not limited to major metros. Significant real estate investment is flowing into Tier 2 and Tier 3 cities due to factors like migration and industrial development.

- Rapidly Developing Cities: Cities like [mention examples of rapidly growing Tier 2 & 3 cities] are witnessing significant growth due to industrialization and increased employment opportunities.

- Reasons for Growth: Relatively lower property prices and a burgeoning population are driving demand in these areas.

- Investment Opportunities: These cities present lucrative real estate investment opportunities for investors looking for higher returns.

Changing Investor Preferences & Investment Strategies

The India real estate investment landscape is also witnessing a shift in investor preferences and investment strategies.

Increased Demand for Luxury & Premium Properties

There's a noticeable surge in demand for luxury and premium properties, driven by rising incomes and changing lifestyles amongst high-net-worth individuals (HNWIs).

- Growth of Luxury Housing Market: The luxury housing segment is witnessing exceptional growth, with developers focusing on high-end amenities and sophisticated designs.

- Factors Affecting Demand: Rising disposable incomes, a preference for upscale living, and a desire for exclusive amenities are major drivers of this trend.

- Examples of Luxury Developments: [Mention examples of luxury real estate projects in major Indian cities].

Rise of Real Estate Investment Trusts (REITs)

REITs are gaining popularity as an attractive real estate investment vehicle in India.

- Benefits of REITs: REITs offer investors the opportunity to participate in the India real estate market without directly owning properties, providing a source of passive income and diversification.

- Growth of the REIT Market in India: The REITs market is expanding rapidly, providing more investment options for both domestic and international investors.

- Potential Risks and Rewards: While REITs offer attractive returns, investors should carefully consider the potential risks involved before investing.

Conclusion: Investing in the Booming India Real Estate Market

The 47% surge in India real estate investment in Q1 2024 is a testament to the market's dynamism and potential. This growth is driven by a combination of strong economic fundamentals, significant infrastructure development, and evolving investor preferences. The opportunities in the India property market are substantial, spanning across established metros and emerging Tier 2 & 3 cities. The rise of REITs further enhances accessibility and diversification options. Capitalize on this India real estate investment surge. Research current market trends and consider diversifying your portfolio with promising Indian properties. Explore the various real estate investment opportunities available and make informed decisions to benefit from this exciting growth trajectory.

Featured Posts

-

Uber Ends Foodpanda Taiwan Acquisition Due To Regulatory Obstacles

May 17, 2025

Uber Ends Foodpanda Taiwan Acquisition Due To Regulatory Obstacles

May 17, 2025 -

New York Knicks Success Despite Brunsons Absence

May 17, 2025

New York Knicks Success Despite Brunsons Absence

May 17, 2025 -

India Real Estate Investment Surge 47 Jump In Q1 2024

May 17, 2025

India Real Estate Investment Surge 47 Jump In Q1 2024

May 17, 2025 -

Arsenals Transfer Bid For Stuttgart Midfielder

May 17, 2025

Arsenals Transfer Bid For Stuttgart Midfielder

May 17, 2025 -

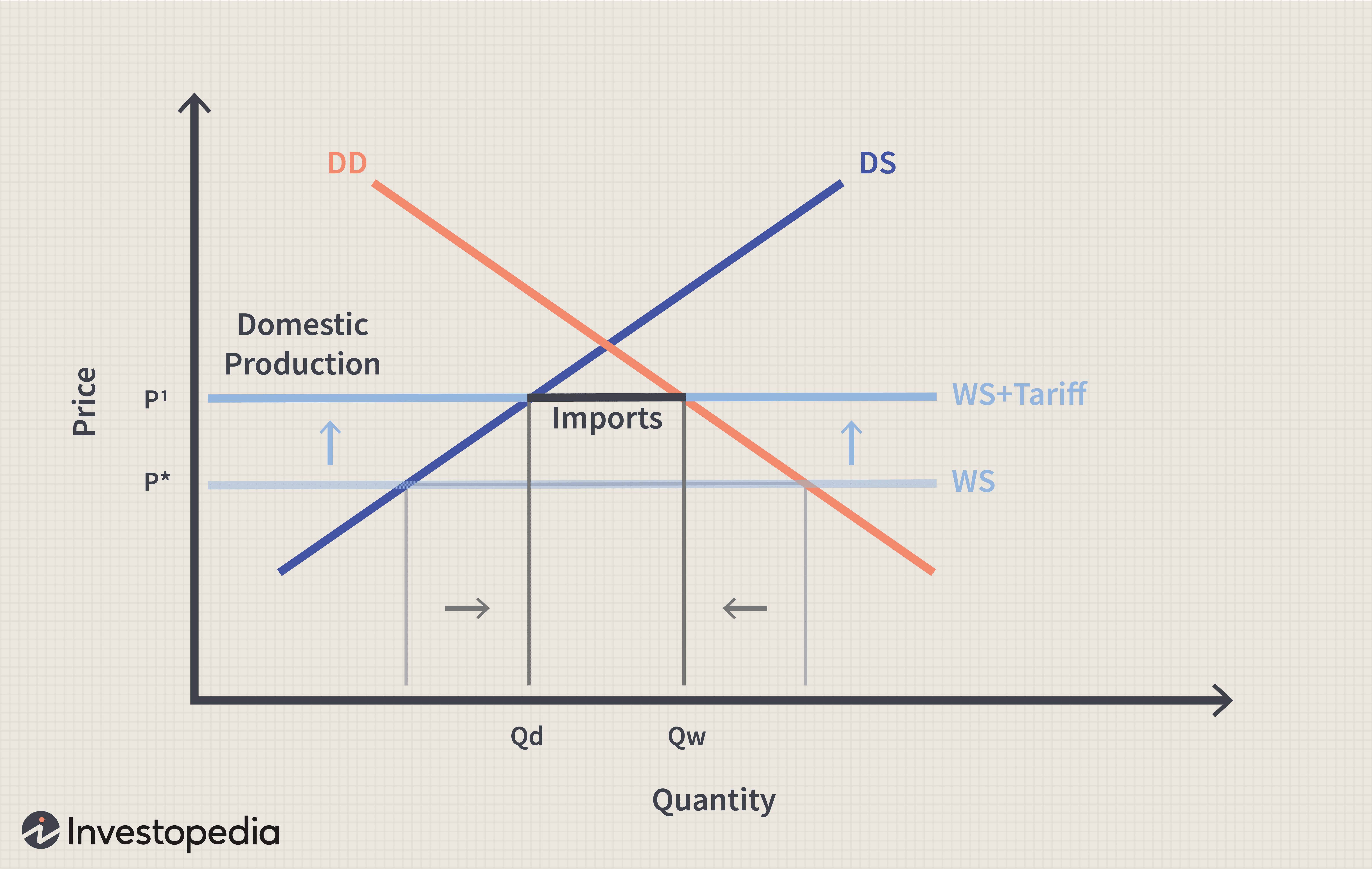

Near Zero Tariffs Canadas New Trade Policy With The Us

May 17, 2025

Near Zero Tariffs Canadas New Trade Policy With The Us

May 17, 2025