Indonesia's Foreign Exchange Reserves Plunge: Rupiah Weakness Takes Toll

Table of Contents

Factors Contributing to the Decline in Indonesia's Foreign Exchange Reserves

Several interconnected factors have contributed to the alarming decline in Indonesia's foreign exchange reserves. Understanding these contributing elements is crucial to formulating effective solutions.

Global Economic Headwinds

The global economic landscape has presented significant headwinds for Indonesia. Rising interest rates in developed economies, fueled by persistent global inflation, have led to capital flight as investors seek higher returns elsewhere. The ongoing war in Ukraine has further exacerbated this situation, disrupting global supply chains and increasing commodity prices. These global challenges have impacted Indonesia's reserves in several ways:

- Capital Flight: Investors have withdrawn funds from emerging markets like Indonesia, seeking safer havens in developed economies.

- Reduced Export Demand: Weakening global demand has reduced export earnings for Indonesia, impacting the inflow of foreign currency.

- Increased Import Costs: Higher global commodity prices have increased Indonesia's import bill, putting pressure on its foreign exchange reserves.

These factors have combined to create a perfect storm, significantly impacting the Rupiah's exchange rate against major currencies. For instance, the Rupiah experienced a [insert percentage]% depreciation against the US dollar in [insert time period], directly correlated to the decline in reserves.

Current Account Deficit

Indonesia's persistent current account deficit has further strained its foreign exchange reserves. A current account deficit arises when a country's imports exceed its exports. In Indonesia's case, several factors have contributed to this imbalance:

- Increased Import Spending: Rising domestic consumption and increased reliance on imported goods have inflated import spending.

- Lower Export Earnings: Challenges in the global market have reduced export revenues, exacerbating the current account deficit.

- Tourism Revenue Fluctuations: While tourism contributes positively to foreign exchange inflows, fluctuations due to global events can impact the overall balance.

Data from [insert source, e.g., Bank Indonesia] shows that the current account deficit reached [insert figure] in [insert time period], placing considerable pressure on the nation's reserves.

Government Spending and Debt Management

Government spending and debt management practices also play a significant role. While government spending is crucial for infrastructure development and social programs, excessive borrowing or inefficient spending can negatively impact foreign exchange reserves:

- Government Borrowing: Increased government borrowing, especially in foreign currency, can put pressure on reserves as repayments become due.

- Debt Repayments in Foreign Currency: Repaying foreign currency-denominated debt requires using foreign exchange reserves.

- Impact on Foreign Investor Confidence: Concerns about fiscal sustainability can erode investor confidence, leading to capital outflows and further reserve depletion.

The government's fiscal policies and their impact on the nation's financial health are therefore under intense scrutiny, with analysts closely monitoring the effectiveness of implemented strategies.

Impact of the Reserves Plunge on the Rupiah

The decline in Indonesia's foreign exchange reserves has had a direct and significant impact on the Rupiah.

Rupiah Volatility

Reduced foreign exchange reserves limit Bank Indonesia's ability to intervene in the forex market to stabilize the Rupiah's exchange rate. This has resulted in increased volatility:

- Reduced Ability to Intervene: With fewer reserves, Bank Indonesia has limited capacity to counter speculative attacks on the Rupiah.

- Speculative Attacks on the Rupiah: The perception of weaker reserves can attract speculative attacks, further depreciating the currency.

- Impact on Import Costs: A weaker Rupiah increases the cost of imports, contributing to inflationary pressures.

The Rupiah experienced significant fluctuations in [insert time period], with the currency depreciating by [insert percentage]% against the US dollar, highlighting the vulnerability stemming from dwindling reserves.

Inflationary Pressures

The weakening Rupiah contributes directly to inflation in Indonesia. This occurs through:

- Increased Import Prices: As the Rupiah depreciates, the cost of imported goods increases, pushing up prices for consumers.

- Cost-Push Inflation: Businesses face increased input costs due to higher import prices, leading to cost-push inflation.

- Impact on Consumer Prices: Higher import costs and cost-push inflation translate into higher consumer prices, affecting household budgets.

This inflationary pressure adds further economic strain on Indonesia, demanding careful management of both monetary and fiscal policies.

Government Measures and Policy Responses

The Indonesian government, through Bank Indonesia and the Ministry of Finance, has implemented various measures to address the situation.

Bank Indonesia's Interventions

Bank Indonesia (BI) has employed several strategies to stabilize the Rupiah and manage the foreign exchange reserves:

- Interest Rate Hikes: Raising interest rates makes Indonesian assets more attractive to foreign investors, potentially attracting capital inflows.

- Forex Market Interventions: BI may intervene in the forex market to buy Rupiah and support its value, although this depletes reserves.

- Foreign Currency Borrowing: Securing foreign currency loans can bolster reserves in the short term, but increases debt levels.

The effectiveness of these interventions is subject to ongoing evaluation, factoring in both domestic and global economic conditions.

Fiscal Policy Adjustments

The Indonesian government has also implemented fiscal policy adjustments, including:

- Spending Cuts: Reducing non-essential government spending can free up resources and reduce pressure on reserves.

- Tax Reforms: Improving tax collection efficiency can increase government revenue, lessening reliance on borrowing.

- Measures to Boost Exports: Government initiatives to promote exports can increase foreign exchange inflows.

The success of these fiscal measures hinges on effective implementation and their impact on economic growth and investor confidence.

Conclusion

The decline in Indonesia's foreign exchange reserves, driven by a confluence of global economic headwinds, a current account deficit, and government spending pressures, has significantly weakened the Rupiah and increased inflationary pressures. Bank Indonesia's interventions and the government's fiscal adjustments are crucial in stabilizing the situation, although their effectiveness will depend heavily on evolving global conditions and the resilience of the Indonesian economy. The outlook remains uncertain, contingent on future global economic developments and the continued success of the implemented policies. Stay updated on the latest news regarding Indonesia's foreign exchange reserves and the Rupiah's stability to make informed financial decisions, and closely monitor Indonesia's foreign exchange market for further developments concerning the Rupiah exchange rate and managing Indonesia's foreign currency reserves effectively.

Featured Posts

-

Aocs Fierce Fact Check Of Jeanine Pirro On Fox News

May 09, 2025

Aocs Fierce Fact Check Of Jeanine Pirro On Fox News

May 09, 2025 -

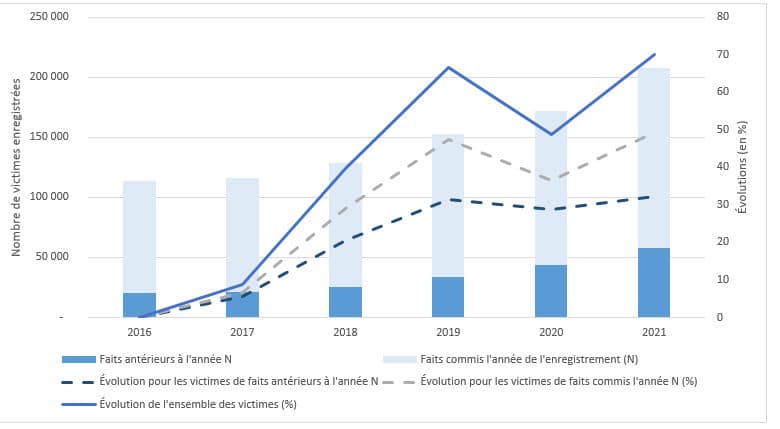

Boxeur De Dijon Accuse De Violences Conjugales Audience En Aout

May 09, 2025

Boxeur De Dijon Accuse De Violences Conjugales Audience En Aout

May 09, 2025 -

Analyzing Elon Musks Net Worth A Correlation With Us Power Dynamics

May 09, 2025

Analyzing Elon Musks Net Worth A Correlation With Us Power Dynamics

May 09, 2025 -

The Great Decoupling And Its Effect On Technological Advancement

May 09, 2025

The Great Decoupling And Its Effect On Technological Advancement

May 09, 2025 -

Franco Colapinto Surprise Contender For Red Bull Racing

May 09, 2025

Franco Colapinto Surprise Contender For Red Bull Racing

May 09, 2025