Investing In BigBear.ai (BBAI): Is It The Next Big Penny Stock Winner?

Table of Contents

Understanding BigBear.ai (BBAI) and its Business Model

What does BigBear.ai do?

BigBear.ai (BBAI) is a leading provider of artificial intelligence (AI)-powered solutions and big data analytics, specializing in the areas of cybersecurity and national security. They leverage advanced technologies to deliver mission-critical insights and solutions to a diverse clientele. Their services encompass a wide range of applications, including threat detection, predictive modeling, and data visualization. The company utilizes cutting-edge techniques in data analytics, machine learning, and artificial intelligence to solve complex problems for its clients.

- Specific Examples: BigBear.ai has worked on numerous projects for government agencies and private sector clients, involving critical infrastructure protection, advanced analytics for defense applications, and cybersecurity threat assessments. Specific project details are often confidential due to the nature of their work.

- Target Market: BigBear.ai's primary target market includes government agencies (particularly within defense and intelligence), and large corporations in sectors needing robust cybersecurity and advanced analytics capabilities.

- Competitive Landscape: The AI and big data market is highly competitive, with many established players and numerous emerging startups. BigBear.ai faces competition from both large technology companies and specialized firms offering similar services.

Analyzing BigBear.ai's Financial Performance and Growth Potential

Financial Health

Analyzing BBAI's financial performance requires a careful review of its recent financial reports, focusing on key metrics such as revenue growth, earnings (or losses), debt levels, and cash flow. It's crucial to understand the company's profitability and its ability to manage its finances effectively. Penny stock investors should pay close attention to these figures as they indicate the overall health of the company. Publicly available financial statements and SEC filings provide the most accurate information.

- Positive Indicators (if any): Look for signs of increasing revenue, improving profitability, and efficient management of debt.

- Negative Indicators (if any): Be aware of consistent losses, high levels of debt, and any warning signs highlighted in financial reports. Transparency is key in understanding the risks involved.

- Growth Trajectory: Assessing BBAI's past performance and analyzing future projections (if available) can help determine the potential for growth. This requires considering market trends and the company's strategic plans.

Risk Assessment

Investing in penny stocks like BBAI inherently involves a high degree of risk. The price volatility can be extreme, leading to significant gains or substantial losses in a short period.

- High Volatility: Be prepared for substantial price swings, both upward and downward.

- Potential for Significant Losses: There's a real possibility of losing a significant portion, or even all, of your investment.

- Dependence on Government Contracts: If BigBear.ai heavily relies on government contracts, the success of its business will be directly tied to government spending and policy decisions.

BigBear.ai (BBAI) vs. Competitors: A Comparative Analysis

Competitive Advantage

To accurately assess BBAI's potential, a comparative analysis against its competitors is crucial. This involves identifying BigBear.ai's unique strengths and weaknesses relative to other companies offering similar AI and big data solutions.

- Technology Comparison: Compare the sophistication and capabilities of BBAI's technology against its competitors.

- Market Share Analysis: Evaluate BigBear.ai's market share within its target markets.

- Financial Performance Comparison: Compare key financial metrics such as revenue, profitability, and growth rates against its competitors.

Investment Strategies for BigBear.ai (BBAI)

Risk Tolerance and Investment Goals

Before investing in BBAI or any penny stock, it's imperative to assess your personal risk tolerance and investment goals. Penny stocks are generally considered high-risk investments and are not suitable for all investors.

- Investment Strategies: Consider both short-term and long-term investment strategies, based on your individual risk profile.

- Diversification: Always diversify your investment portfolio to mitigate risk. Don't put all your eggs in one basket.

Potential Return on Investment (ROI)

While the potential ROI for BBAI could be substantial, it's crucial to remember that the risk is equally high. There's no guarantee of profit, and significant losses are possible. Avoid investing more than you can afford to lose.

Conclusion

Is BigBear.ai (BBAI) the next big penny stock winner? The answer is complex and depends on a multitude of factors. While the company operates in a rapidly growing sector with promising technology, the inherent risks associated with penny stocks, including high volatility and potential for significant losses, cannot be overlooked. Our analysis highlights the need for thorough due diligence and a realistic assessment of your investment goals and risk tolerance. Remember, this analysis is for informational purposes only and should not be construed as financial advice.

To learn more about BigBear.ai, conduct thorough research by reviewing their financial statements, analyst reports, and industry news. Consider your BigBear.ai investment strategy carefully and consult with a qualified financial advisor before making any investment decisions. Remember, always diversify your portfolio and never invest more than you can afford to lose.

Featured Posts

-

Essential Wayne Gretzky Fast Facts Stats Records And More

May 20, 2025

Essential Wayne Gretzky Fast Facts Stats Records And More

May 20, 2025 -

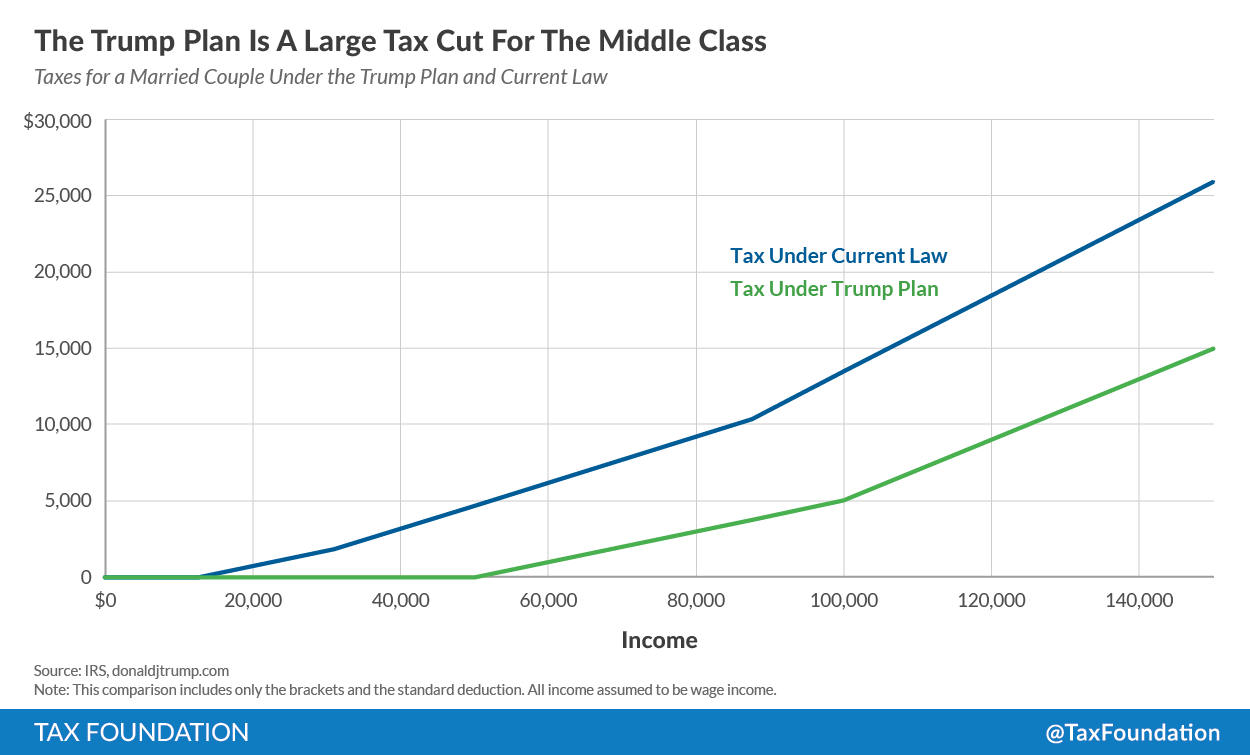

The Stark Math On The Gop Tax Plan Deficit Impact Analysis

May 20, 2025

The Stark Math On The Gop Tax Plan Deficit Impact Analysis

May 20, 2025 -

Nyt Mini Crossword Answers Today March 26 2025

May 20, 2025

Nyt Mini Crossword Answers Today March 26 2025

May 20, 2025 -

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulos

May 20, 2025

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Ulos

May 20, 2025 -

Wildfire Betting The Troubling Trend Of Gambling On Natural Disasters In Los Angeles

May 20, 2025

Wildfire Betting The Troubling Trend Of Gambling On Natural Disasters In Los Angeles

May 20, 2025

Latest Posts

-

Real Madrid In Yeni Teknik Direktoerue Ve Arda Gueler In Gelecegi

May 21, 2025

Real Madrid In Yeni Teknik Direktoerue Ve Arda Gueler In Gelecegi

May 21, 2025 -

Doubters To Believers Liverpool Fc Under Klopp A Retrospective

May 21, 2025

Doubters To Believers Liverpool Fc Under Klopp A Retrospective

May 21, 2025 -

Juergen Klopp Un Bir Sonraki Adimi Transfer Soeylentileri Ve Analiz

May 21, 2025

Juergen Klopp Un Bir Sonraki Adimi Transfer Soeylentileri Ve Analiz

May 21, 2025 -

Son Dakika Juergen Klopp Hangi Takima Transfer Olacak

May 21, 2025

Son Dakika Juergen Klopp Hangi Takima Transfer Olacak

May 21, 2025 -

Klopp Un Gelecegi Transfer Spekuelasyonlari Ve Son Gelismeler

May 21, 2025

Klopp Un Gelecegi Transfer Spekuelasyonlari Ve Son Gelismeler

May 21, 2025